Mexico Fitness Supplements Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Mexico Fitness Supplements Market Overview:

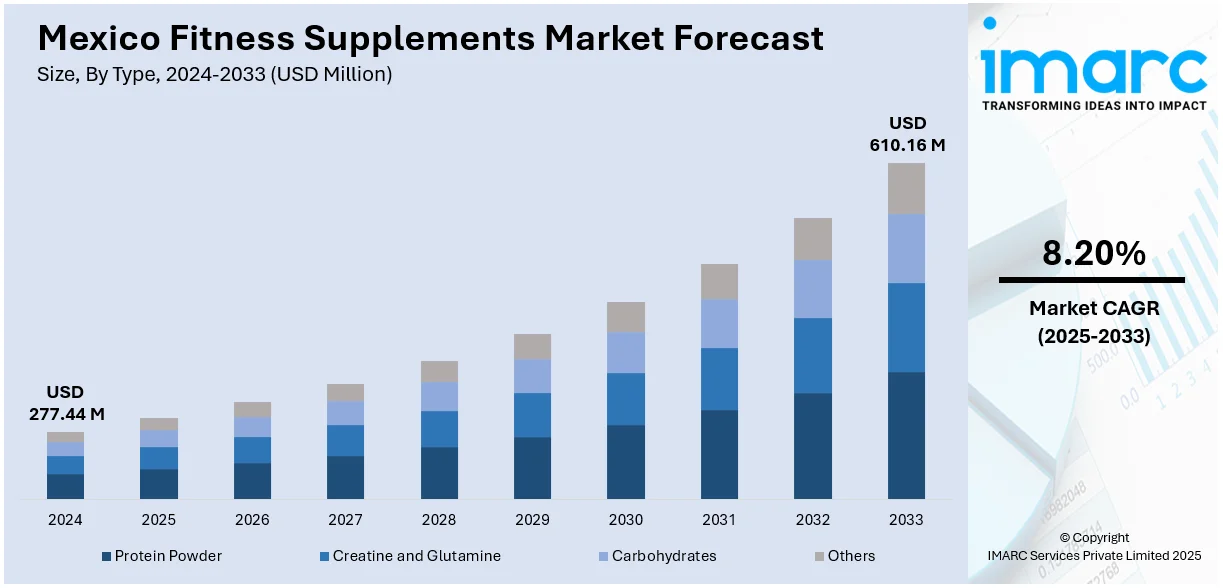

The Mexico fitness supplements market size reached USD 277.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 610.16 Million by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. Rising health awareness, growing gym memberships, and increasing disposable income drive demand for fitness supplements. Additionally, the shift toward preventive healthcare and adoption of personalized nutrition contribute significantly. E-commerce expansion also facilitates accessibility. These factors collectively enhance the Mexico fitness supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 277.44 Million |

| Market Forecast in 2033 | USD 610.16 Million |

| Market Growth Rate 2025-2033 | 8.20% |

Mexico Fitness Supplements Market Trends:

Surge in Natural and Plant-Based Supplements

The Mexico fitness supplements market growth is increasingly influenced by consumer preference for natural, organic, and plant-based products. This shift reflects rising concerns over synthetic ingredients and potential side effects. Manufacturers are responding by introducing supplements with herbal extracts, vegan proteins, and clean-label certifications. This trend aligns with a broader global movement toward sustainable and health-conscious consumption. For instance, Duas Rodas, a Brazilian leader in flavors and ingredients, showcased new products at the Food Tech Summit & Expo Mexico 2024. Driven by a global 18% annual growth in sports nutrition and supplements, the company presented natural innovations like Vitamin-Ace® (high in vitamin C), AnthoPower™ antioxidants, Yuzu Aroma, and the HYDRATE+ effervescent range. Their portfolio emphasized health, energy, and hydration, leveraging Latin America’s biodiversity and advanced technology for high-performance, traceable ingredients. As consumers become more educated about ingredient sourcing and environmental impact, demand for transparency and ethical production practices rises. Consequently, brands emphasizing eco-friendly packaging and cruelty-free testing gain competitive advantage. The focus on natural supplements supports long-term consumer loyalty, fostering consistent market expansion in Mexico’s fitness supplements sector.

Integration of Technology and Personalized Nutrition

Technological advancements are propelling the Mexico fitness supplements market growth through personalized nutrition. Customized supplement formulations based on genetic, biometric, and lifestyle data enable targeted health benefits. Digital platforms and mobile applications facilitate consumer access to personalized recommendations and subscription-based delivery models. This innovation caters to the growing consumer desire for efficacy and convenience. Additionally, AI-driven data analytics help manufacturers optimize product development and marketing strategies. The integration of technology not only improves customer engagement but also enhances the overall supplement consumption experience. Personalized nutrition fosters improved adherence and results, driving sustained growth in Mexico’s fitness supplements market. For instance, USANA offers personalized DNA-based supplements, addressing Mexico’s high rates of obesity (75%), hypertension (49%), and chronic malnutrition in children. Chronic disease costs reach up to MX$1.2 million/year, thereby enhancing the need for such supplements.

Mexico Fitness Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecast at the country/regional level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Protein Powder

- Creatine and Glutamine

- Carbohydrates

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes protein powder, creatine and glutamine, carbohydrates, and others.

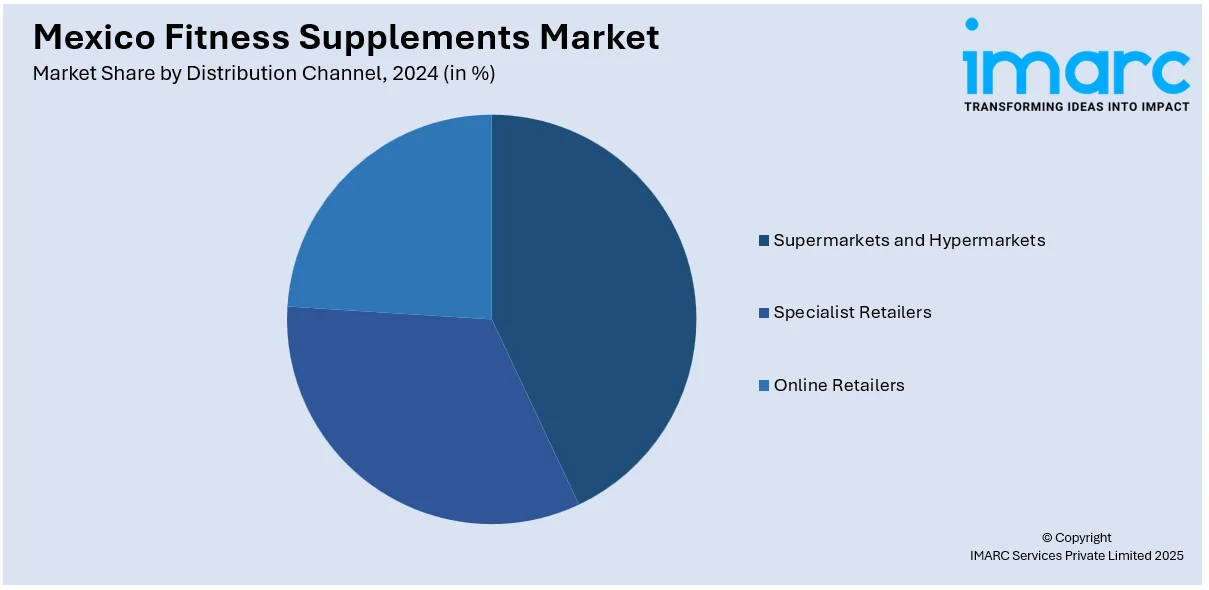

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialist Retailers

- Online Retailers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialist retailers, and online retailers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fitness Supplements Market News:

- In April 2024, Herbalife Ltd. announced a five-year partnership with the Mexican Olympic Committee to enhance athlete training and nutrition. The agreement supports Mexican wrestlers preparing for international events, including the 2024 and 2028 Olympics. Herbalife provides NSF Certified sports nutrition products and expert training at Proactive Sports in California. The partnership also includes community campaigns and nutrition support through Herbalife’s social programs in Mexico.

- In April 2024, MuscleTech, a global sports supplement brand, has partnered with Brazil’s Trust Group to locally manufacture and market its products, expanding its Brazilian portfolio from 4 to over 12 SKUs. This move overcomes import taxes and regulatory hurdles, allowing MuscleTech to compete better in Brazil's growing sports nutrition market. Products like NitroTech and Hydroxycut will be produced under strict quality standards at Trust Group’s facility.

Mexico Fitness Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Protein Powder, Creatine and Glutamine, Carbohydrates, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialist Retailers, Online Retailers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fitness supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fitness supplements market on the basis of type?

- What is the breakup of the Mexico fitness supplements market on the basis of distribution channel?

- What is the breakup of the Mexico fitness supplements market on the basis of region?

- What are the various stages in the value chain of the Mexico fitness supplements market?

- What are the key driving factors and challenges in the Mexico fitness supplements market?

- What is the structure of the Mexico fitness supplements market and who are the key players?

- What is the degree of competition in the Mexico fitness supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fitness supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fitness supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fitness supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)