Mexico Football Market Size, Share, Trends and Forecast by Type, Size, Distribution Channel, and Region, 2026-2034

Mexico Football Market Summary:

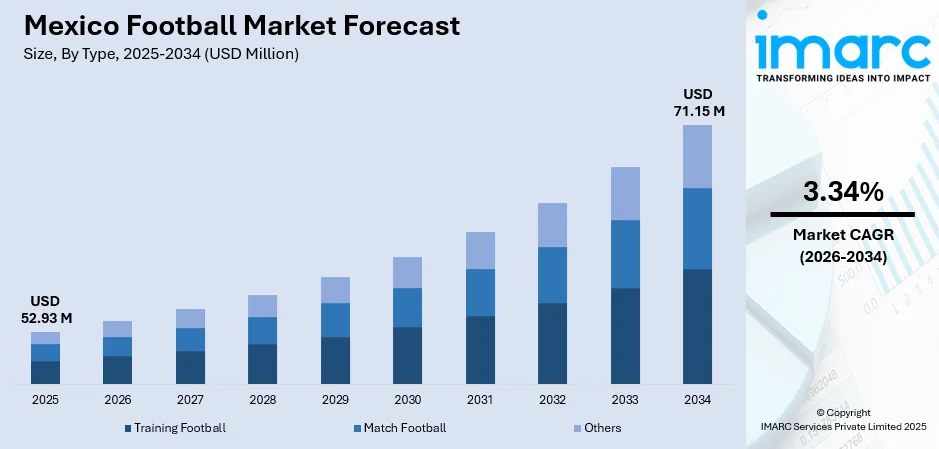

The Mexico football market size was valued at USD 52.93 Million in 2025 and is projected to reach USD 71.15 Million by 2034, growing at a compound annual growth rate of 3.34% from 2026-2034.

The Mexico football market is experiencing steady growth, driven by the country's deeply rooted football culture and upcoming major international sporting events. Rising participation rates across youth and amateur leagues are fueling demand for quality footballs suited to various playing conditions. Enhanced retail accessibility through both traditional sporting goods stores and modern distribution networks is strengthening consumer reach. Growing investments in sports infrastructure and professional league sponsorships are reinforcing brand visibility and product availability, collectively supporting Mexico football market share.

Key Takeaways and Insights:

-

By Type: Match football dominates the market with a share of 47.12% in 2025, driven by strong demand from professional leagues, training academies, and recreational players seeking Federation Internationale de Football Association (FIFA)-certified quality footballs for competitive play and organized matches.

-

By Size: Size 5 leads the market with a share of 45.06% in 2025, reflecting its status as the official standard for adult competitive play as mandated by FIFA regulations for professional matches and tournaments across all sanctioned competitions.

-

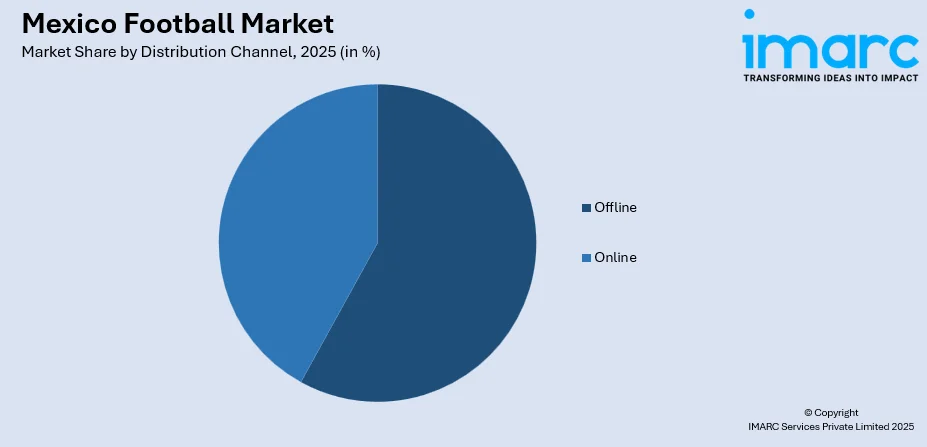

By Distribution Channel: Offline exhibits a clear dominance in the market with 58.04% share in 2025, supported by established sporting goods retailers, specialty stores, and hypermarkets offering hands-on product evaluation and immediate purchase convenience.

-

Key Players: Leading manufacturers drive the Mexico football market by expanding product portfolios, investing in FIFA-certified quality standards, enhancing durability technologies, and strengthening nationwide distribution networks. Their strategic partnerships with professional leagues and grassroots programs boost brand visibility and accelerate market penetration.

To get more information on this market Request Sample

The Mexico football market continues to expand, as the nation prepares to co-host the FIFA World Cup in June-July 2026 alongside the United States and Canada. Mexico will stage thirteen matches across Mexico City, Guadalajara, and Monterrey, with the federal government investing USD 489 Million in infrastructure renovation of Mexico city airport. This sporting event is expected to attract additional 5.5 Million visitors, generating substantial economic impact across host cities. Rising media rights values, digital streaming adoption, and social media interaction are expanding revenue opportunities beyond traditional broadcasting. Growing sponsorship interest from domestic and global brands supports club finances and league development. Increased investments in youth academies and grassroots programs strengthen long-term talent pipelines and fan loyalty. Infrastructure upgrades, improved stadium experiences, and enhanced commercialization of women’s football further broaden the market base.

Mexico Football Market Trends:

Rising Women's Football Participation and League Development

Women's football is experiencing remarkable growth in Mexico, with Liga MX Femenil, women’s professional football league in Mexico, experiencing increased stadium attendance, highlighted by the Apertura 2023 second leg final between Tigres UANL and América, which became the most viewed match ever with 3.9 Million viewers, and set an attendance record for a final with 58,156 fans at the América versus Pachuca game. The league's rising profile has attracted international talent and investment, exemplified by record-breaking transfer activities that signal growing commercial maturity. Enhanced media coverage and strategic partnerships with global brands are elevating visibility, while youth development initiatives ensure sustained participation growth, consequently driving the demand for quality footballs across women's leagues and training programs.

FIFA World Cup 2026 Infrastructure Development

Mexico's preparation as a co-host nation for the FIFA World Cup 2026 is transforming sports infrastructure across host cities. Comprehensive stadium renovations, transportation upgrades, and urban development projects are enhancing facilities for international sporting events. Mexico City has allocated approximately USD 348 Million for mobility initiatives connecting Azteca stadium with major entry points. These investments create lasting infrastructure improvements that will support expanded football activities and Mexico football market growth beyond the tournament.

Youth Development Programs and Grassroots Expansion

Structured youth football programs are expanding across Mexico through federation initiatives and professional club academies. The Mexican Football Federation successfully staged the 2024 edition of the Supercopa FMF tournament with FIFA Forward programme support, identifying and developing young talent nationwide. Professional clubs are establishing comprehensive academy systems that span multiple age categories, creating pathways from grassroots participation to professional careers. This systematic approach to youth development sustains long-term football participation and equipment demand.

Market Outlook 2026-2034:

The Mexico football market outlook remains positive through the forecast period, supported by sustained cultural passion for the sport and major international events catalyzing infrastructure investments. The market generated a revenue of USD 52.93 Million in 2025 and is projected to reach a revenue of USD 71.15 Million by 2034, growing at a compound annual growth rate of 3.34% from 2026-2034. Expanding retail networks, strengthening professional league ecosystems, and growing youth participation are expected to sustain demand growth. Enhanced product quality standards, driven by FIFA certification requirements and technological innovations in ball construction, will continue to elevate consumer expectations and market sophistication.

Mexico Football Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Match Football |

47.12% |

|

Size |

Size 5 |

45.06% |

|

Distribution Channel |

Offline |

58.04% |

Type Insights:

- Training Football

- Match Football

- Others

Match football dominates with a market share of 47.12% of the total Mexico football market in 2025.

Match footballs represent the premium segment designed for competitive play under official regulations, featuring superior construction quality, enhanced aerodynamics, and FIFA certification standards. These footballs undergo rigorous testing for roundness, rebound consistency, water absorption, and pressure retention to ensure reliable performance during professional matches. Liga MX utilizes Voit as its official ball supplier, with the newly unveiled Aerus ball for the Apertura 2025 tournament demonstrating ongoing product innovations in the Mexican professional football ecosystem.

The strong demand for match footballs stems from Mexico's extensive professional league structure, amateur competition networks, and organized recreational activities requiring standardized equipment. Training academies, school programs, and community leagues require match-quality footballs for practice to help athletes hone their skills with equipment that reflects competitive scenarios. Rising quality expectations among consumers and growing awareness about FIFA certification standards continue to strengthen the match football segment's market position in Mexico.

Size Insights:

- Size 1

- Size 2

- Size 3

- Size 4

- Size 5

Size 5 leads with a share of 45.06% of the total Mexico football market in 2025.

Size 5 footballs represent the globally recognized standard for professional and semi-professional matches. Domestic leagues, tournaments, and football academies use size 5 balls for official play and advanced training, creating consistent demand. Their suitability for adult players and older youth groups ensures widespread usage across clubs, schools, and community programs, making size 5 the most commonly purchased and utilized football size nationwide.

In addition, strong fan influence and media visibility reinforce preference for size 5 footballs. Consumers often choose the same ball size seen in professional matches, boosting retail sales. Sports brands concentrate product development, sponsorships, and endorsements on size 5 models, increasing availability and choice. Regular wear and replacement in competitive play further drive repeat purchases, solidifying size 5 footballs as the dominant segment in Mexico. The presence of organized leagues and tournaments across urban and semi-urban regions further sustains long-term demand.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline exhibits a clear dominance with a 58.04% share of the total Mexico football market in 2025.

Offline distribution channels encompass specialty sporting goods stores, department stores, hypermarkets, and retail outlets offering physical product evaluation opportunities. As per IMARC Group, the Mexico retail market is set to attain USD 698.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.38% during 2026-2034. International brands operate flagship stores in major metropolitan areas.

The offline channel's market leadership reflects consumer preferences for hands-on product assessment before purchasing sports equipment, particularly for evaluating football weight, texture, and construction quality. Retail environments enable immediate product availability without shipping delays, supporting impulse purchases and time-sensitive needs for matches or training sessions. Established retailer relationships with manufacturers ensure authentic product availability and warranty support, reinforcing consumer confidence in offline purchasing channels. Additionally, in-store guidance from trained staff and access to promotional discounts further enhance the appeal of offline retail for football buyers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a strong segment of the football market due to high urbanization, better sports infrastructure, and strong club presence. Cities in this region host professional teams, academies, and training facilities, driving demand for footballs, apparel, and accessories. Proximity to international markets also encourages brand penetration, sponsorship activity, and higher consumer spending on quality football products.

Central Mexico holds prominence in the market, as it is home to the country’s largest population, major football clubs, and national training centers. High participation at professional, amateur, and school levels drives consistent demand for football equipment and merchandise. Strong media coverage, frequent tournaments, and well-developed retail networks further support high sales volumes across urban and semi-urban areas.

Southern Mexico shows steady growth in the football market, supported by grassroots participation, community leagues, and youth development programs. Football is widely played at the local level, driving demand for affordable and durable equipment. Improving sports infrastructure, school-based programs, and regional tournaments are increasing engagement, while rising disposable incomes gradually support market expansion across the region.

Market Dynamics:

Growth Drivers:

Why is the Mexico Football Market Growing?

Expanding Professional League Ecosystem and Sponsorship Activity

The expanding professional league ecosystem and rising sponsorship activities are fueling the market growth in Mexico by strengthening commercial revenues, visibility, and fan engagement. The Mexican Football Federation prolonged its kit contract with Adidas through 2034 in November 2024, demonstrating long-term commercial confidence in Mexican football. The growth in domestic leagues, improved club management, and better competitive structures attract higher attendance, media interest, and merchandise sales. Increased sponsorship from brands across beverages, telecom, finance, and apparel provides clubs with stable funding to invest in players, academies, infrastructure, and marketing. Sponsorship-backed campaigns enhance fan experiences through promotions, digital engagement, and community outreach, deepening brand loyalty. Broadcast exposure of sponsored leagues amplifies reach at national and regional levels, encouraging greater consumer spending on football-related products. The professionalization of youth leagues further expands sponsorship opportunities.

Rising Commercialization of Women’s Football

Women’s football is emerging as a strong growth driver, supporting a positive outlook for the Mexico football market. Increasing media coverage, improved league structures, and higher attendance are raising the commercial value of women’s competitions. Brands are showing growing interest in sponsorships aligned with diversity, inclusion, and youth engagement. Clubs are investing more in facilities, player development, and marketing for women’s teams, improving match quality and fan experience. Merchandise sales and digital engagement around women’s football are also increasing steadily. This segment attracts new audiences, including families and younger fans, expanding the overall market base. As performance standards rise and visibility improves, women’s football is expected to become a significant revenue contributor. Its growth complements the men’s game, strengthening the overall football economy in Mexico.

Strong Fan Base and Cultural Importance of Football

The Mexico football market has a highly positive outlook due to the sport’s deep cultural significance and massive nationwide fan base. Football is followed across all age groups, income levels, and regions, creating consistent demand for match tickets, merchandise, broadcasts, and digital content. Domestic leagues and international tournaments attract strong viewership, supporting steady revenue from sponsorships and advertising. Community-level engagement, youth participation, and school programs further strengthen long-term interest. Social media and streaming platforms are expanding fan interaction beyond stadiums, increasing monetization opportunities. As per DataReportal, in January 2024, Mexico had 90.20 Million social media users, representing 70.0% of its entire population. The emotional connection between fans and clubs ensures resilience even during economic fluctuations. As fan experiences become more immersive through technology and content innovation, the football ecosystem continues to grow. This strong cultural foundation provides a stable platform for sustained commercial expansion across media, retail, and event-related segments of the Mexico football market.

Market Restraints:

What Challenges the Mexico Football Market is Facing?

Economic Pressure on Consumer Discretionary Spending

Macroeconomic conditions, including inflation and currency fluctuations, affect consumer purchasing power for discretionary sporting goods expenditures. Price-sensitive consumers may delay premium football purchases or opt for lower-cost alternatives during economic uncertainty. Budget constraints impact participation rates in organized leagues requiring equipment investments and registration fees.

Competition from Counterfeit and Unbranded Products

The market faces competition from counterfeit products replicating branded football designs without meeting quality or safety standards. Unbranded alternatives at lower price points capture value-conscious consumers, particularly in informal retail channels. These products undermine brand positioning and consumer expectations regarding authentic product performance characteristics.

Import Dependencies and Supply Chain Vulnerabilities

Mexico's football market relies substantially on imported products from manufacturing centers in Asia and elsewhere. Supply chain disruptions, logistics costs, and trade policy changes affect product availability and pricing. Limited domestic manufacturing capacity constrains market responsiveness to demand fluctuations and creates vulnerability to international supply chain challenges.

Competitive Landscape:

The Mexico football market features competition among established global sporting goods manufacturers and regional specialists. International brands leverage professional league sponsorships, athlete endorsements, and FIFA certification credentials to establish premium positioning. Companies compete through product innovation, quality differentiation, pricing strategies, and distribution network expansion. Partnerships with the Mexican Football Federation provide visibility and credibility advantages. Retail relationships with major sporting goods chains and presence in hypermarket channels determine market accessibility. Manufacturers investing in local marketing campaigns, grassroots sponsorships, and digital engagement are strengthening brand connections with Mexican consumers across diverse market segments.

Recent Developments:

-

In December 2025, Toluca, a Mexican professional football club, triumphed over the UANL Tigres in a penalty shootout, 9-8, to claim the Apertura tournament championship and became the fifth team since 1996 to secure consecutive titles in the Mexican league. Toluca claimed 12 league titles, matching Chivas as the second most successful team in Mexico.

Mexico Football Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Training Football, Match Football, Others |

| Sizes Covered | Size 1, Size 2, Size 3, Size 4, Size 5 |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico football market size was valued at USD 52.93 Million in 2025.

The Mexico football market is expected to grow at a compound annual growth rate of 3.34% from 2026-2034 to reach USD 71.15 Million by 2034.

Match football dominated the market with a share of 47.12%, driven by strong demand from professional leagues, training academies, and recreational players seeking FIFA-certified quality footballs for competitive play.

Key factors driving the Mexico football market include FIFA World Cup 2026 co-hosting preparations and infrastructure investments, expanding professional league ecosystems and sponsorship activities, strengthening youth development and grassroots participation programs, and growing retail distribution networks and consumer accessibility.

Major challenges include economic pressure on consumer discretionary spending, competition from counterfeit and unbranded products, import dependencies and supply chain vulnerabilities, and price sensitivity among value-conscious consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)