Mexico Fortified Health Drinks Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, and Region, 2025-2033

Mexico Fortified Health Drinks Market Overview:

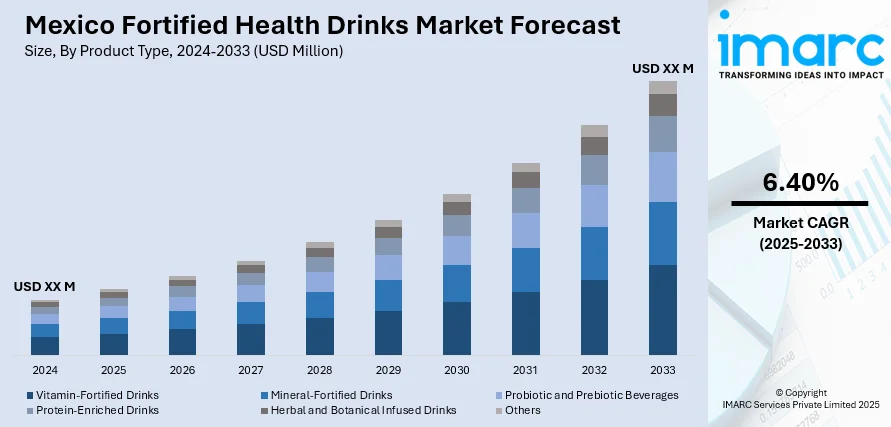

The Mexico fortified health drinks market size is projected to expand at a growth rate (CAGR) of 6.40% during 2025-2033. Rising health concerns, a growing interest in functional nutrition, and improved retail access are accelerating the uptake of fortified health drinks in Mexico. Clear labeling, wider availability across retail and online channels, and proactive lifestyle shifts are shaping consistent demand, particularly among younger, urban, and health-aware segments seeking convenient, preventive nutrition solutions. Consumers are also prioritizing daily wellness through nutrient-rich beverages that support immunity, energy, and digestion, thereby contributing to the expansion of the Mexico fortified health drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 6.40% |

Mexico Fortified Health Drinks Market Trends:

Growing Focus on Preventive Healthcare

Rising worries about chronic diseases, such as obesity, diabetes, and cardiovascular diseases, are catalyzing the demand for fortified health drinks in Mexico, with more consumers looking for preventive measures to handle long-term health threats. Items fortified with vitamins, minerals, and functional components are being integrated into daily practices to enhance immunity, metabolism, and energy levels. This change is especially noticeable among younger and middle-aged individuals who are taking more initiative in managing their health instead of solely responding to sickness. Public health initiatives and digital platforms are enhancing awareness about diet-related hazards, motivating individuals to select drinks that promote overall health. The National Institute of Statistics and Geography (INEGI) reported that diabetes was the second leading cause of death in Mexico in 2024, highlighting the immediate need for preventive lifestyle changes. As a result, the Mexico fortified health drinks market growth is being influenced by rising cases of chronic conditions among the masses.

To get more information on this market, Request Sample

Rising Popularity of Functional Nutrition

An increasing focus on functional nutrition is transforming consumer habits in Mexico and catalyzing the demand for fortified health drinks that provide wellness advantages. Consumers are becoming more discerning, shifting away from sugary conventional beverages and opting for products that enhance immunity, digestive wellness, mental clarity, or bone health. This change is not only confined to health enthusiasts, but also includes parents, professionals, and seniors, who are interested in drinks that support daily wellness. This movement coincides with the wider growth of the nation’s functional food industry, which hit USD 2.8 billion in 2024 and is expected to rise to USD 4.9 billion by 2033 at a CAGR of 5.80%, as reported by IMARC Group. The emphasis is now on ingredients that have a specific purpose, encouraging brands to adopt transparent labeling and remove additives that lack a health benefit. With the growing awareness about the influence of diet, fortified drinks are being incorporated into daily habits instead of being used just as occasional supplements.

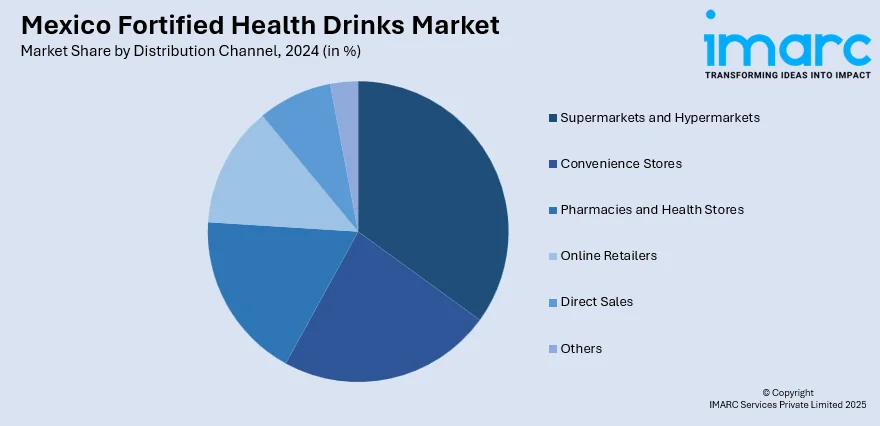

Wider Product Accessibility and Retail Expansion

Enhanced retail distribution and robust e-commerce integration are pivotal in broadening the availability of fortified health drinks in Mexico. A broader selection of formulations is now accessible through supermarkets, pharmacies, and online platforms, providing consumers additional chances to discover functional drinks. Retail stores are utilizing in-store promotions, bundle offers, and loyalty schemes to capture attention, whereas online platforms improve subscription services and personalized advertising. This dual-channel expansion is increasing the accessibility of fortified drinks, particularly in semi-urban regions where product availability was once restricted. As reported by the National Association of Supermarkets and Department Stores (ANTAD), retail sales in Mexico increased by 7.1% in 2024. The expansion in consumer traffic is benefiting health-focused beverage categories, allowing them to ride the wave of broader retail success and improve brand recall among both new and returning buyers.

Mexico Fortified Health Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, form, and distribution channel.

Product Type Insights:

- Vitamin-Fortified Drinks

- Mineral-Fortified Drinks

- Probiotic and Prebiotic Beverages

- Protein-Enriched Drinks

- Herbal and Botanical Infused Drinks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamin-fortified drinks, mineral-fortified drinks, probiotic and prebiotic beverages, protein-enriched drinks, herbal and botanical infused drinks, and others.

Form Insights:

- Powdered Drinks

- Ready-to-Drink (RTD)

- Liquid Concentrates

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes powdered drinks, ready-to-drink (RTD), and liquid concentrates.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies and Health Stores

- Online Retailers

- Direct Sales

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmacies and health stores, online retailers, direct sales, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fortified Health Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin-Fortified Drinks, Mineral-Fortified Drinks, Probiotic and Prebiotic Beverages, Protein-Enriched Drinks, Herbal and Botanical Infused Drinks, Others |

| Forms Covered | Powdered Drinks, Ready-to-Drink (RTD), Liquid Concentrates |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies and Health Stores, Online Retailers, Direct Sales, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fortified health drinks market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fortified health drinks market on the basis of product type?

- What is the breakup of the Mexico fortified health drinks market on the basis of form?

- What is the breakup of the Mexico fortified health drinks market on the basis of distribution channel?

- What is the breakup of the Mexico fortified health drinks market on the basis of region?

- What are the various stages in the value chain of the Mexico fortified health drinks market?

- What are the key driving factors and challenges in the Mexico fortified health drinks market?

- What is the structure of the Mexico fortified health drinks market and who are the key players?

- What is the degree of competition in the Mexico fortified health drinks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fortified health drinks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fortified health drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fortified health drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)