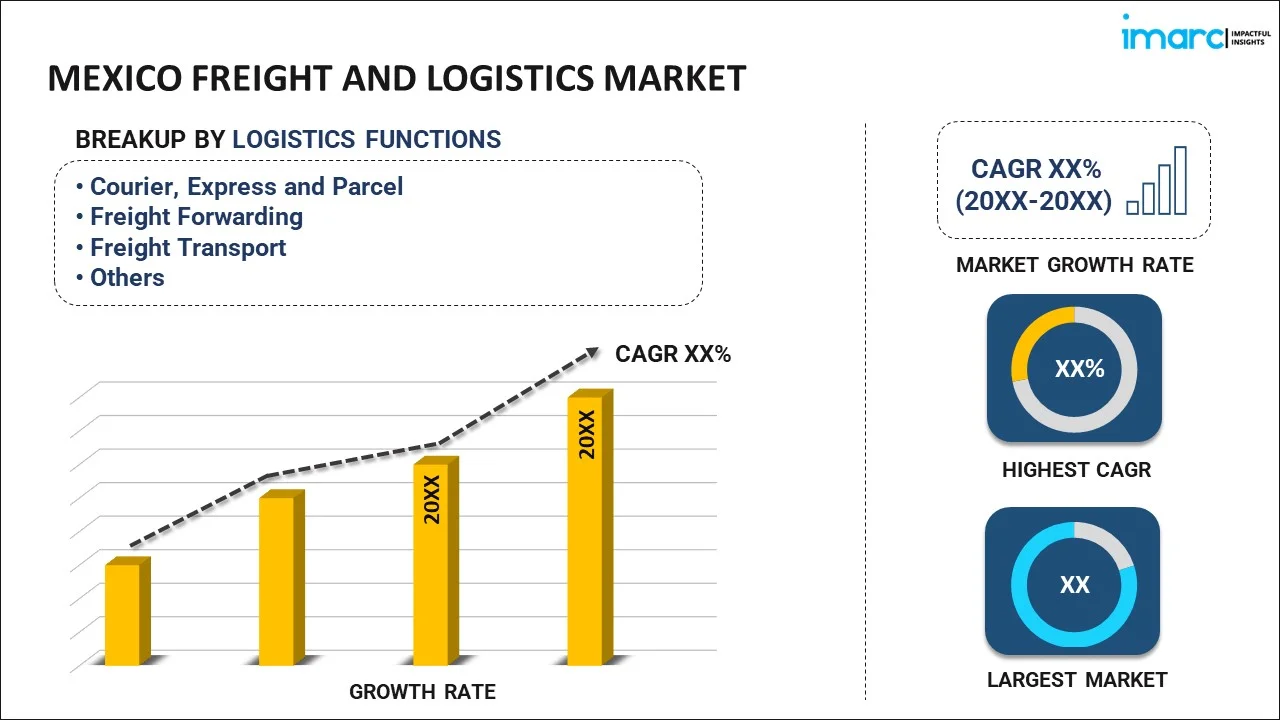

Mexico Freight and Logistics Market Report by Logistics Function (Courier, Express and Parcel, Freight Forwarding, Freight Transport, Warehousing and Storage, and Others), End Use Industry (Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Region 2026-2034

Mexico Freight and Logistics Market Size, Share & Trends

Mexico freight and logistics market size reached USD 123.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 193.2 Billion by 2034, exhibiting a growth rate (CAGR) of 4.98% during 2026-2034. The increasing technological advancements, such as automation, robotics, artificial intelligence, and Internet of Things (IoT), which can enhance efficiency, reduce costs, and provide real-time tracking and monitoring capabilities, are primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 123.2 Billion |

|

Market Forecast in 2034

|

USD 193.2 Billion |

| Market Growth Rate 2026-2034 | 4.98% |

Access the full market insights report Request Sample

Freight and logistics refer to the comprehensive processes involved in the transportation, management, and coordination of goods or cargo from one point to another. It encompasses the entire supply chain, including transportation modes such as road, rail, air, and sea. Freight involves the physical movement of goods, while logistics entails the strategic planning, organization, and optimization of these movements. Effective freight and logistics management ensures the timely and efficient delivery of products, minimizing costs and maximizing operational efficiency. This industry plays a critical role in trade, connecting producers, manufacturers, and consumers across distances. Technological advancements, such as tracking systems and automation, have significantly enhanced the precision and speed of freight and logistics operations, contributing to the overall efficiency of supply chain networks.

Mexico Freight and Logistics Market Trends:

Expansion in E-commerce and Last-Mile Delivery Services

The expansion in e-commerce is one of the most powerful Mexico freight and logistics market trends, transforming how products are warehoused, transported, and delivered. With growing numbers of consumers buying online, companies are highly investing in last-mile delivery networks to satisfy expectations for faster delivery, especially in highly populated urban locations. This transformation has created the need for cutting-edge technologies, such as route optimization software, real-time tracking technology, and intelligent warehousing. Micro-fulfilment centers and metropolitan logistics centers are also emerging as key elements of contemporary distribution models. These technologies are optimizing operating efficiency and curtailing delivery time in key metropolitan markets. Focusing on speed, ease, and customer satisfaction, firms are also adding more fleet operations and third-party logistics contracts. With the advancement of e-commerce, the demand for last-mile delivery solutions in the Mexico freight and logistics market growth substantially. These developments facilitate an agile supply chain ecosystem and drive long-term competitiveness in the logistics industry.

Infrastructure Modernization and Intermodal Connectivity

Infrastructure modernization is a prime mover in defining the future of the freight and logistics industry in Mexico. Major initiatives in highway systems, seaports, airports, and rail networks are enhancing freight mobility, facilitating greater intermodal connectivity, and streamlining transport bottlenecks. These advancements enable the creation of more resistant and efficient supply chains at lower costs, facilitating enterprises to optimize operations along long-distance and cross-border corridors. Mexico's geographic location as a logistics gateway between North and South America adds to the promise of integrated transport solutions. Intermodal connectivity, especially between rail and trucking, is becoming popular because of its cost savings and green advantage. For instance, in May 2025, J.B. Hunt, BNSF, and GMXT introduced Quantum de México, a high-speed intermodal service with real-time tracking and enhanced on-time delivery for service-sensitive cross-border freight. Moreover, such shifts are anticipated to facilitate long-term growth in the Mexico freight and logistics market by facilitating quicker, more efficient goods movement domestically and internationally. As emphasized across reports, this is the focal trend within the Mexico freight and logistics market outlook, as infrastructure investment continues to consolidate the nation's position in international trade and sets it up for long-term logistics growth.

Growing Nearshoring and Supply Chain Reshaping

Nearshoring has emerged as a key trend within the logistics environment, as multinational corporations look to decrease dependency on far-flung vendors and limit supply chain risk. Mexico's geographical closeness to the United States and beneficial trade arrangements make it a prime location for moving manufacturing and distribution operations. This shift is revolutionizing conventional supply chain systems and calling for substantial investment in local logistics infrastructure. Warehousing automation, high-tech inventory management systems, and data-driven distribution networks are being prioritized by companies in order to facilitate this move. The growth of industrial parks and logistics hubs throughout northern Mexico is an immediate consequence of this shift. Based on Mexico freight and logistics market analysis, nearshoring is expected to fuel long-term demand for customized freight solutions. These advancements not only bolster operational resilience but also enhance efficiency while lessening lead times. Therefore, the outlook is good, with nearshoring set to greatly increase Mexico freight and logistics market share in the near future.

Mexico Freight and Logistics Opportunities:

The Mexican freight and logistics market has enormous opportunities driven by its geographically strategic position, expanding manufacturing base, and more robust trade agreements. As a strategic bridge between North and South America, and as a result of its close proximity to important U.S. markets, Mexico presents a perfect platform for regional and global distribution. The growth of nearshoring by multinational manufacturers is putting increasing Mexico freight and logistics market demand on secure logistics services, particularly in the automotive, electronics, and consumer goods industries. In addition, advancement in road, rail, and port infrastructure provides new avenues for streamlined cargo transportation, while industrial parks and logistics corridors promote integrated supply networks. Amplified utilization of digital platforms and automation complements further operational efficiency and customer satisfaction. Mexico's involvement in the USMCA agreement guarantees tariff benefits and regulatory compliance, supporting cross-border trade volumes. These conditions as a whole present strong opportunities for warehousing operators, logistics providers, and investors looking to take advantage of increasing domestic consumption and growing global trade connectivity.

Mexico Freight and Logistics Challenges:

As per the Mexico freight and logistics market analysis, industry possesses significant potential, it is also confronted by a number of issues that need careful consideration. Lack of infrastructure in areas of the country, especially rural and interior regions, can raise the risk of delay in transportation and lengthen delivery times. Traffic issues in major cities and near major ports contribute to operational delays. Moreover, security issues such as cargo robbery and road safety challenges are constant threats that require more rigid oversight and prevention. Regulatory gaps and bureaucratic bottlenecks, particularly in the area of customs operations, can be hurdles for cross-border logistics even after trade deals like USMCA. In addition, more skilled workers and sophisticated training are becoming increasingly needed to handle increasingly sophisticated supply chain technologies. Environmental laws and the shift towards sustainable logistics can also impose cost and implementation hurdles on smaller companies. Tackling these areas with directed investment, regulatory streamlining, and public-private partnership will be paramount for maintaining the industry's future growth and dependability.

Mexico Freight and Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on logistics function and end use industry.

Logistics Function Insights:

To get detailed segment analysis of this market Request Sample

- Courier, Express and Parcel

- Domestic

- International

- Freight Forwarding

- Air

- Sea and Inland Waterways

- Others

- Freight Transport

- Air

- Pipelines

- Rail

- Road

- Sea and Inland Waterways

- Warehousing and Storage

- Non-Temperature Controlled

- Temperature Controlled

- Others

The report has provided a detailed breakup and analysis of the market based on the logistics function. This includes courier, express and parcel, (domestic and international), freight forwarding, (air, sea and inland waterways, and others), freight transport (air, pipelines, rail, road, and sea and inland waterways), warehousing and storage (non-temperature controlled and temperature controlled), and others.

End Use Industry Insights:

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others.

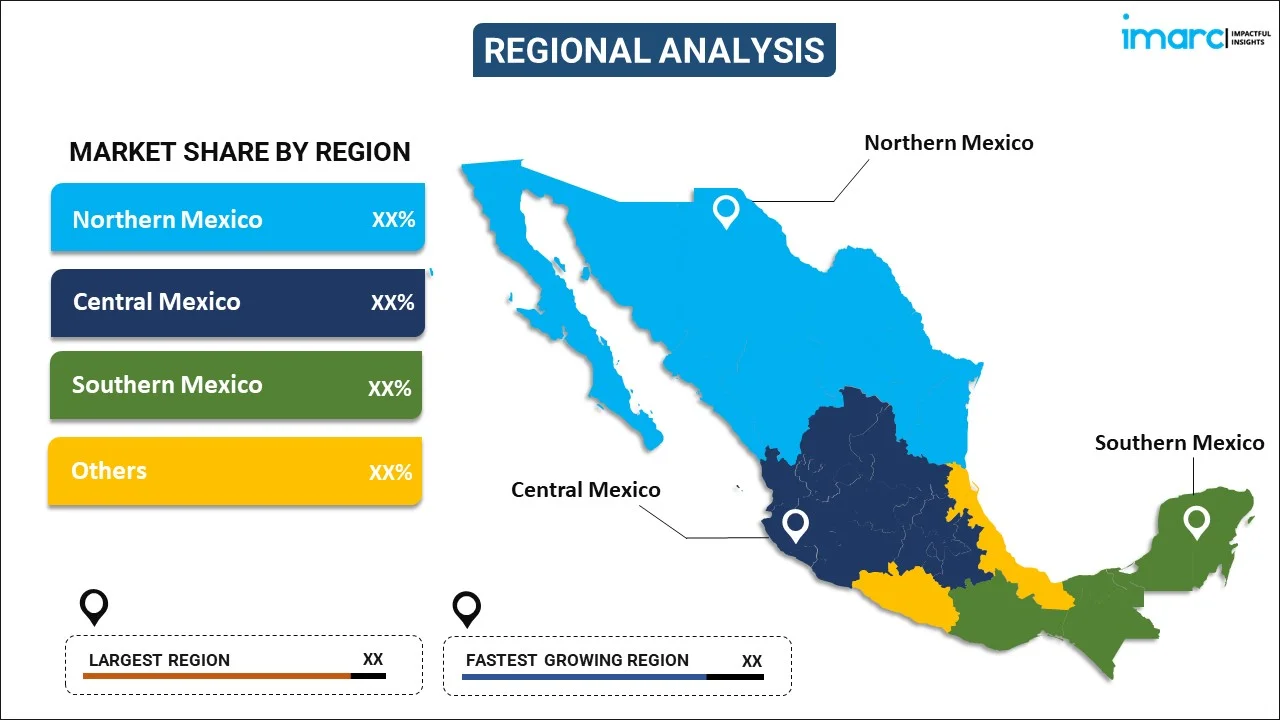

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In June 2025 – DP World inaugurated a new freight forwarding office in Mexico City to enhance its end-to-end logistics services in North and Central America. It deepens Mexico's role within DP World's regional strategy, supporting cross-border supply chains in automotive, retail, technology, and industrial sectors more comprehensively.

- In December 2024 – Freight Technologies (Fr8Tech) has partnered with Nestlé Mexico to maximize its domestic logistics with the Fr8App platform. The two-year deal applies cutting-edge freight-matching technology to maximize shipment efficiency, dependability, and cost savings throughout Mexico, making Fr8Tech even stronger in providing technology-enabled logistics solutions for large industry participantss

- In April 2025 – U.S.-based OTTO Express said it would initiate full truckload (FTL) operations in Mexico by the end of the year. In an initial investment of 20 trailers, the company will directly serve intra-Mexico routes, enhancing cost-effectiveness and minimizing dependency on intermediaries to address increasing domestic logistics demand.

Mexico Freight and Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Logistics Functions Covered |

|

| End Use Industries Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico freight and logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico freight and logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico freight and logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The freight and logistics market in the Mexico was valued at USD 123.2 Billion in 2025.

The Mexico freight and logistics market is projected to exhibit a CAGR of 4.98% during 2026-2034, reaching a value of USD 193.2 Billion by 2034.

Key factors driving the Mexico freight and logistics market include its strategic location for North American trade, growth in nearshoring and manufacturing activities, infrastructure development in ports and transport corridors, and the adoption of digital technologies. Additionally, supportive trade agreements like USMCA and rising domestic consumption are boosting demand for efficient, integrated, and scalable logistics solutions across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)