Mexico Frozen Potato Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End-Use, and Region, 2025-2033

Mexico Frozen Potato Products Market Overview:

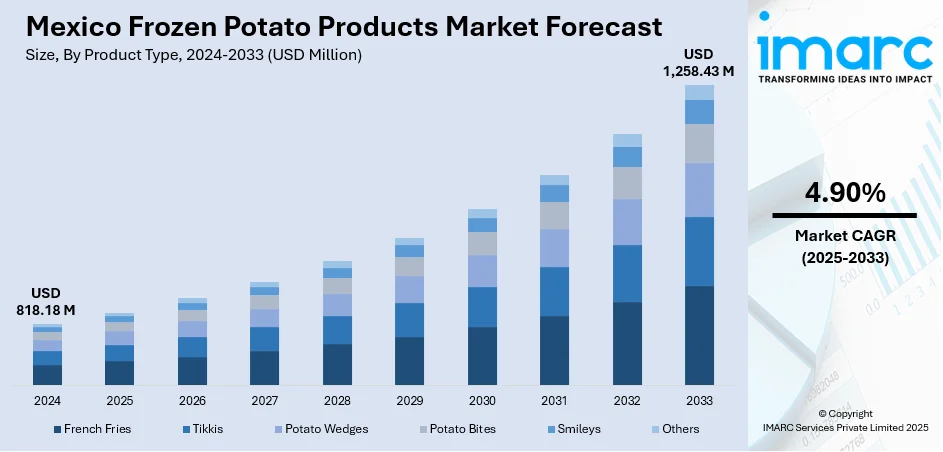

The Mexico frozen potato products market size reached USD 818.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,258.43 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. Rising urbanization, escalating demand for convenient ready-to-cook foods, expansion of fast-food chains, and greater exposure to Western dietary habits are driving Mexico’s frozen potato products market, supported further by improved cold chain logistics and growing retail penetration across both traditional supermarkets and modern convenience stores.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 818.18 Million |

| Market Forecast in 2033 | USD 1,258.43 Million |

| Market Growth Rate 2025-2033 | 4.90% |

Mexico Frozen Potato Products Market Trends:

Urbanization and Changing Consumer Lifestyles

Urbanization is one of the key macroeconomic drivers remodeling consumption behaviors throughout Mexico, and it also is contributing to the expanding demand for frozen potato products. As cities grow, there is a clear trend in eating habits fueled by fast-paced lifestyles, rising disposable incomes, and changing family types. Urban residents, especially from metropolitan areas such as Mexico City, Guadalajara, and Monterrey, tend to opt for quick, convenient meals because of time pressures and hectic work schedules. This need for convenience has hugely boosted the popularity of ready-to-cook frozen potato foods like French fries, hash browns, wedges, and potato bites. Hypermarkets and supermarkets have taken advantage of this trend by stocking a large range of frozen potato products, frequently packaged with sauces or as part of full meal solutions. These products are attractive to single professionals, dual-income families, and students who value ease of preparation and flavor over conventional cooking techniques.

To get more information on this market, Request Sample

Growth of the Quick Service Restaurant (QSR) Industry

The growth of the quick service restaurant (QSR) market in Mexico is another key market driver. International fast-food chains, such as McDonald's, Burger King, and KFC, regional QSR brands, and local restaurants all depend significantly on frozen potato products owing to their consistency, price competitiveness, and convenience in high-volume settings. French fries, for instance, are a standard item on the menu of almost every QSR chain. Frozen potato products are widely used as they provide standardized size, texture, and flavor, vital considerations for chain restaurants with multiple outlets that need to keep up quality and brand image across different locations. Frozen products have a longer life span and are less difficult to store and ship, which is beneficial for the logistics network of the fast-food sector. The increasing penetration of QSRs in Mexican metropolitan and mid-sized cities is driving bulk demand for frozen potatoes. With rising foreign investment in the foodservice industry and higher acceptance of casual dining experiences, more QSR outlets are opening in malls, airports, and transit points.

Mexico Frozen Potato Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end-use.

Product Type Insights:

- French Fries

- Tikkis

- Potato Wedges

- Potato Bites

- Smileys

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes French fries, tikkis, potato wedges, potato bites, smileys, and others.

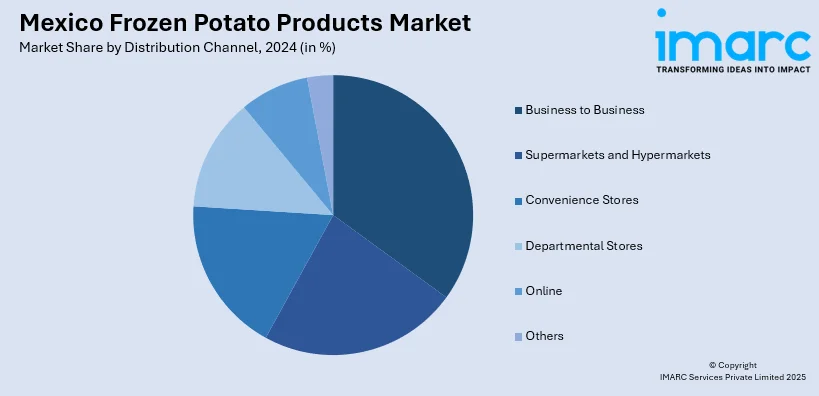

Distribution Channel Insights:

- Business to Business

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes business to business, supermarkets and hypermarkets, convenience stores, departmental stores, online, and others.

End-Use Insights:

- Food Services

- Retail

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes food services and retail.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Frozen Potato Products Market News:

- March 2025: Wendy’s announced that it would accelerate its expansion in Mexico, aiming to add 125 new restaurants across Latin America by 2028, with a strong focus on Mexico as a strategic hub. Wendy's has a strong link to frozen potato products as it sources frozen French fries and other potato-based items from major suppliers to ensure consistent quality across its fast-food operations.

Mexico Frozen Potato Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | French Fries, Tikkis, Potato Wedges, Potato Bites, Smileys, Others |

| Distribution Channels Covered | Business to Business, Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online, Others |

| End-Uses Covered | Food Services, Retail |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico frozen potato products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico frozen potato products market on the basis of product type?

- What is the breakup of the Mexico frozen potato products market on the basis of distribution channel?

- What is the breakup of the Mexico frozen potato products market on the basis of end-use?

- What is the breakup of the Mexico frozen potato products market on the basis of region?

- What are the various stages in the value chain of the Mexico frozen potato products market?

- What are the key driving factors and challenges in the Mexico frozen potato products market?

- What is the structure of the Mexico frozen potato products market and who are the key players?

- What is the degree of competition in the Mexico frozen potato products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico frozen potato products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico frozen potato products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico frozen potato products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)