Mexico Genetic Testing Market Size, Share, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

Mexico Genetic Testing Market Overview:

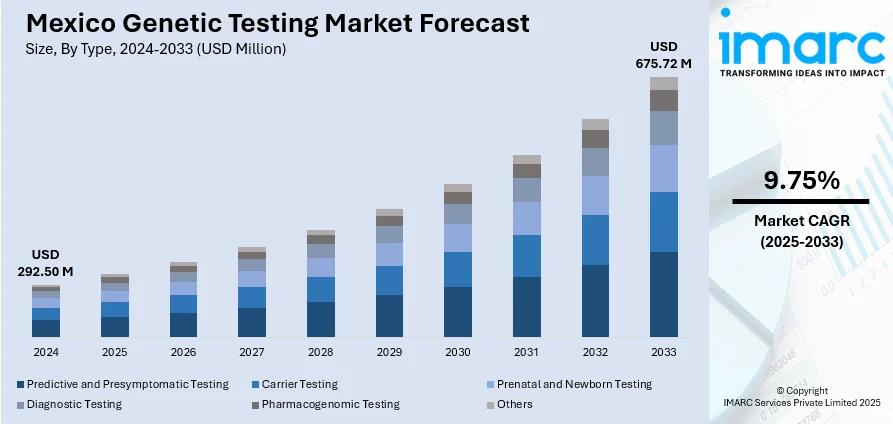

The Mexico genetic testing market size reached USD 292.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 675.72 Million by 2033, exhibiting a growth rate (CAGR) of 9.75% during 2025-2033. The market is growing due to rising demand for personalized medicine, increased awareness of preventive healthcare, and expanding direct-to-consumer (DTC) test accessibility. Advancements in prenatal and newborn screening, along with private-sector investments and government health initiatives, further propel adoption. However, affordability and regulatory clarity remain key challenges for broader market penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 292.50 Million |

| Market Forecast in 2033 | USD 675.72 Million |

| Market Growth Rate 2025-2033 | 9.75% |

Mexico Genetic Testing Market Trends:

Growth of Oncology Genetic Testing for Precision Cancer Treatment

Oncology genetic testing is gaining traction in Mexico as healthcare providers increasingly adopt precision medicine approaches for cancer treatment. Tests such as next-generation sequencing (NGS) and liquid biopsies are being used to identify genetic mutations and biomarkers, allowing for targeted therapies and improved patient outcomes. The rising cancer burden, coupled with growing awareness of genetic predisposition to malignancies, is supporting the Mexico genetic testing market growth. Cancer is the fourth leading cause of mortality in Mexico, accounting for about 46,200 premature deaths every year, with a projected 106% increase in per capita cancer healthcare spending by 2050. Enhanced methods of screening and treatment might save 50% of these premature deaths, generate 13,000 full-time employment opportunities, and increase life expectancy by a mean of five months. Such results would make a significant difference if implemented effectively. In addition, HPV vaccinations can also prevent 84% of cervical cancer deaths, resulting in an annual saving of MXN 1,323 Million (approximately USD 73 Million) in health costs. Private hospitals and diagnostic chains are partnering with global biotech firms to offer advanced genomic profiling services. However, high costs and limited insurance coverage restrict access for many patients. Government efforts to expand cancer screening programs and partnerships with research institutions are expected to enhance adoption. As technology becomes more affordable and awareness grows, oncology genetic testing is poised to play a pivotal role in the fight against cancer, creating a positive Mexico genetic testing market outlook.

Expansion of Prenatal and Newborn Genetic Testing in Mexico

Another key trend in the market is the growing adoption of prenatal and newborn genetic screening. With increasing awareness of genetic disorders and advancements in non-invasive prenatal testing (NIPT), more expectant parents are opting for early screening to detect conditions including Down syndrome and cystic fibrosis. A study of 182 Mexican-Mestizo patients with Lynch syndrome found that 67.5% had MLH1 mutations, and the MLH1 c.676C>T variant was found in 17.5% of the probands. While family test results were reported to everyone, only 28.2% of the 451 at-risk relatives underwent cascade testing, indicating a need for improved communication and access within the hereditary cancer screening program in Mexico. Government initiatives and private healthcare providers are promoting these tests to reduce infant mortality and improve neonatal care. Additionally, rising maternal age and higher disposable incomes are contributing to market growth. Private laboratories and hospitals are partnering with international genetic testing firms to offer advanced diagnostic solutions. Moreover, the improving healthcare infrastructure, prenatal and newborn genetic testing, supporting better health outcomes, are also expanding the Mexico genetic testing market share.

Mexico Genetic Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the county and regional levels for 2025-2033. Our report has categorized the market based on type, technology, and application.

Type Insights:

- Predictive and Presymptomatic Testing

- Carrier Testing

- Prenatal and Newborn Testing

- Diagnostic Testing

- Pharmacogenomic Testing

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes predictive and presymptomatic testing, carrier testing, prenatal and newborn testing, diagnostic testing, pharmacogenomic testing, and others.

Technology Insights:

- Cytogenetic Testing and Chromosome Analysis

- Biochemical Testing

- Molecular Testing

- DNA Sequencing

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes cytogenetic testing and chromosome analysis, biochemical testing, and molecular testing (DNA sequencing, and others).

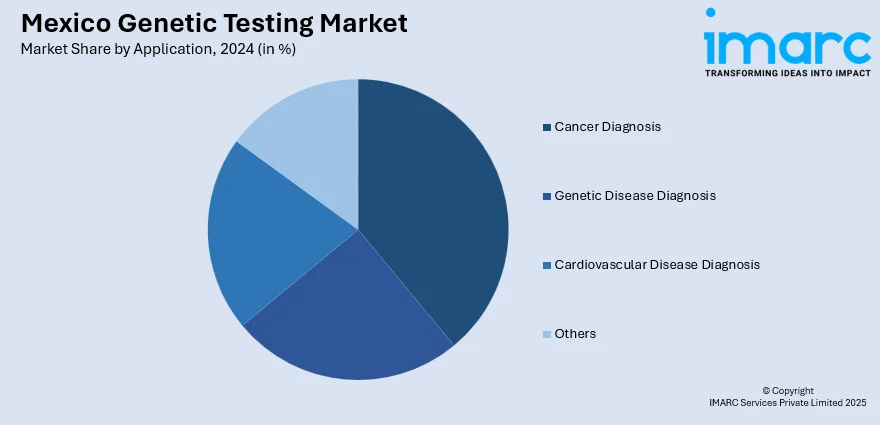

Application Insights:

- Cancer Diagnosis

- Genetic Disease Diagnosis

- Cardiovascular Disease Diagnosis

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cancer diagnosis, genetic disease diagnosis, cardiovascular disease diagnosis, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Genetic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Predictive and Presymptomatic Testing, Carrier Testing, Prenatal and Newborn Testing, Diagnostic Testing, Pharmacogenomic Testing, Others |

| Technologies Covered |

|

| Applications Covered | Cancer Diagnosis, Genetic Disease Diagnosis, Cardiovascular Disease Diagnosis, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico genetic testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico genetic testing market on the basis of type?

- What is the breakup of the Mexico genetic testing market on the basis of technology?

- What is the breakup of the Mexico genetic testing market on the basis of application?

- What is the breakup of the Mexico genetic testing market on the basis of region?

- What are the various stages in the value chain of the Mexico genetic testing market?

- What are the key driving factors and challenges in the Mexico genetic testing market?

- What is the structure of the Mexico genetic testing market and who are the key players?

- What is the degree of competition in the Mexico genetic testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico genetic testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico genetic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico genetic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)