Mexico Gluten Free Food Market Size, Share, Trends and Forecast by Product Type, Source, Sales Channel, and Region, 2026-2034

Mexico Gluten Free Food Market Summary:

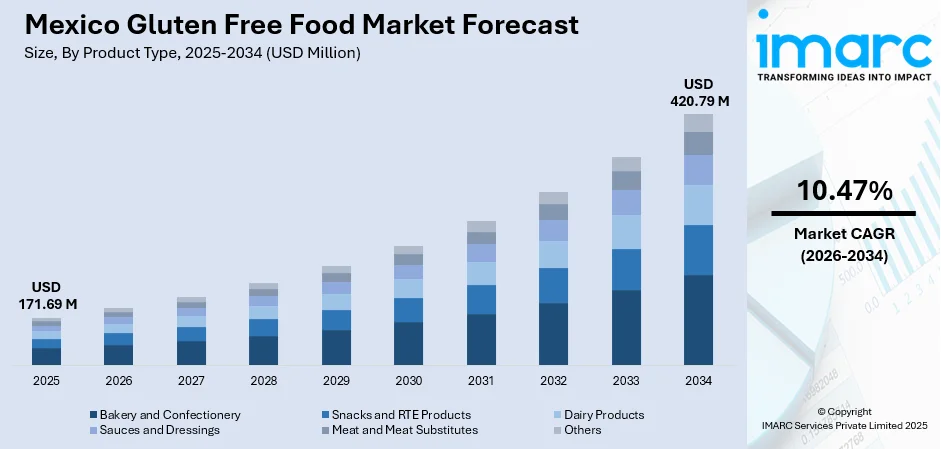

The Mexico gluten free food market size was valued at USD 171.69 Million in 2025 and is projected to reach USD 420.79 Million by 2034, growing at a compound annual growth rate of 10.47% from 2026-2034.

The Mexico gluten-free food market is experiencing robust expansion, driven by escalating consumer health consciousness and increasing awareness of gluten-related disorders. The market benefits from the country's strong culinary heritage of naturally gluten-free corn-based foods, while simultaneously witnessing innovation in wheat-alternative products. Rising urbanization, growing middle-class purchasing power, and an expanding retail infrastructure are collectively fueling market momentum. The proliferation of dedicated gluten-free bakeries and enhanced product availability in mainstream supermarkets further support market accessibility and consumer adoption.

Key Takeaways and Insights:

- By Product Type: Bakery and Confectionery dominate the market with a share of 35% in 2025, driven by rising demand for gluten-free bread, tortillas, cookies, and confectionery items that replicate traditional wheat-based favorites while catering to health-conscious consumers seeking allergen-free baked goods.

- By Source: Plant-Based leads the market with a share of 72% in 2025, attributable to the strong consumer preference for plant-based ingredients including corn, rice, amaranth, quinoa, and other ancient grains that align with clean-label trends and sustainable dietary choices prevalent among Mexican consumers.

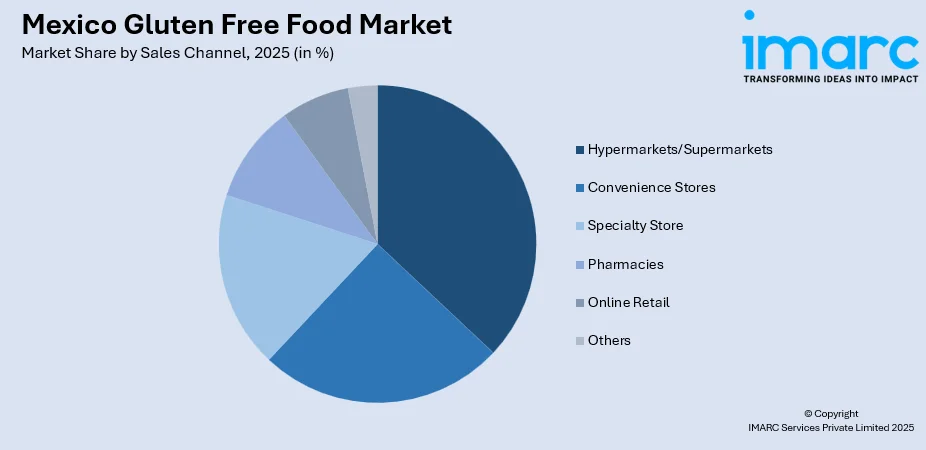

- By Sales Channel: Hypermarkets/Supermarkets represent the largest segment with a market share of 37% in 2025, driven by extensive product variety, competitive pricing, and convenience, hypermarkets and supermarkets dominate Mexico’s gluten-free food market, supported by loyalty programs, promotions, and organized displays, shaping consumer preferences and market trends.

- Key Players: The Mexico gluten-free food market exhibits a moderately fragmented competitive structure, featuring participation from multinational corporations alongside regional manufacturers and emerging local brands. Market participants are emphasizing product innovation, clean-label formulations, and strategic distribution partnerships.

To get more information on this market Request Sample

The Mexico gluten-free food market is underpinned by the country's unique dietary landscape, where traditional corn-based foods naturally complement the gluten-free category. An estimated eight hundred thousand to one million Mexicans are believed to have celiac disease, creating a substantial base of medically-driven consumers. Beyond medical necessity, voluntary adoption of gluten-free diets has surged among health-conscious millennials and wellness-focused consumers seeking functional foods with perceived health benefits. In 2024, Mexico updated its national allergen‑labeling rules (under its official food‑label standards), requiring that pre‑packaged foods clearly declare gluten and other priority allergens, a change likely to boost transparency and consumer confidence in gluten‑free labeling. The market is further supported by government awareness initiatives and evolving food labeling regulations that enhance consumer confidence and product transparency.

Mexico Gluten Free Food Market Trends:

Rising Integration of Ancient Grains and Indigenous Ingredients

The market is witnessing increasing incorporation of traditional Mexican grains such as amaranth, chia, and quinoa into gluten-free formulations. These nutrient-dense ingredients resonate with consumers seeking authentic, locally-sourced products while delivering enhanced nutritional profiles including higher protein and fiber content compared to conventional gluten-free alternatives. According to sources, in 2025, Government of Mexico formally designated amaranth as a national priority under the FAO One Country One Priority Product (OCOP) Initiative, and launched a sustainable production programme involving the creation of new high‑protein amaranth lines and support structures for small‑ and medium‑scale farmers to integrate amaranth into the national nutrition supply chain.

Expansion of Premium and Clean-Label Product Offerings

Consumer demand for transparency is driving manufacturers toward clean-label formulations free from artificial additives and preservatives. Premium gluten-free products featuring organic certifications, non-GMO verification, and minimal ingredient lists are gaining traction among affluent urban consumers willing to pay price premiums for perceived quality and health benefits. For example, in 2025 Granolín a health‑food brand with a “clean‑label” portfolio free from additives and artificial ingredients, expanded into Mexico via distribution in about 430 stores of Walmart México, offering granolas, bars and snacks tailored to consumers seeking additive‑free, protein‑rich, and keto/vegan‑friendly options.

Modernization of Traditional Mexican Foods into Gluten-Free Formats

Traditional Mexican cuisine is being reimagined through gluten-free innovation, with manufacturers developing certified gluten-free versions of tortillas, tamales, and regional snacks. This trend preserves cultural food heritage while addressing the dietary needs of gluten-sensitive consumers who seek familiar flavors without compromising their health requirements. For example MASECA, a leading Mexican masa/flour producer, offers masa flour explicitly labeled “Gluten Free,” allowing consumers to make authentic‑tasting corn tortillas, tamales, sopes and other traditional dishes without gluten or added preservatives.

Market Outlook 2026-2034:

The Mexico gluten-free food market is positioned for sustained expansion throughout the forecast period, supported by increasing healthcare awareness, rising disposable incomes, and evolving consumer dietary preferences. The market is anticipated to benefit from continued retail channel development, enhanced e-commerce penetration, and ongoing product innovation across all categories. Manufacturers are expected to intensify focus on improving taste profiles and textural qualities of gluten-free products while expanding distribution networks to underserved regions. The convergence of health and wellness trends with growing celiac disease awareness will continue driving both medically-driven and lifestyle-based demand. The market generated a revenue of USD 171.69 Million in 2025 and is projected to reach a revenue of USD 420.79 Million by 2034, growing at a compound annual growth rate of 10.47% from 2026-2034.

Mexico Gluten Free Food Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Bakery and Confectionery | 35% |

| Source | Plant-Based | 72% |

| Sales Channel | Hypermarkets/Supermarkets | 37% |

Product Type Insights:

- Bakery and Confectionery

- Snacks and RTE Products

- Dairy Products

- Sauces and Dressings

- Meat and Meat Substitutes

- Others

The bakery and confectionery dominate with a market share of 35% of the total Mexico gluten free food market in 2025.

Bakery and confectionery leadership reflects the central role of bread, pastries, and other baked treats in Mexican daily consumption. Advances in gluten-free baking technology have enhanced product quality, allowing confectionery and bakery items to closely replicate the taste and texture of traditional wheat-based goods. The segment covers a wide variety of products, including gluten-free bread loaves, tortillas, cookies, cakes, and pastries, serving both everyday snacking and special occasions. In February 2024, BRCGS published its updated “Gluten‑Free Global Standard – Issue 4,” which strengthened certification criteria for gluten‑free foods, and its adoption by ACELMEX A.C. (Mexico’s leading celiac‑patient association) gave gluten‑free food producers in Mexico greater legitimacy and enabled use of trusted gluten‑free trademarks on packaging.

Growth is fueled by consumer demand for convenient, ready-to-eat bakery and confectionery products, alongside the expansion of specialized gluten-free bakeries in urban areas. Manufacturers are innovating with ancient grains and novel flour blends to boost nutritional value without compromising flavor or texture. The surge in artisanal and premium gluten-free bakery and confectionery offerings further strengthens the segment, appealing to discerning, quality-focused consumers.

Source Insights:

- Plant-Based

- Animal-Based

The plant-based leads with a share of 72% of the total Mexico gluten free food market in 2025.

The plant-based segment dominance is supported by Mexico’s rich agricultural heritage and the wide availability of naturally gluten-free crops. Staples such as corn, rice, amaranth, quinoa, and various legumes form the foundation of plant-based gluten-free products. Growing consumer interest in health and sustainability has further strengthened demand for botanically-derived gluten-free alternatives. In fact, in 2025 roughly 9% of the Mexican population identifies as vegan, 19% as vegetarian, and another 30% as flexitarian, underlining wide acceptance of plant‑based diets beyond niche groups.

The segment benefits from rising awareness of the environmental and health advantages of plant-based diets. Manufacturers are leveraging the nutritional richness of indigenous Mexican grains, which provide higher levels of protein, fiber, and micronutrients compared with conventional gluten-free ingredients. The versatility of plant-based sources allows their use across bakery, snacks, beverages, and ready-to-eat products, supporting innovation and broadening consumer choice.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Store

- Pharmacies

- Online Retail

- Others

The hypermarkets/supermarkets dominate with a market share of 37% of the total Mexico gluten free food market in 2025.

Their wide-ranging product selection, competitive pricing strategies, and extensive presence across urban and semi-urban areas make hypermarkets and supermarkets the preferred destination for consumers seeking gluten-free products. These retail formats also benefit from impactful promotional campaigns, targeted marketing, and loyalty programs, which further enhance customer footfall, engagement, and repeat purchases. At the 2025 Mexican Healthy Products Summit, over 40 major retail chains showcased their commitment to expanding healthy, gluten‑free, and specialty‑diet food offerings across supermarkets, hypermarkets, and convenience stores.

Moreover, the convenience of one-stop shopping, well-organized product displays, and in-store assistance significantly improves the overall shopping experience for health-conscious consumers. While smaller retail formats and online channels are gradually expanding, hypermarkets and supermarkets continue to hold a dominant position, strongly influencing market trends and consumer preferences.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for gluten-free foods, characterized by higher industrialization, greater proximity to United States markets, and elevated consumer purchasing power. The region historically has greater wheat consumption compared to southern areas, driving stronger demand for gluten-free wheat alternatives. Advanced retail infrastructure featuring major supermarket chains and specialty health food stores ensures comprehensive product availability across urban centers.

Central Mexico, anchored by Mexico City metropolitan area, constitutes the largest regional market owing to concentrated population density and sophisticated consumer demographics. The region benefits from highest retail penetration including dedicated gluten-free bakeries, specialty health stores, and premium supermarket chains. Urban consumers demonstrate elevated health consciousness and willingness to adopt dietary modifications, supporting strong demand for innovative gluten-free product offerings.

Southern Mexico presents a distinctive market landscape where traditional corn-based dietary patterns naturally align with gluten-free consumption. The region's culinary heritage emphasizes naturally gluten-free ingredients including corn tortillas, tamales, and indigenous preparations. Market growth is driven by increasing awareness of formal gluten-free certifications and the introduction of value-added products that enhance traditional foods while ensuring gluten-free compliance.

The remaining regions encompass diverse geographic areas with varying levels of market development and consumer awareness. These markets present emerging growth opportunities as retail modernization expands and health consciousness increases. Tourism-oriented coastal regions demonstrate elevated demand for gluten-free options catering to international visitors with dietary requirements, supporting localized market development and product availability expansion.

Market Dynamics:

Growth Drivers:

Why is the Mexico Gluten Free Food Market Growing?

Increasing Prevalence and Awareness of Celiac Disease and Gluten Sensitivity

Growing medical diagnosis rates and heightened public awareness of gluten-related disorders are fundamental drivers of market expansion. Clinical research indicates that celiac disease prevalence in Mexico may be higher than previously thought for instance, a 2004‑2005 serologic screening in healthy blood donors found positivity for tTGA antibodies in about 2.7% of individuals, suggesting a larger undetected population. Enhanced diagnostic capabilities and healthcare provider education have improved identification of gluten sensitivity cases, expanding the medically-driven consumer base. Public health initiatives and patient advocacy organizations are actively disseminating information regarding symptoms, diagnosis, and dietary management, contributing to informed consumer decision-making.

Rising Health Consciousness and Wellness-Oriented Consumer Behavior

The broader health and wellness movement is significantly influencing gluten-free food adoption beyond medically-necessary consumption. Mexican consumers, particularly millennials and urban professionals, are increasingly prioritizing dietary choices perceived to support overall well-being, digestive health, and weight management. The association of gluten-free diets with clean eating, reduced inflammation, and enhanced energy levels has driven voluntary adoption among health-conscious individuals. Social media influence and wellness lifestyle trends have amplified consumer interest in gluten-free alternatives as part of holistic health approaches. Notably, a 2024 survey found that 61% of Mexicans reported having reduced gluten consumption even without a diagnosed gluten disorder as part of a shift toward healthier eating.

Expanding Retail Infrastructure and Product Accessibility

The modernization and expansion of Mexico's retail landscape has substantially improved gluten-free product accessibility for consumers nationwide. Major supermarket chains have dedicated increasing shelf space to gluten-free categories while specialty health food stores continue proliferating in urban centers. In addition, the Mexican government’s Ley General de la Alimentación Adecuada y Sostenible (LGAAS), enacted in 2024, promotes access to safe, nutritious, and culturally appropriate foods for all citizens, creating a policy environment that supports wider availability of specialized diets, including gluten‑free options. The emergence of dedicated gluten-free bakeries and restaurants provides convenient consumption options for dietary-restricted individuals. E-commerce platform growth has further enhanced accessibility, enabling consumers in underserved regions to procure specialized products through digital channels.

Market Restraints:

What Challenges the Mexico Gluten Free Food Market is Facing?

Premium Pricing and Affordability Constraints

Gluten-free products typically command significant price premiums compared to conventional alternatives, creating affordability barriers for price-sensitive consumers. Higher ingredient costs, specialized manufacturing requirements, and limited production scale contribute to elevated retail pricing that may restrict market penetration among lower-income demographics.

Product Quality and Sensory Attribute Challenges

Despite technological advancements, certain gluten-free products continue exhibiting inferior taste, texture, and shelf-life characteristics compared to wheat-based counterparts. Consumer dissatisfaction with organoleptic properties may discourage repeat purchases and limit category expansion among discretionary consumers seeking comparable sensory experiences.

Cross-Contamination Concerns and Certification Complexities

Ensuring complete gluten-free integrity throughout supply chains presents significant challenges for manufacturers and retailers. Cross-contamination risks during production, storage, and handling can compromise product safety for celiac consumers. Inconsistent certification standards and labeling practices may create consumer confusion and erode confidence in product claims.

Competitive Landscape:

The Mexico gluten-free food market exhibits a dynamic competitive environment characterized by participation from established multinational corporations, regional food manufacturers, and emerging specialty brands. Market leaders are leveraging extensive distribution networks, brand recognition, and research capabilities to maintain competitive positioning. Companies are increasingly focusing on product innovation, clean-label formulations, and strategic partnerships with retail chains to capture market share. The competitive landscape is further shaped by ongoing mergers, acquisitions, and capacity expansions as participants seek to strengthen market presence. Differentiation strategies emphasize quality certifications, unique ingredient sourcing, and targeted marketing toward health-conscious consumer segments.

Recent Developments:

- In Jan 2025, PepsiCo completed its $1.2 billion acquisition of Siete Foods, a Mexican‑American brand known for grain‑free, gluten‑free tortillas, chips, sauces, and snacks. The move strengthens PepsiCo’s “better‑for‑you” and multicultural food portfolio, reflecting growing demand for allergen‑friendly and health‑focused products.

- In February 2024, Grupo Bimbo has acquired Amaritta Food SL, a specialist gluten‑free bread producer, to expand its presence in Mexico’s growing gluten‑free market. Amaritta’s 2,000 m² allergen‑free facility can produce 10 million gluten‑free units annually, signaling significant scale. The move reflects mainstream bakers treating gluten‑free as a strategic growth area.

Mexico Gluten Free Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bakery and Confectionary, Snacks and RTE Products, Dairy Products, Sauces and Dressings, Meat and Meat Substitutes, Others |

| Sources Covered | Plant-Based, Animal-Based |

| Sales Channels Covered | Hypermarkets/Supermarkets, Convenience Stores, Specialty Store, Pharmacies, Online Retail, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico gluten free food market size was valued at USD 171.69 Million in 2025.

The Mexico gluten free food market is expected to grow at a compound annual growth rate of 10.47% from 2026-2034 to reach USD 420.79 Million by 2034.

Bakery and confectionery segment dominated the market with a 35% share, driven by strong consumer demand for gluten-free bread, tortillas, and baked goods that replicate traditional wheat-based favourites.

Key factors driving the Mexico gluten free food market include increasing prevalence and awareness of celiac disease and gluten sensitivity, rising health consciousness among consumers, and expanding retail infrastructure enhancing product accessibility.

Major challenges include premium product pricing creating affordability barriers, inconsistent product quality and sensory attributes compared to conventional alternatives, cross-contamination risks during production, and limited consumer awareness in rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)