Mexico Gourmet Foods Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Mexico Gourmet Foods Market Overview:

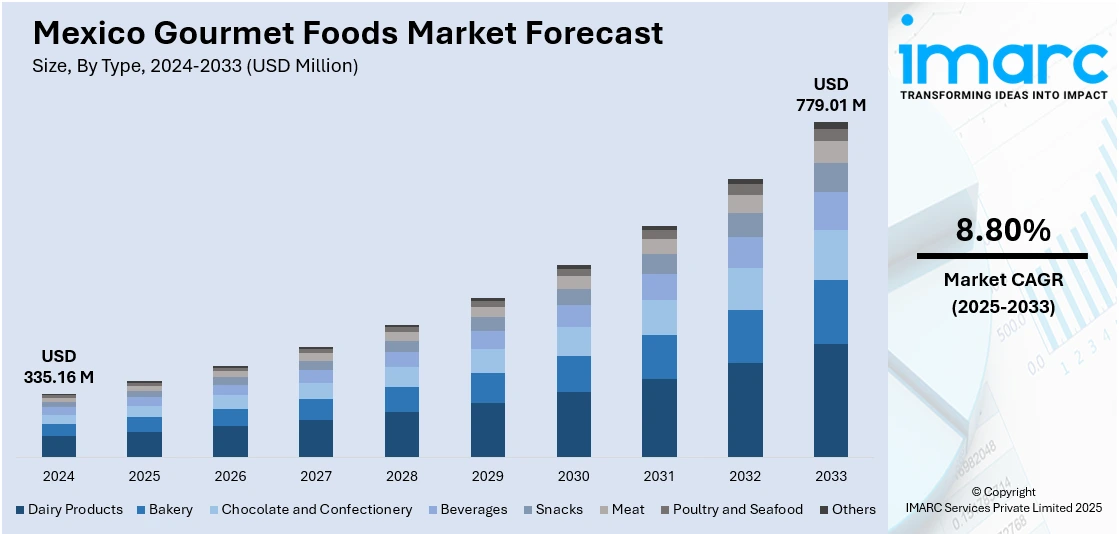

The Mexico gourmet foods market size reached USD 335.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 779.01 Million by 2033, exhibiting a growth rate (CAGR) of 8.80% during 2025-2033. At present, Mexican consumers are looking for gourmet food items that provide distinct and premium flavors. This trend, along with the increasing demand for food products that are natural, organic, and contain no artificial additives, is bolstering the market growth. Besides this, the heightened number of manufacturers choosing e-commerce to sell their products is expanding the Mexico gourmet foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 335.16 Million |

| Market Forecast in 2033 | USD 779.01 Million |

| Market Growth Rate 2025-2033 | 8.80% |

Mexico Gourmet Foods Trends:

Growing Consumer Demand for Premium and Exotic Flavors

Mexican consumers are looking for gourmet food items that provide distinct and premium flavors. This is because consumers are becoming more interested in culinary experience and the discovery of global cuisines. Thus, Mexican consumers are preferring high-quality ingredients, offbeat spices, and organic offerings, leading to increased demand for gourmet foods. They are reacting by widening product ranges to meet changing tastes by adding artisanal cheeses, craft chocolates, and flavored oils. Restaurants and food service outlets are also responding by producing more specialist and innovative menus that include gourmet features. This transition to more evolved dietary lifestyles is driving the market in Mexico, as consumers are increasingly care about the quality and genuineness of the products they buy. In 2025, Nestle launched its Chocobakery treats in Mexico to redefine the whole chocolate experience in the country. The range comprises Choco Trio, a chocolate bar that blends milk chocolate with crispy biscuit chunks, Choco Cookies, which has a tender, buttery dough paired with creamy chocolate centers, and Choco Biscuit, an ideal mix of chocolate and biscuit. The three product lines come in various options and formats, featuring the well-known Nestlé brand as well as prominent local brands like Garoto.

Increased Role of Health and Wellness Trends

Consumers are valuing health and wellness, and thus increasingly seeking gourmet food items that are natural, organic, and contain no artificial additives. This emphasis on healthier lifestyles is encouraging food companies in Mexico to create products reflecting these tastes, including gluten-free, low-sugar, and plant-based foods. The movement towards conscious consumption is also driving the demand for gourmet foods that are healthy, which include superfoods, functional foods, and fortified drinks. As consumers become more aware about the health benefits of ingredients, they are shifting towards gourmet food options that fit their wellness agendas. This is also affecting the food service sector as restaurants are adding healthier, gourmet options to their menus for catering to the demands of a better-informed and health-conscious customer base. The IMARC Group predicts that the Mexico superfoods market sized will reach USD 4.0 Billion by 2033.

Growth of E-commerce and Online Food Retail

The expansion of e-commerce is bolstering the Mexico gourmet foods market growth, as consumers are increasingly choosing the convenience of online shopping. Online platforms are providing a vast array of gourmet foods, ranging from high-end chocolates to high-quality olive oils, so that consumers can easily consume gourmet foods from the comfort of their homes. Online stores are reaping the benefits of an increase in home delivery, as customers find it more convenient to purchase gourmet products online because of the variety and competitive prices. Social media sites also drive the business, with influencers and bloggers putting up gourmet food brands and products. Consequently, both small-scale producers and large food companies are using e-commerce platforms to connect to new consumer groups and reach out to more Mexicans in the country's urban and rural areas.

Mexico Gourmet Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Dairy Products

- Bakery

- Chocolate and Confectionery

- Beverages

- Snacks

- Meat

- Poultry and Seafood

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes dairy products, bakery, chocolate and confectionery, beverages, snacks, meat, poultry and seafood, and others.

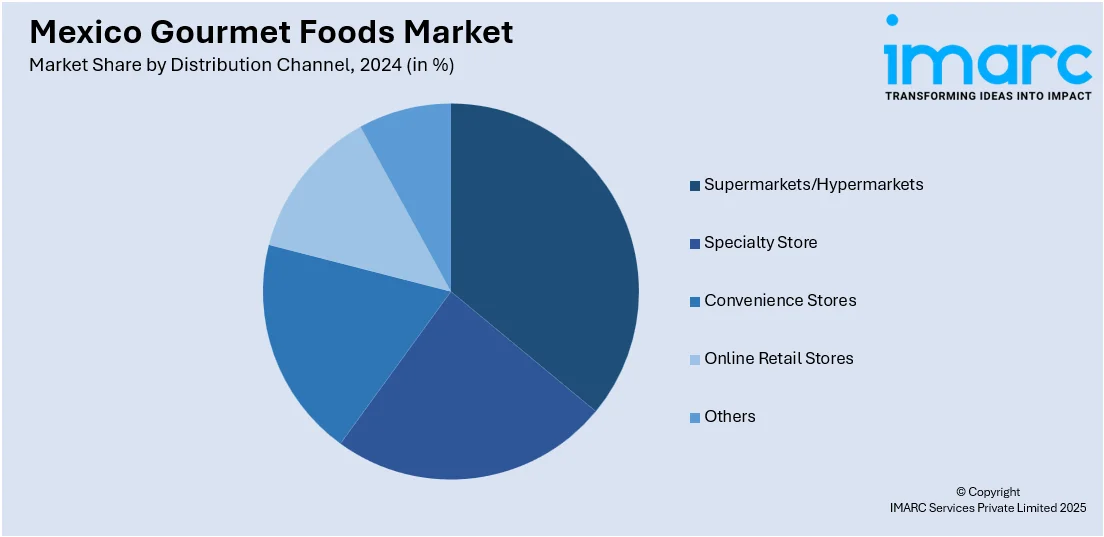

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Specialty Store

- Convenience Stores

- Online Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, specialty store, convenience stores, online retail stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Gourmet Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dairy Products, Bakery, Chocolate and Confectionery, Beverages, Snacks, Meat, Poultry and Seafood, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty Store, Convenience Stores, Online Retail Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico gourmet foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico gourmet foods market on the basis of type?

- What is the breakup of the Mexico gourmet foods market on the basis of distribution channel?

- What is the breakup of the Mexico gourmet foods market on the basis of region?

- What are the various stages in the value chain of the Mexico gourmet foods market?

- What are the key driving factors and challenges in the Mexico gourmet foods market?

- What is the structure of the Mexico gourmet foods market and who are the key players?

- What is the degree of competition in the Mexico gourmet foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico gourmet foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico gourmet foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico gourmet foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)