Mexico Green Cement Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2025-2033

Mexico Green Cement Market Overview:

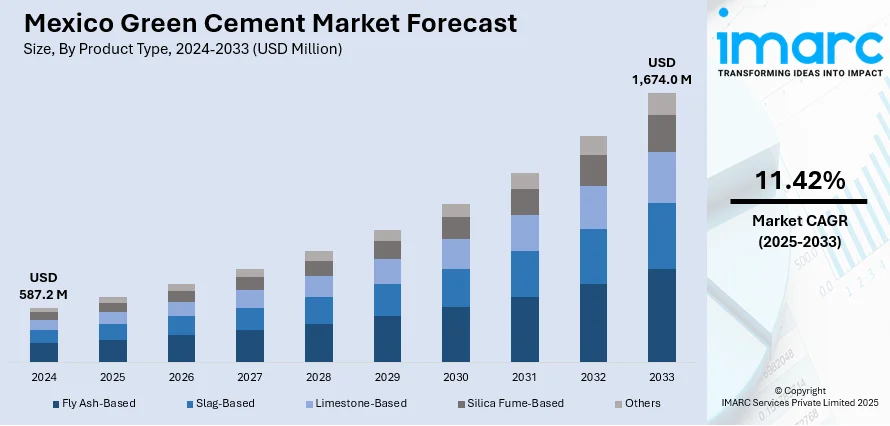

The Mexico green cement market size reached USD 587.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,674.0 Million by 2033, exhibiting a growth rate (CAGR) of 11.42% during 2025-2033. The increasing environmental awareness, government regulations promoting sustainable construction, rising demand for energy-efficient buildings, technological advancements in green concrete production, and corporate social responsibility initiatives responding to consumer demand for eco-friendly materials are expanding the Mexico green cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 587.2 Million |

| Market Forecast in 2033 | USD 1,674.0 Million |

| Market Growth Rate 2025-2033 | 11.42% |

Mexico Green Cement Market Trends:

Shift Toward Low-Carbon Cement Production

The Mexico green cement market growth is primarily driven by a rapid shift toward low-carbon cement production, driven by increasing environmental awareness and pressure to reduce industrial emissions. Manufacturers are embracing advanced techniques that significantly reduce the clinker content in cement, replacing it with alternative materials such as natural pozzolans, calcined clays, and industrial byproducts. These innovative approaches not only reduce the carbon footprint but also maintain or even improve the strength and durability of cement. Additionally, the industry is seeing strong support from regulatory frameworks promoting sustainable construction practices. For instance, at the "Roadmap for the Decarbonization of the Building Sector" workshop in Mexico City on September 26, 2024, leaders from the construction sector and groups like Sustainability for Mexico (SUMe) and WRI México emphasized the pressing need to implement a National Buildings Decarbonization Roadmap, addressing a sector that accounts for 40% of CO2 emissions from energy consumption. This momentum is encouraging cement producers to invest in research and development to create proprietary green formulations that can serve both economic and environmental goals. As companies position themselves as sustainability leaders, the adoption of cleaner production technologies is expected to accelerate, establishing green cement as a preferred building material in upcoming infrastructure and residential projects across Mexico.

Infrastructure Development Driving Demand for Green Alternatives

With a growing emphasis on sustainable development, green cement is becoming integral to major infrastructure projects in Mexico. Government initiatives focusing on eco-conscious urbanization and climate-resilient infrastructure are pushing contractors and developers to use environmentally friendly building materials. For instance, the State of Mexico's government announced major environmental initiatives on January 30, 2025, totaling MX$ 54 million (USD 2.6 million). In response, cement manufacturers are expanding their production capacities, modernizing plants, and incorporating automated systems to ensure both efficiency and compliance with green standards. Green cement is also gaining popularity in private sector projects, including commercial real estate and residential construction, as companies aim to align with ESG goals and consumer expectations, which in turn is positively impacting Mexico green cement market outlook. The increased availability of innovative green cement products has further improved accessibility and trust among buyers. This trend is reinforced by a broader cultural and policy-driven shift toward sustainability, making green cement a strategic choice for stakeholders across the construction value chain. As infrastructure investment continues, green cement is poised to become a foundational element in Mexico’s low-carbon building movement.

Mexico Green Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

- Fly Ash-Based

- Slag-Based

- Limestone-Based

- Silica Fume-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fly ash-based, slag-based, limestone-based, silica fume-based, and others.

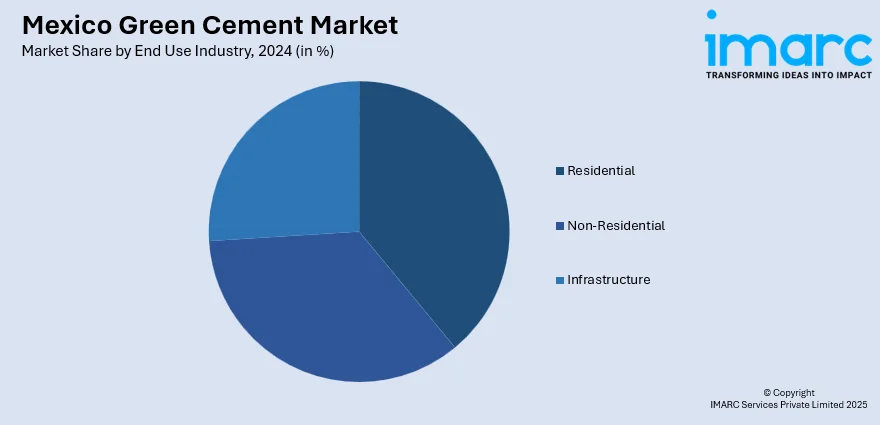

End Use Industry Insights:

- Residential

- Non-Residential

- Infrastructure

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes residential, non-residential, and infrastructure.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Green Cement Market News:

- On February 26, 2025, Holcim México announced that its sustainable products, ECOPlanet, ECOCycle, and ECOPact, had reduced CO2 emissions by 1.7 million tonnes in 2024. With a goal of 27% by 2027, ECOPact, a low-carbon concrete, accounts for 15% of the company's concrete sales and cuts CO₂ emissions by at least 30%. While ECOCycle adds recycled components to concrete for non-structural uses, ECOPlanet cement, which accounts for 56% of cement sales and aims for 77% by 2027, cuts emissions by 35–65% when compared to typical blends.

Mexico Green Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fly Ash-Based, Slag-Based, Limestone-Based, Silica Fume-Based, Others |

| End Use Industries Covered | Residential, Non-Residential, Infrastructure |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico green cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico green cement market on the basis of product type?

- What is the breakup of the Mexico green cement market on the basis of end use industry?

- What is the breakup of the Mexico green cement market on the basis of region?

- What are the various stages in the value chain of the Mexico green cement market?

- What are the key driving factors and challenges in the Mexico green cement?

- What is the structure of the Mexico green cement market and who are the key players?

- What is the degree of competition in the Mexico green cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico green cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico green cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico green cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)