Mexico Grid Automation Market Size, Share, Trends and Forecast by Component, Application, End-User, and Region, 2025-2033

Mexico Grid Automation Market Overview:

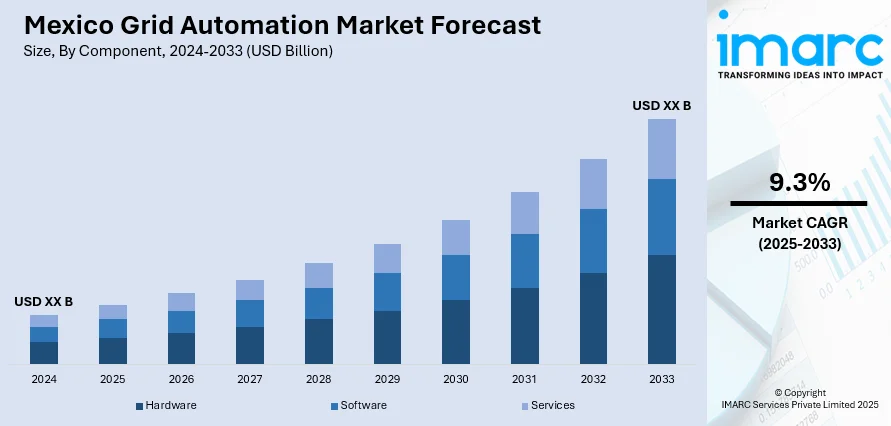

The Mexico grid automation market size is projected to exhibit a growth rate (CAGR) of 9.3% during 2025-2033. Increasing demand for reliable and efficient power distribution, government investments in smart grid technologies, the need to integrate renewable energy sources, regulatory support for modernization, and the push for improved energy security and operational efficiency are some of the factors contributing to Mexico grid automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 9.3% |

Mexico Grid Automation Market Trends:

Expansion of Grid Automation Manufacturing Capacity

The grid automation industry in Mexico is expanding rapidly due to improved production capacity for sophisticated grid technologies. New manufacturing facilities are being built to meet the growing demand for automation equipment, such as reclosers, sensors, and system protection tools. These expansions not only meet the demands of the local market, but also improve the company's capacity to service larger Latin American and international markets. With improvements to industrial infrastructure, Mexico is emerging as a vital center for the manufacture of crucial components that enhance electrical grid systems, increase operational efficiency, and speed grid modernization activities throughout the region. This move is critical to improving grid resilience and meeting the rising need for dependable energy infrastructure. These factors are intensifying the Mexico grid automation market growth. For example, in November 2024, G&W Electric opened a new state-of-the-art manufacturing facility in San Luis Potosí, Mexico, expanding production capacity to meet rising demand across Latin America. The facility would support grid automation solutions, including reclosers, sensors, and system protection equipment, bolstering G&W Electric’s ability to serve global markets and enhance power grid infrastructure. This expansion aligns with the company's strategy to support growth in Mexico and beyond while improving coordination with global engineering teams.

Strengthening Grid Automation Support

In Mexico, the grid automation market is experiencing a significant boost due to increased production capacity for advanced grid solutions. New manufacturing facilities are being established to support the rising demand for automation equipment, including reclosers, sensors, and system protection tools. These expansions are not only addressing local market needs but also enhancing the ability to serve broader Latin American and global markets. With improvements in manufacturing infrastructure, Mexico is becoming a key hub for the production of critical components that strengthen power grid systems, improve operational efficiency, and accelerate grid modernization efforts across the region. This shift is vital for enhancing grid resilience and supporting the growing demand for reliable energy infrastructure. For instance, in November 2024, GE Vernova opened a Power Transmission service unit in Toluca, Mexico, strengthening its grid automation services. The unit would offer a range of services, including spare parts supply, maintenance, and modernization for high-voltage switchgears and transformers. This expansion enhances local support, improving the efficiency and reliability of Mexico’s power transmission infrastructure, and reinforces GE Vernova's commitment to sustainable energy solutions.

Mexico Grid Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, and end-user.

Component Insights:

- Hardware

- Sensors

- Programmable Logic Controllers (PLCs)

- Remote Terminal Units (RTUs)

- Communication Networks

- Software

- Supervisory Control and Data Acquisition (SCADA)

- Distribution Management Systems (DMS)

- Advanced Metering Infrastructure (AMI)

- Grid Optimization Software

- Services

- Installation and Integration

- Maintenance and Support

- Consulting and Training

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (sensors, programmable logic controllers (PLCS), remote terminal units (RTUS), and communication networks), software, (supervisory control and data acquisition (SCADA), distribution management systems (DMS), advanced metering infrastructure (AMI), and grid optimization software), and services (installation and integration, maintenance and support, and consulting and training).

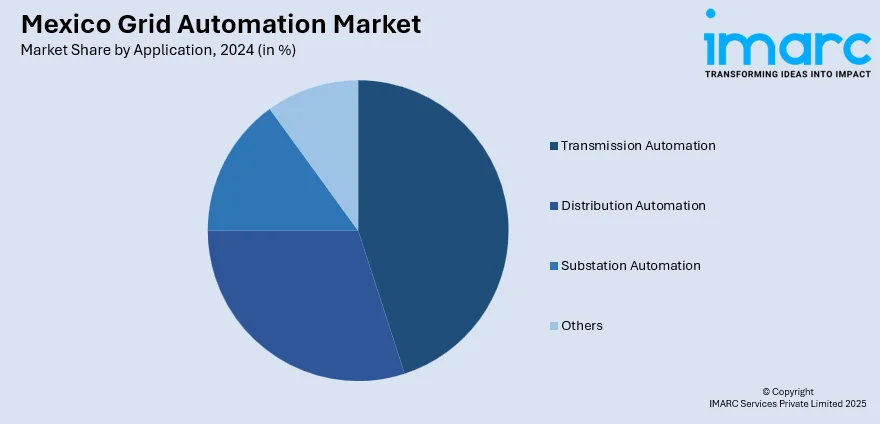

Application Insights:

- Transmission Automation

- Distribution Automation

- Substation Automation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transmission automation, distribution automation, substation automation, and others.

End-User Insights:

- Utilities

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes utilities, industrial, commercial, and residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Grid Automation Market News:

- In March 2025, Schneider Electric launched the One Digital Grid Platform, an AI-powered solution to enhance grid resiliency, efficiency, and reliability. The platform helps utilities modernize grid operations in Mexico by integrating software for better asset management, real-time insights, and efficient DER integration. It supports grid modernization with predictive analytics, automation, and reduced outages, crucial for Mexico's energy transition to cleaner, more affordable energy solutions.

Mexico Grid Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Transmission Automation, Distribution Automation, Substation Automation, Others |

| End-Users Covered | Utilities, Industrial, Commercial, Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico grid automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico grid automation market on the basis of component?

- What is the breakup of the Mexico grid automation market on the basis of application?

- What is the breakup of the Mexico grid automation market on the basis of end-user?

- What is the breakup of the Mexico grid automation market on the basis of region?

- What are the various stages in the value chain of the Mexico grid automation market?

- What are the key driving factors and challenges in the Mexico grid automation market?

- What is the structure of the Mexico grid automation market and who are the key players?

- What is the degree of competition in the Mexico grid automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico grid automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico grid automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico grid automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)