Mexico Hair Transplant Market Size, Share, Trends and Forecast by Type, Gender, End User, and Region, 2025-2033

Mexico Hair Transplant Market Overview:

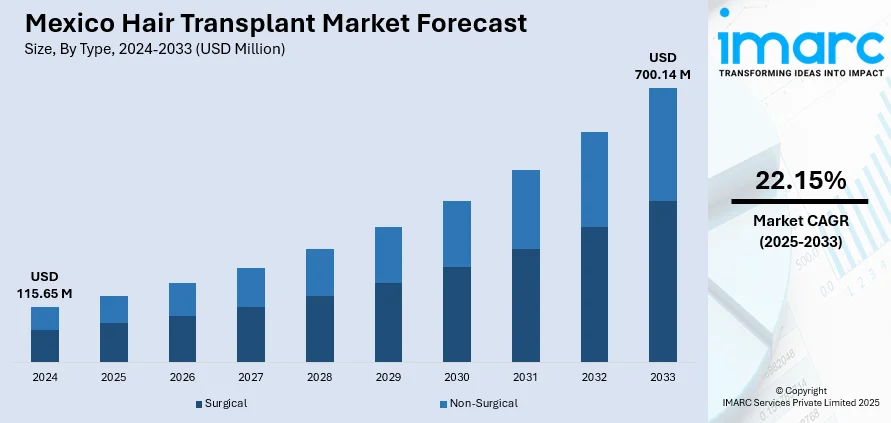

The Mexico hair transplant market size reached USD 115.65 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 700.14 Million by 2033, exhibiting a growth rate (CAGR) of 22.15% during 2025-2033. The market is driven by growing aesthetic awareness among younger professionals, leading to higher demand for reliable and discreet hair restoration procedures. The expansion of specialized clinics offering international-quality treatments is improving access and patient confidence nationwide, thereby fueling the market. Medical tourism, combined with cost-effective service models, are further augmenting the Mexico hair transplant market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 115.65 Million |

| Market Forecast in 2033 | USD 700.14 Million |

| Market Growth Rate 2025-2033 | 22.15% |

Mexico Hair Transplant Market Trends:

Rising Demand for Aesthetic Procedures Among Young Professionals

In Mexico, younger generations, particularly urban male professionals, are increasingly investing in appearance-enhancing procedures, including hair restoration. A growing societal emphasis on youthfulness and personal image is encouraging individuals facing hair loss to seek long-term, reliable solutions. In Mexico, 50% of men between the ages of 20 and 30 are affected by androgenic alopecia, with the rate increasing to 80% as they get older. Hair thinning is frequently linked to reduced self-esteem and professional confidence, especially in visually driven sectors such as sales, media, and hospitality. As a result, Follicular Unit Extraction (FUE) and other minimally invasive procedures are gaining traction among this demographic. Clinics are responding by tailoring packages that appeal to younger clients with discreet, flexible, and affordable treatment options. The availability of low-interest financing, weekend consultations, and customized regimens is contributing to wider adoption. Digital media further reinforces this trend, with influencers, cosmetic practitioners, and satisfied clients sharing their experiences and outcomes. The convergence of improved affordability, visibility, and accessibility is increasing procedure volumes among adults aged 25 to 40. This shifting consumer behavior and emphasis on aesthetics are important contributors to Mexico hair transplant market growth, particularly in metropolitan centers like Mexico City, Guadalajara, and Monterrey.

Influence of Cross-Border Medical Tourism and Regional Cost Advantages

Mexico’s proximity to the United States and its lower healthcare costs have positioned it as a regional hub for medical tourism, particularly in the aesthetic sector. Hair transplant procedures form a critical part of this segment, attracting patients from the U.S., Canada, and Central America seeking affordable, high-quality care. The cost of FUE procedures in Mexico is significantly lower than in developed countries, often without compromising clinical quality or post-operative support. Mexico has become a popular destination for affordable and high-quality hair transplants, offering savings of 40% to 70% compared to the United States and Europe. Mexico boasts advanced techniques such as FUE (Follicular Unit Extraction) and FUT (Follicular Unit Transplantation), with well-trained doctors and modern facilities meeting international standards. The country’s favorable exchange rates, lower cost of living, and all-inclusive packages contribute to its growing reputation as a leading choice for hair restoration procedures. Accredited clinics in cities such as Tijuana, Cancún, and Mexico City are increasingly marketing packages that include travel coordination, recovery lodging, and bilingual staff support, thereby offering an integrated patient experience. The average cost of a FUT transplant in Mexico is USD 4,500, and FUE costs USD 5,400, significantly lower than the prices in the US, where FUT costs around USD 15,000 and FUE around USD 20,000. Government initiatives supporting medical tourism infrastructure further reinforce the sector’s appeal. In addition, returning Mexican expatriates and binational patients are contributing to procedural volumes, given their familiarity with domestic healthcare systems and price sensitivity. These dynamics have encouraged sustained investment in technology, training, and global-standard care protocols. The continued inflow of cross-border patients and the emphasis on affordability, transparency, and safety are supporting market stability and shaping international perception of Mexico as a trusted destination for aesthetic restoration.

Mexico Hair Transplant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, gender, and end user.

Type Insights:

- Surgical

- Non-Surgical

The report has provided a detailed breakup and analysis of the market based on the type. This includes surgical and non-surgical.

Gender Insights:

- Male

- Female

The report has provided a detailed breakup and analysis of the market based on gender. This includes male and female.

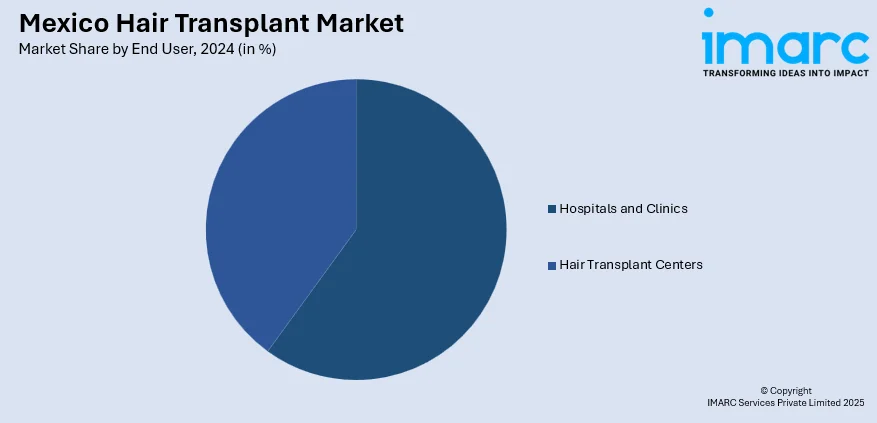

End User Insights:

- Hospitals and Clinics

- Hair Transplant Centers

The report has provided a detailed breakup and analysis of the market based on end user. This includes hospitals and clinics and hair transplant centers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hair Transplant Market News:

- On February 25, 2025, Art Line Hair Clinic announced its expansion into Mexico, bringing Turkey's renowned expertise in hair transplants to Tijuana, with a second branch opening in Mexico City in March 2025. The clinic offers advanced hair restoration techniques such as Follicular Unit Extraction (FUE), Sapphire FUE, and Direct Hair Implantation (DHI), ensuring natural and long-lasting results tailored to individual patient needs.

- On August 28, 2024, Hair Medical Restoration (HMR) celebrated the grand opening of its new clinic in Tijuana, Mexico, expanding its 15-year legacy of providing hair restoration services. The clinic is capable of conducting up to three surgeries at the same time, utilizing advanced methods like FUE (Follicular Unit Extraction) and DHI (Direct Hair Implantation). With plans for further expansion across Mexico and the introduction of additional services like Hydrafacial treatments, HMR aims to meet the growing demand for hair loss solutions.

Mexico Hair Transplant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Surgical, Non-Surgical |

| Genders Covered | Male, Female |

| End Users Covered | Hospital and Clinics, Hair Transplant Centers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hair transplant market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hair transplant market on the basis of type?

- What is the breakup of the Mexico hair transplant market on the basis of gender?

- What is the breakup of the Mexico hair transplant market on the basis of end user?

- What is the breakup of the Mexico hair transplant market on the basis of region?

- What are the various stages in the value chain of the Mexico hair transplant market?

- What are the key driving factors and challenges in the Mexico hair transplant market?

- What is the structure of the Mexico hair transplant market and who are the key players?

- What is the degree of competition in the Mexico hair transplant market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hair transplant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hair transplant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hair transplant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)