Mexico Health Drinks Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Health Drinks Market Overview:

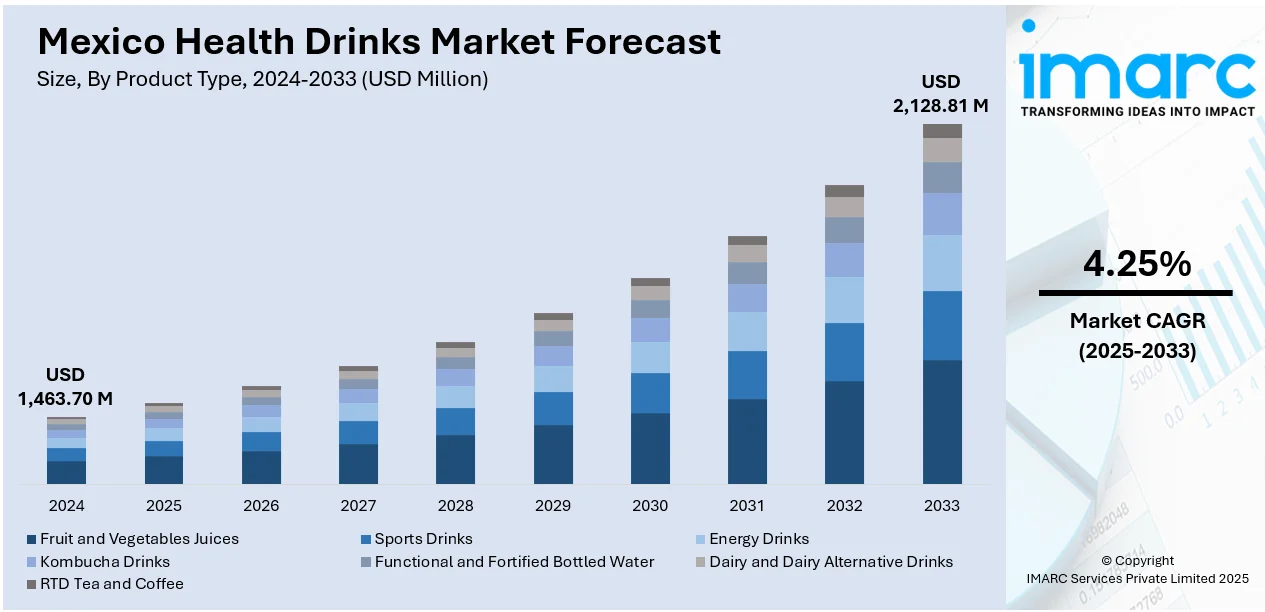

The Mexico health drinks market size reached USD 1,463.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,128.81 Million by 2033, exhibiting a growth rate (CAGR) of 4.25% during 2025-2033. The market is driven by a surging consumer demand for functional drinks that are healthy to consume and provide various benefits to consumers, such as immunity boosts, energy, and digestive wellness. Rising recognition of the necessity for healthy living combined with increasing disposable incomes has resulted in greater demand for organic and natural ingredients in drinks. Besides, the growing retail and e-commerce availability of health drinks is meeting the changing demands of health-conscious consumers, further augmenting the Mexico health drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,463.70 Million |

| Market Forecast in 2033 | USD 2,128.81 Million |

| Market Growth Rate 2025-2033 | 4.25% |

Mexico Health Drinks Market Trends:

Growing Demand for Functional Beverages

The demand for functional beverages in Mexico has increased significantly in recent years, with consumers seeking drinks that offer health benefits beyond basic hydration. A survey conducted among 1,200 consumers across Mexico, the Dominican Republic, Colombia, Guatemala, Brazil, and Peru revealed that nearly 80% were aware of functional foods and beverages. The main priorities among consumers were nutritional quality (51%) and support for general well-being (47%). This trend is being spurred by an increased awareness of the part diet plays in general wellbeing, combined with a heightened preference for drinks that contribute to immunity, digestive health, and energy. Functional health drinks, including fortified juices, probiotic drinks, and those containing vitamins and minerals, are on the rise among Mexican consumers. These beverages are promoted as substitutes for sugar-based sodas and energy drinks, appealing to the health-conscious portion of society. The inclusion of natural ingredients like herbal extracts, vitamins, and probiotics in these products further attracts customers who value clean-label products with no artificial additives. Also, the emphasis on preventive healthcare is contributing significantly to the Mexico health drinks market growth.

To get more information on this market, Request Sample

Surge in Online Sales and E-commerce Platforms

The market is increasingly benefiting from the growth of e-commerce and online sales channels. According to industry reports, the digital penetration rate among active internet users stands at 83.3%. As consumers become increasingly digitally equipped and adopt the convenience of shopping from the comfort of their homes, health drinks are gaining visibility through online channels. E-commerce enables consumers to search a wider variety of health drinks, such as specialty and niche items that are not easily found in brick-and-mortar stores. The trend has also been enhanced by the COVID-19 pandemic, which pushed more consumers toward online grocery and health product shopping. Moreover, online sites offer convenient price comparisons, customer feedback, and direct access to brand offers, which draw more consumers to buy health drinks online. Delivery services and subscription schemes are also available, allowing customers to easily receive their preferred health drinks regularly, both in terms of convenience and cost. As digital penetration continues to grow in Mexico, online sales of health drinks are expected to increase significantly, expanding market reach and driving sales.

Mexico Health Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Fruit and Vegetables Juices

- Sports Drinks

- Energy Drinks

- Kombucha Drinks

- Functional and Fortified Bottled Water

- Dairy and Dairy Alternative Drinks

- RTD Tea and Coffee

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fruits and vegetables juices, sports drinks, energy drinks, kombucha drinks, functional and fortified bottled water, dairy and dairy alternative drinks, and RTD tea and coffee.

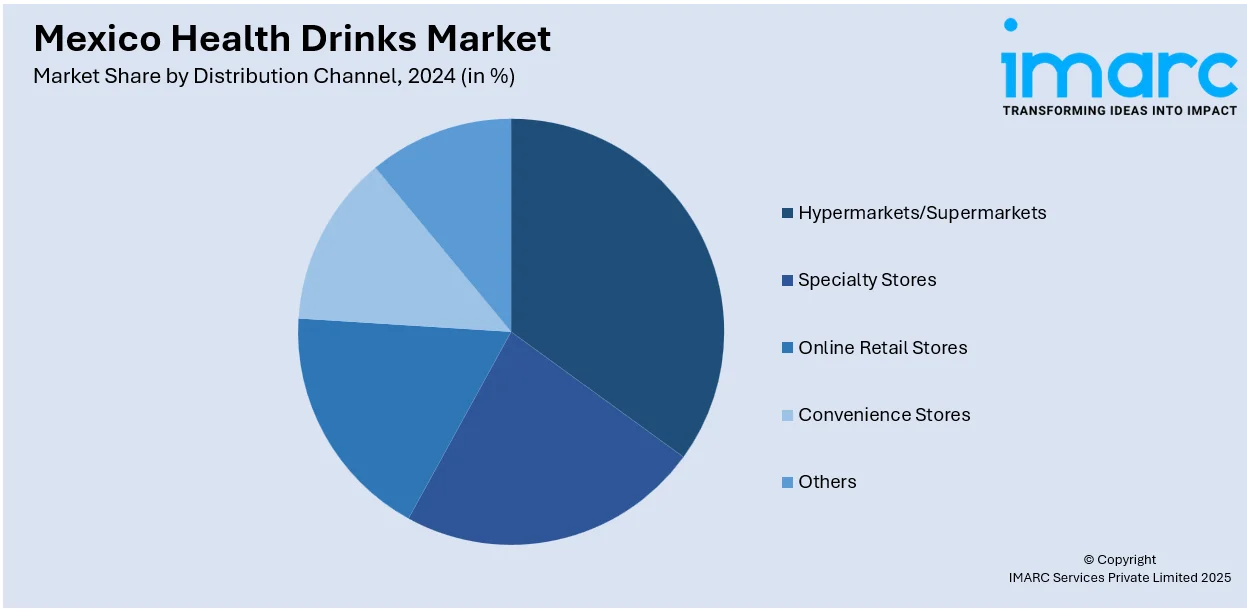

Distribution Channel Insights:

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Retail Stores

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets/supermarkets, specialty stores, online retail stores, convenience stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Health Drinks Market News:

- On February 4, 2025, Danone México reaffirmed its commitment to health and nutrition through its "Ruta de Impacto Danone" strategy, focusing on science-based development of dairy, water, and plant-based beverages to promote balanced lifestyles. Notably, 25% of its products have received endorsements from institutions such as the Mexican Pediatric Association and the Mexican Diabetes Federation, and the entire children's portfolio is fortified with essential vitamins and minerals. This initiative aligns with Danone's global recognition, having secured the top position in the 2024 Global Access to Nutrition Index (ATNI), which evaluates major food sector companies worldwide.

Mexico Health Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fruits and Vegetables Juices, Sports Drinks, Energy Drinks, Kombucha Drinks, Functional and Fortified Bottled Water, Dairy and Dairy Alternative Drinks, RTD Tea and Coffee |

| Distribution Channels Covered | Hypermarkets/Supermarkets, Specialty Stores, Online Retail Stores, Convenience Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico health drinks market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico health drinks market on the basis of product type?

- What is the breakup of the Mexico health drinks market on the basis of distribution channel?

- What is the breakup of the Mexico health drinks market on the basis of region?

- What are the various stages in the value chain of the Mexico health drinks market?

- What are the key driving factors and challenges in the Mexico health drinks market?

- What is the structure of the Mexico health drinks market and who are the key players?

- What is the degree of competition in the Mexico health drinks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico health drinks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico health drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico health drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)