Mexico Health Insurance Market Size, Share, Trends and Forecast by Provider, Type, Plan Type, Demographics, Provider Type, and Region, 2025-2033

Mexico Health Insurance Market Overview:

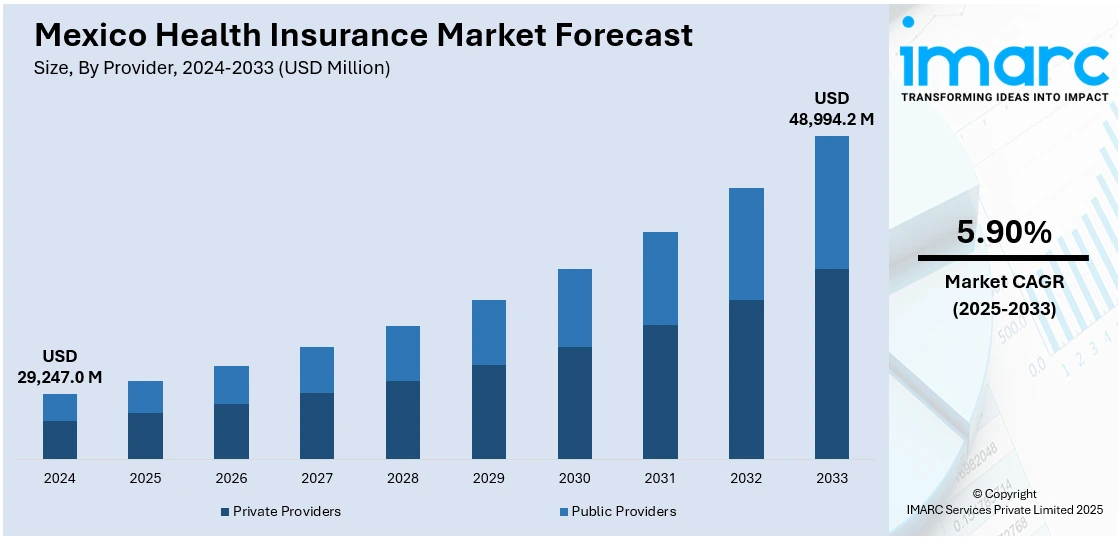

The Mexico health insurance market size reached USD 29,247.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 48,994.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. The increased healthcare expenditures, heightened health risk awareness, expanding middle class, and government reforms, such as the expansion of the public health system, as well as private insurers providing more customized plans, are some of the factors driving the Mexico health insurance market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29,247.0 Million |

| Market Forecast in 2033 | USD 48,994.2 Million |

| Market Growth Rate 2025-2033 | 5.90% |

Mexico Health Insurance Market Trends:

Rise in Demand for Private Health Insurance

The need for private health insurance in Mexico is steadily increasing, especially among the middle and upper classes. With the extensive public healthcare system challenged by factors such as waiting times and difficulty in accessing specialized care, more Mexicans are turning towards private insurance so as to ensure immediate and better medical care. Any available treatment could be more credible to those who can afford it through private health insurance as it provides more flexibility, an expanded choice of health care providers, and shorter waiting times for procedures. Moreover, awareness around health care needs and the scope of a comprehensive insurance policy have led to an increased demand among consumers for private policies providing greater coverage beyond conventional medical needs. This competition on the insurance market is being further stimulated by rising medical costs and the general demand for better health care service, making the private insurance industry a pivotal player in the ever-changing Mexico health insurance market share.

Growth of Digital Health Insurance Platforms

Digitalization is a developing phenomenon in the health insurance sector in Mexico. Several insurers have now introduced online platforms and mobile applications through which customers can manage their policies, lodge claims, and even take advantage of telemedicine services. These digital applications offer more convenience to policyholders and enable insurance companies to streamline their operations, thereby cutting costs and enhancing customer experience. The COVID-19 pandemic has promoted the takeoff of telehealth services, with more insurers adding telemedicine options to their packages. With enhanced smartphone usage and internet penetration in Mexico, demand for digital health insurance platforms should continue rising. Consumers enjoy the convenience of access, instant updates, and the possibility to consult remotely with doctors, particularly in rural areas where there is limited healthcare infrastructure. This trend is compelling insurers to invest in technology and grow their digital products to address changing consumer expectations, which is further influencing the Mexico health insurance market outlook toward a digital shift.

Focus on Preventive Health Coverage

In Mexico, an increasing amount of attention is given to preventive health care services in the health insurance policies involved. As healthcare costs continue to rise, most patients are becoming increasingly aware of the importance of early detection, prompting insurers to introduce more preventive care benefits, such as periodic check-ups, vaccinations, wellness programs, and chronic disease screenings. This entire shift towards preventive health aligns with international health trends that recognize early intervention as a means to curtail long-term treatment costs and improve public health. Mexican insurers are also seeing the advantages of preventive services, primarily from health results, but also as a differentiator of new customers, and retention. Furthermore, prevention as a primary part of health cover is increasingly sought because of an aging population and the rise of lifestyle diseases, such as diabetes and hypertension, which heightens the demand even further for preventive coverage.

Mexico Health Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on provider, type, plan type, demographics, and provider type.

Provider Insights:

- Private Providers

- Public Providers

The report has provided a detailed breakup and analysis of the market based on the provider. This includes private providers and public providers.

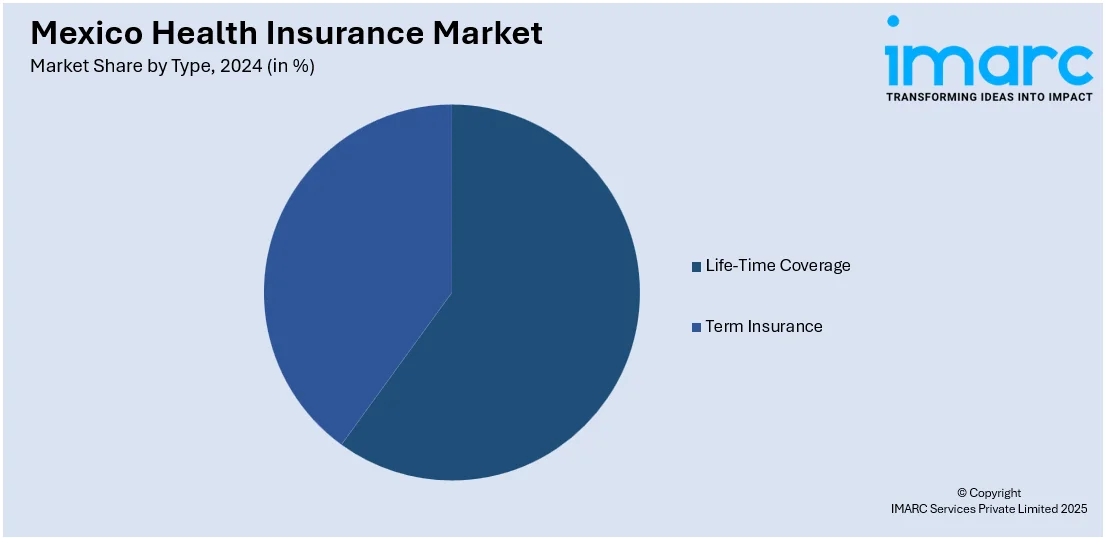

Type Insights:

- Life-Time Coverage

- Term Insurance

The report has provided a detailed breakup and analysis of the market based on the type. This includes life-time coverage and term insurance.

Plan Type Insights:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the plan type. This includes medical insurance, critical illness insurance, family floater health insurance, and others.

Demographics Insights:

- Minor

- Adults

- Senior Citizen

The report has provided a detailed breakup and analysis of the market based on the demographics. This includes minor, adults, and senior citizen.

Provider Type Insights:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPO)

A detailed breakup and analysis of the market based on the provider type have also been provided in the report. This includes preferred provider organizations (PPOS), point of service (POS), health maintenance organizations (HMOS), and exclusive provider organizations (EPO).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Health Insurance Market News:

- In October 2024, Generali Employee Benefits (GEB) announced a new strategic alliance in Mexico, strengthening its dedication to broadening their international employee benefits portfolio. This updated agreement will enhance value for their Captive clients operating in Mexico, further solidifying GEB’s dominant position in the market. This collaboration will provide Captive clients and their brokers with a new alternative for employee benefits plans, featuring a comprehensive array of solutions, outstanding service, and innovation.

- In July 2023, the insurance firm MAPFRE came to an agreement with the Mexican life insurer Insignia Life. MAPFRE will obtain 94 percent of shares and begin collaborating on a variety of life products that will enhance the expansion of this business in the Mexican market. This latest investment showcases MAPFRE’s dedication to the country and reflects its confidence in the Mexican insurance sector. The cost of the acquisition totals 1.6 billion Mexican pesos.

Mexico Health Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPO) |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico health insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico health insurance market on the basis of provider?

- What is the breakup of the Mexico health insurance market on the basis of type?

- What is the breakup of the Mexico health insurance market on the basis of plan type?

- What is the breakup of the Mexico health insurance market on the basis of demographics?

- What is the breakup of the Mexico health insurance market on the basis of provider type?

- What is the breakup of the Mexico health insurance market on the basis of region?

- What are the various stages in the value chain of the Mexico health insurance market?

- What are the key driving factors and challenges in the Mexico health insurance market?

- What is the structure of the Mexico health insurance market and who are the key players?

- What is the degree of competition in the Mexico health insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico health insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico health insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico health insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)