Mexico Healthcare CRM Market Size, Share, Trends and Forecast by Product, Application, Technology, End Use, and Region, 2025-2033

Mexico Healthcare CRM Market Overview:

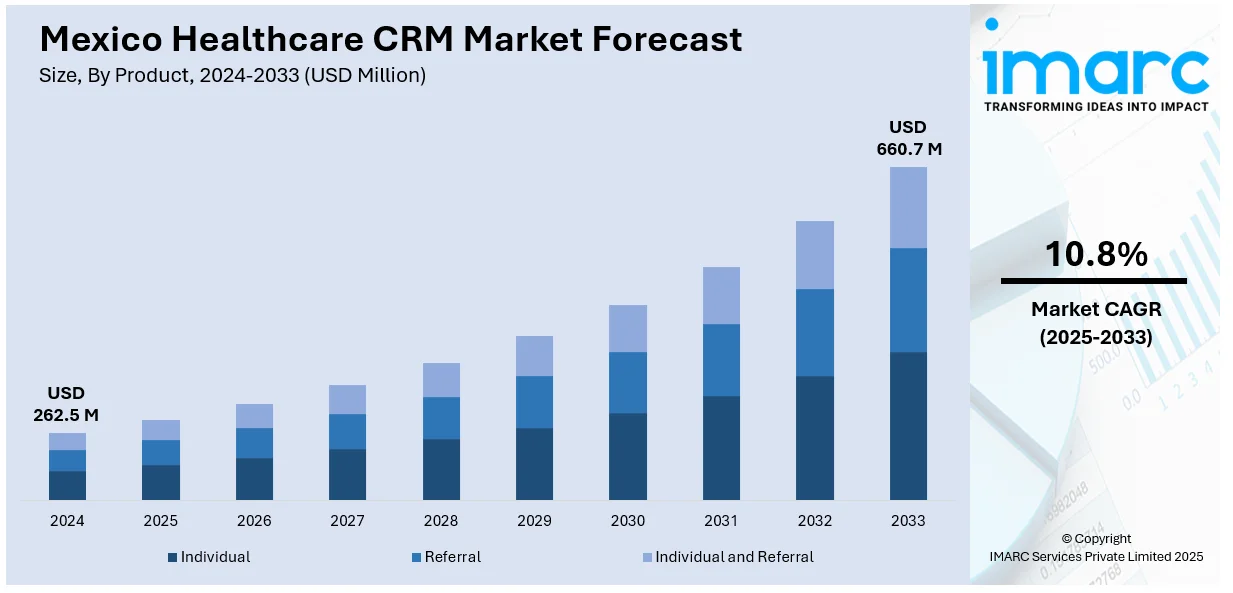

The Mexico Healthcare CRM Market size reached USD 262.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 660.7 Million by 2033, exhibiting a growth rate (CAGR) of 10.8% during 2025-2033. The market is experiencing growth driven by the rising demand for personalized patient care, increased adoption of telemedicine, and the expansion of digital infrastructure, while government initiatives, private investments, and the need for efficient chronic disease management are further accelerating the adoption of CRM systems to enhance patient engagement, retention, and operational efficiency across healthcare facilities in Mexico.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 262.5 Million |

| Market Forecast in 2033 | USD 660.7 Million |

| Market Growth Rate 2025-2033 | 10.8% |

Mexico Healthcare CRM Market Trends:

Growing Emphasis on Patient-Centric Care Models

Mexico’s healthcare system is shifting toward patient-centric care, encouraging providers to adopt CRM solutions for personalized patient engagement. Medical facilities may manage patient data, provide customized health communications, automate reminders, and monitor follow-ups with the help of healthcare CRM software. This change is assisted by increased digital literacy and higher expectations from patients for proactive care experiences. Public and private healthcare providers are leveraging CRM tools to build stronger patient relationships, improve satisfaction rates, and boost treatment adherence. With chronic disease prevalence rising in Mexico, particularly diabetes and cardiovascular conditions, the need for continuous engagement is growing. CRM technologies are becoming vital in supporting long-term care coordination, thereby fueling the Mexico healthcare CRM market outlook across hospitals, clinics, and specialty care centers.

Integration of CRM with Telemedicine and Digital Health Platforms

Mexico's quick move towards telemedicine, largely driven by the COVID-19 pandemic, is propelling the need for CRM solutions that are incorporated into virtual care platforms. With a projected 87.42% of Mexico's population forecast to be internet-enabled by 2025, telehealth is emerging as the central element of healthcare provision. CRM software, which captures and evaluates virtual interactions to facilitate real-time communication, remote monitoring, and customized treatment plans while upholding data compliance, is being used by healthcare workers more and more. CRM systems are evolving to support multi-channel engagement as telemedicine becomes more widespread, ranging from video consultations to chatbots and smartphone apps. This integration improves the patient experience, decreases administrative burden, and enables healthcare providers to effectively serve rural and underserved communities, thus increasing access and enhancing continuity of care throughout Mexico's healthcare system.

Rise in Healthcare Investments and Digital Infrastructure

Mexico’s growing investments in healthcare modernization are contributing to a broader digital transformation, thus impelling the Mexico healthcare CRM market share. Both government-led and private-sector initiatives are promoting the use of health information technology (IT) solutions, including CRM systems, to streamline operations and improve service delivery. A digital environment that is favorable to CRM integration is being created by the deployment of cloud-based platforms, hospital information systems (HIS), and electronic health records (EHRs). Furthermore, international collaborations and funding in health tech startups are introducing innovative CRM capabilities tailored to regional needs. Ongoing improvements in infrastructure are enabling more healthcare providers, especially in urban areas, to transition from manual systems to digital CRM platforms, thereby enhancing patient engagement, care coordination, and data management.

Mexico Healthcare CRM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, application, technology and end use.

Product Insights:

- Individual

- Referral

- Individual and Referral

The report has provided a detailed breakup and analysis of the market based on the product. This includes individual, referral, and individual and referral.

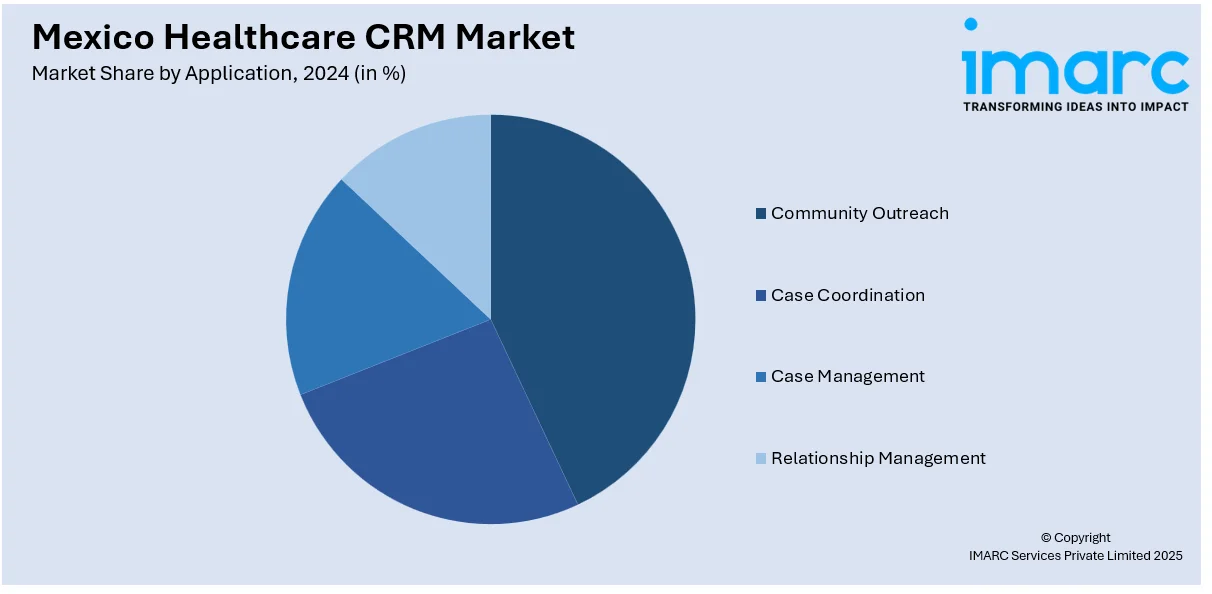

Application Insights:

- Community Outreach

- Case Coordination

- Case Management

- Relationship Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes community outreach, case coordination, case management, and relationship management.

Technology Insights:

- Cloud-based

- Mobile

- Social

- Collaborative

- Predictive

The report has provided a detailed breakup and analysis of the market based on the technology. This includes cloud-based, mobile, social, collaborative, and predictive.

End Use Insights:

- Payers

- Providers

- Life Science Companies

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes payers, providers, and life science companies.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Healthcare CRM Market News:

- In April 2024, IQVIA and Salesforce expanded their global partnership to co-develop Salesforce’s Life Sciences Cloud, integrating IQVIA’s Orchestrated Customer Engagement (OCE) platform with Salesforce’s AI-powered CRM. This next-gen platform aims to revolutionize engagement across the life sciences sector by combining advanced data, analytics, and technology. IQVIA will continue supporting OCE clients through 2029, while the new solution is expected to launch in 2025 for pharma and biotech customers.

Mexico Healthcare CRM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Individual, Referral, Individual and Referral |

| Applications Covered | Community Outreach, Case Coordination, Case Management, Relationship Management |

| Technologies Covered | Cloud-based, Mobile, Social, Collaborative, Predictive |

| End Uses Covered | Payers, Providers, Life Science Companies |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico healthcare CRM market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico healthcare CRM market on the basis of product?

- What is the breakup of the Mexico healthcare CRM market on the basis of application?

- What is the breakup of the Mexico healthcare CRM market on the basis of technology?

- What is the breakup of the Mexico healthcare CRM market on the basis of end use?

- What is the breakup of the Mexico healthcare CRM market on the basis of region?

- What are the various stages in the value chain of the Mexico healthcare CRM market?

- What are the key driving factors and challenges in the Mexico healthcare CRM market?

- What is the structure of the Mexico healthcare CRM market and who are the key players?

- What is the degree of competition in the Mexico healthcare CRM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico healthcare CRM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico healthcare CRM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico healthcare CRM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)