Mexico Healthy Instant Meals Market Size, Share, Trends and Forecast by Product Type, Ingredient Type, Packaging Type, Distribution Channel, End User, and Region, 2025-2033

Mexico Healthy Instant Meals Market Overview:

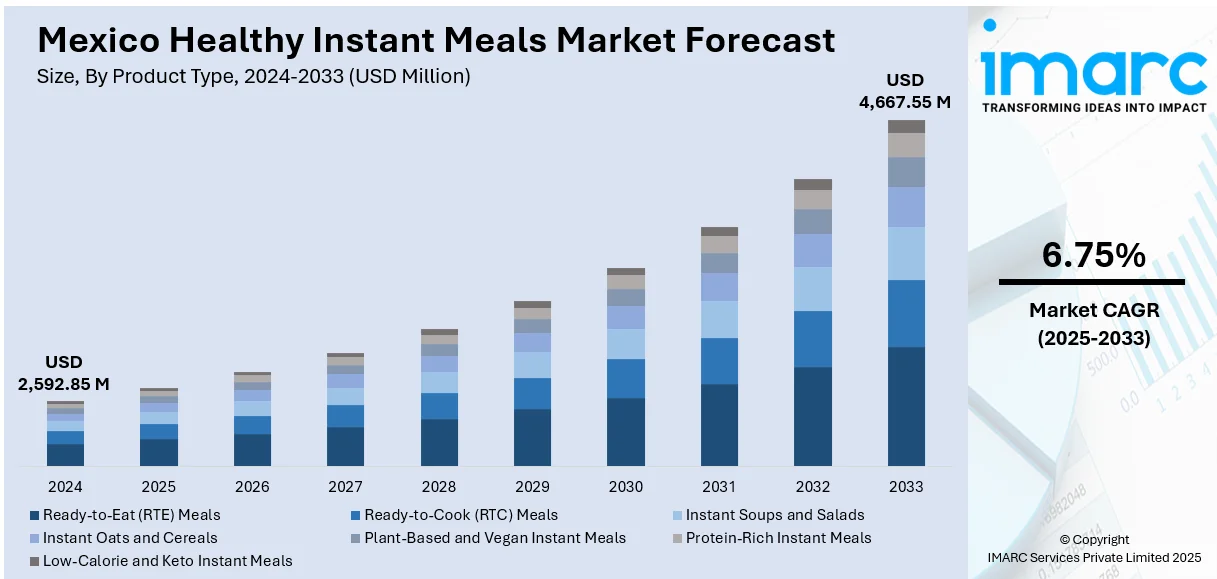

The Mexico healthy instant meals market size reached USD 2,592.85 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,667.55 Million by 2033, exhibiting a growth rate (CAGR) of 6.75% during 2025-2033. The market is driven by growing demand for nutritious convenience foods among time-pressed urban consumers. Regulatory action and rising public health consciousness are prompting the reformulation of instant meals toward lower sodium and cleaner ingredients, thereby fueling the market. Digital commerce is unlocking direct access to wellness-oriented brands and expanding product visibility, further augmenting the Mexico healthy instant meals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,592.85 Million |

| Market Forecast in 2033 | USD 4,667.55 Million |

| Market Growth Rate 2025-2033 | 6.75% |

Mexico Healthy Instant Meals Market Trends:

Government Nutrition Policies and Public Health Concerns

Mexico’s government has become increasingly proactive in combating the national obesity crisis and related chronic health conditions, including Type 2 diabetes and hypertension. Public policies mandating front-of-pack nutrition warnings and restrictions on unhealthy food advertising to children are reshaping the packaged food landscape. About one-third of Mexican children are considered obese or overweight, with sugary drinks and processed foods accounting for 40% of their daily calorie intake. Schools that violate the junk food ban face fines ranging from USD 545 to USD 5,450. The ban applies to 255,000 schools. These regulations have forced brands to innovate within the instant meals segment, prioritizing reduced sugar, salt, and fat content without compromising on flavor or shelf stability. Consumers are also more aware of the long-term effects of unhealthy eating, which has pushed them toward more informed and cautious purchasing decisions. Educational campaigns led by public health institutions are encouraging citizens to read nutritional labels and avoid ultra-processed items. In response, food companies are launching healthier instant meals containing legumes, whole grains, vegetables, and lean proteins to align with dietary guidelines. Institutional procurement—such as school meal programs—is also being influenced by stricter nutritional criteria, accelerating the adoption of healthier options. This ecosystem of regulatory accountability and consumer awareness is accelerating reformulation efforts, compelling established and emerging players alike to meet stricter standards. Consequently, the market for health-oriented convenience meals is expanding beyond niche health enthusiasts to broader household segments, which is a core contributor to Mexico healthy instant meals market growth.

To get more information on this market, Request Sample

E-commerce Growth and the Rise of Wellness-Driven Brands

The rapid expansion of Mexico’s e-commerce ecosystem is reshaping food retail and enabling healthy instant meal brands to engage directly with consumers. Online platforms provide space for detailed product information, nutritional certifications, and user reviews, attributes that resonate strongly with wellness-conscious shoppers. Direct-to-consumer models, subscription boxes, and influencer-led marketing strategies are enhancing product visibility and trial, especially among millennials and Gen Z buyers. Smaller, mission-driven brands are using digital storefronts to introduce clean-label, organic, and plant-based meals that are tailored to specific health goals such as weight management, low-carb diets, or gluten intolerance. Large platforms like Amazon Mexico and Mercado Libre are dedicating space to health-focused food categories, while delivery apps offer same-day access to curated instant meal selections. The meal delivery market in Mexico is projected to generate USD 3.00 billion in revenue by 2025, with a 4.72% CAGR through 2030. In 2025, the average revenue per user (ARPU) is expected to be USD 78.92, with 28.8% market penetration. By 2030, the number of users in the market is anticipated to reach 46.8 million. Social media campaigns highlighting meal prep ease, functional ingredients, and sustainability claims further build emotional affinity with brands. Additionally, digital promotions during health awareness months or fitness challenges are driving seasonal spikes in demand. This digitally enabled marketplace allows emerging companies to rapidly scale without traditional retail infrastructure, fostering category innovation and expanding customer choice. As a result, digital transformation is reinforcing the long-term penetration of healthy instant meals across diverse Mexican consumer groups.

Mexico Healthy Instant Meals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, ingredient type, packaging type, distribution channel, and end user.

Product Type Insights:

- Ready-to-Eat (RTE) Meals

- Ready-to-Cook (RTC) Meals

- Instant Soups and Salads

- Instant Oats and Cereals

- Plant-Based and Vegan Instant Meals

- Protein-Rich Instant Meals

- Low-Calorie and Keto Instant Meals

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ready-to-eat (RTE) meals, ready-to-cook (RTC) meals, instant soups and salads, instant oats and cereals, plant-based and vegan instant meals, protein-rich instant meals, and low-calorie and keto instant meals.

Ingredient Type Insights:

- Organic and Natural Ingredients

- Plant-Based Ingredients

- Gluten-Free Ingredients

- Protein-Fortified Ingredients

The report has provided a detailed breakup and analysis of the market based on the ingredient type. This includes organic and natural ingredients, plant-based ingredients, gluten-free ingredients, and protein-fortified ingredients.

Packaging Type Insights:

- Pouches

- Cups and Bowls

- Trays and Boxes

- Cans and Bottles

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes pouches, cups and bowls, trays and boxes, and cans and bottles.

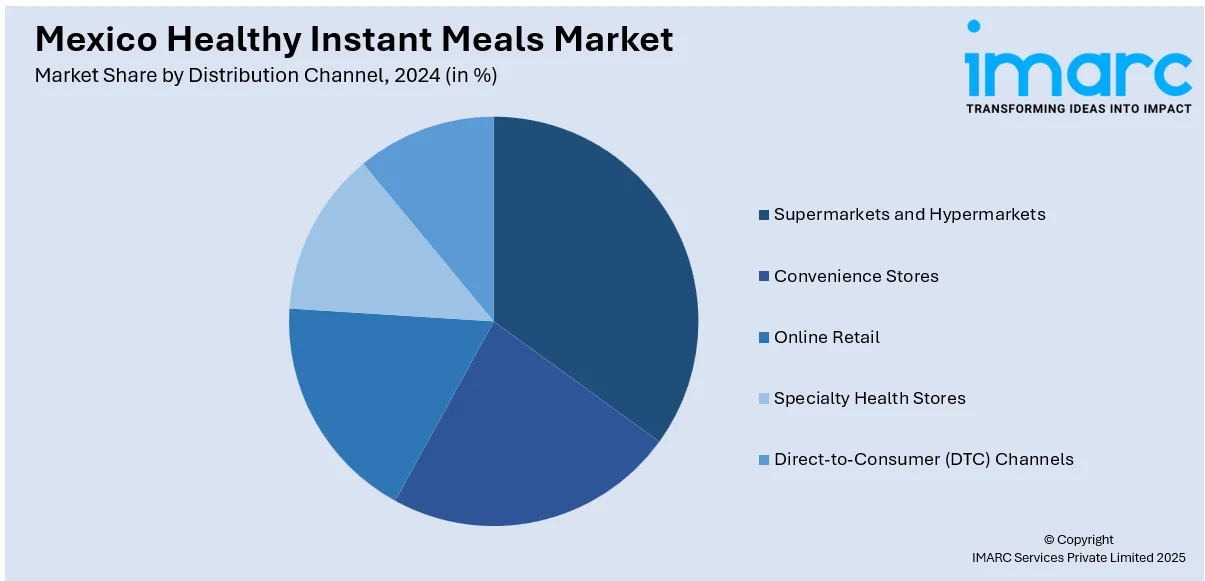

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Health Stores

- Direct-to-Consumer (DTC) Channels

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online retail, specialty health stores, and direct-to-consumer (DTC) channels.

End User Insights:

- Working Professionals

- Students

- Fitness Enthusiasts

- Travelers and Outdoor Consumers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes working professionals, students, fitness enthusiasts, and travelers and outdoor consumers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Healthy Instant Meals Market News:

- On April 17, 2024, MegaMex Foods introduced DOÑA MARÍA® Mole Rojo, a foodservice-specific mole paste designed to offer authentic Mexican flavor with ease of use for restaurant operators. The product, crafted with ingredients like ancho peppers, peanuts, sesame seeds, and chocolate, promises to elevate dishes like chicken, chilaquiles, and even desserts in minutes. According to Datassential (2023), entrees made with mole saw a 52% increase in median spend, showcasing the growing interest in diverse and convenient meal options.

Mexico Healthy Instant Meals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ready-to-Eat (RTE) Meals, Ready-to-Cook (RTC) Meals, Instant Soups and Salads, Instant Oats and Cereals, Plant-Based and Vegan Instant Meals, Protein-Rich Instant Meals, Low-Calorie and Keto Instant Meals |

| Ingredient Types Covered | Organic and Natural Ingredients, Plant-Based Ingredients, Gluten-Free Ingredients, Protein-Fortified Ingredients |

| Packaging Types Covered | Pouches, Cups and Bowls, Trays and Boxes, Cans and Bottles |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Health Stores, Direct-to-Consumer (DTC) Channels |

| End Users Covered | Working Professionals, Students, Fitness Enthusiasts, Travelers and Outdoor Consumers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico healthy instant meals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico healthy instant meals market on the basis of product type?

- What is the breakup of the Mexico healthy instant meals market on the basis of ingredient type?

- What is the breakup of the Mexico healthy instant meals market on the basis of packaging type?

- What is the breakup of the Mexico healthy instant meals market on the basis of distribution channel?

- What is the breakup of the Mexico healthy instant meals market on the basis of end user?

- What is the breakup of the Mexico healthy instant meals market on the basis of region?

- What are the various stages in the value chain of the Mexico healthy instant meals market?

- What are the key driving factors and challenges in the Mexico healthy instant meals market?

- What is the structure of the Mexico healthy instant meals market and who are the key players?

- What is the degree of competition in the Mexico healthy instant meals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico healthy instant meals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico healthy instant meals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico healthy instant meals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)