Mexico Hearing Aids Market Size, Share, Trends and Forecast by Product Type, Hearing Loss, Patient Type, Technology Type, End-User, and Region, 2025-2033

Mexico Hearing Aids Market Overview:

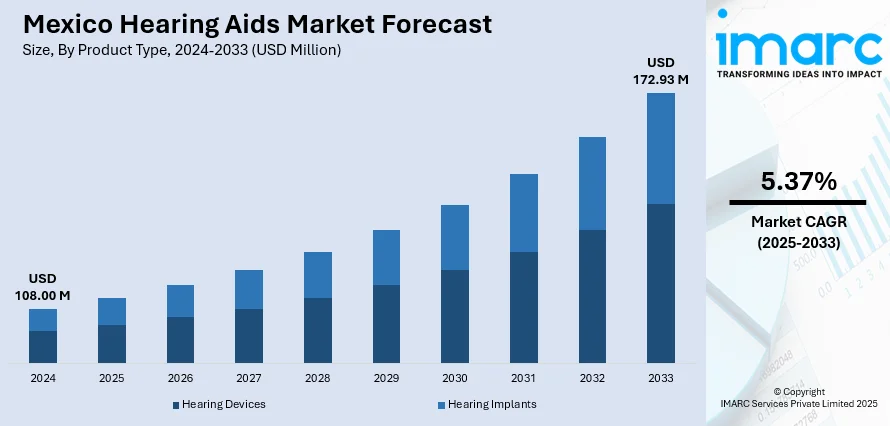

The Mexico hearing aids market size reached USD 108.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 172.93 Million by 2033, exhibiting a growth rate (CAGR) of 5.37% during 2025-2033. The market is driven by the rising adoption of advanced hearing aids, fueled by growing consumer demand for wireless connectivity, AI-enhanced sound processing, and discreet designs, particularly among younger and tech-savvy users. Increasing hearing impairment prevalence, especially among the aging population, alongside improving healthcare access and disposable incomes, further accelerates market demand. Additionally, cost-effective solutions, including OTC devices and tele-audiology services, are expanding market reach, thereby augmenting the Mexico hearing aids market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 108.00 Million |

| Market Forecast in 2033 | USD 172.93 Million |

| Market Growth Rate 2025-2033 | 5.37% |

Mexico Hearing Aids Market Trends:

Growing Adoption of Digital and Wireless Hearing Aids in Mexico

The sector is witnessing a shift towards wireless and digital hearing aid technology. Consumer awareness and understanding of advanced hearing solutions are increasing, leading to a growing demand for devices equipped with Bluetooth, smartphone compatibility, and AI-driven sound processing capabilities. Wireless digital hearing aids offer a range of interactions with supported mobile devices, TVs, and other audio sources, as well as convenience for individuals with hearing loss, enabling improved user experience. The growth is also driven by increased access to better technologies (digital hearing aids) that provide much superior noise reduction, directional microphones, and features that can be tailored relative to analog hearing aids. Aside from the legislative efforts that continue to contribute to growing awareness and availability of hearing aids, the push to mandate more sophisticated solutions is driven by a documented increase in hearing loss among the elderly. A study conducted on Mexican children who were given cochlear implants identified 47% (14 of 30) with a genetic cause for their severe to profound sensorineural hearing loss (SNHL), with 71% of the diagnoses being syndromic. Of these syndromic cases, 80% could not be diagnosed clinically, underscoring the paramount importance of genetic testing. This highlights the growing need for sophisticated hearing solutions and early interventions within the country's hearing health industry. Manufacturers are also focusing on developing rechargeable and discreet designs, appealing to younger users who prioritize aesthetics and convenience. With improving healthcare infrastructure and increasing disposable income, the adoption of high-tech hearing aids is expected to grow steadily in Mexico over the coming years.

Increasing Demand for Affordable and Accessible Hearing Care Solutions

The rising demand for cost-effective and accessible hearing care solutions is supporting the Mexico hearing aids market growth. Despite technological advancements, affordability remains a major concern for many Mexicans, leading to a growing preference for budget-friendly hearing aids. Over-the-counter (OTC) hearing devices and online retail platforms are gaining traction as they provide cheaper alternatives to traditional prescription-based models. According to an industry report, in 2024, Mexico surpassed 100 million online users, of whom 67 million were actively engaged in e-commerce, driving the country's online shopping market to reach MXN 789.7 Billion (approximately USD 41 Billion), a 20% increase compared to 2023. With the digital adoption rate accelerating, the role of personal experiences in shopping becomes crucial for success. This trend opens doors for Mexican hearing aid firms to enhance their online presence and increase customer engagement by utilizing advanced e-commerce strategies. The implementation of government initiatives and NGO programs aimed at improving hearing healthcare accessibility are also contributing to market growth. Additionally, tele-audiology services are emerging, enabling remote hearing tests and consultations, particularly in rural areas with limited access to specialists. As awareness about hearing loss prevention and treatment increases, more consumers are seeking economical yet reliable options. This trend is encouraging manufacturers to develop entry-level digital hearing aids without compromising on essential features, making hearing care more inclusive across different socioeconomic groups in Mexico.

Mexico Hearing Aids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, hearing loss, patient type, technology type, and end-user.

Product Type Insights:

- Hearing Devices

- Behind-the-Ear (BTE)

- Receiver-in-the Ear (RITE)

- In-the-Ear (ITE)

- Canal Hearing Aids (CHA)

- Others

- Hearing Implants

- Cochlear Implants

- BAHA Implants

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hearing devices (behind-the-ear (BTE), receiver-in-the ear (RITE), in-the-ear (ITE), canal hearing aids (CHA), and others) and hearing implants (cochlear implants and BAHA implants).

Hearing Loss Insights:

- Sensorineural Hearing Loss

- Conductive Hearing Loss

A detailed breakup and analysis of the market based on the hearing loss have also been provided in the report. This includes sensorineural hearing loss and conductive hearing loss.

Patient Type Insights:

- Adults

- Pediatrics

The report has provided a detailed breakup and analysis of the market based on the patient type. This includes adults and pediatrics.

Technology Type Insights:

- Analog

- Digital

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes analog and digital.

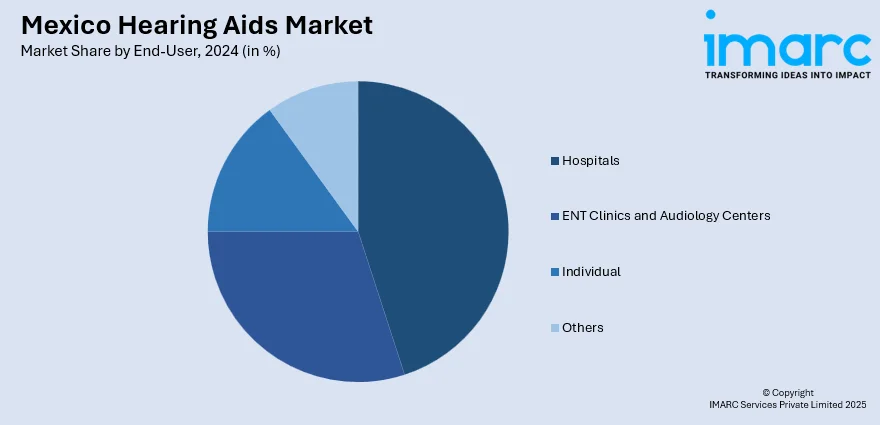

End-User Insights:

- Hospitals

- ENT Clinics and Audiology Centers

- Individual

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals, ENT clinics and audiology centers, individual, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hearing Aids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Hearing Losses Covered | Sensorineural Hearing Loss, Conductive Hearing Loss |

| Patient Types Covered | Adults, Pediatrics |

| Technology Types Covered | Analog, Digital |

| End-Users Covered | Hospitals, ENT Clinics and Audiology Centers, Individual, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hearing aids market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hearing aids market on the basis of product type?

- What is the breakup of the Mexico hearing aids market on the basis of hearing loss?

- What is the breakup of the Mexico hearing aids market on the basis of patient type?

- What is the breakup of the Mexico hearing aids market on the basis of technology type?

- What is the breakup of the Mexico hearing aids market on the basis of end-user?

- What is the breakup of the Mexico hearing aids market on the basis of region?

- What are the various stages in the value chain of the Mexico hearing aids market?

- What are the key driving factors and challenges in the Mexico hearing aids market?

- What is the structure of the Mexico hearing aids market and who are the key players?

- What is the degree of competition in the Mexico hearing aids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hearing aids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hearing aids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hearing aids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)