Mexico Heat Exchanger Market Size, Share, Trends and Forecast by Product, Material, End User Industry, and Region, 2025-2033

Mexico Heat Exchanger Market Overview:

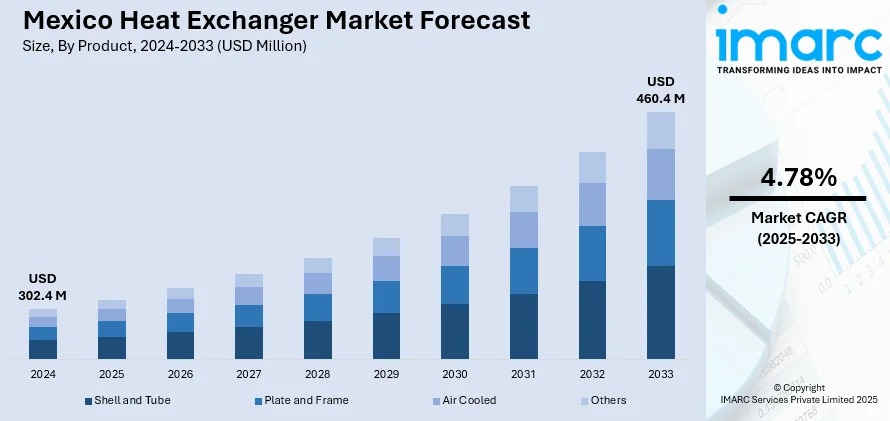

The Mexico heat exchanger market size reached USD 302.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 460.4 Million by 2033, exhibiting a growth rate (CAGR) of 4.78% during 2025-2033. The market is growing due to rising demand from power generation, chemicals, and HVAC sectors. Increasing industrialization, stricter energy efficiency rules, and infrastructure upgrades are also supporting the use of advanced thermal exchange technologies across multiple industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 302.4 Million |

| Market Forecast in 2033 | USD 460.4 Million |

| Market Growth Rate 2025-2033 | 4.78% |

Mexico Heat Exchanger Market Trends:

Rising Energy Efficiency Standards

Mexico's heat exchanger market is expanding steadily as industries adapt to stricter energy efficiency regulations. Sectors like oil and gas, power, and chemical processing are investing in modern thermal management systems to reduce operational costs and emissions. The shift towards cleaner energy and sustainable industrial practices has increased the use of high-performance equipment. Heat exchangers play a key role in ensuring minimal heat loss, especially in temperature-sensitive applications. Ongoing modernization in the manufacturing and power sectors is fueling new installations. There's also growing awareness about lifecycle cost savings from equipment that reduces energy consumption. Regional government policies encouraging eco-friendly solutions are also contributing to market activity. In addition, manufacturers are tailoring solutions for localized needs, improving adoption rates across various scales of operation. A noticeable trend in the market is the gradual shift from conventional to compact and plate-type heat exchangers. These options offer better heat transfer efficiency in smaller footprints, making them ideal for plants with space constraints. Several companies have introduced designs with corrosion resistance and low maintenance needs to attract buyers in harsh industrial settings. These developments are enhancing long-term performance and influencing buyer preferences in the Mexican market.

Industrial Growth Supporting Demand

The rise in industrial output in Mexico is directly impacting the demand for heat exchangers. As sectors such as petrochemicals, food processing, and HVAC continue expanding, the need for efficient heat management solutions is growing. These devices support various functions, from maintaining temperature control to recycling waste heat, which helps improve process efficiency and reduce environmental impact. Infrastructure development across the country, including power plants and commercial buildings, is creating new opportunities for heat exchanger installations. Increased construction of data centers, and urban cooling systems also support the market. The demand for durable and cost-effective systems is influencing how local manufacturers innovate and upgrade their offerings. Recent developments show companies focusing on hybrid designs that work efficiently across variable loads and operating conditions. This is particularly useful in industries with fluctuating energy usage. There's also a trend toward integrating digital monitoring features, allowing operators to track performance and detect issues early. These technological additions not only improve efficiency but also help avoid costly downtime. Such innovations are shaping purchasing decisions and setting the stage for long-term demand in the country's thermal equipment segment.

Mexico Heat Exchanger Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, material, and end user industry.

Product Insights:

- Shell and Tube

- Plate and Frame

- Air Cooled

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes shell and tube, plate and frame, air cooled, and others.

Material Insights:

- Carbon Steel

- Stainless Steel

- Nickel

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes carbon steel, stainless steel, nickel, and others.

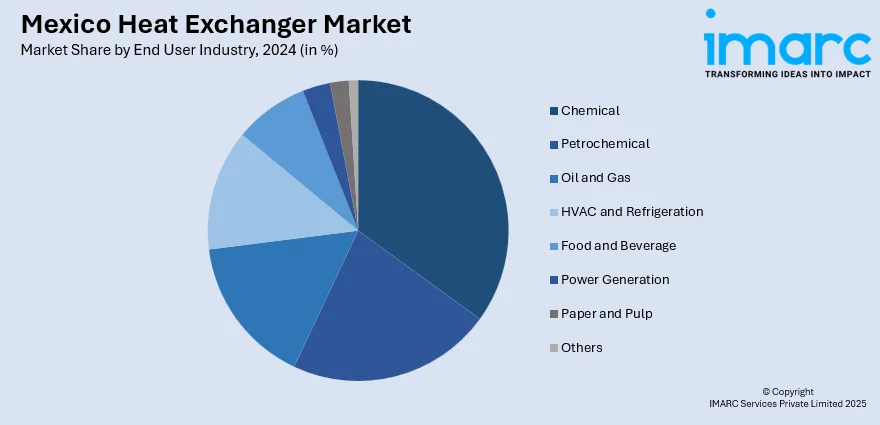

End User Industry Insights:

- Chemical

- Petrochemical

- Oil and Gas

- HVAC and Refrigeration

- Food and Beverage

- Power Generation

- Paper and Pulp

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes chemical, petrochemical, oil and gas, HVAC and refrigeration, food and beverage, power generation, paper and pulp, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Heat Exchanger Market News:

- December 2024: Guntner opened its fifth production plant in Monterrey, Mexico, expanding heat exchanger capacity by 30%. The 27,000 m² facility focused on high-efficiency condensers and liquid coolers, enhancing product diversity, improving delivery timelines, and strengthening Mexico’s position in the regional heat exchanger industry.

- July 2024: Danfoss expanded its Monterrey Campus in Mexico by 40,000 m², doubling microchannel heat exchanger capacity. The facility supported rising demand for energy-efficient HVAC systems and refrigerant transition technologies, strengthening Mexico’s role in the global heat exchanger supply and manufacturing landscape.

Mexico Heat Exchanger Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shell and Tube, Plate and Frame, Air Cooled, Others |

| Materials Covered | Carbon Steel, Stainless Steel, Nickel, Others |

| End User Industries Covered | Chemical, Petrochemical, Oil and Gas, HVAC and Refrigeration, Food and Beverage, Power Generation, Paper and Pulp, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico heat exchanger market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico heat exchanger market on the basis of product?

- What is the breakup of the Mexico heat exchanger market on the basis of material?

- What is the breakup of the Mexico heat exchanger market on the basis of end user industry?

- What is the breakup of the Mexico heat exchanger market on the basis of region?

- What are the various stages in the value chain of the Mexico heat exchanger market?

- What are the key driving factors and challenges in the Mexico heat exchanger market?

- What is the structure of the Mexico heat exchanger market and who are the key players?

- What is the degree of competition in the Mexico heat exchanger market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico heat exchanger market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico heat exchanger market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico heat exchanger industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)