Mexico Heat Pump Market Size, Share, Trends and Forecast by Rated Capacity, Product Type, End Use Sector, and Region, 2025-2033

Mexico Heat Pump Market Overview:

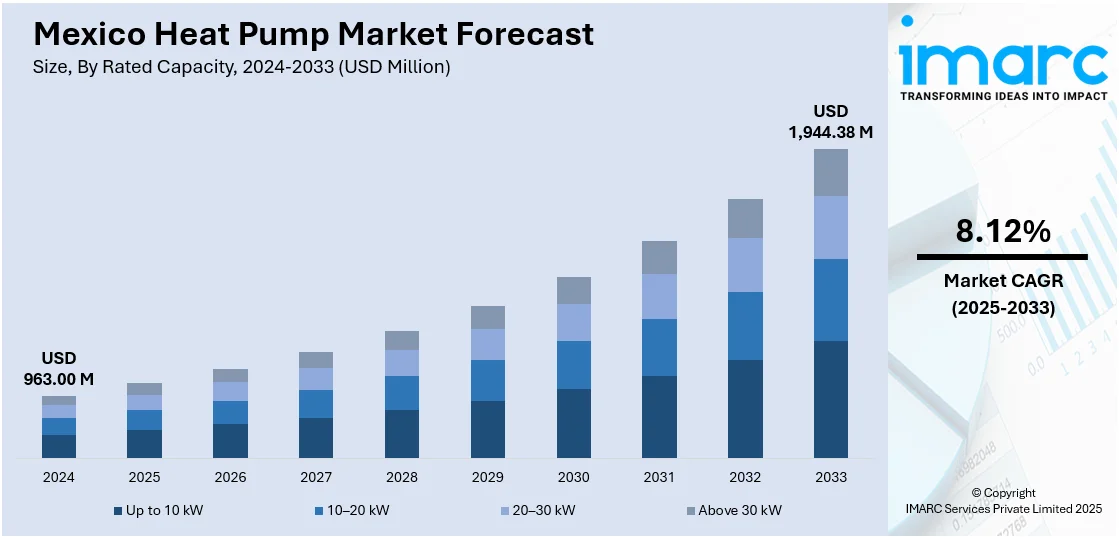

The Mexico heat pump market size reached USD 963.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,944.38 Million by 2033, exhibiting a growth rate (CAGR) of 8.12% during 2025-2033. The increasing climate variability and temperature extremes, coupled with a rise in infrastructure projects and climate policies, are driving the demand for adaptable climate control systems, such as heat pumps, thereby impacting the Mexico heat pump market share. These systems offer energy-efficient solutions for managing temperature fluctuations and align with Mexico's decarbonization objectives. As urban development accelerates, heat pumps are becoming integral to new construction, ensuring year-round comfort while contributing to sustainability and emissions reduction efforts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 963.00 Million |

| Market Forecast in 2033 | USD 1,944.38 Million |

| Market Growth Rate 2025-2033 | 8.12% |

Mexico Heat Pump Market Trends:

Climate Variability and Temperature Extremes

Rising climate variability and more frequent temperature extremes in Mexico are driving the need for flexible and robust climate control solutions such as heat pumps. Although Mexico has historically experienced various temperate climates, recent years have brought stronger heatwaves and sporadic cold snaps, worsened by changing climate conditions. For example, in 2024, severe heat in Mexico resulted in more than 125 fatalities, exacerbated by climate change. As reported by the World Weather Attribution, the heatwave, driven by a heat dome, was 35 to 200 times more probable because of human-caused global warming. Conventional heating, ventilation, and air conditioning (HVAC) systems frequently have difficulty handling these variations, particularly those built for performance in just one season. Heat pumps, on the other hand, provide heating and cooling from one device, which makes them perfect for conditions with increasing temperature fluctuations. This adaptability guarantees comfort throughout the year, making heat pumps more vital in areas experiencing intense heatwaves or harsh winters. With the rise of climate unpredictability, both individuals and businesses are seeking systems that adjust while maintaining efficiency and affordability.

Rising Number of Infrastructure Projects

As urban areas in Mexico develop and infrastructure initiatives increase, there is a higher demand for effective, scalable climate management systems. The development of new housing complexes, business areas, and industrial structures creates an ideal opportunity for incorporating advanced technologies such as heat pumps. For instance, in 2024, Martí Batres, the Head of Mexico City, introduced a US$1.13 billion infrastructure initiative, addressing 21 priority projects in seven essential sectors, such as public spaces, mobility, sustainability, and cultural growth. Such initiative showcases the growing emphasis on sustainable urban development, in which energy-efficient technologies like heat pumps are becoming an essential component of the design. Construction regulations are advancing to encompass energy efficiency criteria, encouraging builders to incorporate sustainable solutions. In dense urban areas, space-saving and dual-function heat pumps are especially attractive because of their compact design and multi-season performance. As Mexico continues transitioning toward smart, sustainable urban planning, heat pumps are emerging as a core element in modern building practices.

Climate Policy and Decarbonization Goals

Mexico’s climate strategy, aligned with international environmental commitments, is driving the adoption of low-carbon technologies, including heat pumps. As the country strives to lower greenhouse gas emissions, there is an increase in need to phase out fossil fuel-based heating and cooling systems. Heat pumps, which operate on electricity and can be paired with renewable energy sources, are well-aligned with these decarbonization goals. These systems help reduce carbon footprints across both residential and industrial sectors. Besides this, the focus of the governing body on building green infrastructure by reducing carbon emissions and improving energy efficiency is bolstering the Mexico heat pump market growth. In 2024, Mexico City hosted a workshop on the "Roadmap for the Decarbonization of the Building Sector," urging the implementation of energy efficiency standards to reduce CO2 emissions from buildings, which account for 40% of energy-related emissions. This push for cleaner energy alternatives is creating a favorable regulatory environment, with policymakers and the private sector responding through incentive programs, procurement policies, and investments in green infrastructure.

Mexico Heat Pump Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on rated capacity, product type, and end use sector.

Rated Capacity Insights:

- Up to 10 kW

- 10–20 kW

- 20–30 kW

- Above 30 kW

The report has provided a detailed breakup and analysis of the market based on the rated capacity. This includes up to 10 kW, 10-20 kW, 20-30 kW, and above 30 kW.

Product Type Insights:

- Air Source Heat Pump

- Ground Source Heat Pump

- Water Source Heat Pump

- Exhaust Air Heat Pump

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes air source heat pump, ground source heat pump, water source heat pump, exhaust air heat pump, and others.

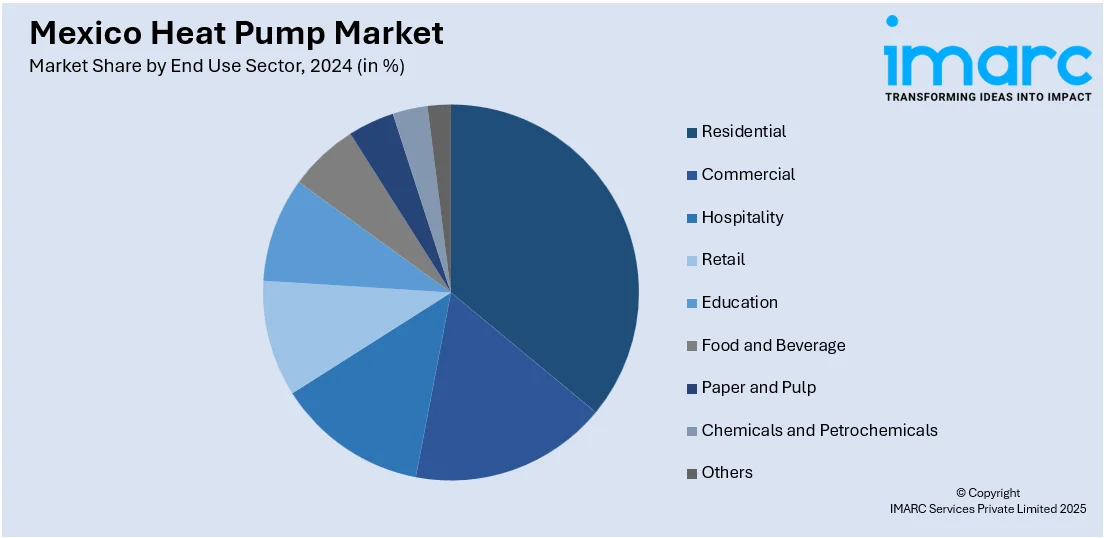

End Use Sector Insights:

- Residential

- Commercial

- Hospitality

- Retail

- Education

- Food and Beverage

- Paper and Pulp

- Chemicals and Petrochemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes residential, commercial, hospitality, retail, education, food and beverage, paper and pulp, chemicals and petrochemicals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Heat Pump Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Rated Capacities Covered | Up to 10 kW, 10–20 kW, 20–30 kW, Above 30 kW |

| Product Types Covered | Air Source Heat Pump, Ground Source Heat Pump, Water Source Heat Pump, Exhaust Air Heat Pump, Others |

| End Use Sectors Covered | Residential, Commercial, Hospitality, Retail, Education, Food and Beverage, Paper and Pulp, Chemicals and Petrochemicals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico heat pump market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico heat pump market on the basis of rated capacity?

- What is the breakup of the Mexico heat pump market on the basis of product type?

- What is the breakup of the Mexico heat pump market on the basis of end use sector?

- What is the breakup of the Mexico heat pump market on the basis of region?

- What are the various stages in the value chain of the Mexico heat pump market?

- What are the key driving factors and challenges in the Mexico heat pump?

- What is the structure of the Mexico heat pump market and who are the key players?

- What is the degree of competition in the Mexico heat pump market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico heat pump market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico heat pump market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico heat pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)