Mexico Heat Recovery Systems Market Size, Share, Trends and Forecast by Type, Technology, Industry, and Region, 2026-2034

Mexico Heat Recovery Systems Market Summary:

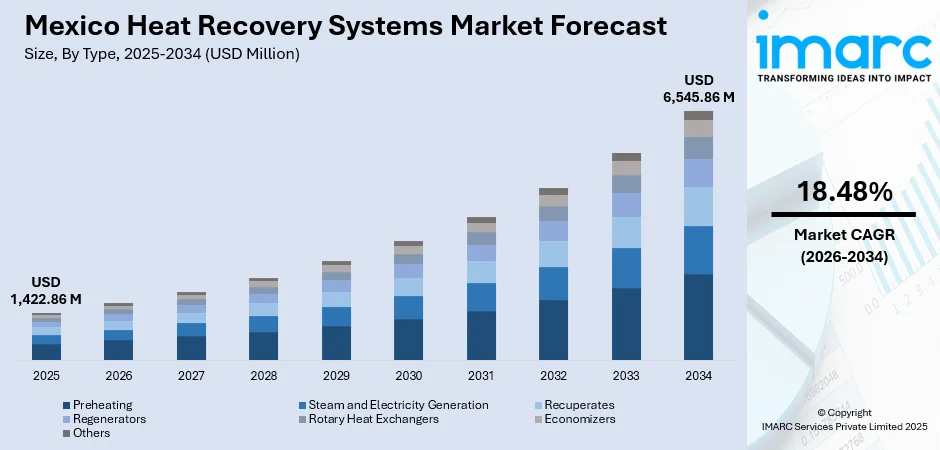

The Mexico heat recovery systems market size was valued at USD 1,422.86 Million in 2025 and is projected to reach USD 6,545.86 Million by 2034, growing at a compound annual growth rate of 18.48% from 2026-2034.

The Mexico heat recovery systems market is rapidly expanding, fueled by rising industrial demand for energy-efficient solutions and stronger environmental sustainability initiatives across major manufacturing sectors. By capturing and reusing thermal energy from industrial processes, these systems optimize energy consumption, reduce operational costs, and contribute to national carbon emission reduction goals. This growth reflects a broader shift toward sustainable industrial practices across Mexico.

Key Takeaways and Insights:

-

By Type: Steam and electricity generation dominates the market with a share of 30.12% in 2025, driven by increasing industrial demand for onsite power generation capabilities and growing emphasis on reducing operational costs through efficient waste heat utilization.

-

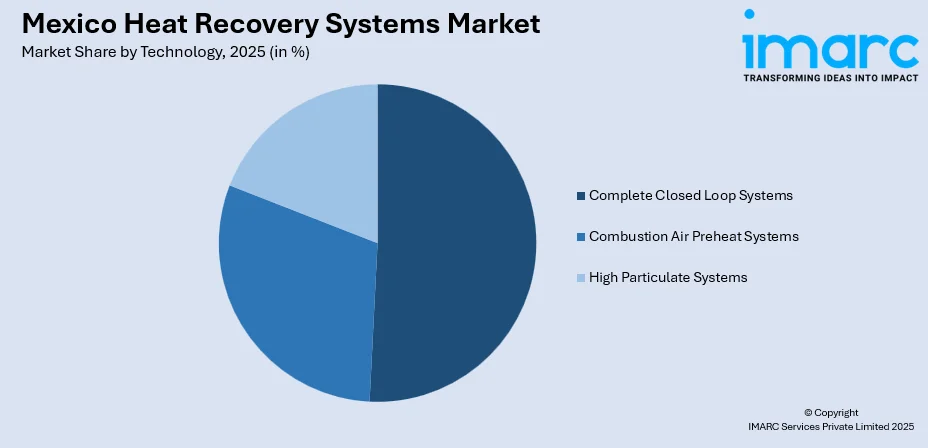

By Technology: Complete closed loop systems lead the market with a share of 50.06% in 2025, owing to superior heat transfer efficiency and reliable performance in capturing waste heat from diverse industrial applications across manufacturing facilities.

-

By Industry: Petroleum refining represents the largest segment with a market share of 25.1% in 2025, attributed to extensive refinery operations generating substantial waste heat and ongoing modernization efforts to improve energy efficiency.

-

Key Players: The Mexico heat recovery systems market exhibits a competitive landscape characterized by international technology providers and regional equipment manufacturers competing through technological innovation, strategic partnerships, and comprehensive service offerings across industrial sectors.

To get more information on this market Request Sample

The Mexico heat recovery systems market is witnessing significant growth as industrial facilities increasingly focus on energy efficiency and sustainable operations. Government incentives promoting energy optimization, alongside stringent environmental regulations, are driving adoption across petroleum refining, cement, metal, and chemical industries. Advanced heat exchangers and intelligent monitoring technologies improve system performance and simplify integration, making implementation more feasible. As per sources, in 2025, Alfa Laval Mexico promoted its “T-Line” heat exchanger technology, enabling up to 30% improved efficiency in legacy systems while reducing material usage and lifecycle costs. Moreover, companies are recognizing the cost-saving potential of capturing waste heat to lower operational expenses while meeting sustainability goals. Additionally, strategic infrastructure upgrades and nearshoring trends are boosting demand for energy-efficient solutions across Mexico’s industrial sector. This convergence of regulatory support, technological advancement, and economic incentives is shaping a robust and evolving market landscape.

Mexico Heat Recovery Systems Market Trends:

Industrial Energy Optimization Driving Adoption

Mexican industries are increasingly embracing heat recovery systems to enhance energy efficiency and lower operational expenses amid rising energy costs. According to sources, in July 2025, Güntner’s AHEAT plant in Monterrey, Mexico, reduced direct emissions by 17.7% and market-based indirect emissions by 25.1%, while improving energy and water efficiency through renewable systems. Further, key manufacturing sectors, including petroleum refining and chemical processing, are incorporating advanced waste heat capture technologies to maximize energy utilization. These systems allow plants to recover and reuse thermal energy, improving overall operational efficiency, reducing fuel consumption, and supporting more cost-effective and sustainable industrial production processes across Mexico.

Sustainability Initiatives Accelerating Market Growth

Heightened focus on environmental sustainability and carbon reduction is accelerating the adoption of heat recovery systems in Mexican industrial operations. As per sources, ABB’s Saltillo, Mexico, production site reduced total emissions by 80% over two years, cutting over 5,200 tons of CO₂e through smart energy management, photovoltaics, and efficiency measures. Further, companies are deploying these solutions to achieve corporate sustainability targets while adhering to stricter environmental regulations on industrial emissions. By reducing energy wastage and minimizing greenhouse gas outputs, these technologies support cleaner production practices, reinforce corporate environmental responsibility, and drive overall market expansion within Mexico’s industrial sustainability framework.

Technological Advancements Enhancing System Efficiency

Ongoing innovations in heat exchanger design, advanced materials, and system engineering are significantly boosting the efficiency and affordability of heat recovery systems. Integration with industrial automation and real-time monitoring tools enables precise control and optimization of thermal energy capture. These technological enhancements allow diverse manufacturing facilities to maximize energy recovery, reduce operational costs, and maintain consistent process performance, positioning heat recovery solutions as critical components of modern industrial infrastructure.

Market Outlook 2026-2034:

The Mexico heat recovery systems market outlook remains robust as industrial expansion and nearshoring trends create substantial demand for energy-efficient manufacturing solutions. Ongoing refinery modernization projects and investments in industrial infrastructure are expected to sustain strong adoption rates throughout the forecast period. Government support for energy efficiency initiatives combined with favorable regulatory frameworks positions the market for continued expansion. The market generated a revenue of USD 1,422.86 Million in 2025 and is projected to reach a revenue of USD 6,545.86 Million by 2034, growing at a compound annual growth rate of 18.48% from 2026-2034.

Mexico Heat Recovery Systems Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Steam and Electricity Generation | 30.12% |

| Technology | Complete Closed Loop Systems | 50.06% |

| Industry | Petroleum Refining | 25.1% |

Type Insights:

- Preheating

- Steam and Electricity Generation

- Recuperates

- Regenerators

- Rotary Heat Exchangers

- Economizers

- Others

The steam and electricity generation dominates with a market share of 30.12% of the total Mexico heat recovery systems market in 2025.

The steam and electricity generation maintains leadership within the Mexico heat recovery systems market driven by industrial demand for reliable onsite power generation capabilities. Manufacturing facilities increasingly leverage waste heat recovery technologies to generate electricity and steam, reducing dependence on external power sources while achieving substantial operational cost savings. In October 2025, Mexico issued new Electric Sector Law guidelines to fast-track strategic private power projects, easing permitting and supporting onsite generation, cogeneration, and energy optimization aligned with national development plans.

Heat recovery systems designed for steam and electricity generation provide significant energy efficiency benefits for Mexico’s energy-intensive industrial processes. By incorporating advanced turbine systems and organic Rankine cycle technologies, these solutions effectively convert low-grade waste heat into usable electrical and thermal energy. This enables industrial facilities to optimize energy utilization, reduce operational costs, and achieve sustainability goals, reinforcing environmentally responsible practices while enhancing overall process efficiency across diverse manufacturing sectors.

Technology Insights:

Access the comprehensive market breakdown Request Sample

- Complete Closed Loop Systems

- Combustion Air Preheat Systems

- High Particulate Systems

Complete closed loop systems lead with a share of 50.06% of the total Mexico heat recovery systems market in 2025.

Complete closed loop systems dominate the technology segment due to their high heat transfer efficiency and reliable performance across various industrial applications. By employing enclosed circulation mechanisms, these systems minimize heat loss and contamination risks, ensuring optimal energy recovery from waste heat generated in manufacturing processes. Their consistent operation and superior efficiency make them a preferred choice for industries aiming to reduce energy consumption, lower operational costs, and support sustainable production practices.

The widespread adoption of complete closed loop technology reflects industrial preferences for comprehensive heat recovery solutions offering consistent performance and reduced maintenance requirements. Continuous advancements in heat exchanger materials and system design are enhancing closed loop system efficiency, making them increasingly attractive for energy-intensive applications across Mexican industries. As per sources, in 2025, Copeland showcased its oil-free centrifugal compressor at AHR Expo Mexico, enabling recovery of 3.7 Million BTU/hour, boosting energy efficiency, reducing maintenance, and supporting sustainable industrial HVACR operations.

Industry Insights:

- Petroleum Refining

- Metal Production

- Cement

- Chemical

- Paper and Pulp

- Others

The petroleum refining exhibits a clear dominance with a 25.1% share of the total Mexico heat recovery systems market in 2025.

The petroleum refining leads heat recovery system adoption driven by extensive refinery operations generating substantial thermal waste during crude oil processing. In October 2025, Mexico increased crude oil processing in its National Refining System by 40% from October 2024 to July 2025, enhancing refinery efficiency and boosting distillate production. Moreover, Mexico's significant petroleum refining infrastructure, including major facilities operated by Pemex and ongoing refinery modernization projects, creates sustained demand for advanced heat recovery technologies to improve energy efficiency.

Refineries adopt waste heat recovery systems across processes such as thermal cracking, catalytic treatment, and distillation to enhance energy efficiency and lower operational costs. Government investments in upgrading existing refineries and constructing new facilities, including the Dos Bocas refinery in Tabasco, are further driving the deployment of these systems. These initiatives support sustainable operations, optimize resource utilization, and expand opportunities for integrating advanced heat recovery technologies across Mexico’s petroleum refining sector.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico leads the market due to concentrated manufacturing activity and proximity to U.S. supply chains. States like Nuevo León, Chihuahua, and Baja California host extensive maquiladoras and heavy industries that generate significant waste heat, driving strong demand for energy recovery systems. Industrial efficiency and cost savings remain key adoption factors in this region.

Central Mexico shows robust market growth, supported by automotive and chemical manufacturing clusters in the Bajío region. States including Guanajuato, Querétaro, and San Luis Potosí attract considerable industrial investment, creating demand for energy-efficient technologies. Heat recovery systems help optimize production processes, reduce operational costs, and align with sustainability objectives across these expanding industrial hubs.

Southern Mexico offers substantial market potential due to petroleum extraction and refining operations in Tabasco, Campeche, and Veracruz. Key refinery infrastructure, including the Dos Bocas refinery, combined with government investments in energy projects, drives heat recovery system adoption. These technologies enhance energy efficiency, support sustainable operations, and improve cost management in the region’s energy-intensive industries.

Other regions present emerging opportunities as industrial development spreads beyond traditional corridors. Infrastructure projects, special economic zones, and new industrial clusters are fostering demand for energy-efficient solutions. Heat recovery systems are increasingly adopted to optimize energy use, reduce operational expenses, and support sustainable industrial growth in these developing areas of Mexico

Market Dynamics:

Growth Drivers:

Why is the Mexico Heat Recovery Systems Market Growing?

Rising Energy Costs Driving Industrial Efficiency Investments

The continuous increase in energy prices across Mexico is significantly propelling heat recovery system adoption as industrial facilities seek cost-effective solutions to manage operational expenditures. Manufacturing companies recognize the substantial potential of waste heat recovery technologies in reducing fuel consumption and electricity costs while maintaining production capacity. Industrial processes in petroleum refining, cement production, and metal manufacturing generate considerable thermal waste that can be captured and repurposed for useful applications. In September 2025, CONUEE and IMIQ signed a Letter of Intent to enhance Mexico’s industrial energy efficiency, promoting collaborative projects, technical information exchange, and sustainable energy practices through 2029. Heat recovery systems enable facilities to convert this otherwise lost energy into valuable steam or electricity, directly reducing utility expenses and improving overall plant efficiency throughout their operations.

Environmental Regulations Accelerating Technology Adoption

Increasingly stringent environmental regulations governing industrial emissions and energy efficiency standards are compelling Mexican manufacturers to invest in heat recovery technologies. Government initiatives promoting sustainable industrial practices and carbon emission reduction targets create favorable conditions for waste heat recovery system deployment across multiple sectors. According to sources, in September 2025, Mexico’s SEMARNAT unveiled the PROMARNAT 2025-2030 program, setting national environmental priorities including emissions reduction, renewable energy promotion, and integration of climate action across industrial sectors. Further, companies face growing pressure from regulatory authorities and stakeholders to demonstrate environmental responsibility and improve energy utilization metrics. Heat recovery systems offer practical solutions enabling industrial facilities to achieve compliance with environmental standards while simultaneously realizing operational cost savings through enhanced energy efficiency.

Industrial Expansion and Nearshoring Trends Creating Demand

The ongoing expansion of Mexican manufacturing capacity driven by nearshoring trends and foreign direct investment is generating substantial demand for energy-efficient industrial solutions. Companies establishing or expanding production facilities in Mexico prioritize modern technologies that optimize energy consumption and support sustainability objectives. In February 2025, Volkswagen announced modernization of its Puebla and Silao plants in Mexico to produce large volumes of electric vehicles, supporting nearshoring, energy-efficient production, and sustainable manufacturing initiatives. Moreover, the automotive, aerospace, and electronics sectors experiencing rapid growth throughout Mexico require reliable energy infrastructure and efficient manufacturing processes. Heat recovery systems represent essential components of modern industrial facilities, enabling companies to achieve operational excellence while meeting energy efficiency expectations from international partners and investors.

Market Restraints:

What Challenges the Mexico Heat Recovery Systems Market is Facing?

High Initial Capital Investment Requirements

The high upfront costs of heat recovery system installation pose a major barrier, particularly for small and medium-sized enterprises. Expenses related to equipment, complex installation, and necessary infrastructure modifications require significant financial commitment, which may deter adoption despite the long-term operational savings and energy efficiency benefits these systems provide.

Technical Complexity and Integration Challenges

Integrating heat recovery systems into existing industrial operations presents technical complexity and potential production disruptions. Adapting legacy equipment and processes to accommodate new technologies requires specialized engineering expertise and careful planning. Extended installation timelines and integration challenges may slow adoption, especially for facilities with limited technical resources or tightly scheduled production cycles.

Skilled Workforce Availability Constraints

Market growth is limited by the scarcity of skilled technicians and engineers experienced in heat recovery system design, installation, and maintenance. Industrial facilities often face challenges in recruiting qualified personnel to operate and sustain these sophisticated systems efficiently, potentially affecting system performance, reliability, and overall adoption rates across industrial sectors.

Competitive Landscape:

The Mexico heat recovery systems market features a competitive landscape comprising international technology providers, regional equipment manufacturers, and specialized engineering firms serving diverse industrial sectors. Market participants differentiate through technological innovation, comprehensive service offerings, and established relationships with major industrial customers across petroleum refining, manufacturing, and chemical processing industries. Companies compete on system efficiency, reliability, and total cost of ownership while expanding service capabilities to include installation, maintenance, and performance optimization. Strategic partnerships between technology providers and local distributors enhance market reach and customer support capabilities throughout Mexico's industrial regions.

Mexico Heat Recovery Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Preheating, Steam and Electricity Generation, Recuperators, Regenerators, Rotary Heat Exchangers, Economizers, Others |

| Technologies Covered | Complete Closed Loop Systems, Combustion Air Preheat Systems, High Particulate Systems |

| Industries Covered | Petroleum Refining, Metal Production, Cement, Chemical, Paper and Pulp, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico heat recovery systems market size was valued at USD 1,422.86 Million in 2025.

The Mexico heat recovery systems market is expected to grow at a compound annual growth rate of 18.48% from 2026-2034 to reach USD 6,545.86 Million by 2034.

The steam and electricity generation segment leads the market with a 30.12% share, driven by industrial demand for onsite power generation and growing emphasis on operational cost reduction through efficient waste heat utilization.

Key factors driving the Mexico heat recovery systems market include rising energy costs compelling industrial efficiency investments, stringent environmental regulations accelerating technology adoption, and industrial expansion driven by nearshoring trends creating demand for energy-efficient manufacturing solutions.

Major challenges include high initial capital investment requirements, technical complexity in integrating systems with existing industrial processes, skilled workforce availability constraints, and extended payback periods that may discourage adoption among smaller industrial facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)