Mexico Heavy-Duty Automotive Aftermarket Market Size, Share, Trends and Forecast by Replacement Part, Vehicle Type, Service Channel, and Region, 2025-2033

Mexico Heavy-Duty Automotive Aftermarket Market Overview:

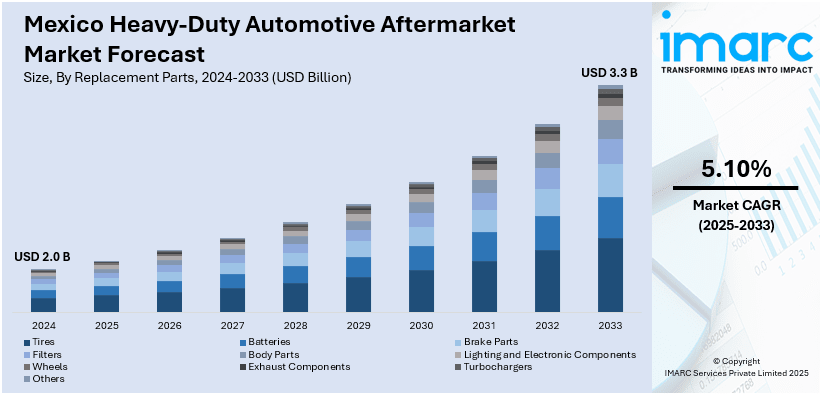

The Mexico heavy-duty automotive aftermarket market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is driven by a growing commercial vehicle fleet, aging truck population, rising cross-border freight activity, and increasing demand for replacement parts. Government support for logistics infrastructure, expanding e-commerce logistics, and the presence of major OEM service networks also contribute to sustained aftermarket growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.0 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Market Growth Rate 2025-2033 | 5.10% |

Mexico Heavy-Duty Automotive Aftermarket Market Analysis:

- Major Drivers: Increased vehicle ownership, longer vehicle lifespans, and higher consumer expenditure are propelling Mexico's automotive aftermarket. Development of e-commerce platforms, urbanization, and high penetration of independent workshops further foster demand for spare parts, maintenance services, and accessories in passenger and commercial vehicles.

- Major Market Trends: Digitization, online sales of parts, and mobile service applications are reshaping the market. More demand is emerging for green parts, advanced electronics, and vehicle personalization. Telematics integration and predictive maintenance solutions are gaining popularity, while cross-border imports of motor vehicle components increase product availability and affordability among consumers in Mexico.

- Market Opportunities: Growth potential in e-commerce and digital platform expansion. Growing interest in vehicle customization, hybrid/electric vehicle servicing, and high-end spare parts presents new revenue avenues. Partnerships with service shops and aftermarkets suppliers, and untapped rural markets, offer brands the opportunity to expand presence and improve customer interaction.

- Market Challenges: Excessive competition from informal markets, varying import tariffs, and currency fluctuations affect profitability. Counterfeit components, compliance with regulations, and different quality standards are risks. Moreover, electrification of vehicles calls for skills, tool, and inventory realignment, posing a challenge to traditional players in the aftermarket to innovate and stay relevant.

Mexico Heavy-Duty Automotive Aftermarket Market Trends:

Expansion of Digital Sales Channels and E-Catalog Platforms

Mexico’s aftermarket is rapidly digitizing, with distributors and service providers turning to e-commerce platforms and e-catalog systems to simplify parts procurement. These tools help fleet operators and repair shops reduce downtime by improving parts accuracy and speed. Integrated inventory features minimize errors and enhance pricing transparency. Mobile-friendly interfaces and apps allow technicians to order parts anytime. As internet and smartphone use grows nationwide, digital tools are boosting supply chain responsiveness and expanding market access, particularly in semi-urban and remote regions. This shift is creating new growth avenues for aftermarket businesses. For instance, as per industry reports, Mexico’s USD 121.7 Billion in auto parts production and USD 106.1 Billion in exports in 2024 reflect a deeply integrated and fast-moving supply chain. With more than 90% of exports headed to the U.S. and Canada, manufacturers face strict delivery timelines and high service expectations. This environment requires streamlined procurement, accurate inventory tracking, and efficient distribution—areas where digital platforms and e-catalog systems play a vital role. The sector’s increasing complexity, especially with electrical components making up 19.49% of output, further underscores the need for responsive, real-time digital tools that can support catalog-intensive categories and improve operational precision across the value chain.

To get more information on this market, Request Sample

Growth in Remanufactured and Reconditioned Parts Demand

Environmental regulations and cost pressures are prompting greater adoption of remanufactured and reconditioned components in Mexico’s heavy-duty aftermarket. Operators of aging vehicle fleets are increasingly turning to remanufactured engines, transmissions, and brake systems as cost-effective alternatives to new parts. These components meet industry standards for performance and reliability while offering considerable savings. Additionally, growing awareness of sustainability and circular economy principles is pushing fleets and service providers toward reusing high-value parts rather than discarding them. Local remanufacturing facilities and partnerships with global remanufacturers are also strengthening the supply ecosystem. With rising freight movement and extended vehicle lifespans, demand for high-quality remanufactured parts is expected to rise, offering a stable revenue stream for aftermarket suppliers and rebuilders. For instance, according to industry reports, in February 2024, Mexico’s auto parts production exceeded USD 10.3 Billion, marking a 13.15% year-over-year rise and 11.12% growth over the year’s first two months. Suspension and steering parts rose 23%, while tires, rubber parts, engines, and stampings also posted double-digit growth. In April 2024, car production reached 358,575 units (up 21.7%) and exports hit 289,756 units (up 14.4%), with over 85% sent to the U.S.

Mexico Heavy-Duty Automotive Aftermarket Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on replacement part, vehicle type, and service channel.

Replacement Part Insights:

- Tires

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Exhaust Components

- Turbochargers

- Others

The report has provided a detailed breakup and analysis of the market based on the replacement part. This includes tires, battery, brake parts, filters, body parts, lighting and electronic components, wheels, exhaust components, turbochargers, and others.

Vehicle Type Insights:

- Class 4 to Class 6

- Class 7 and Class 8

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes class 4 to class 6 and class 7 and class 8.

Service Channel Insights:

- DIY

- OE Seller

- DIFM

A detailed breakup and analysis of the market based on the service channel have also been provided in the report. This includes DIY, OE seller, and DIFM.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Heavy-Duty Automotive Aftermarket Market News:

- In March 2025, Holley Performance Brands, a leading name in high-performance automotive aftermarket solutions, officially entered the Mexican market. This strategic expansion aims to bring Holley’s extensive lineup of performance products to a rapidly growing market of vehicle customizers. The initial rollout features the company’s Modern Truck & Off-Road product segment, which includes specialized solutions for vehicles such as Jeeps, Ford Broncos, and mid-size pickups. Key brands now available in Mexico include ADS, Baer, Edge, DiabloSport, Flowmaster, Superchips, Holley, ACCEL, and MSD. These are accessible through authorized distributors, including AutoZone stores and professional installers.

- In March 2025, Motorcar Parts of America Inc. announced the expansion of its product coverage for starters, alternators, brake calipers, pads, and rotors with over 120 new part numbers, covering 30 million additional vehicles. These parts, offered under brands like Quality-Built and Pure Energy, target the professional installer market.

Mexico Heavy-Duty Automotive Aftermarket Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Replacement Parts Covered | Tires, Battery, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Exhaust Components, Turbochargers, Others |

| Vehicle Types Covered | Class 4 to Class 6, Class 7 and Class 8 |

| Service Channels Covered | DIY, OE Seller, DIFM |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico heavy-duty automotive aftermarket market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico heavy-duty automotive aftermarket market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico heavy-duty automotive aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The heavy-duty automotive aftermarket market in Mexico was valued at USD 2.0 Billion in 2024.

The Mexico heavy-duty automotive aftermarket market is projected to exhibit a CAGR of 5.10% during 2025-2033, reaching a value of USD 3.3 Billion by 2033.

Key factors driving Mexico’s heavy-duty automotive aftermarket market include rising vehicle ownership, longer average vehicle lifespans, and increasing consumer focus on affordable maintenance. Growth of e-commerce platforms, availability of diverse spare parts, and the dominance of independent workshops further fuel demand, supported by urbanization, economic recovery, and expanding middle-class spending power.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)