Mexico Hemodialysis Market Size, Share, Trends and Forecast by Segment, Modality, End-User, and Region, 2025-2033

Mexico Hemodialysis Market Overview:

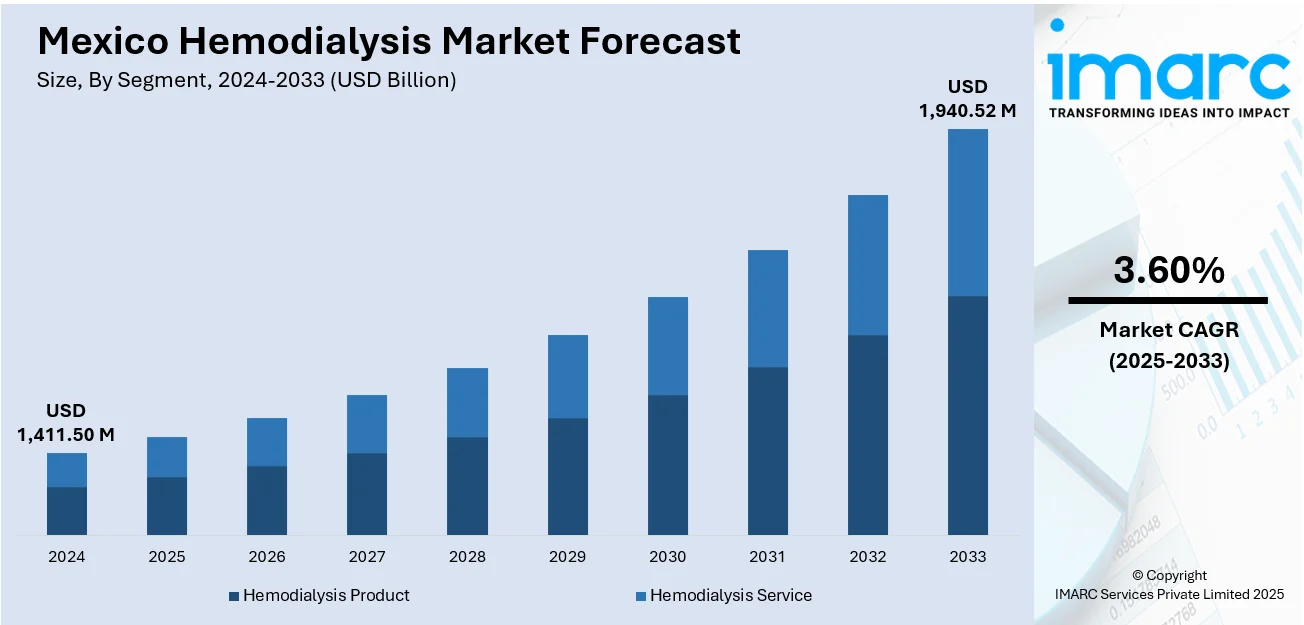

The Mexico hemodialysis market size reached USD 1,411.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,940.52 Million by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The rising prevalence of chronic kidney disease (CKD) due to diabetes, hypertension, and an aging population, rapid adoption of advanced home-based and portable dialysis technologies, expanding private healthcare facilities, and favorable government reimbursement policies are bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,411.50 Million |

| Market Forecast in 2033 | USD 1,940.52 Million |

| Market Growth Rate 2025-2033 | 3.60% |

Mexico Hemodialysis Market Trends:

Surging CKD Prevalence Driven by Diabetes, Hypertension, and Aging

Mexico is confronting a mounting CKD challenge driven by demographic and health trends. Adult diabetes prevalence reached 16.9% in 2022, and CKD now affects approximately 14.5 million individuals, ranking among the country’s top ten causes of mortality. The population aged 65 and above is projected to expand from 8.2 million in 2015 to over 30 million by 2050, a 277% increase, further enlarging the CKD patient base. Moreover, overweight and obesity afflict 75.2% of Mexican adults, exacerbating risks of diabetes, hypertension and subsequent renal impairment. With Mexico holding the sixth-highest CKD mortality rate globally, both public and private healthcare sectors are under pressure to scale hemodialysis services and related equipment. This urgent surge in service demand underscores the need for strategic investments in capacity expansion and preventive care to manage the growing CKD burden effectively.

To get more information on this market, Request Sample

Transition Toward Home-Based Dialysis and Telehealth Integration

Mexico’s hemodialysis sector is undergoing a strategic realignment from traditional in-center treatments to home-based modalities, driven by objectives of cost optimization, patient empowerment, and technological innovation. Peritoneal dialysis (PD), historically reimbursed at approximately 70% utilization by the public social security system, and home hemodialysis are now being actively promoted through increased investment in satellite clinics and home-dialysis centers. Recent home dialysis systems feature compact, user-friendly designs and integrated remote-monitoring capabilities, while telehealth services, encompassing video consultations and remote therapy management are emerging as cost-effective adjuncts that enhance treatment adherence, continuity, and clinical outcomes. This paradigm shift not only alleviates capacity constraints in hospital facilities but also responds to patient demand for flexibility and convenience. As policymakers and providers continue to scale infrastructure and digital support, home-based dialysis is poised to deliver sustainable improvements in both operational efficiency and quality of care. These initiatives are supported by government policies and provider partnerships aimed at expanding access to home therapies across urban and rural areas alike.

Mexico Hemodialysis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on segment, modality, and end-user.

Segment Insights:

- Hemodialysis Product

- Machines

- Dialyzers

- Others

- Hemodialysis Service

- In-center Services

- Home Services

The report has provided a detailed breakup and analysis of the market based on the segment. This includes hemodialysis product (machines, dialyzers, and others) and hemodialysis service (in-center services and home services).

Modality Insights:

- Conventional Hemodialysis

- Short Daily Hemodialysis

- Nocturnal Hemodialysis

A detailed breakup and analysis of the market based on the modality have also been provided in the report. This includes conventional hemodialysis, short daily hemodialysis, and nocturnal hemodialysis.

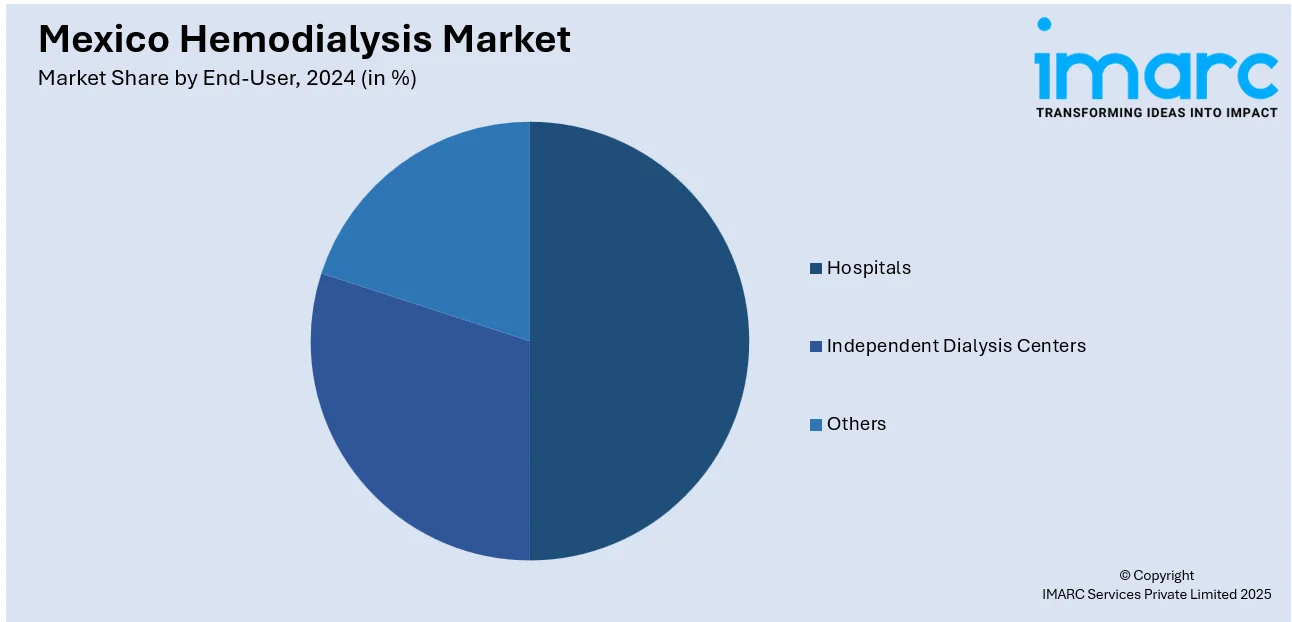

End-User Insights:

- Hospitals

- Independent Dialysis Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals, independent dialysis centers, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hemodialysis Market News:

- March 2025: Fresenius Medical Care Mexico expanded access to High-Volume Hemodiafiltration (HighVolumeHDF) in seven centers through a partnership with CCINSHAE, targeting low-income chronic kidney disease patients. The initiative includes installing 150 advanced 5008S CorDiax machines, doubling patients receiving this proven, mortality-reducing therapy nationwide.

- July 2024: Erika de Reynosa, a Fresenius Medical Care plant in Reynosa, Tamaulipas, invested USD 10 million in a new subsidiary. The expansion will create around 600 jobs and enhance production of medical technology, particularly equipment for hemodialysis, peritoneal dialysis, and chronic kidney-failure treatment.

Mexico Hemodialysis Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered |

|

| Modalities Covered | Conventional Hemodialysis, Short Daily Hemodialysis, Nocturnal Hemodialysis |

| End-Users Covered | Hospitals, Independent Dialysis Centers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hemodialysis market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hemodialysis market on the basis of segment?

- What is the breakup of the Mexico hemodialysis market on the basis of modality?

- What is the breakup of the Mexico hemodialysis market on the basis of end-user?

- What is the breakup of the Mexico hemodialysis market on the basis of the region?

- What are the various stages in the value chain of the Mexico hemodialysis market?

- What are the key driving factors and challenges in the Mexico hemodialysis market?

- What is the structure of the Mexico hemodialysis market and who are the key players?

- What is the degree of competition in the Mexico hemodialysis market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hemodialysis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hemodialysis market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hemodialysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)