Mexico Higher Education Market Size, Share, Trends and Forecast by Component, Deployment Mode, Course Type, Learning Type, End User, and Region, 2025-2033

Mexico Higher Education Market Overview:

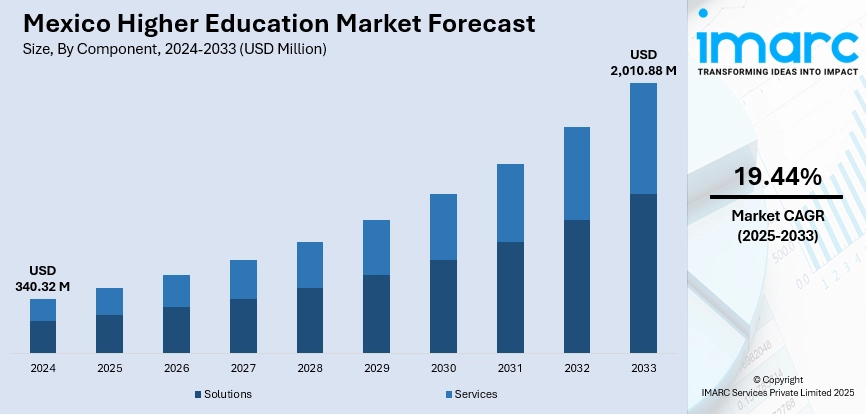

The Mexico higher education market size reached USD 340.32 Million in 2024. The market is projected to reach USD 2,010.88 Million by 2033, exhibiting a growth rate (CAGR) of 19.44% during 2025-2033. The market is driven by Mexico's shifting labor dynamics, where most workers are millennials or Gen Z demanding flexible upskilling options, accelerating adoption of hybrid education models amid rising wage pressures. These factors, combined with government-backed digital education initiatives, are reshaping institutional offerings, further augmenting the Mexico higher education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 340.32 Million |

| Market Forecast in 2033 | USD 2,010.88 Million |

| Market Growth Rate 2025-2033 | 19.44% |

Mexico Higher Education Market Trends:

Increasing Demand for Online and Hybrid Learning Programs

The market is undergoing a notable transition towards online and hybrid learning models. The COVID-19 pandemic has expedited the adoption of digital technologies, and many institutions have continued to invest in virtual platforms to cater to student preferences. This trend is driven by working professionals seeking flexible schedules, as well as cost-conscious students avoiding relocation expenses. In Mexico, millennials and Generation Z make up more than 64% of the labor force, which has 59.7 million individuals (INEGI). Businesses are under greater pressure with a 20% rise in the minimum wage and the emergence of hybrid work systems, as reflected in an industrial study. With MXN$375 (approximately USD 19.22) a day at the northern border and MXN$ 249 (approximately USD 12.77) elsewhere, companies are forced to rethink their financial and talent retention strategies immediately in response to volatile economic conditions. This shift highlights an increased demand for digital learning solutions tailored to multigenerational and flexible workforces to stay competitive. Additionally, government initiatives, such as the Programa de Educación Abierta y a Distancia, support digital education expansion. However, challenges remain, including internet accessibility in rural areas and the need for faculty training in digital pedagogy. As technology improves and more students prioritize convenience, online and hybrid education is expected to grow, pushing universities to enhance their digital infrastructure and curriculum offerings.

To get more information on this market, Request Sample

Growing Focus on Leadership Development and Soft Skills in a Hybrid Work Era

The increasing focus on leadership development and soft skills is also supporting the Mexico higher education market growth. This can be supported by the rise of hybrid work culture and employer demand for adaptable professionals. As remote and flexible work models become entrenched, universities are integrating communication, emotional intelligence, and collaborative problem-solving into curricula to prepare graduates for decentralized work environments. A scoping review done in June 2024 indicated that hybrid and remote work patterns significantly enhance employee well-being and organizational productivity, with 72% of Mexican workers valuing flexibility during the post-pandemic period. Studies have shown that hybrid work patterns enhance work-life balance, job satisfaction, and productivity, thus fueling the demand for corporate training in different sectors. As the hybrid workforce in Mexico grows, there is a need for businesses to invest in digital skills, leadership, and communication to maintain their competitive edge and drive employee engagement. Institutions are offering specialized courses in remote team management and digital leadership, responding to corporate expectations. Additionally, experiential learning—such as virtual internships and cross-functional projects—is gaining traction, helping students refine interpersonal skills in hybrid settings. Employers in Mexico’s expanding tech and service sectors particularly value these competencies, as they enhance productivity in blended workplaces. Government and private sector partnerships are further supporting this shift, with initiatives promoting lifelong learning in leadership and digital collaboration. As hybrid work becomes the norm, universities that embed soft skills and leadership training into degree programs will gain a competitive edge, ensuring graduates thrive in changing professional landscapes.

Mexico Higher Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, course type, learning type, and end user.

Component Insights:

- Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (student information management system, content collaboration, data security and compliance, campus management, and others), and services (managed services, and professional services).

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Course Type Insights:

- Arts

- Economics

- Engineering

- Law

- Science

- Others

The report has provided a detailed breakup and analysis of the market based on the course type. This includes arts, economics, engineering, law, science, and others.

Learning Type Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the learning type have also been provided in the report. This includes online and offline.

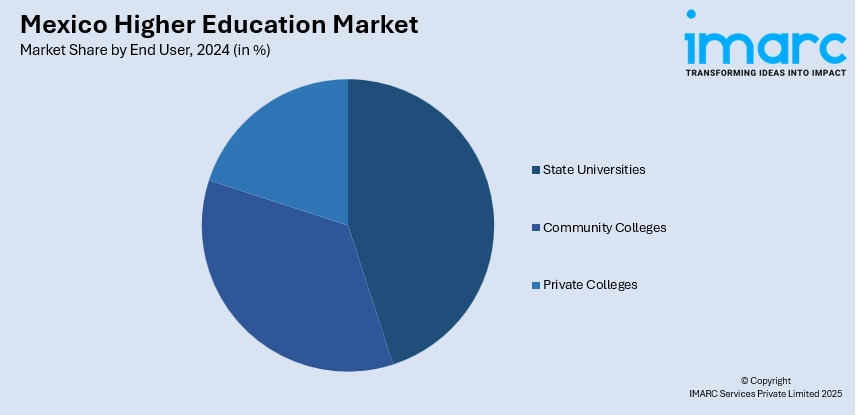

End User Insights:

- State Universities

- Community Colleges

- Private Colleges

The report has provided a detailed breakup and analysis of the market based on the end user. This includes state universities, community colleges, and private colleges.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Higher Education Market News:

-

April 17, 2025: Coursera launched AI-powered courses in Spanish to enhance access to quality learning in Mexico, which has turned into its third-largest market with 7.3 million students. The new initiative uses generative AI to dub and translate over 100 courses, thus enhancing the completion rate of courses and student engagement, particularly in corporate training programs. The project is intended to break language barriers, bringing benefits to individuals and businesses seeking job-related skills from companies such as IBM and Microsoft.

Mexico Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Course Types Covered | Arts, Economics, Engineering, Law, Science, Others |

| Learning Types Covered | Online, Offline |

| End Users Covered | State Universities, Community Colleges, Private Colleges |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico higher education market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico higher education market on the basis of component?

- What is the breakup of the Mexico higher education market on the basis of deployment mode?

- What is the breakup of the Mexico higher education market on the basis of course type?

- What is the breakup of the Mexico higher education market on the basis of learning type?

- What is the breakup of the Mexico higher education market on the basis of end user?

- What is the breakup of the Mexico higher education market on the basis of region?

- What are the various stages in the value chain of the Mexico higher education market?

- What are the key driving factors and challenges in the Mexico higher education market?

- What is the structure of the Mexico higher education market and who are the key players?

- What is the degree of competition in the Mexico higher education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico higher education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico higher education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico higher education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)