Mexico Home Diagnostic Testing Market Size, Share, Trends and Forecast by Test Type, Form, Distribution Channel, and Region, 2025-2033

Mexico Home Diagnostic Testing Market Overview:

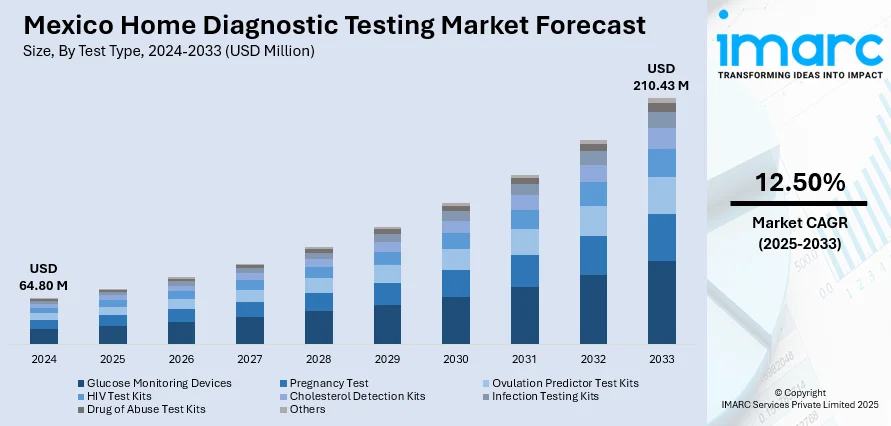

The Mexico home diagnostic testing market size reached USD 64.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 210.43 Million by 2033, exhibiting a growth rate (CAGR) of 12.50% during 2025-2033. At present, the rising incidence of chronic diseases is creating the need for accessible, convenient, and continuous health monitoring solutions. In addition, the ongoing digitalization of healthcare, which is encouraging innovations and wider distribution of kits through online channels, is contributing to the expansion of the Mexico home diagnostic testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 64.80 Million |

| Market Forecast in 2033 | USD 210.43 Million |

| Market Growth Rate 2025-2033 | 12.50% |

Mexico Home Diagnostic Testing Market Trends:

Rising incidence of chronic diseases

The growing prevalence of chronic diseases is offering a favorable market outlook. With the high prevalence of diseases like high blood pressure and thyroid imbalances, individuals are looking for simple solutions to monitor their health without going to the doctor as often. People can keep an eye on vital signs like blood pressure, cholesterol, and blood sugar levels in real time with the use of home diagnostic kits. This enables early detection and timely intervention, which are essential for managing chronic conditions effectively. Patients prefer home testing for its privacy, cost-effectiveness, and the ability to test at their own pace. The growing geriatric population, which is more prone to chronic illnesses, is also contributing to the demand for home-based testing solutions. As per the World Data Atlas, the population of Mexicans aged 65 years and older increased by 3.25% from 8.6% in 2023 to 8.9% in 2024. Rising awareness about disease prevention and self-care is further promoting the use of these devices. Families with chronic disease patients are employing these tools to reduce hospital trips and improve care efficiency. As technology is advancing, home test kits are becoming more accurate, user-friendly, and widely available in pharmacies. Increasing healthcare costs and limited access to diagnostic centers in some regions are also leading people to utilize home testing options.

To get more information on this market, Request Sample

Expansion of telehealth services

The expansion of telehealth services is impelling the Mexico home diagnostic testing market growth. According to the IMARC Group, the Mexico telehealth market size reached USD 342.00 Million in 2024. As more people are turning to virtual consultations, the need for accurate at-home diagnostic solutions is rising. Patients are employing home testing kits to measure vital health parameters and share real-time results with doctors during telehealth appointments. This process supports timely diagnosis and treatment decisions without visiting clinics and hospitals. Home diagnostic tools work effectively alongside telehealth platforms, allowing individuals to manage conditions, such as diabetes, hypertension, and infections, from the comfort of their homes. The convenience and efficiency of combining telehealth with home testing appeal to busy individuals and those in remote areas with limited healthcare infrastructure. The ongoing digitalization of healthcare is enabling innovations and wider distribution of these kits through online channels. In addition, government and private sector initiatives that promote telemedicine are also encouraging the employment of self-testing solutions. With the growing trust in telehealth, patients feel more confident using home diagnostics under virtual medical supervision. This shift supports proactive healthcare management, reduces pressure on hospitals, and promotes a patient-centered care model.

Mexico Home Diagnostic Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on test type, form, and distribution channel.

Test Type Insights:

- Glucose Monitoring Devices

- Pregnancy Test

- Ovulation Predictor Test Kits

- HIV Test Kits

- Cholesterol Detection Kits

- Infection Testing Kits

- Drug of Abuse Test Kits

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes glucose monitoring devices, pregnancy test, ovulation predictor test kits, HIV test kits, cholesterol detection kits, infection testing kits, drug of abuse test kits, and others.

Form Insights:

- Cassettes

- Midstream

- Instruments

- Strips

- Test

- Digital Monitoring

- Dip Cards

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes cassettes, midstream, instruments, strips, test, digital monitoring, and dip cards.

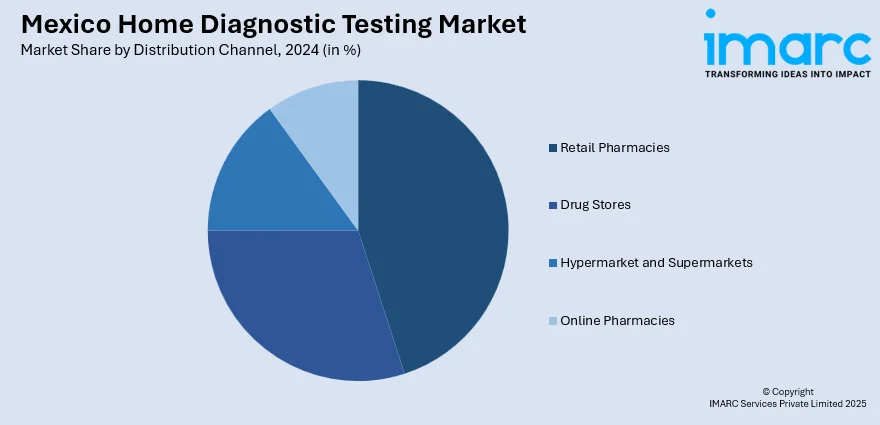

Distribution Channel Insights:

- Retail Pharmacies

- Drug Stores

- Hypermarket and Supermarkets

- Online Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies, drug stores, hypermarket and supermarkets, and online pharmacies.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Home Diagnostic Testing Market News:

- In February 2024, Mexico's Federal Commission for Protection against Health Risks (Cofepris) sanctioned home testing kits for HIV, marking an important advancement in public health. This choice allowed people to conduct tests on their own with oral fluid samples or obtain demonstrations from trained staff. The project sought to enhance diagnostic availability, guarantee prompt treatment, and tackle the requirements of at-risk populations.

Mexico Home Diagnostic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Glucose Monitoring Devices, Pregnancy Test, Ovulation Predictor Test Kits, HIV Test Kits, Cholesterol Detection Kits, Infection Testing Kits, Drug of Abuse Test Kits, Others |

| Forms Covered | Cassettes, Midstream, Instruments, Strips, Test, Digital Monitoring, Dip Cards |

| Distribution Channels Covered | Retail Pharmacies, Drug Stores, Hypermarket and Supermarkets, Online Pharmacies |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico home diagnostic testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico home diagnostic testing market on the basis of test type?

- What is the breakup of the Mexico home diagnostic testing market on the basis of form?

- What is the breakup of the Mexico home diagnostic testing market on the basis of distribution channel?

- What is the breakup of the Mexico home diagnostic testing market on the basis of region?

- What are the various stages in the value chain of the Mexico home diagnostic testing market?

- What are the key driving factors and challenges in the Mexico home diagnostic testing market?

- What is the structure of the Mexico home diagnostic testing market and who are the key players?

- What is the degree of competition in the Mexico home diagnostic testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico home diagnostic testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico home diagnostic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico home diagnostic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)