Mexico Home Healthcare Market Size, Share, Trends and Forecast by Product, Service, Indication, and Region, 2025-2033

Mexico Home Healthcare Market Overview:

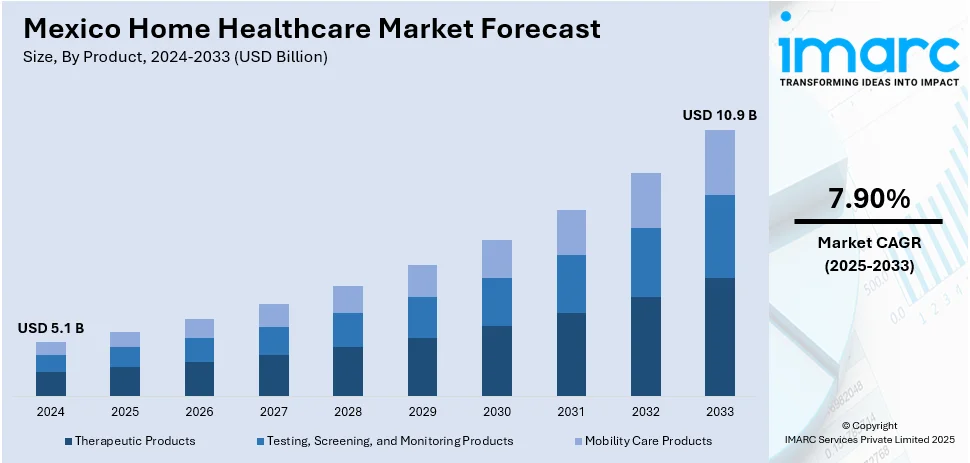

The Mexico home healthcare market size reached USD 5.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.9 Billion by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. The market is driven by mounting demand for in-home services, especially for chronic conditions, coupled with the adoption of technology for personalized care. These trends are underpinning the growth of the market with a rosy outlook for sustained growth and an increasing portion of the healthcare sector, particularly reflected in the expanding Mexico home healthcare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.1 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Market Growth Rate 2025-2033 | 7.90% |

Mexico Home Healthcare Market Trends:

Increased Demand for Home Healthcare Services

The Mexican home healthcare market is also witnessing considerable growth with the rising population and the emerging trend of home care. Older patients, more likely to need extended medical care, are seeking customized care in the comfort of their own homes. This is because they do not want to be hospitalized for extended periods and prefer skilled nursing, rehabilitation therapy, and palliative care. In addition, chronic illnesses, including diabetes, cardiovascular diseases, and respiratory illnesses, are accelerating, which necessitates continuous management that is best for home healthcare environments. The Mexican government and healthcare facilities have also been facilitating this shift through policy reforms that promote home care solutions. As per the sources, in October 2024, Mexico initiated its "House-to-House Health" program with 20,000 public officials to carry out the country's health census to provide individualized care to the elderly and individuals with disabilities. Moreover, Mexico home healthcare market outlook is experiencing a rising trend, with more adoption of in-home services. This market growth perspective shows the ongoing establishment of a strong healthcare infrastructure to serve the needs of geriatric and chronically ill population.

Greater Emphasis on Home-based Specialized Care of Chronic Diseases

Mexico's home healthcare industry is witnessing a rising demand for specialist care services fueled by the growth in chronic illnesses. Patients afflicted with conditions like diabetes, high blood pressure, and respiratory disorders are highly getting treated at home because it provides greater convenience and comfort than treatment at hospitals. Specialist services including infusion therapy, respiratory therapy, and wound care are in strong demand. This change towards home care is brought about primarily because of its affordability and flexibility, which minimizes hospital readmission and healthcare spending. Healthcare practitioners are now creating personalized care plans that focus on the specific needs of such patients to provide better quality of life and health outcomes. Consequently, the market for managing chronic disease in Mexico's home healthcare industry is set to grow substantially. This intensifying focus on treating chronic conditions at home is in sync with the Mexico home healthcare market share overall favorable growth trend, improving its future stake in the healthcare system.

Technological Advances Improving Home Healthcare Delivery

The use of technology is transforming home healthcare in Mexico, promoting increased efficiency and service quality. For instance, in November of 2024, Viasat and Altán introduced Mexico's first home and mobile LTE broadband service by satellite, which provides high-speed connectivity to more than 150,000 inhabitants of 13 underserved states. Furthermore, new technologies such as telemedicine, wearable health sensors, and remote patient monitoring equipment have been instrumental in the delivery of customised care in the home. They enable practitioners to monitor vital signs, trace progress, and make adjustments in line without visiting the hospital unnecessarily. Telehealth services have become highly popular, allowing for consultations between healthcare professionals and patients using digital channels, providing continuous care for chronic disease sufferers. In addition, home-based diagnostic equipment and mobile health apps are putting patients in greater control of their own healthcare. These technologies are helping improve patient outcomes and enable healthcare systems to work more effectively, with overall costs lowered. In this context, therefore, Mexico's home healthcare sector is poised to grow, led by the role of technology uptake in addressing mounting demand for at-home medical treatment. This will also be supporting the Mexico home healthcare market growth favorably over time.

Mexico Home Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, service and indication.

Product Insights:

- Therapeutic Products

- Testing, Screening, and Monitoring Products

- Mobility Care Products

The report has provided a detailed breakup and analysis of the market based on the product. This includes therapeutic products, testing, screening, and monitoring products, and mobility care products.

Service Insights:

- Skilled Nursing

- Rehabilitation Therapy

- Hospice and Palliative Care

- Unskilled Care

- Respiratory Therapy

- Infusion Therapy

- Pregnancy Care

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes skilled nursing, rehabilitation therapy, hospice and palliative care, unskilled care, respiratory therapy, infusion therapy, and pregnancy care.

Indication Insights:

- Cancer

- Respiratory Diseases

- Movement Disorders

- Cardiovascular Diseases and Hypertension

- Pregnancy

- Wound Care

- Diabetes

- Hearing Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes cancer, respiratory diseases, movement disorders, cardiovascular diseases and hypertension, pregnancy, wound care, diabetes, hearing disorders, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Home Healthcare Market News:

- In August of 2023, Partners in Health (PIH) launched Casa Materna in Siltepec, Chiapas, Mexico, in partnership with the Ministry of Health. The facility has the goal to decrease maternal mortality through respectful, midwifery-led care for mothers and infants, increasing access to safe, dignified birth in the area.

Mexico Home Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Therapeutic Products, Testing, Screening, and Monitoring Products, Mobility Care Products |

| Services Covered | Skilled Nursing, Rehabilitation Therapy, Hospice and Palliative Care, Unskilled Care, Respiratory Therapy, Infusion Therapy, Pregnancy Care |

| Indications Covered | Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases and Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico home healthcare market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico home healthcare market on the basis of product?

- What is the breakup of the Mexico home healthcare market on the basis of service?

- What is the breakup of the Mexico home healthcare market on the basis of indication?

- What is the breakup of the Mexico home healthcare market on the basis of region?

- What are the various stages in the value chain of the Mexico home healthcare market?

- What are the key driving factors and challenges in the Mexico home healthcare?

- What is the structure of the Mexico home healthcare market and who are the key players?

- What is the degree of competition in the Mexico home healthcare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico home healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico home healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico home healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)