Mexico Home Security Systems Market Size, Share, Trends and Forecast by Product, Residence Type, and Region, 2025-2033

Mexico Home Security Systems Market Overview:

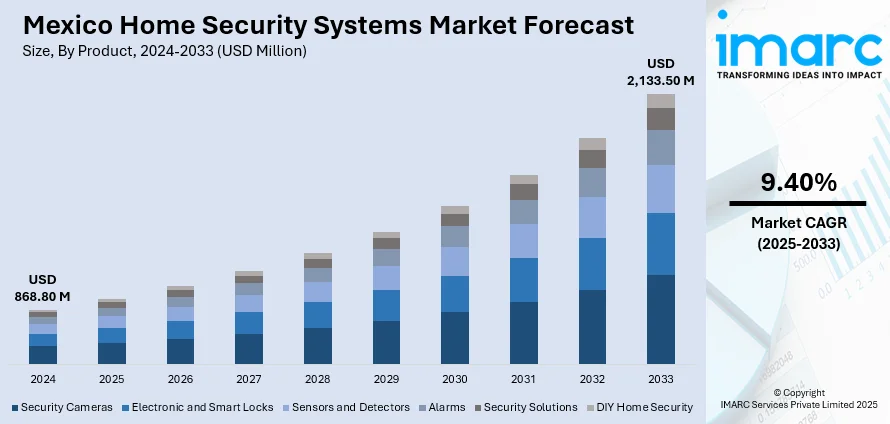

The Mexico home security systems market size reached USD 868.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,133.50 Million by 2033, exhibiting a growth rate (CAGR) of 9.40% during 2025-2033. The market is witnessing significant growth due to increasing urbanization, rising concerns over property safety, and the adoption of smart technologies. Consumers are also favoring systems with remote access, real-time alerts, and integration with smart home devices. Competitive pricing and innovation by local and global players, along with government support for smart infrastructure further boosts the Mexico home security systems market share across residential and commercial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 868.80 Million |

| Market Forecast in 2033 | USD 2,133.50 Million |

| Market Growth Rate 2025-2033 | 9.40% |

Mexico Home Security Systems Market Trends:

Rising Demand for Smart Security Solutions

The Mexican home security systems market is also experiencing a rise in demand for intelligent security solutions, fueled by the rising use of IoT-enabled devices. The use of smart cameras, video doorbells, motion sensors, and connected alarms that provide real-time monitoring and alerts is becoming common among homeowners. The devices are more convenient, enabling users to access and control their homes remotely using smartphones or voice assistants. The combination of machine learning and artificial intelligence further improves detection and response to threats. As cities continue to grow and concerns about property protection become more prevalent, consumers are favoring products that not only protect but are also simple to operate and integrate with existing smart home systems. The trend is redefining the market, compelling makers to innovate even more.

Mobile Integration

Mobile integration is one of the major trends shaping the Mexico home security systems market. The consumers now prefer security systems that provide easy control and monitoring via tablets and smartphones. Such mobile-integrated systems enable users to have real-time notifications, live viewing of cameras, and setting control from remote locations, increasing convenience and security of mind. Whether away for work or holiday, homeowners are able to remotely arm or disarm security alarms, lock and unlock doors, or talk through smart doorbells. Not only does this enhanced accessibility enhance user experience, but it enhances the efficacy of home security as well, allowing for instant responses to perceived danger. With mobile technology continuing to advance, compatibility with home security systems is becoming more advanced, further propelling adoption rates among urban and suburban homes.

Integration of Security Systems with Smart Homes

A major factor driving the Mexico home security systems market growth is the increasing integration of security solutions with broader smart home ecosystems. Modern consumers seek seamless connectivity between their security systems and smart devices such as lighting, locks, thermostats, and voice assistants like Alexa or Google Assistant. This integration allows for automated responses for example, lights turning on when motion is detected or doors locking when the alarm is armed. It enhances both convenience and security, creating a unified home management experience. As smart home adoption rises across Mexico, security systems are evolving from standalone products into interconnected components of intelligent living environments. This trend is improving user satisfaction and also expanding the market by attracting tech-savvy homeowners and new adopters alike.

Mexico Home Security Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and residence type.

Product Insights:

- Security Cameras

- Electronic and Smart Locks

- Sensors and Detectors

- Alarms

- Security Solutions

- DIY Home Security

The report has provided a detailed breakup and analysis of the market based on the product. This includes security cameras, electronic and smart locks, sensors and detectors, alarms, security solutions, and DIY home security.

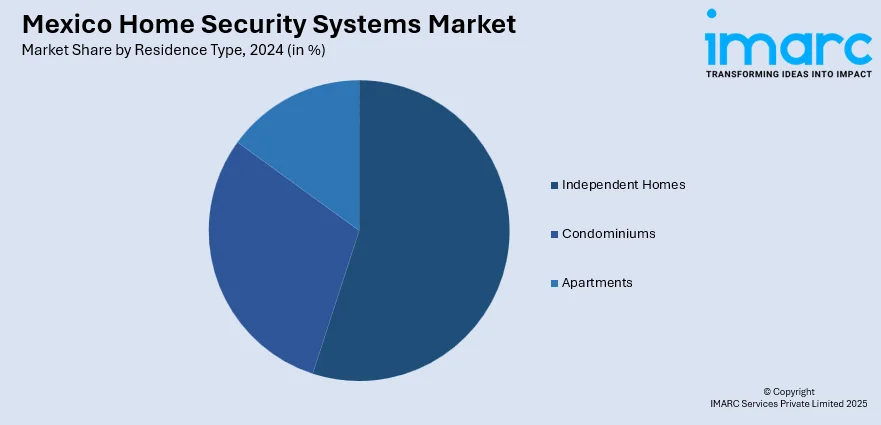

Residence Type Insights:

- Independent Homes

- Condominiums

- Apartments

A detailed breakup and analysis of the market based on the residence type have also been provided in the report. This includes independent homes, condominiums, and apartments.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Home Security Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Security Cameras, Electronic and Smart Locks, Sensors and Detectors, Alarms, Security Solutions, DIY Home Security |

| Residence Types Covered | Independent Homes, Condominiums, Apartments |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico home security systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico home security systems market on the basis of product?

- What is the breakup of the Mexico home security systems market on the basis of residence type?

- What is the breakup of the Mexico home security systems market on the basis of region?

- What are the various stages in the value chain of the Mexico home security systems market?

- What are the key driving factors and challenges in the Mexico home security systems market?

- What is the structure of the Mexico home security systems market and who are the key players?

- What is the degree of competition in the Mexico home security systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico home security systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico home security systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico home security systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)