Mexico Home Theater Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Mexico Home Theater Market Summary:

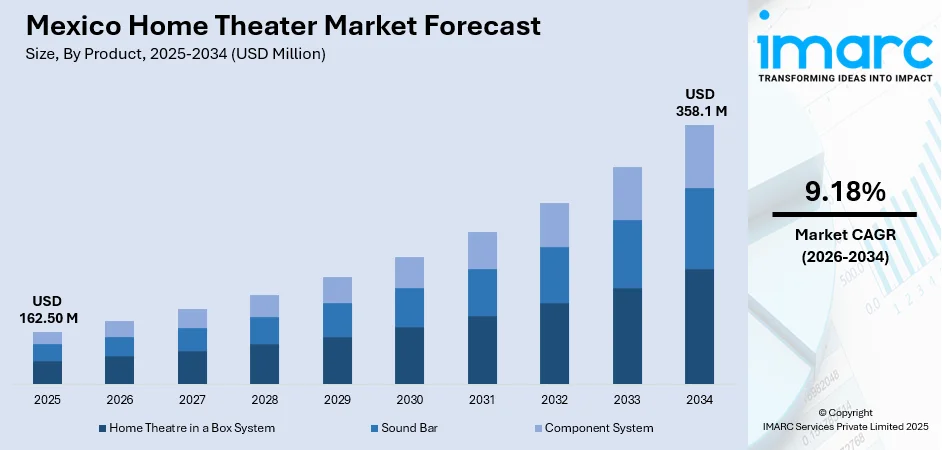

The Mexico home theater market size was valued at USD 162.50 Million in 2025 and is projected to reach USD 358.1 Million by 2034, growing at a compound annual growth rate of 9.18% from 2026-2034.

The Mexico home theater market is experiencing robust expansion driven by rising consumer demand for immersive entertainment experiences within domestic settings. Increasing disposable incomes among the growing middle-class population, coupled with rapid urbanization trends across metropolitan areas, are fueling adoption of advanced audio-visual systems. The proliferation of streaming services and expanding smart home ecosystems further accelerates market penetration, as consumers seek enhanced viewing experiences that replicate cinematic quality.

Key Takeaways and Insights:

- By Product: Sound bar dominates the market with a share of 56% in 2025, driven by compact design preferences, affordability compared to component systems, and seamless integration with smart televisions and streaming devices for enhanced audio experiences.

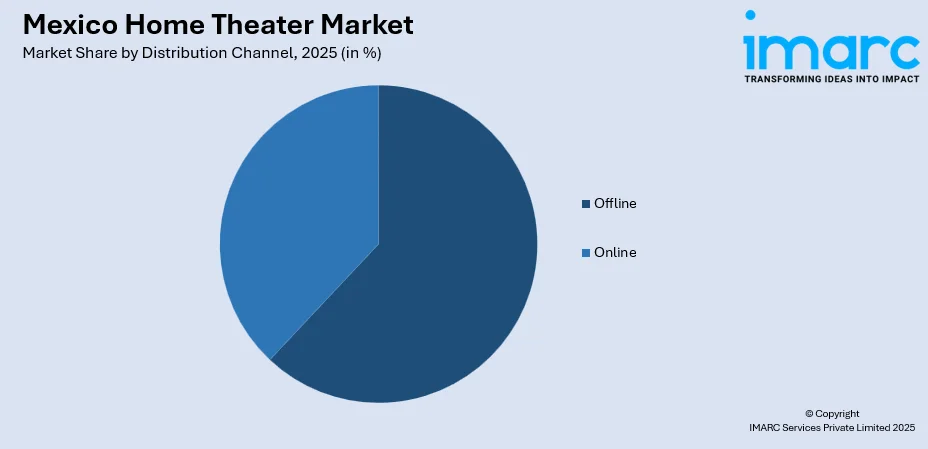

- By Distribution Channel: Offline segment leads the market with a share of 62% in 2025, attributed to consumer preference for hands-on product evaluation, immediate availability, expert consultation at retail stores, and flexible financing options offered by leading electronics retailers.

- Key Players: The Mexico home theater market exhibits a moderately fragmented competitive landscape, with multinational consumer electronics corporations competing alongside regional distributors. Major players leverage brand recognition, technological innovation, and strategic retail partnerships to capture market share across diverse price segments and consumer demographics.

To get more information on this market Request Sample

The Mexico home theater market is undergoing transformative growth as consumer entertainment preferences shift toward premium in-home experiences. Rising smartphone penetration of the adult population has accelerated digital consumption patterns, with streaming services like Netflix and Amazon Prime Video driving demand for superior audio-visual equipment. In February 2025, Netflix announced a USD 1 Billion investment to produce approximately 20 original movies and television shows annually in Mexico over the next four years, demonstrating significant content investment in the region. The market benefits from Mexico's position as Latin America's economy with a growing middle class increasingly willing to invest in home entertainment upgrades. Additionally, the expansion of smart home ecosystems and integration of voice-assistant technologies are creating new growth avenues for connected home theater solutions.

Mexico Home Theater Market Trends:

Rising Adoption of Smart Home Integration and Voice-Controlled Audio Systems

The integration of home theater systems with smart home ecosystems represents a defining trend in Mexico's consumer electronics landscape. Consumers increasingly demand seamless connectivity between soundbars, smart televisions, and voice assistants, enabling hands-free control and multi-room audio experiences. The Mexico smart speaker market size is anticipated to reach USD 829.8 Million by 2033, exhibiting a growth rate (CAGR) of 21.2% during 2025-2033, reflecting strong consumer appetite for connected audio devices. This trend is particularly pronounced among urban consumers seeking to streamline daily routines through intelligent home automation.

Expansion of Streaming Services Driving Premium Audio Equipment Demand

The exponential growth of over-the-top streaming platforms is fundamentally reshaping home entertainment consumption patterns in Mexico. Major international and regional streaming services collectively serve millions of Mexican subscribers seeking theatrical-quality content delivery within domestic settings. This streaming revolution has intensified consumer demand for audio equipment capable of delivering immersive experiences comparable to theatrical presentations. The growing availability of Dolby Atmos content on streaming platforms is particularly driving adoption of compatible soundbar systems featuring advanced spatial audio technologies. Streaming services' continued investment in original Mexican content further strengthens viewer engagement and motivates consumers to upgrade home audio systems for enhanced entertainment experiences.

Premiumization Trend and Growing Consumer Preference for Wireless Solutions

Mexican consumers are increasingly prioritizing quality over price when selecting home entertainment equipment, reflecting broader premiumization trends across the consumer electronics sector. This affluence shift is driving demand for wireless soundbar systems that eliminate cable clutter while delivering superior audio performance. Manufacturers are responding with sleek, aesthetically appealing designs featuring Bluetooth and Wi-Fi connectivity that complement modern home decor preferences. The growing middle-class population demonstrates willingness to invest in premium audio solutions offering enhanced functionality, seamless smart home integration, and sophisticated design elements that elevate living spaces while providing immersive entertainment experiences.

Market Outlook 2026-2034:

The Mexico home theater market presents favorable growth prospects driven by sustained economic expansion and evolving consumer entertainment preferences. Rising urbanization rates of the population residing in urban areas, create concentrated demand centers for advanced home entertainment solutions. The market benefits from increasing internet penetration, facilitating broader access to streaming content that drives audio equipment demand. Investment in digital infrastructure and 5G network deployment will further enhance streaming experiences and smart home connectivity. The market generated a revenue of USD 162.50 Million in 2025 and is projected to reach a revenue of USD 358.1 Million by 2034, growing at a compound annual growth rate of 9.18% from 2026-2034.

Mexico Home Theater Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Sound Bar | 56% |

| Distribution Channel | Offline | 62% |

Product Insights:

- Home Theatre in a Box System

- Sound Bar

- Component System

The sound bar dominates with a market share of 56% of the total Mexico home theater market in 2025.

Sound bars have emerged as the preferred home theater solution for Mexican consumers seeking enhanced audio experiences without the complexity of traditional multi-speaker configurations. The segment's dominance reflects consumer preference for space-efficient, aesthetically pleasing audio solutions that seamlessly complement modern flat-panel televisions. Sound bars offer compelling value propositions through simplified installation, wireless connectivity options, and compatibility with streaming platforms supporting advanced audio formats including Dolby Atmos.

The Mexico soundbar market is driven by the increasing demand driven by smart TV adoption and streaming service proliferation. IMARC Group expects the Mexico smart TV market to reach USD 11.5 Billion by 2034, exhibiting a growth rate (CAGR) of 12% during 2026-2034. In the Mexican context, sound bars particularly appeal to urban consumers in compact living spaces seeking immersive audio without dedicated entertainment rooms. Major manufacturers continue introducing mid-range models featuring built-in voice assistants and smart home integration capabilities to capture the growing Mexican middle-class market segment.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

The offline segment leads with a share of 62% of the total Mexico home theater market in 2025.

Offline retail channels maintain dominant market position in Mexico's home theater sector, reflecting consumer preference for experiential purchasing decisions when investing in audio-visual equipment. Physical retail stores enable customers to evaluate sound quality, compare products side-by-side, and receive expert guidance from sales associates. Major electronics retailers have established extensive store networks offering dedicated home entertainment sections with demonstration facilities.

The offline channel's strength is further reinforced by flexible financing options, including installment payment plans that make premium home theater systems accessible to broader consumer segments. Major retailers offer credit facilities enabling consumers to acquire high-quality audio equipment through manageable monthly payments. While e-commerce continues gaining traction among tech-savvy shoppers, the tactile nature of audio equipment purchasing and importance of after-sales service support sustain offline channel dominance. Consumers value the ability to experience sound quality firsthand and receive personalized recommendations from knowledgeable sales staff before committing to significant purchases.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for home theater systems, driven by proximity to the United States and higher household incomes from manufacturing sector employment. The region encompasses major industrial hubs, where nearshoring-driven wage gains are lifting discretionary spending on consumer electronics.

Central Mexico witnesses high demand for home theater owing to concentrated urban population centers including Mexico City and surrounding metropolitan areas. The region benefits from superior retail infrastructure, extensive electronics store networks, and high consumer awareness of premium audio-visual technologies among the metropolitan middle-class population.

Southern Mexico presents emerging growth opportunities as economic development initiatives and tourism sector expansion increase regional prosperity. While market penetration remains lower compared to northern and central regions, improving retail distribution and expanding internet connectivity are gradually driving home entertainment adoption among southern consumers.

Market Dynamics:

Growth Drivers:

Why is the Mexico Home Theater Market Growing?

Rising Disposable Incomes and Expanding Middle-Class Consumer Base

Mexico's economic growth trajectory is fundamentally reshaping consumer spending patterns on home entertainment systems. The expanding middle-class population possesses increasing purchasing power to invest in premium audio-visual equipment that enhances domestic living experiences. Rising household incomes enable consumers to prioritize quality home entertainment solutions, transitioning from basic television audio to sophisticated soundbar and home theater configurations. This affluence growth is particularly pronounced in metropolitan areas where dual-income households demonstrate strong propensity for discretionary electronics purchases. As per the IMARC Group, the Mexico smart home market size is expected to reach USD 4.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.3% during 2025-2033, reflecting broader consumer electronics adoption trends.

Proliferation of Streaming Services and Digital Content Consumption

The explosive growth of streaming platforms has fundamentally transformed home entertainment consumption patterns, creating sustained demand for audio equipment capable of delivering immersive experiences. Local platforms collectively serve millions of Mexican subscribers seeking theatrical-quality content delivery within domestic settings. The availability of high-definition and ultra-high-definition content with advanced audio formats including Dolby Atmos motivates consumers to upgrade home audio systems. Streaming services' investment in original Mexican content further strengthens engagement and drives equipment purchases. The Mexico OTT TV and video market is indicating sustained content consumption growth that supports home theater demand.

Urbanization Trends and Smart Home Technology Adoption

Rapid urbanization across Mexico concentrates consumer demand in metropolitan areas where modern housing developments incorporate advanced entertainment infrastructure. Urban consumers demonstrate heightened interest in smart home technologies that integrate entertainment systems with broader connected device ecosystems. The desire for seamless connectivity between soundbars, smart televisions, streaming devices, and voice assistants drives adoption of compatible home theater equipment. Home automation systems and energy-efficient appliances appeal particularly to urban residents seeking streamlined daily routines and enhanced entertainment experiences. The expanding availability of high-speed internet connectivity and mobile broadband facilitates streaming consumption that underpins home theater market growth.

Market Restraints:

What Challenges the Mexico Home Theater Market is Facing?

Price Sensitivity Among Mass-Market Consumers

Despite growing middle-class prosperity, significant portions of the Mexican consumer base remain price-sensitive when evaluating home entertainment purchases. Premium home theater systems represent substantial investments that compete with other household spending priorities. Economic uncertainties and inflation concerns may prompt consumers to delay discretionary electronics purchases or opt for lower-priced alternatives.

Digital Divide and Uneven Internet Infrastructure

Regional disparities in internet connectivity and digital infrastructure create uneven market development across Mexico. Rural and semi-urban areas with limited broadband access experience reduced streaming consumption that constrains home theater demand. The digital divide between metropolitan centers and provincial regions restricts market penetration in underserved geographic areas.

Competition from Alternative Entertainment Solutions

Home theater systems face competitive pressure from alternative audio solutions including wireless headphones, portable speakers, and smartphone audio enhancement devices. Younger consumers may prioritize personal audio devices over shared home entertainment systems. The availability of free ad-supported streaming platforms reduces urgency for premium audio equipment investments.

Competitive Landscape:

The Mexico home theater market exhibits a moderately fragmented competitive structure characterized by the presence of established multinational consumer electronics corporations competing alongside regional distributors and emerging domestic players. Market participants employ diverse strategies including product innovation, competitive pricing, strategic retail partnerships, and targeted marketing campaigns to capture market share across varied consumer segments. Major international brands leverage technological expertise and global brand recognition to position premium offerings, while regional players compete through localized distribution networks and flexible financing options. The competitive landscape is intensifying as e-commerce platforms expand consumer access to diverse product selections with transparent price comparisons. Manufacturers increasingly focus on developing affordable mid-range soundbar systems featuring smart connectivity to capture the growing Mexican middle-class market segment.

Mexico Home Theater Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Home Theatre in a Box System, Sound Bar, Component System |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico home theater market size was valued at USD 162.50 Million in 2025.

The Mexico home theater market is expected to grow at a compound annual growth rate of 9.18% from 2026-2034 to reach USD 358.1 Million by 2034.

Sound bar dominated the market with a 56% share in 2025, driven by consumer preference for compact, wireless audio solutions that deliver enhanced sound quality while integrating seamlessly with smart televisions and streaming platforms.

Key factors driving the Mexico home theater market include rising disposable incomes, expanding middle-class consumer base, proliferation of streaming services, growing smart home technology adoption, and increasing urbanization driving demand for premium home entertainment solutions.

Major challenges include price sensitivity among mass-market consumers, digital divide limiting rural market penetration, competition from alternative audio solutions, supply chain dependencies on imported components, and economic uncertainties affecting discretionary spending patterns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)