Mexico Hydraulic Equipment Market Size, Share, Trends and Forecast by Type, End-User Industry, and Region, 2025-2033

Mexico Hydraulic Equipment Market Overview:

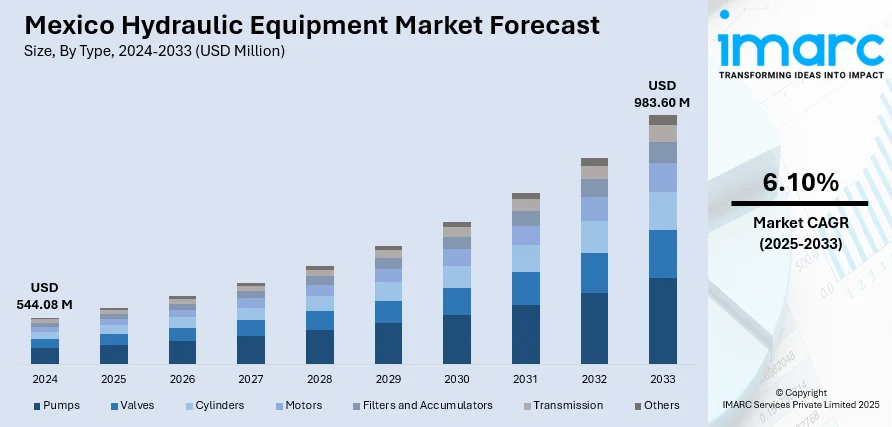

The Mexico hydraulic equipment market size reached USD 544.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 983.60 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. Growth in manufacturing, construction, and mining sectors, coupled with increasing automation in industrial processes, is propelling demand for advanced hydraulic solutions. Government infrastructure projects and foreign direct investments further support this upward trend. These factors collectively contribute to a steady rise in the Mexico hydraulic equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 544.08 Million |

| Market Forecast in 2033 | USD 983.60 Million |

| Market Growth Rate 2025-2033 | 6.10% |

Mexico Hydraulic Equipment Market Trends:

Integration of Predictive Maintenance Technologies

One of the significant trends influencing Mexico hydraulic equipment market growth is the use of predictive maintenance solutions based on IoT and data analytics. Companies are more commonly installing sensors within hydraulic systems to monitor component wear, pressure oscillations, and fluid health in real time. These technologies assist in lowering downtime, maximizing maintenance cycles, and prolonging equipment life, which is essential in mining and heavy construction sectors. With digital transformation gathering pace throughout Mexico's industrial sector, the need for system intelligence is increasingly being felt. This has an impact on procurement and leads to suppliers providing smart, diagnostics-based hydraulic components. Adoption of such technologies not only raises operational efficiency but also safety and reliability, thus favorably impacting the overall Mexico hydraulic equipment market growth. For instance, Norrhydro’s NorrDigi system uses digital control of four-chamber hydraulic cylinders to enhance precision, energy efficiency, and speed. It incorporates piston accumulators that store and recover energy, helping cut down on power use and heat output. By gathering system performance data, it also enables predictive maintenance and offers potential for downsizing components to reduce costs. Created in partnership with Volvo Construction Equipment and the University of Tampere, NorrDigi is designed for use in heavy-duty machines such as excavators and mining equipment.

To get more information of this market, Request Sample

Expansion of Localized Production and Aftermarket Services

To improve responsiveness and reduce import dependency, several global and domestic firms are expanding localized production and aftermarket support for hydraulic systems in Mexico. This trend aligns with nearshoring strategies adopted by OEMs and component manufacturers targeting North American markets. Establishing production hubs within Mexico helps companies cater to regional customers more efficiently, offering quicker lead times, cost savings, and tailored engineering support. For instance, in May 2024, Wipro Hydraulics signed an agreement to acquire Canada-based Mailhot Industries, expanding its reach into North America, including Mexico. Mailhot specializes in hydraulic cylinders for refuse trucks and snow equipment. The deal strengthens Wipro’s position in key sectors like mining, utilities, and defense, and enhances its global manufacturing and innovation footprint. Simultaneously, demand for aftermarket services—such as refurbishment, spare parts, and technical support—has increased across industries relying on hydraulic equipment for critical operations. As industrial operations mature and equipment longevity becomes a priority, these value-added services are becoming essential. This expansion in localized capabilities directly supports the Mexico hydraulic equipment market growth.

Mexico Hydraulic Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-user industry.

Type Insights:

- Pumps

- Valves

- Cylinders

- Motors

- Filters and Accumulators

- Transmission

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pumps, valves, cylinders, motors, filters and accumulators, transmission, and others.

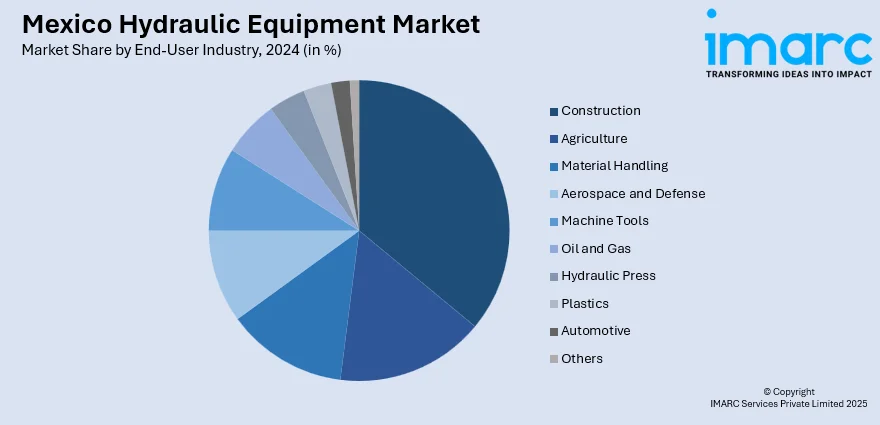

End-User Industry Insights:

- Construction

- Agriculture

- Material Handling

- Aerospace and Defense

- Machine Tools

- Oil and Gas

- Hydraulic Press

- Plastics

- Automotive

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes construction, agriculture, material handling, aerospace and defense, machine tools, oil and gas, hydraulic press, plastics, automotive, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hydraulic Equipment Market News:

- In June 2024, Hengli established a 141,000 sq. meter facility in Mexico under Hengli de Mexico, S.A. de C.V., aimed at manufacturing, servicing, and warehousing hydraulic products. The plant will create over 300 jobs and focus on equipment for construction, cranes, and aerial platforms, enhancing regional support.

- In May 2024, Brennan Industries opened a new distribution facility in Querétaro, Mexico, marking a strategic move to support growing customer demand and improve supply chain efficiency. The expansion reflects Brennan’s commitment to local service, aligning with its broader growth efforts, including acquisitions and international e-commerce development, in the hydraulics and pneumatics sector.

- In March 2024, Switzerland’s Sulzer opened a new hydraulic pump factory in Cuautitlán Izcalli, Mexico, investing approximately USD 7.1 Million. The plant benefits from Mexico’s skilled workforce, favorable industrial environment, and proximity to the U.S. market, strengthening Sulzer’s manufacturing footprint and supply chain efficiency in the region.

- In January 2024, Continental invested around USD 90 Million to build a new hydraulic hose production plant in Aguascalientes, Mexico. The facility will create over 200 jobs in its initial phase and double regional production capacity. Construction began in late 2024, with operations expected by late 2025.

Mexico Hydraulic Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pumps, Valves, Cylinders, Motors, Filters and Accumulators, Transmission, Others |

| End-User Industries Covered | Construction, Agriculture, Material Handling, Aerospace and Defense, Machine Tools, Oil and Gas, Hydraulic Press, Plastics, Automotive, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hydraulic equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hydraulic equipment market on the basis of type?

- What is the breakup of the Mexico hydraulic equipment market on the basis of end-user industry?

- What is the breakup of the Mexico hydraulic equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico hydraulic equipment market?

- What are the key driving factors and challenges in the Mexico hydraulic equipment market?

- What is the structure of the Mexico hydraulic equipment market and who are the key players?

- What is the degree of competition in the Mexico hydraulic equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hydraulic equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hydraulic equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hydraulic equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)