Mexico Hydrogen Generation Market Size, Share, Trends and Forecast by Technology, Application, System Type, and Region, 2025-2033

Mexico Hydrogen Generation Market Overview:

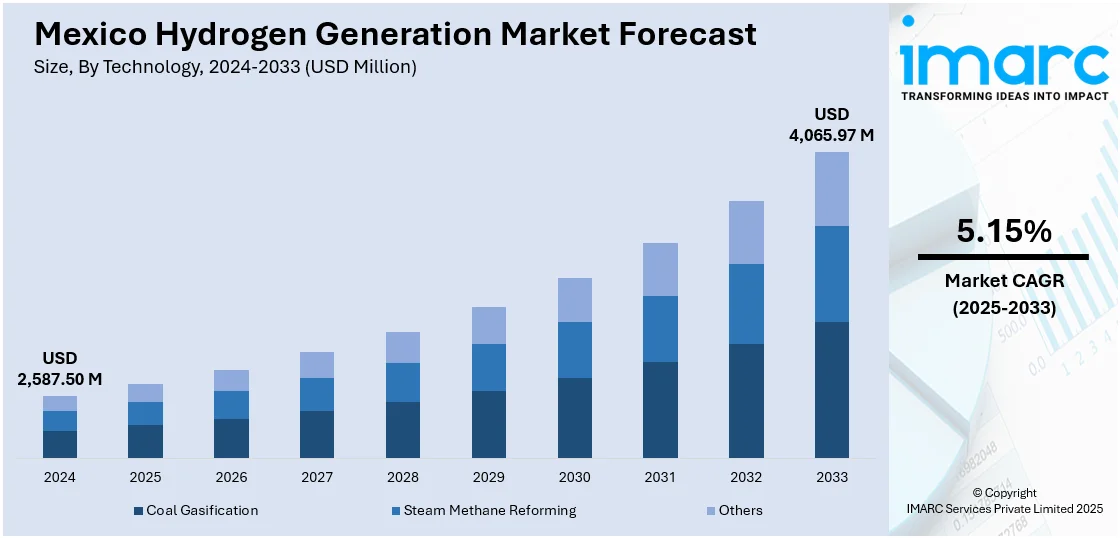

The Mexico hydrogen generation market size reached USD 2,587.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,065.97 Million by 2033, exhibiting a growth rate (CAGR) of 5.15% during 2025-2033. The governing agency of Mexico is actively promoting hydrogen as a part of its overall energy transition policy. This trend, along with the movement towards renewable sources of energy, is impelling the market growth. Moreover, technological progress is playing a critical role in expanding the Mexico hydrogen generation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,587.50 Million |

| Market Forecast in 2033 | USD 4,065.97 Million |

| Market Growth Rate 2025-2033 | 5.15% |

Mexico Hydrogen Generation Market Trends:

Government Policies and Incentives Supporting Hydrogen Development

The government of Mexico is actively promoting hydrogen as a part of its overall energy transition policy. As of 2024, at least 15 projects were under development in Mexico, according to the information provided by the hydrogen trade body in Mexico, Asociación Mexicana de Hidrógeno (AMH). With investments in clean energy and the introduction of policies like the National Strategy for Hydrogen, Mexico is establishing an encouraging environment for the development of the hydrogen market. These measures are offering financial incentives and subsidies to the companies engaged in hydrogen production, storage, and transportation. In addition, Mexico is also prioritizing the development of regulatory frameworks that promote private sector engagement while maintaining environmental sustainability. Such robust policy support is propelling the growth of hydrogen infrastructure, making it an increasingly viable energy solution for industrial uses and transportation. As the demand for green hydrogen increases, Mexico is positioning itself in line with global energy trends, becoming a major leader in the hydrogen economy.

Increasing Demand for Clean Energy Solutions

The movement towards renewable sources of energy is contributing to the Mexico hydrogen generation market growth. Mexico is constantly looking for alternatives to fossil fuels, especially in its manufacturing industries, which are heavy polluters. The nation's resolve to lessen its carbon imprint is encouraging companies to embrace cleaner technologies, and hydrogen is one such leading alternative. By investing in hydrogen production, particularly green hydrogen that is derived from renewable energies such as solar and wind energy, Mexico is diversifying from relying on the use of old forms of energy sources like natural gas and oil. This process is growing the need for hydrogen, especially within industries like power generation, transport, and manufacturing. The heightened demand for carbon-free energy solutions is motivating the government to enhance its hydrogen production capacity to fulfill both local and global market demands.

Technological Advancements in Hydrogen Production

Technological progress is playing a critical role in driving the market in Mexico. Advancements in electrolysis technology, which uses electricity to produce hydrogen from water, are currently reducing the cost of hydrogen production. These improvements in efficiency and scalability are making hydrogen a more viable and cost-effective alternative to traditional energy sources. Additionally, the ongoing development of new materials and processes for hydrogen storage and transportation is facilitating its integration into the energy grid and industrial applications. As these technologies continue to evolve, Mexico is investing in research and development (R&D) to foster local innovation and collaborate with global leaders in hydrogen technology. These advancements are creating new opportunities for businesses and governments to scale up hydrogen production and infrastructure, ensuring that Mexico remains competitive in the industry. Development of a $10bn green hydrogen facility in Mexico will start from 2026, and operations in 2028, a senior official said in a press conference by President Claudia Sheinbaum. The 1.2GW wind farm will be constructed by Helax, owned by Copenhagen Infrastructure Partners, at the Isthmus of Tehuantepec in Oaxaca, where the separation between the Pacific Ocean and the Gulf of Mexico is the smallest.

Mexico Hydrogen Generation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, application, and system type.

Technology Insights:

- Coal Gasification

- Steam Methane Reforming

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes coal gasification, steam methane reforming, and others.

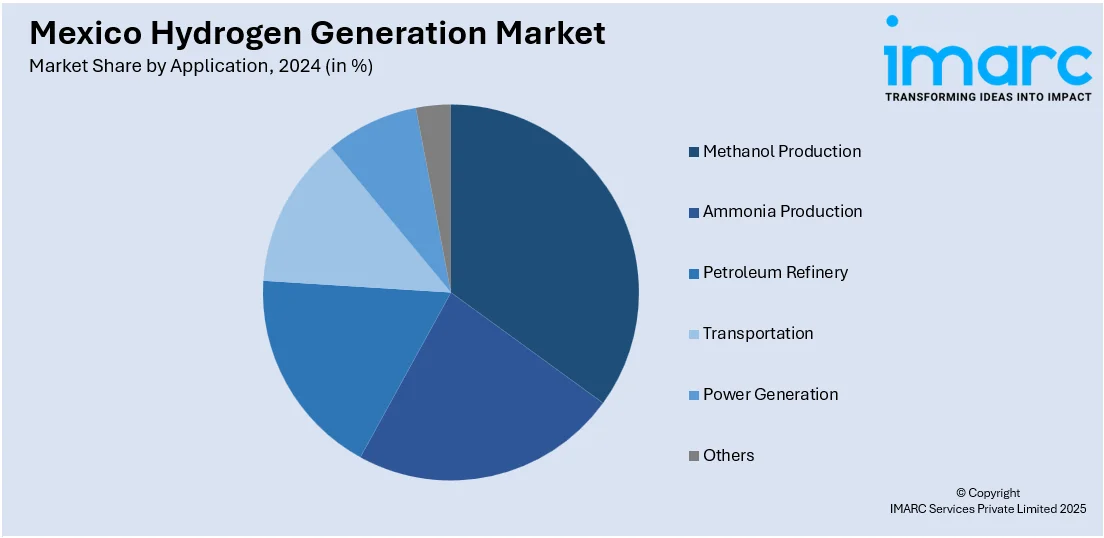

Application Insights:

- Methanol Production

- Ammonia Production

- Petroleum Refinery

- Transportation

- Power Generation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes methanol production, ammonia production, petroleum refinery, transportation, power generation, and others.

System Type Insights:

- Merchant

- Captive

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes merchant and captive.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Hydrogen Generation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Coal Gasification, Steam Methane Reforming, Others |

| Applications Covered | Methanol Production, Ammonia Production, Petroleum Refinery, Transportation, Power Generation, Others |

| System Types Covered | Merchant, Captive |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico hydrogen generation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico hydrogen generation market on the basis of technology?

- What is the breakup of the Mexico hydrogen generation market on the basis of application?

- What is the breakup of the Mexico hydrogen generation market on the basis of system type?

- What is the breakup of the Mexico hydrogen generation market on the basis of region?

- What are the various stages in the value chain of the Mexico hydrogen generation market?

- What are the key driving factors and challenges in the Mexico hydrogen generation market?

- What is the structure of the Mexico hydrogen generation market and who are the key players?

- What is the degree of competition in the Mexico hydrogen generation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico hydrogen generation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico hydrogen generation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico hydrogen generation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)