Mexico Industrial Exhaust Systems Market Size, Share, Trends and Forecast by Type, End-Use Industry, and Region, 2025-2033

Mexico Industrial Exhaust Systems Market Overview:

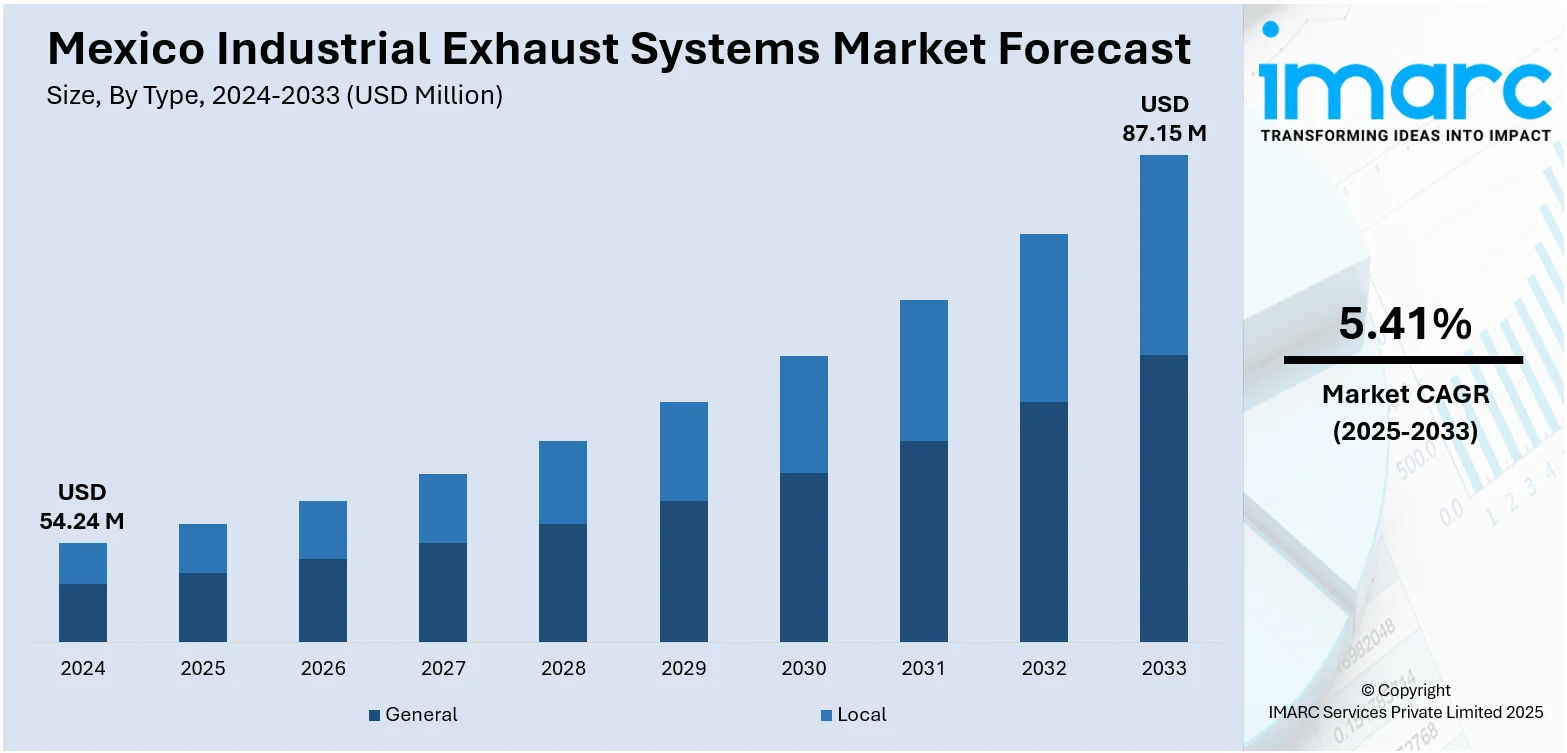

The Mexico industrial exhaust systems market size reached USD 54.24 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 87.15 Million by 2033, exhibiting a growth rate (CAGR) of 5.41% during 2025-2033. The industrial exhaust systems market is driven by growth in construction and infrastructure, stringent environmental regulations, and advancements in automation. The need for efficient air management in new construction projects and the integration of smart exhaust systems with Industry 4.0 technologies is also contributing to the expansion of the Mexico industrial exhaust systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54.24 Million |

| Market Forecast in 2033 | USD 87.15 Million |

| Market Growth Rate 2025-2033 | 5.41% |

Mexico Industrial Exhaust Systems Market Trends:

Increase in Construction and Infrastructure Development

The growing construction and infrastructure industries in Mexico plays a crucial role in driving the need for industrial exhaust systems as the nation witnesses a rise in major projects, including commercial centers, manufacturing plants, data centers, logistics hubs, and essential energy facilities. These advancements necessitate all-encompassing air management systems to control the substantial emissions, dust, and heat generated by construction equipment and continuous activities. Industrial exhaust systems are crucial not only during the construction phase but also as a lasting infrastructure to maintain indoor air quality, safeguard equipment, and comply with progressively stringent environmental regulations. Current building regulations in Mexico highlight sustainable design and employee safety, encouraging developers to integrate advanced exhaust systems from the initial planning phases. A prominent instance is the 2025 inauguration of ODATA’s QR03 data center in Querétaro, Mexico’s largest facility of this type, featuring an investment surpassing $3 billion. The complex, comprising five structures and capable of accommodating up to 300 MW of capacity, illustrates the connection between infrastructure development and advanced environmental management, including industrial ventilation systems. Projects of this magnitude demonstrate how the need for exhaust systems extends beyond conventional manufacturing into fields, such as data and technology, where regulating temperature, air filtration, and emissions management are crucial. The ongoing investment from both the government and private sector is supporting the Mexico industrial exhaust systems market growth.

To get more information on this market, Request Sample

Integration of Automation and Industry 4.0 Practices

The growing use of automation and Industry 4.0 technologies in Mexican manufacturing is transforming the demand for industrial exhaust systems, steering them towards more intelligent, integrated, and data-informed solutions. As factories throughout Mexico adopt robotics, automated manufacturing lines, and Internet of Things (IoT)-driven monitoring systems to boost efficiency and minimize downtime, exhaust systems are evolving from simple ventilation units into intelligent components of the digital factory landscape. These advanced exhaust systems utilize sensors, programmable logic controllers (PLCs), and real-time connectivity to enable predictive maintenance, adjustable airflow dynamics, and improved energy efficiency. Their integration helps achieve lean manufacturing objectives while enhancing environmental safety through continuous air quality monitoring and automated controls. The transition is not a choice but a necessity for maintaining competitiveness in a swiftly digitalizing environment. Demonstrating this trend, the Mexico Industry 4.0 sector achieved USD 2,470.50 million in 2024 and is projected to expand to USD 8,330.45 million by 2033, exhibiting a compound annual growth rate (CAGR) of 14.46% between 2025 and 2033, according to the IMARC Group. This rapid expansion signifies a notable shift toward cutting-edge manufacturing technologies, where industrial exhaust systems are crucial for ensuring operational continuity and safety in these advanced facilities. As manufacturing facilities grow smarter, there is an increase in the need for exhaust solutions that integrate smoothly with other systems, providing not only air filtration but also analytics and automation to enhance performance.

Mexico Industrial Exhaust Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use industry.

Type Insights:

- General

- Local

The report has provided a detailed breakup and analysis of the market based on the type. This includes general and local.

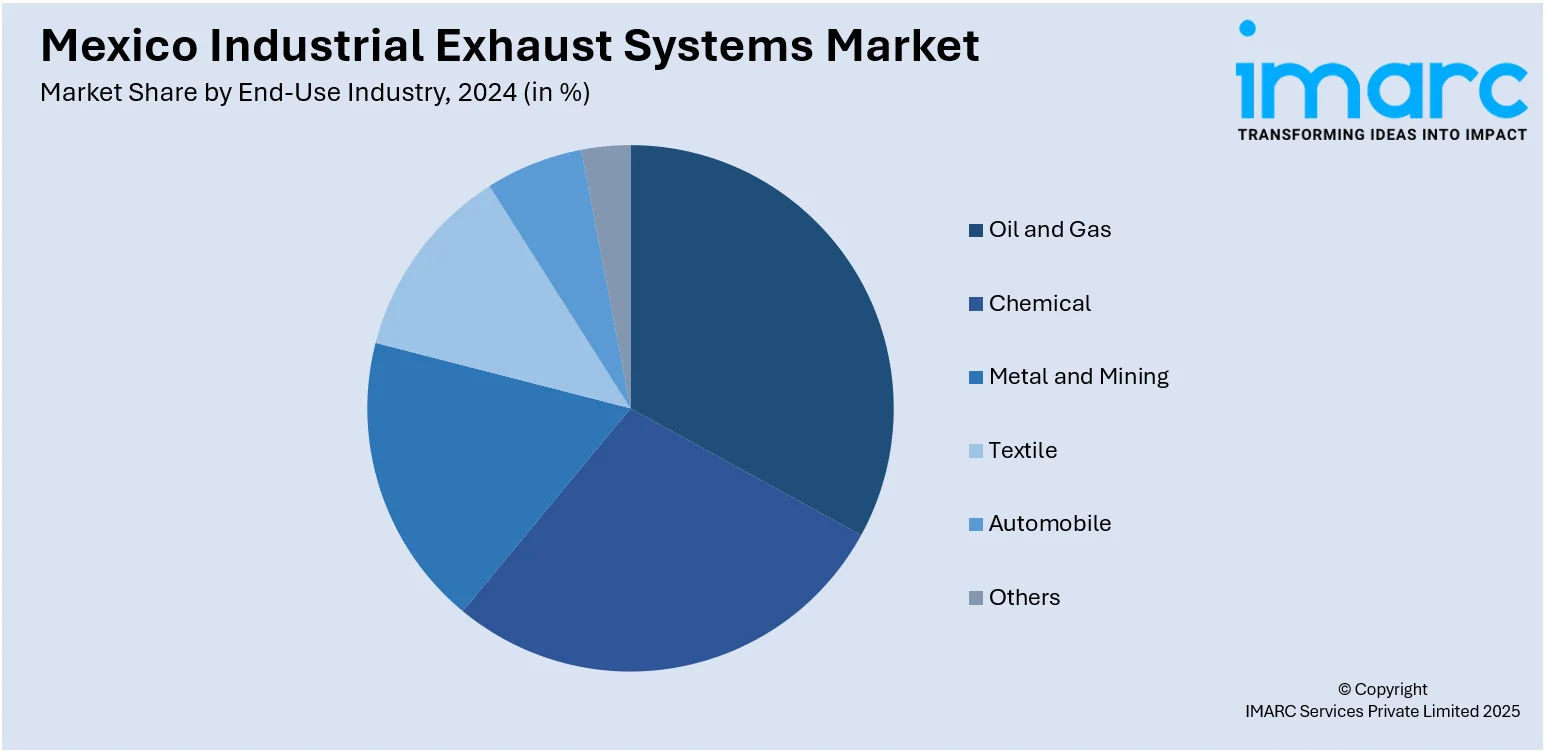

End-Use Industry Insights:

- Oil and Gas

- Chemical

- Metal and Mining

- Textile

- Automobile

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes oil and gas, chemical, metal and mining, textile, automobile, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Exhaust Systems Market News:

- In May 2025, Tata AutoComp Systems Ltd. and Katcon Global launched a joint venture in Mexico to produce advanced lightweight composites and exhaust system components. This marks Tata AutoComp’s first technology-led partnership, targeting the North American automotive and off-road markets. The venture builds on their 13-year collaboration in exhaust systems and emission solutions.

Mexico Industrial Exhaust Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | General, Local |

| End-Use Industries Covered | Oil and Gas, Chemical, Metal and Mining, Textile, Automobile, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial exhaust systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial exhaust systems market on the basis of type?

- What is the breakup of the Mexico industrial exhaust systems market on the basis of end-use industry?

- What is the breakup of the Mexico industrial exhaust systems market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial exhaust systems market?

- What are the key driving factors and challenges in the Mexico industrial exhaust systems market?

- What is the structure of the Mexico industrial exhaust systems market and who are the key players?

- What is the degree of competition in the Mexico industrial exhaust systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial exhaust systems market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial exhaust systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial exhaust systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)