Mexico Industrial Gas Market Size, Share, Trends and Forecast by Type, Application, Supply Mode, and Region, 2025-2033

Mexico Industrial Gas Market Overview:

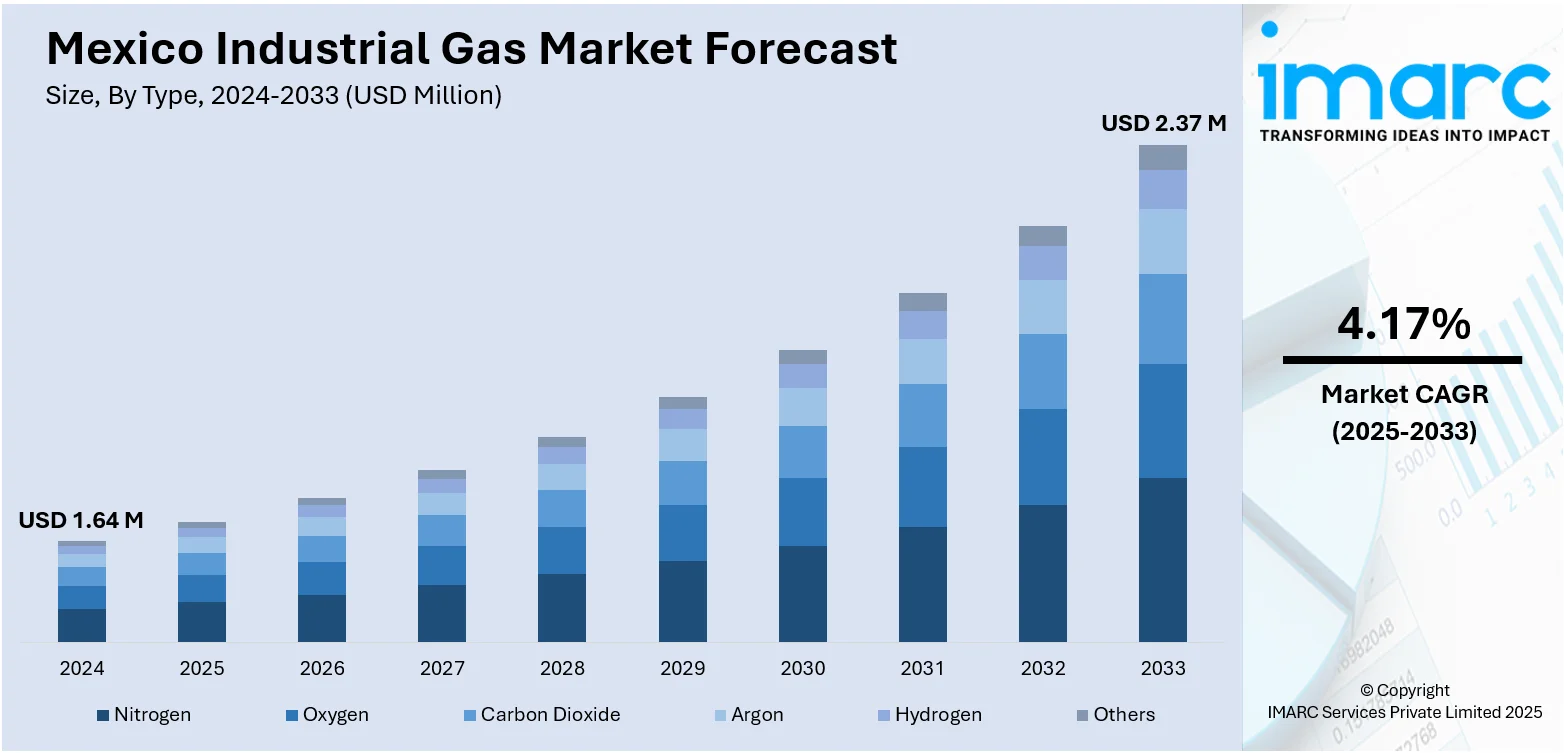

The Mexico industrial gas market size reached USD 1.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2.37 Million by 2033, exhibiting a growth rate (CAGR) of 4.17% during 2025-2033. Robust growth in manufacturing, healthcare, and food and beverage sectors is one of the factors contributing to Mexico industrial gas market share. Additionally, increasing demand for clean energy solutions, particularly hydrogen, and technological advancements in gas production and distribution further propel market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.64 Million |

| Market Forecast in 2033 | USD 2.37 Million |

| Market Growth Rate 2025-2033 | 4.17% |

Mexico Industrial Gas Market Trends:

Growth in Production Capacity and Renewable Energy Focus

Mexico's industrial gas industry is growing fast as firms make investments in new manufacturing plants, such as hydrogen plants and air separation units. This is to improve the supply of vital gases like hydrogen and nitrogen, used across numerous industries. The country's drive towards using renewable sources of energy, particularly green hydrogen, as part of a general national energy policy also supports the growth. The emphasis on clean energy and sustainability is bringing in strong investment in the infrastructure needed for production and supply of these gases. Consequently, Mexico becomes a major player in the international industrial gas market, providing stable and renewable energy to industry and promoting the development of cleaner energy options. This transition holds long-term prospects for the industrial gas industry in the region. These factors are intensifying the Mexico industrial gas market growth. For example, according to industry reports, companies like Air Liquide and Cryoinfra are boosting production capacity, with new hydrogen plants and air separation facilities. The government’s National Energy Plan 2024-2030, with USD 23.4 Billion in investment, supports renewable energy, including green hydrogen.

To get more information on this market, Request Sample

Growth in LNG Production and Export Capacity

In Mexico, the industrial gas market is witnessing a boost in liquefied natural gas (LNG) production, with new facilities coming online to meet growing demand. A recent development offshore in Altamira has enhanced the country’s LNG production capabilities, focusing on providing clean and cost-effective LNG to downstream customers. This increase in production capacity highlights Mexico’s role as a key player in the global LNG market, ensuring a reliable supply for both domestic and international markets. With strategic investments in LNG infrastructure, Mexico is positioning itself to meet the energy needs of a variety of industries, including power generation and transport. This expansion supports Mexico's energy goals and bolsters the country’s export capacity, ensuring long-term growth in its industrial gas sector. As demand for cleaner energy solutions rises, Mexico’s LNG sector is becoming increasingly integral to global energy markets. For instance, in July 2024, New Fortress Energy successfully produced its first liquefied natural gas (LNG) at the Fast LNG facility offshore Altamira, Mexico. The plant has a production capacity of 1.4 Million Tons per year and aims to supply low-cost, clean LNG to downstream terminal customers.

Mexico Industrial Gas Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and supply mode.

Type Insights:

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes nitrogen, oxygen, carbon dioxide, argon, hydrogen, and others.

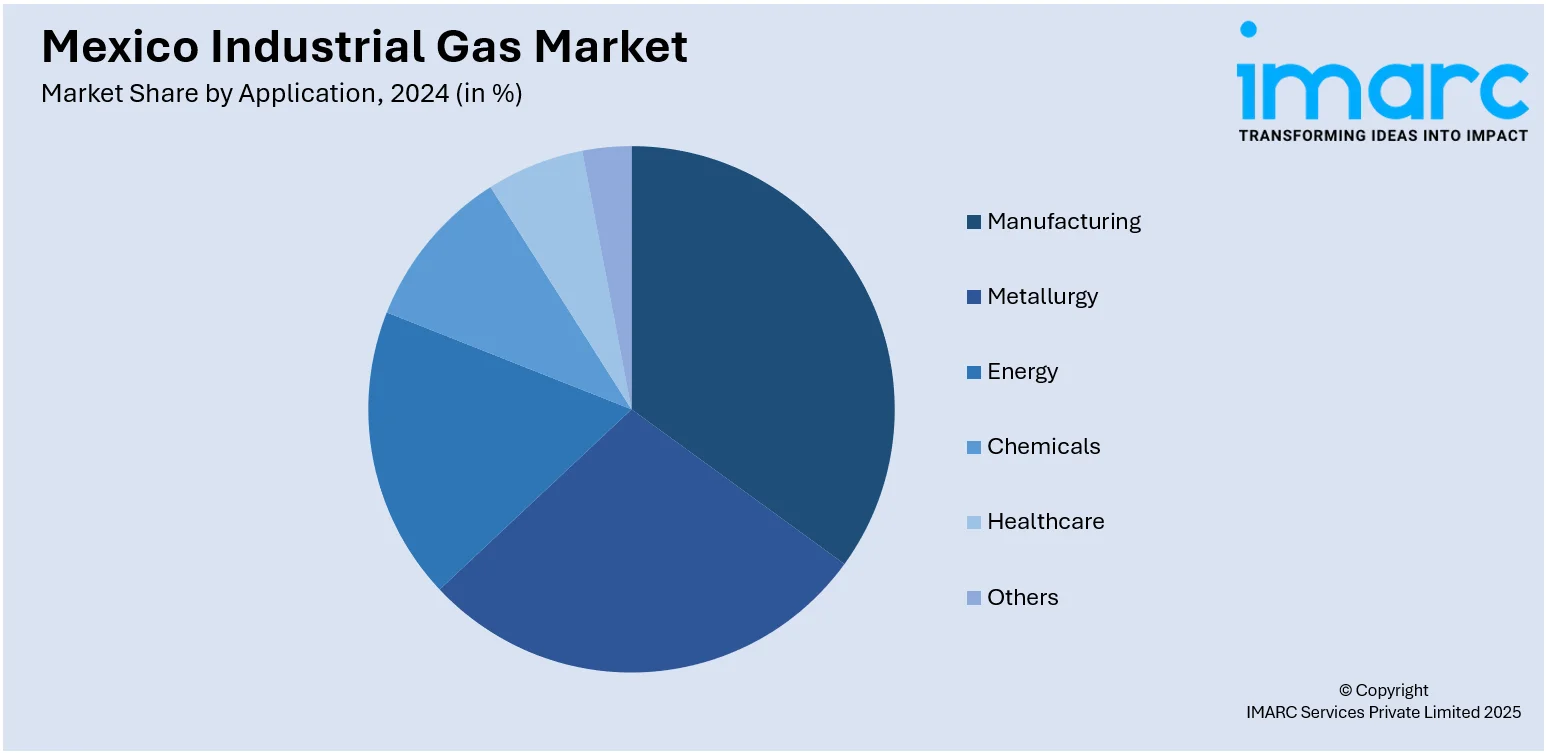

Application Insights:

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes manufacturing, metallurgy, energy, chemicals, healthcare, and others.

Supply Mode Insights:

- Packaged

- Bulk

- On-Site

A detailed breakup and analysis of the market based on the supply mode have also been provided in the report. This includes packaged, bulk, and on-site.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen, Oxygen, Carbon Dioxide, Argon, Hydrogen, Others |

| Applications Covered | Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, Others |

| Supply Modes Covered | Packaged, Bulk, On-Site |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial gas market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial gas market on the basis of type?

- What is the breakup of the Mexico industrial gas market on the basis of application?

- What is the breakup of the Mexico industrial gas market on the basis of supply mode?

- What is the breakup of the Mexico industrial gas market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial gas market?

- What are the key driving factors and challenges in the Mexico industrial gas market?

- What is the structure of the Mexico industrial gas market and who are the key players?

- What is the degree of competition in the Mexico industrial gas market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial gas market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial gas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)