Mexico Industrial Hoses Market Size, Share, Trends and Forecast by Material Type, Application, and Region, 2025-2033

Mexico Industrial Hoses Market Overview:

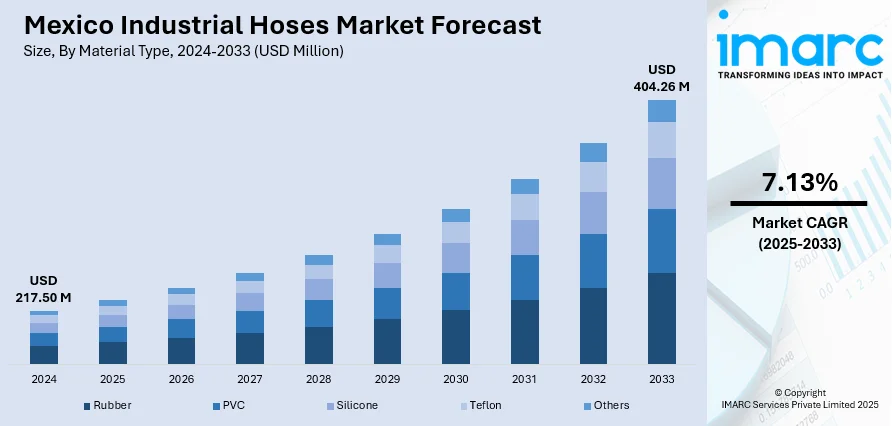

The Mexico industrial hoses market size reached USD 217.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 404.26 Million by 2033, exhibiting a growth rate (CAGR) of 7.13% during 2025-2033. The demand is stimulated by healthy growth in auto manufacturing, which requires high-quality hoses for automotive systems. Developing infrastructure and construction activities also enhance the use of hoses in water, fuel, and concrete transfer. Industrialization growth in industries such as oil and gas, food processing, among others, also drives increased demand for trusted fluid handling. Advances in the technology of hose material and increased interest in sustainable, high-performing products also help fuel the Mexico industrial hoses market share, with industries looking to achieve efficiency, safety, and environmental sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 217.50 Million |

| Market Forecast in 2033 | USD 404.26 Million |

| Market Growth Rate 2025-2033 | 7.13% |

Mexico Industrial Hoses Market Trends:

Infrastructure Development and Industrialization

Mexico’s commitment to upgrading its infrastructure is driving consistent demand for industrial hoses. These hoses play a critical role across construction and public works projects, where they are used in systems for water delivery, concrete transfer, air ventilation, and chemical handling. As more industrial parks, residential zones, and transportation corridors are built, contractors require reliable hose solutions to ensure efficiency and safety on job sites. Industrialization efforts especially the expansion of manufacturing, energy, and processing facilities also rely on hoses for fluid movement, dust suppression, and waste management. Additionally, increased mechanization in construction means that modern equipment increasingly depends on flexible hose systems. As public and private sectors invest in both new developments and infrastructure upgrades, the need for rugged, purpose-built hoses becomes more pronounced, making this trend a long-term driver of Mexico industrial hoses market growth.

To get more information on this market, Request Sample

Automotive Industry Expansion

Mexico’s automotive industry, contributing about 18% of the country’s manufacturing gross domestic product (GDP), is a key driver for industrial hose demand. As global and regional automakers expand production facilities, the need for durable, high-performance hoses in fuel, brake, air conditioning, and cooling systems grows. With the rise of electric and hybrid vehicles, hoses must withstand higher temperatures and pressures while meeting stricter safety and space requirements. original equipment manufacturers (OEMs) and tier suppliers increasingly require consistent, quality-assured hoses that comply with global standards. As vehicle technologies evolve, industrial hoses must adapt to new materials, tighter space constraints, and safety requirements This ongoing innovation, alongside Mexico’s vital role in the North American auto supply chain, positions hose manufacturers as essential partners in supporting evolving vehicle technologies and operational efficiency across the automotive sector.

Technological Advancements and Sustainability

Materials and manufacturing innovation is transforming Mexico's industrial hose market. Businesses are creating hoses that are more flexible, tougher, and chemically resistant, and better equipped to withstand adverse environments. New hoses are lighter, simpler to maneuver, and more versatile for a particular industrial application, ranging from oil and gas to food processing. Meanwhile, interest is increasing in sustainable production not only in how hoses are produced and disposed of but also in how they're manufactured. This has spurred the development of hoses that incorporate recyclable or biodegradable components. In addition, innovations like embedded sensors for monitoring wear are being introduced incrementally to minimize downtime and increase workplace safety. With increasing environmental consciousness and regulation levels, manufacturers are being prompted by industries to find hose solutions that are both performing and environmentally conscious, compelling them to provide smarter, cleaner, and more robust products.

Mexico Industrial Hoses Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type and application.

Material Type Insights:

- Rubber

- PVC

- Silicone

- Teflon

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes rubber, PVC, silicone, Teflon, and others.

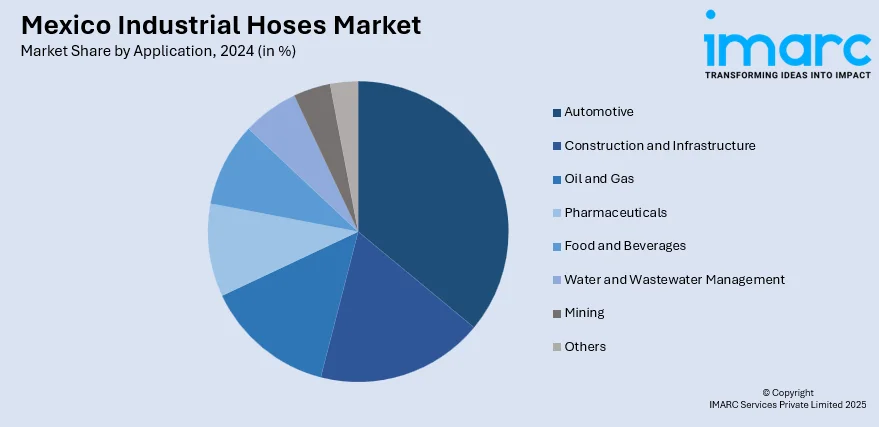

Application Insights:

- Automotive

- Construction and Infrastructure

- Oil and Gas

- Pharmaceuticals

- Food and Beverages

- Water and Wastewater Management

- Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, construction and infrastructure, oil and gas, pharmaceuticals, food and beverages, water and wastewater management, mining, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Hoses Market News:

- In December 2024, Continental launched the X-Life XCP5, a premium braided hydraulic hose designed for high-pressure applications in industries like mining, agriculture, and construction. The hose offers superior flexibility, abrasion resistance, and operates in extreme temperatures. It meets ISO 18752 standards and pairs with Continental’s leak-resistant B2 fittings. This launch aligns with Continental’s plan to double its hydraulic hose capacity through a new $90 million manufacturing plant in Mexico, aimed at serving the Americas.

- In May 2024, Brennan Industries expanded into Mexico with a new distribution facility to better support customers’ operations and supply chain needs. This strategic move enhances access to hydraulic, pneumatic, and instrumentation components, ensuring efficient service and uninterrupted workflows. The expansion reflects Brennan’s commitment to global growth, customer alignment, and innovation, following recent milestones like its U.K. e-commerce launch and acquisitions, further solidifying its leadership in the hydraulics industry.

Mexico Industrial Hoses Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Rubber, PVC, Silicone, Teflon, Others |

| Applications Covered | Automotive, Construction and Infrastructure, Oil and Gas, Pharmaceuticals, Food and Beverages, Water and Wastewater Management, Mining, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial hoses market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial hoses market on the basis of material type?

- What is the breakup of the Mexico industrial hoses market on the basis of application?

- What is the breakup of the Mexico industrial hoses market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial hoses market?

- What are the key driving factors and challenges in the Mexico industrial hoses market?

- What is the structure of the Mexico industrial hoses market and who are the key players?

- What is the degree of competition in the Mexico industrial hoses market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial hoses market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial hoses market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial hoses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)