Mexico Industrial Lubricants Market Size, Share, Trends and Forecast by Product Type, Base Oil, End-Use Industry, and Region, 2025-2033

Mexico Industrial Lubricants Market Overview:

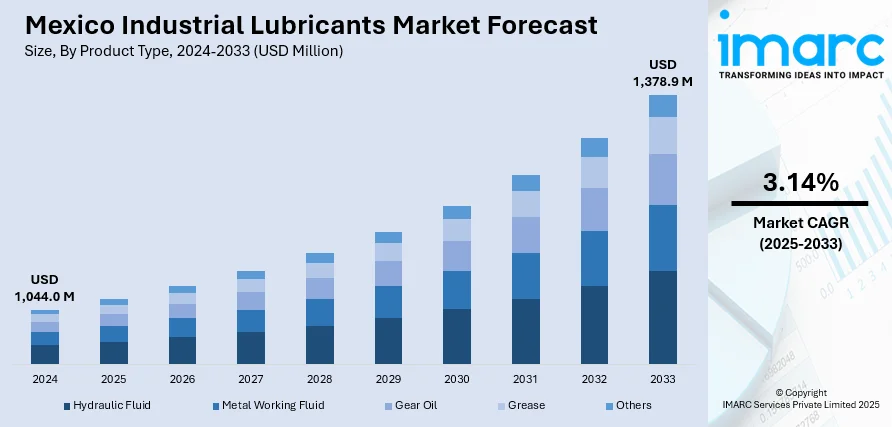

The Mexico industrial lubricants market size reached USD 1,044.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,378.9 Million by 2033, exhibiting a growth rate (CAGR) of 3.14% during 2025-2033. Automotive manufacturing expansion, rising vehicle ownership, and fleet lubrication needs are driving consistent consumption. Industrial activity growth, predictive maintenance adoption, and machinery modernization are supporting broader lubricant use. Environmental regulation, demand for biodegradable formulations, waste oil recycling, and sustainability-aligned procurement are some of the factors positively impacting the Mexico lubricants market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,044.0 Million |

| Market Forecast in 2033 | USD 1,378.9 Million |

| Market Growth Rate 2025-2033 | 3.14% |

Mexico Industrial Lubricants Market Trends:

Expansion of Automotive and Transportation Sectors

The steady growth of Mexico’s automotive manufacturing industry and vehicle ownership rates plays a central role in driving demand for lubricants. As one of the largest vehicle producers in Latin America, Mexico hosts major assembly plants for global automakers, including facilities for cars, trucks, and buses. These operations require large volumes of industrial lubricants for machinery and equipment used in assembly lines. On the consumer side, increasing vehicle registrations and an aging car fleet contribute to sustained demand for engine oils, transmission fluids, and greases. Regular maintenance cycles, coupled with aftermarket service growth, reinforce the need for both synthetic and mineral-based lubricants. Independent repair shops and dealership service networks are also expanding their lubricant offerings to meet vehicle-specific performance requirements. Furthermore, fleet operators in logistics and public transportation sectors are investing in high-performance lubricants to extend engine life and reduce downtime. Around the midpoint of these automotive and mobility shifts, Mexico lubricants market growth reflects a convergence of manufacturing strength and consumer vehicle maintenance practices.

To get more information of this market, Request Sample

Industrial Output Growth and Machinery Modernization

Another significant factor is the increase in industrial activity across key sectors such as mining, manufacturing, and construction. These industries operate heavy-duty equipment that demands high-performance lubricants to maintain machinery efficiency, reduce wear, and comply with operational safety standards. With Mexico serving as a nearshoring destination for U.S.-based manufacturers, industrial parks are expanding in states like Nuevo León, Jalisco, and Guanajuato. This growth requires consistent lubrication of hydraulic systems, gearboxes, compressors, and turbines. Many facilities are modernizing machinery and integrating predictive maintenance tools that rely on lubricant condition monitoring, further promoting the use of premium lubricant formulations. Additionally, regulations mandating safe and environmentally responsible industrial operations are pushing companies to adopt lubricants with higher thermal stability and reduced environmental impact. OEM recommendations and evolving equipment specifications are also shifting demand toward synthetic and semi-synthetic products. The diversification of industrial end-users ensures a broad and stable customer base for lubricant suppliers, who are responding with customized product lines and onsite service models to support industrial uptime.

Environmental Regulations and Shift Toward Sustainable Formulations

Increasing regulatory focus on emissions, waste management, and environmental sustainability is reshaping procurement and product strategies in the lubricant space. Governmental agencies and environmental frameworks such as NOM (Norma Oficial Mexicana) standards are prompting companies to reduce their use of high-VOC, non-biodegradable lubricants. In response, lubricant manufacturers are developing eco-friendly formulations, including biodegradable oils and re-refined base oils, that align with sustainability metrics. The market is witnessing a gradual shift toward low-viscosity and energy-efficient lubricants that support fuel economy and reduce carbon footprints. Companies with formal ESG commitments are aligning lubricant procurement with broader sustainability goals, including carbon reporting and ISO 14001 certifications. Furthermore, waste oil recycling programs are being promoted by both public and private entities to minimize environmental harm and improve supply chain circularity. These environmental and regulatory pressures are not only fostering innovation in formulation but also influencing customer behavior, particularly among multinational corporations with local operations. As compliance and sustainability become more integral to business practices, lubricant producers are adapting product portfolios and marketing strategies accordingly.

Mexico Industrial Lubricants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, base oil, and end-use industry.

Product Type Insights:

- Hydraulic Fluid

- Metal Working Fluid

- Gear Oil

- Grease

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hydraulic fluid, metal working fluid, gear oil, grease, and others.

Base Oil Insights:

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

The report has provided a detailed breakup and analysis of the market based on the base oil. This includes mineral oil, synthetic oil, and bio-based oil.

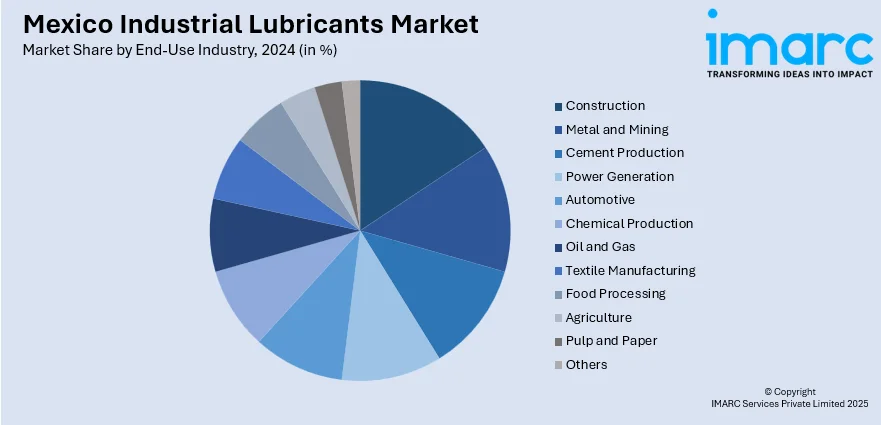

End-Use Industry Insights:

- Construction

- Metal and Mining

- Cement Production

- Power Generation

- Automotive

- Chemical Production

- Oil and Gas

- Textile Manufacturing

- Food Processing

- Agriculture

- Pulp and Paper

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes construction, metal and mining, cement production, power generation, automotive, chemical production, oil and gas, textile manufacturing, food processing, agriculture, pulp and paper, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets, including demand trends by product type, base oil, and end-use industry. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Lubricants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hydraulic Fluid, Metal Working Fluid, Gear Oil, Grease, Others |

| Base Oils Covered | Mineral Oil, Synthetic Oil, Bio-based Oil |

| End-Use Industries Covered | Construction, Metal and Mining, Cement Production, Power Generation, Automotive, Chemical Production, Oil and Gas, Textile Manufacturing, Food Processing, Agriculture, Pulp and Paper, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial lubricants market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial lubricants market on the basis of product type?

- What is the breakup of the Mexico industrial lubricants market on the basis of base oil?

- What is the breakup of the Mexico industrial lubricants market on the basis of end-use industry?

- What is the breakup of the Mexico industrial lubricants market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial lubricants market?

- What are the key driving factors and challenges in the Mexico industrial lubricants market?

- What is the structure of the Mexico industrial lubricants market and who are the key players?

- What is the degree of competition in the Mexico industrial lubricants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial lubricants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial lubricants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)