Mexico Industrial Robotics for Assembly Lines Market Size, Share, Trends and Forecast by Robot Type, Payload Capacity, Application, End-Use, and Region, 2025-2033

Mexico Industrial Robotics for Assembly Lines Market Overview:

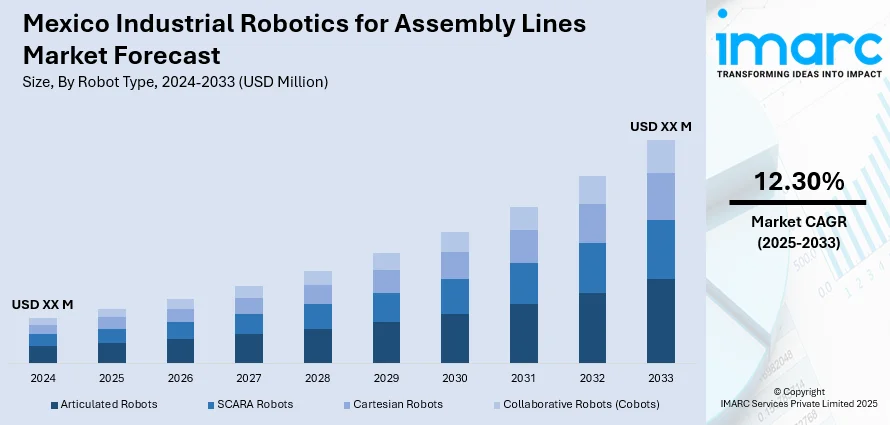

The Mexico industrial robotics for assembly lines market size is projected to exhibit a growth rate (CAGR) of 12.30% during 2025-2033. The market is expanding due to rising automation in manufacturing and increasing adoption of Industry 4.0 technologies. Moreover, strong investment in automotive and electronics sectors continues to support Mexico industrial robotics for assembly lines market share across key industrial regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 12.30% |

Mexico Industrial Robotics for Assembly Lines Market Trends:

Rising Demand for Automation in Mexico

The growing need for automation is a major driver for Mexico industrial robotics for assembly lines market growth. As companies seek ways to increase efficiency, enhance accuracy, and reduce operating costs, the use of robotics has become increasingly crucial. Robotics for assembly lines has been shown to substantially minimize human error, enhance speed of production, and allow for handling of intricate tasks with high consistency. In November 2024, Safran Aircraft Engines made a huge leap by expanding its operations in Querétaro, Mexico, by opening a new assembly line for CFM LEAP engines. The expansion prompted the need to increase the use of sophisticated robotic solutions in assembly lines to cope with growing production demands. The new line incorporated automation technologies, which increased assembly process efficiency, allowing for greater throughput and accuracy in engine assembly. Automation also serves a vital purpose in achieving global quality standards and regulatory safety standards. As Safran expanded, it was evident that robotics was revolutionizing conventional production techniques. The greater use of robotics not only increases productivity but also enhances the competitiveness of Mexican production globally. This growth spurs additional investment in automation technologies, contributing to further Mexico's position as the industrial robotics leader

To get more information on this market, Request Sample

Technological Advancements in Electric Mobility Manufacturing

The transition towards electric mobility is fueling technological advancements in Mexico's manufacturing sector, particularly in the industrial robotics for assembly lines market. As the automotive industry embraces electric and hybrid vehicles, the need for more advanced, efficient, and sustainable production processes has become critical. Robotics plays a central role in this transformation by enabling manufacturers to meet the rising demand for electric vehicle components while reducing production time and costs. In December 2024, Airtificial secured a Euro 9 Million contract to design and deliver an advanced robotic assembly line for electric vehicle compressors. This line incorporated cutting-edge robotic arms, artificial vision systems, and induction technology, optimizing the assembly of eCompressors, a crucial component in electric vehicle cooling systems. This technology significantly enhances the speed, precision, and flexibility of the manufacturing process. As the electric vehicle market grows, so does the need for high-tech robotic solutions that can handle the complex requirements of these components. Airtificial’s contract is a clear example of how electric mobility is driving innovation in robotics, pushing the boundaries of what industrial robots can achieve. This development in Mexico reflects a broader trend towards automation in industries focused on sustainability and energy efficiency, positioning the country as a key player in the future of global manufacturing.

Mexico Industrial Robotics for Assembly Lines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on robot type, payload capacity, application, and end-use.

Robot Type Insights:

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Collaborative Robots (Cobots)

The report has provided a detailed breakup and analysis of the market based on the robot type. This includes articulated robots, SCARA robots, cartesian robots, and collaborative robots (Cobots).

Payload Capacity Insights:

- Up to 5 Kg

- 5 to 10 Kg

- 10 to 20 Kg

- Above 20 Kg

The report has provided a detailed breakup and analysis of the market based on the payload capacity. This includes Up to 5 Kg, 5 to 10 Kg, 10 to 20 Kg, and above 20 Kg.

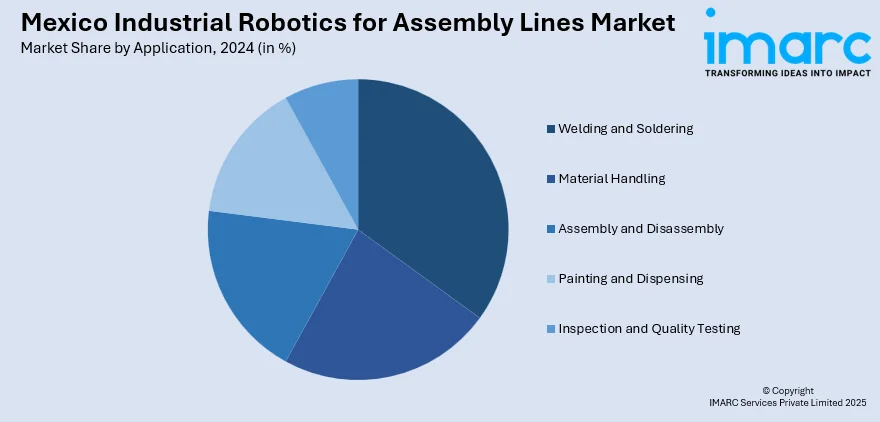

Application Insights:

- Welding and Soldering

- Material Handling

- Assembly and Disassembly

- Painting and Dispensing

- Inspection and Quality Testing

The report has provided a detailed breakup and analysis of the market based on the application. This includes welding and soldering, material handling, assembly and disassembly, painting and dispensing, and inspection and quality testing.

End-Use Insights:

- Automotive

- Electronics and Semiconductor

- Metal and Machinery

- Plastics and Chemicals

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes automotive, electronics and semiconductor, metal and machinery, plastics and chemicals, food and beverage, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Robotics for Assembly Lines Market News:

- April 2025: FANUC showcased advanced robotics and automation solutions at Automate 2025, featuring collaborative robots, autonomous mobile robots, and precision technologies. This demonstration highlighted the growing demand for industrial robotics in assembly lines, boosting automation efficiency and expanding market opportunities in Mexico's manufacturing sector.

- March 2025: ENGEL expanded its production capabilities by opening a new plant in Querétaro, Mexico. This strategic investment in local manufacturing aimed to meet rising demand for injection molding machines, indirectly impacting the Industrial Robotics for Assembly Lines market by increasing automation needs and enhancing production efficiency in the region.

Mexico Industrial Robotics for Assembly Lines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Robot Types Covered | Articulated Robots, SCARA Robots, Cartesian Robots, Collaborative Robots (Cobots) |

| Payload Capacities Covered | Up to 5 Kg, 5 to 10Kg, 10 to 20 Kg, Above 20 Kg |

| Applications Covered | Welding and Soldering, Material Handling, Assembly and Disassembly, Painting and Dispensing, Inspection and Quality Testing |

| End-Use Covered | Automotive, Electronics and Semiconductor, Metal and Machinery, Plastics and Chemicals, Food and Beverage, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial robotics for assembly lines market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial robotics for assembly lines market on the basis of robot types?

- What is the breakup of the Mexico industrial robotics for assembly lines market on the basis of payload capacity?

- What is the breakup of the Mexico industrial robotics for assembly lines market on the basis of application?

- What is the breakup of the Mexico industrial robotics for assembly lines market on the basis of end-use?

- What is the breakup of the Mexico industrial robotics for assembly lines market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial robotics for assembly lines market?

- What are the key driving factors and challenges in the Mexico industrial robotics for assembly lines market?

- What is the structure of the Mexico industrial robotics for assembly lines market and who are the key players?

- What is the degree of competition in the Mexico industrial robotics for assembly lines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial robotics for assembly lines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial robotics for assembly lines market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial robotics for assembly lines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)