Mexico Industrial Robotics Market Size, Share, Trends and Forecast by Type, Function, End Use Industry, and Region, 2025-2033

Mexico Industrial Robotics Market Overview:

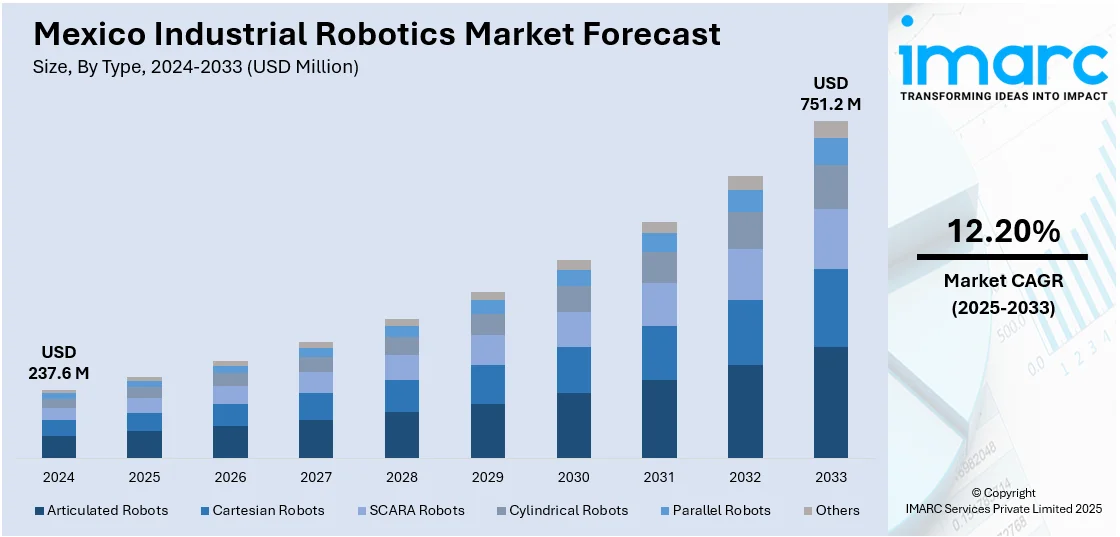

The Mexico industrial robotics market size reached USD 237.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 751.2 Million by 2033, exhibiting a growth rate (CAGR) of 12.20% during 2025-2033. The rising manufacturing automation, growing demand for precision and efficiency, increasing investments in automotive and electronics sectors, supportive government initiatives, adoption of Industry 4.0 technologies, labor cost optimization, and the need to enhance production scalability are driving the growth of the market in Mexico.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 237.6 Million |

| Market Forecast in 2033 | USD 751.2 Million |

| Market Growth Rate 2025-2033 | 12.20% |

Mexico Industrial Robotics Market Trends:

Growing Adoption of Industry 4.0 and Smart Manufacturing Practices

The growing transition toward Industry 4.0 in Mexico is reshaping industrial production by integrating intelligent robotics with digital infrastructure, which is creating a positive Mexico industry robotics market outlookAccording to industry reports, Mexico hosted over 600,000 establishments linked to the manufacturing sector by the end of 2023, underscoring the scale of opportunity for advanced automation solutions. Additionally, companies across sectors such as food processing, electronics, aerospace, and metal fabrication are investing in cyber-physical systems, cloud connectivity, and real-time monitoring through IoT-enabled robotic solutions. These developments support predictive maintenance, adaptive production schedules, and energy-efficient workflows. In facilities where production customization and batch variability are high, flexible robotics systems are becoming essential for rapid reconfiguration. Also, key industrial clusters in Baja California, Nuevo León, and Guanajuato are witnessing expanded pilot projects focused on digital twins, remote diagnostics, and robotic cells connected through centralized control systems. The Mexican government and private sector are also encouraging local innovation and SME participation through funding for automation upgrades. Besides this, the influx of multinational robotics manufacturers and integrators is helping disseminate technical know-how and expand access to simulation software and advanced control platforms. These developments are reinforcing the shift from isolated robotic units to integrated, networked automation ecosystems in the Mexican industry. These factors are also collectively augmenting Mexico industrial robotics market share.

Surge in Automotive Sector Automation

Mexico’s automotive industry emerges as a critical driver for industrial robotics deployment, particularly across assembly lines and welding operations. According to industry reports, Mexico vehicle exports rose by 5.4% in 2024, totaling 3,479,086 units, with the United States accounting for 79.7% (2,771,287 units) of the shipments. This strong export performance is reinforcing Mexico’s appeal as a vehicle manufacturing hub, prompting original equipment manufacturers (OEMs) to expand their use of industrial robotics. To maintain high output volumes and meet strict quality benchmarks required by international markets, OEMs are increasingly investing in robotic systems for welding, assembly, painting, and inspection tasks. Furthermore, the country hosts facilities for global automotive giants such as General Motors, Volkswagen, Nissan, and BMW, many of which are adopting collaborative robots (cobots) to streamline repetitive and precision-intensive tasks. Moreover, the emphasis on minimizing defects and aligning with international quality benchmarks is increasing reliance on machine vision-enabled robotic arms, which is providing an impetus to Mexico industrial robotics market growth. s supply chains demand more agile and scalable production capabilities, automation with robotics allows manufacturers to meet volume fluctuations without expanding the human workforce. This industrial shift is also accelerating the demand for trained robotics operators and maintenance technicians in regional talent development programs.

Mexico Industrial Robotics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, function, and end use industry.

Type Insights:

- Articulated Robots

- Cartesian Robots

- SCARA Robots

- Cylindrical Robots

- Parallel Robots

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes articulated robots, cartesian robots, SCARA robots, cylindrical robots, parallel robots, and others.

Function Insights:

- Soldering and Welding

- Materials Handling

- Assembling and Disassembling

- Painting and Dispensing

- Milling, Cutting and Processing

- Others

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes soldering and welding, materials handling, assembling and disassembling, painting and dispensing, milling, cutting and processing, and others.

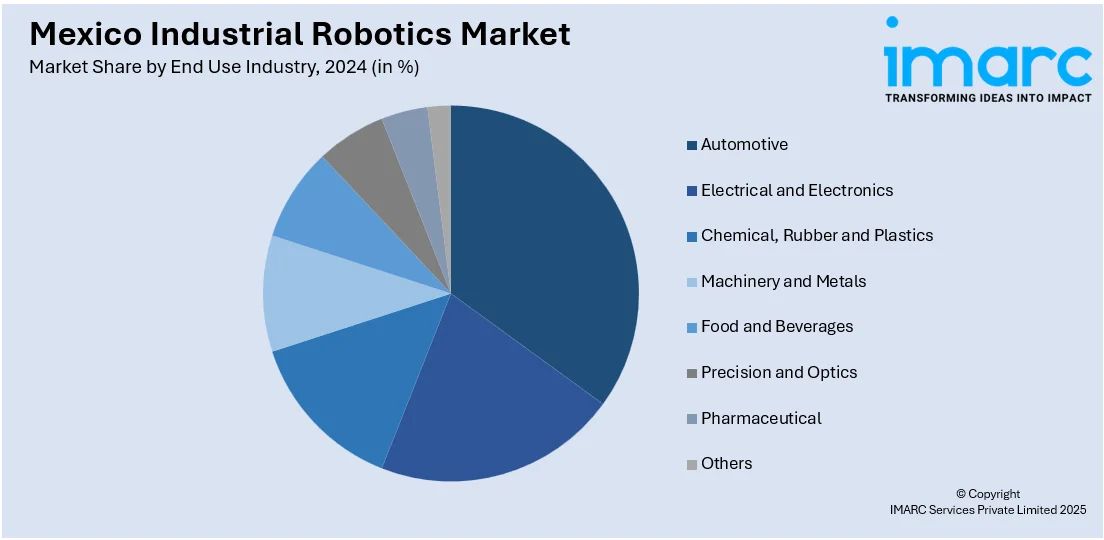

End Use Industry Insights:

- Automotive

- Electrical and Electronics

- Chemical, Rubber and Plastics

- Machinery and Metals

- Food and Beverages

- Precision and Optics

- Pharmaceutical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electrical and electronics, chemical, rubber and plastics, machinery and metals, food and beverages, precision and optics, pharmaceutical, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Industrial Robotics Market News:

- On August 21, 2024, Foxconn announced the development of a digital twin for its new factory in Guadalajara, Mexico, aiming to enhance industrial automation and efficiency. The virtual factory enables engineers to simulate assembly lines and train AI-driven robots, utilizing Siemens Xcelerator software and NVIDIA Omniverse. The firm anticipates over 30% annual energy savings and significant cost reductions. This initiative positions Foxconn at the forefront of integrating digital twin technology to optimize manufacturing processes and drive industrial efficiencies

Mexico Industrial Robotics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Articulated Robots, Cartesian Robots, SCARA Robots, Cylindrical Robots, Parallel Robots, Others |

| Functions Covered | Soldering and Welding, Materials Handling, Assembling and Disassembling, Painting and Dispensing, Milling, Cutting and Processing, Others |

| End Use Industries Covered | Automotive, Electrical and Electronics, Chemical, Rubber and Plastics, Machinery and Metals, Food and Beverages, Precision and Optics, Pharmaceutical, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico industrial robotics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico industrial robotics market on the basis of type?

- What is the breakup of the Mexico industrial robotics market on the basis of function?

- What is the breakup of the Mexico industrial robotics market on the basis of end use industry?

- What is the breakup of the Mexico industrial robotics market on the basis of region?

- What are the various stages in the value chain of the Mexico industrial robotics market?

- What are the key driving factors and challenges in the Mexico industrial robotics market?

- What is the structure of the Mexico industrial robotics market and who are the key players?

- What is the degree of competition in the Mexico industrial robotics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico industrial robotics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico industrial robotics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico industrial robotics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)