Mexico Inland Cargo Shipping Market Size, Share, Trends and Forecast by Cargo Type, Mode of Transport, Service Type, End-Use Industry, and Region, 2025-2033

Mexico Inland Cargo Shipping Market Overview:

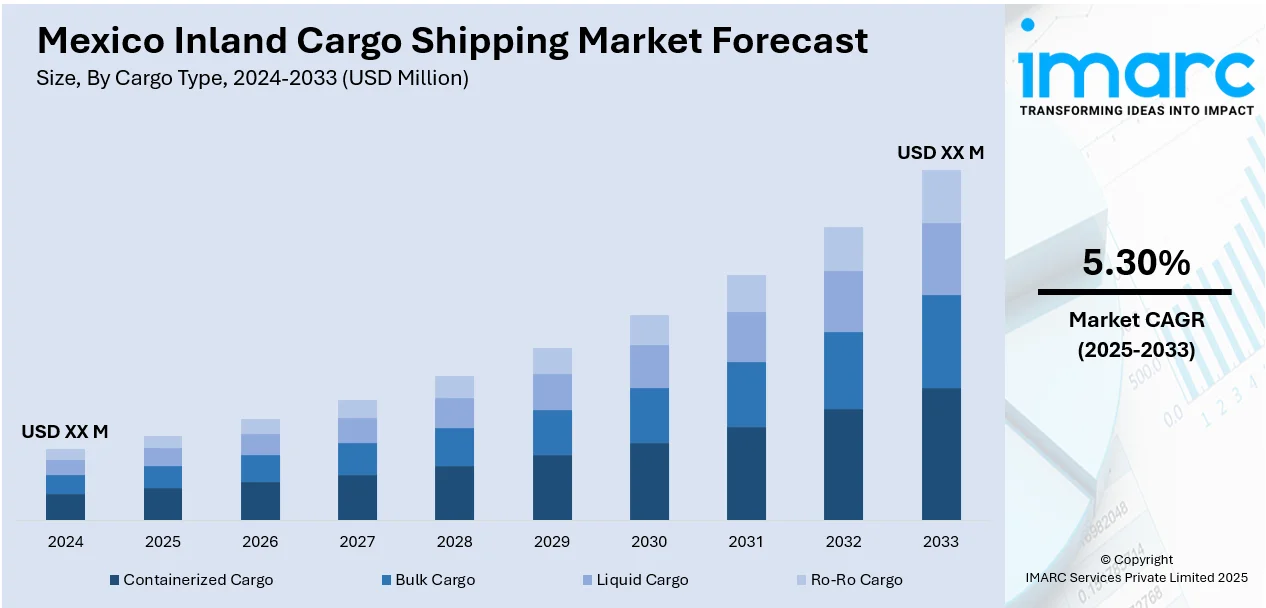

The Mexico inland cargo shipping market size is projected to exhibit a growth rate (CAGR) of 5.30% during 2025-2033. E-commerce growth and shifting client expectations are encouraging businesses to adopt faster, tech-driven inland shipping solutions across Mexico. Furthermore, the rise of intermodal transport, which combines road, rail, and sea, is improving reliability, reducing delays, and enhancing flexibility in logistics networks. These developments are playing a key role in expanding the Mexico inland cargo shipping market share across both domestic and cross-border trade routes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.30% |

Mexico Inland Cargo Shipping Market Trends:

Growth in E-Commerce and Retail Demand

The swift expansion of e-commerce in Mexico is transforming the inland freight shipping industry. The e-commerce market is expected to be worth USD 47.5 billion in 2024 and is forecasted to attain USD 176.6 billion by 2033, growing at a CAGR of 14.5%, while logistics needs are increasing rapidly as well. Retailers, both e-commerce sites and physical stores, face demands to expedite product movement more effectively throughout a geographically varied nation. Inland cargo networks are establishing themselves as the core of distribution, particularly in high-demand regions, such as Mexico City, Guadalajara, and Monterrey. The growth of last-mile delivery services is catalyzing the demand for accurate and timely transportation. With individual demands increasingly leaning towards quicker delivery times and immediate order tracking, companies are depending on inland shipping to stay on schedule. This change involves more than just volume but also encourages logistics companies to implement more advanced technologies, enhance routing efficiency, and invest in infrastructure capable of handling higher traffic and more regular shipments. Inland cargo shipping is transitioning from a supportive role to an essential component of achieving client satisfaction goals, reducing delivery durations, and sustaining competitive rates.

To get more information on this market, Request Sample

Increase in Intermodal Integration

The rising incorporation of intermodal transport systems is a crucial factor impelling the Mexico inland cargo shipping market growth. Companies are developing more flexible, efficient, and scalable shipping systems by integrating road, rail, and sea freight. This change is particularly significant for international logistics, as congestion, delays, and inefficiencies in one-mode transport can disrupt delivery timelines and increase expenses. Intermodal systems enable the real-time rerouting or adjustment of cargo based on traffic conditions, rail accessibility, or port congestion. It also provides redundancy, so if one method encounters issues, another can compensate without jeopardizing the supply chain. Logistics companies and shippers gain advantages by customizing their routes for speed, cost, or dependability based on the type of cargo and its destination. Connecting ports with inland rail and highway networks enhances asset utilization and minimizes downtime. The increasing use of intermodal shipping is transforming the movement of cargo throughout Mexico and into international markets, providing a more reliable option than relying solely on long-haul trucking. In line with this trend, in 2025, Crowley announced the launch of its Mexico Gulf Express service, starting May 16, to streamline cargo movement between Mexico, the US Midwest, and Canada. The service combines a 3-day ocean route from Tuxpan, Veracruz to Gulfport, Mississippi, with inland rail via Canadian National Railway. This intermodal solution aims to reduce congestion and improve speed, reliability, and sustainability in cross-border logistics.

Mexico Inland Cargo Shipping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on cargo type, mode of transport, service type, and end-use industry.

Cargo Type Insights:

- Containerized Cargo

- Bulk Cargo

- Liquid Cargo

- Ro-Ro Cargo

The report has provided a detailed breakup and analysis of the market based on the cargo type. This includes containerized cargo, bulk cargo, liquid cargo, and ro-ro cargo.

Mode of Transport Insights:

- Inland Waterways

- Coastal Shipping

- Transoceanic Shipping

A detailed breakup and analysis of the market based on the mode of transport have also been provided in the report. This includes inland waterways, coastal shipping, and transoceanic shipping.

Service Type Insights:

- Freight Forwarding

- Warehousing and Distribution

- Customs Brokerage

The report has provided a detailed breakup and analysis of the market based on the service type. This includes freight forwarding, warehousing and distribution, and customs brokerage.

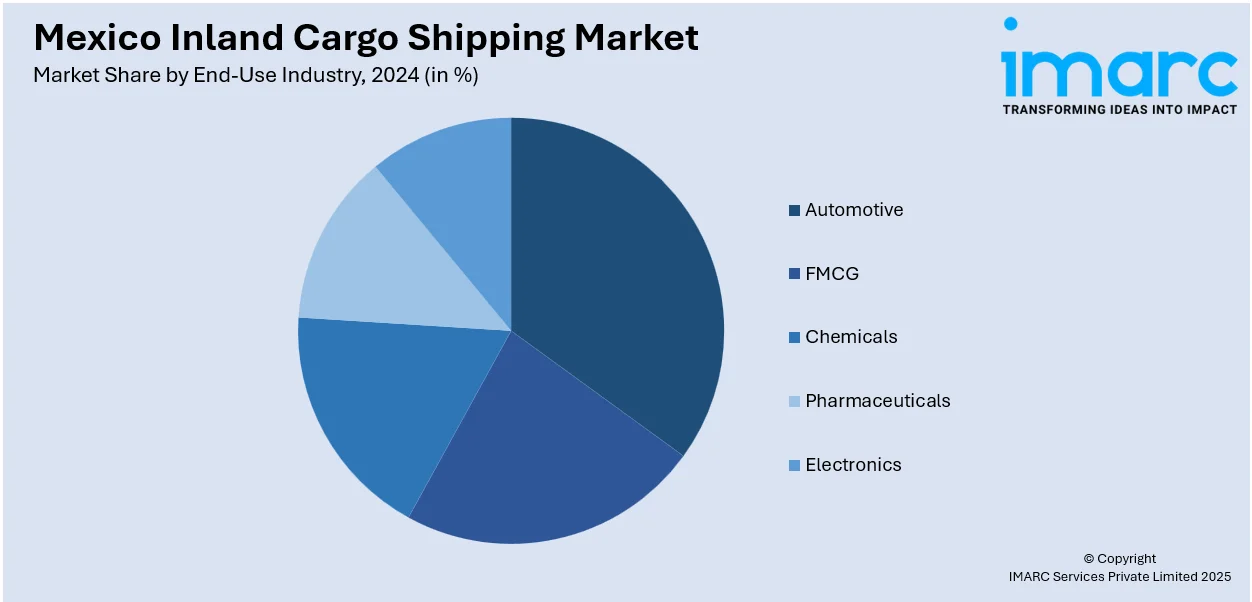

End-Use Industry Insights:

- Automotive

- FMCG

- Chemicals

- Pharmaceuticals

- Electronics

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes automotive, FMCG, chemicals, pharmaceuticals, and electronics.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Inland Cargo Shipping Market News:

- In February 2025, Mexican freight company Transportes Marva announced a pilot project using 120 electric semi-trailers on the Monterrey–Nuevo Laredo route. Operated by its subsidiary BY Deléctrico, the project aims to reduce CO₂ emissions and improve logistics in the Texas-Monterrey corridor.

- In November 2024, Mexican President Gloria Sheinbaum announced plans to expand Progreso Port on the Yucatan Peninsula, including deepening and widening the shipping channel to accommodate larger vessels. The expansion improved inland connectivity by linking the port to the new Maya Train railway, boosting its role in Mexico’s international logistics. This project aimed to ease congestion and support the region’s manufacturing and textile industries.

Mexico Inland Cargo Shipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cargo Types Covered | Containerized Cargo, Bulk Cargo, Liquid Cargo, Ro-Ro Cargo |

| Mode of Transports Covered | Inland Waterways, Coastal Shipping, Transoceanic Shipping |

| Service Types Covered | Freight Forwarding, Warehousing and Distribution, Customs Brokerage |

| End-Use Industries Covered | Automotive, FMCG, Chemicals, Pharmaceuticals, Electronics |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico inland cargo shipping market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico inland cargo shipping market on the basis of cargo type?

- What is the breakup of the Mexico inland cargo shipping market on the basis of mode of transport?

- What is the breakup of the Mexico inland cargo shipping market on the basis of service type?

- What is the breakup of the Mexico inland cargo shipping market on the basis of end-use industry?

- What is the breakup of the Mexico inland cargo shipping market on the basis of region?

- What are the various stages in the value chain of the Mexico inland cargo shipping market?

- What are the key driving factors and challenges in the Mexico inland cargo shipping market?

- What is the structure of the Mexico inland cargo shipping market and who are the key players?

- What is the degree of competition in the Mexico inland cargo shipping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico inland cargo shipping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico inland cargo shipping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico inland cargo shipping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)