Mexico Insulation Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Insulation Materials Market Overview:

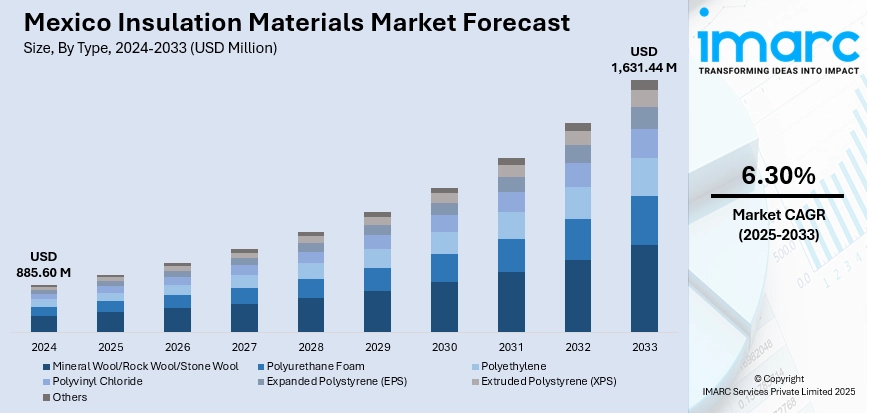

The Mexico insulation materials market size reached USD 885.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,631.44 Million by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is expanding driven by increasing construction activities and rising energy efficiency regulations. At the same time, growing awareness of sustainable building practices and demand for thermal and acoustic insulation solutions are key trends boosting Mexico insulation materials market share across residential and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 885.60 Million |

| Market Forecast in 2033 | USD 1,631.44 Million |

| Market Growth Rate 2025-2033 | 6.30% |

Mexico Insulation Materials Market Trends:

Expansion through Strategic Acquisitions

The market has experienced notable growth driven by strategic acquisitions, which have allowed companies to broaden their product offerings and strengthen their foothold in the competitive regional landscape. Moreover, these benefits enable companies to deliver comprehensive solutions more efficiently, thereby increasing their market share. Aligned with this trend, in September 2024, Krempel, a global manufacturer of electrical insulation materials, completed the acquisition of EIC Insulation Company, a Mexican-based company. This move significantly expanded Krempel’s presence in the Americas, particularly in the electrical insulation segment. EIC’s modern production facilities and strategic location near Monterrey enabled Krempel to optimize supply chain operations and logistics, improving delivery speed and reducing costs. Additionally, integrating EIC’s expertise in customized components enhanced Krempel’s product portfolio, allowing it to offer more tailored solutions to customers. The acquisition demonstrated a clear commitment to meeting the growing regional demand for high-quality insulation products driven by developments in the industrial and energy sectors. Krempel positioned itself for accelerated growth within the Mexico insulation materials market by leveraging these synergies. This strategic expansion has strengthened Krempel’s competitive edge, contributing positively to the overall development and modernization of the insulation materials sector in Mexico and across the Americas.

To get more information on this market, Request Sample

Investment in Manufacturing Capacity

Investment in advanced manufacturing facilities has become a pivotal driver for the Mexico insulation materials market growth, as companies seek to improve product quality, increase capacity, and foster innovation. In addition, such investments not only enhance operational efficiency but also enable firms to respond swiftly to evolving industry demands and stricter environmental regulations. In March 2025, Weidmann, a global leader in electrical insulation, inaugurated a new 30,000 m² production plant in Saltillo, Mexico. The state-of-the-art facility was designed with cutting-edge technology and sustainable manufacturing practices to serve customers across the Americas. Furthermore, this expansion significantly enhanced Weidmann’s manufacturing capabilities, enabling it to meet the increasing demand for electrical insulation products driven by growth in sectors such as energy, transportation, and infrastructure. The new plant also supports research and development efforts, promoting innovation in insulation materials that improve performance and durability. Along with this, Weidmann improved supply chain resilience and reduced lead times for regional customers by enhancing local production. This move reinforced the company’s commitment to maintaining high-quality standards while expanding its market presence.

Mexico Insulation Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Mineral Wool/Rock Wool/Stone Wool

- Polyurethane Foam

- Polyethylene

- Polyvinyl Chloride

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes mineral wool/rock wool/stone wool, polyurethane foam, polyethylene, polyvinyl chloride, expanded polystyrene (EPS), extruded polystyrene (XPS), and others.

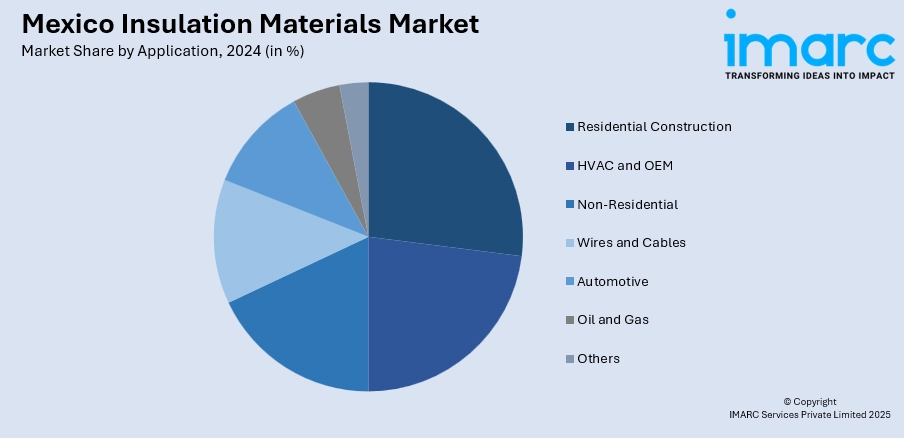

Application Insights:

- Residential Construction

- HVAC and OEM

- Non-Residential

- Wires and Cables

- Automotive

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential construction, HVAC and OEM, non-residential, wires and cables, automotive, oil and gas, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Insulation Materials Market News:

- March 2025: Weidmann inaugurated a new 30,000 m² plant in Saltillo, Mexico, enhancing its electrical insulation materials production. This facility boosted manufacturing capacity and innovation capabilities, strengthening Weidmann’s market presence and supporting growing demand across the insulation materials market.

- July 2024: Arkema expanded its sustainable insulation materials portfolio in Mexico by leveraging its Queretaro manufacturing site. This move enhanced local production of eco-friendly coatings and resins, boosting the insulation materials market by supporting energy-efficient, durable, and low-carbon building solutions.

Mexico Insulation Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mineral Wool/Rock Wool/Stone Wool, Polyurethane Foam, Polyethylene, Polyvinyl Chloride, Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Others |

| Applications Covered | Residential Construction, HVAC and OEM, Non-Residential, Wires and Cables, Automotive, Oil and Gas, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico insulation materials market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico insulation materials market on the basis of type?

- What is the breakup of the Mexico insulation materials market on the basis of application?

- What is the breakup of the Mexico insulation materials market on the basis of region?

- What are the various stages in the value chain of the Mexico insulation materials market?

- What are the key driving factors and challenges in the Mexico insulation materials market?

- What is the structure of the Mexico insulation materials market and who are the key players?

- What is the degree of competition in the Mexico insulation materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico insulation materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico insulation materials market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico insulation materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)