Mexico Insulin Pumps Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Insulin Pumps Market Overview:

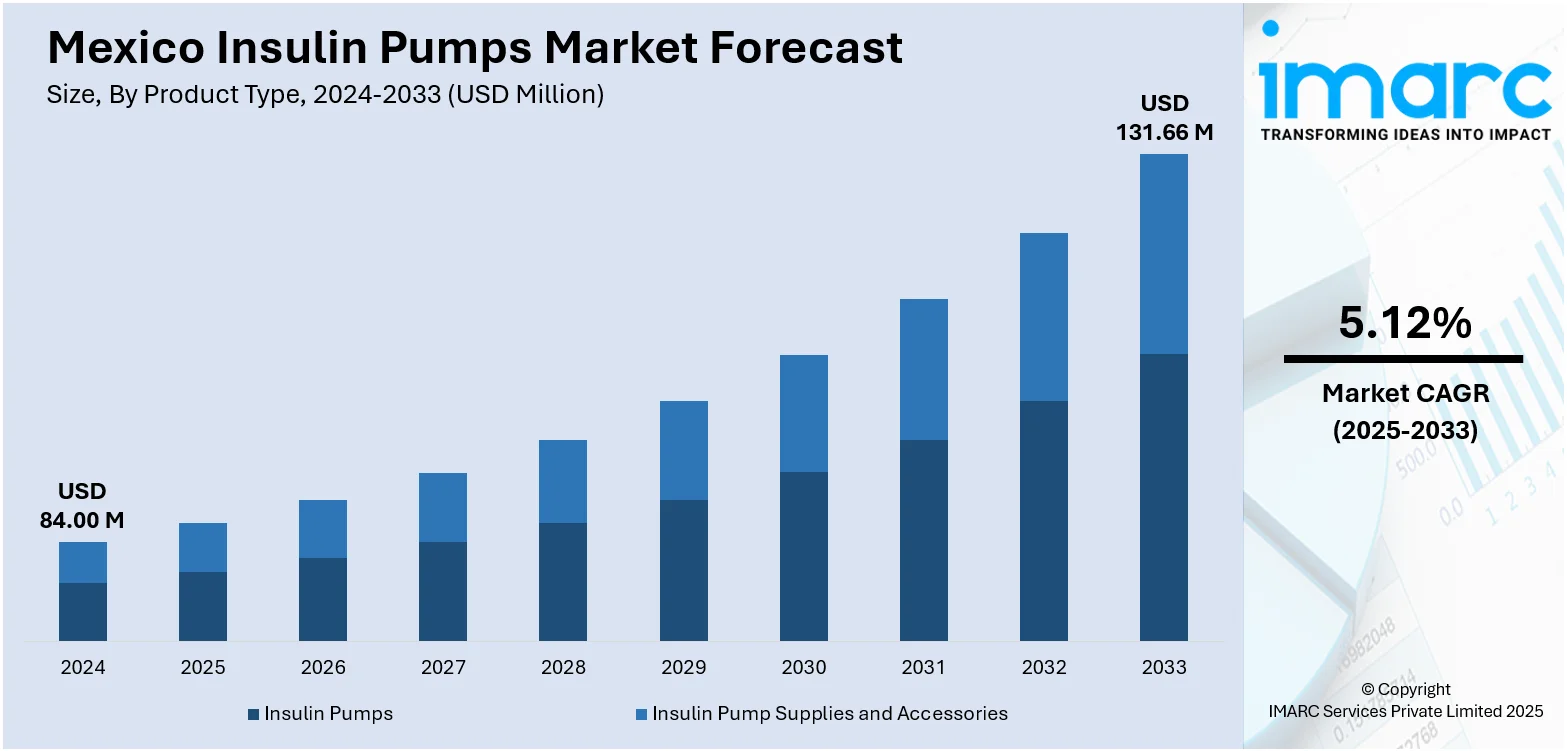

The Mexico insulin pumps market size reached USD 84.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 131.66 Million by 2033, exhibiting a growth rate (CAGR) of 5.12% during 2025-2033. The high and rising diabetes prevalence across Mexico, ongoing technological advancements in closed-loop and continuous glucose monitoring (CGM)-integrated pumps offering improved glycemic control and patient convenience, and favorable healthcare reforms are among the key factors contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 84.00 Million |

| Market Forecast in 2033 | USD 131.66 Million |

| Market Growth Rate 2025-2033 | 5.12% |

Mexico Insulin Pumps Market Trends:

Rise of Patch Pumps and Smart Features

Mexico’s insulin pumps market is expanding with the rise of ultra-compact patch pumps and smart, interconnected systems that combine CGM, Bluetooth-enabled smartphone apps, and data-driven insulin delivery algorithms. These innovations provide discreet, tubing-free infusion and real-time glycemic insights, boosting time-in-range and minimizing hypoglycemia, while manufacturers invest heavily in next-generation closed-loop controls and interoperable platforms for seamless integration with telehealth services and electronic health records. For instance, in November 2024, Medtronic introduced its Smart MDI system in Mexico, combining the InPen app and Simplera CGM to provide real-time, tailored insulin dosing guidance and missed dose detection functionality. This convergence of hardware, software, and therapeutics is forging new partnerships among device makers, app developers, and healthcare providers, expanding offerings from basic basal-only patch pumps to hybrid closed-loop systems and driving sustained growth across Mexico’s dynamic market.

To get more information on this market, Request Sample

High Diabetes Prevalence and Underserved Patient Population

Mexico faces one of the world’s highest diabetes burdens. Approximately 16.4% of Mexico’s adult population had diabetes in 2024. Nearly 47.5% of these cases remain undiagnosed, underscoring significant unmet needs for advanced management solutions. This expansive patient base, coupled with rising healthcare awareness and patient advocacy efforts, is fueling insulin pump adoption as users seek superior glycemic control and reduced injection burdens. Urbanization, lifestyle shifts, and increasing obesity rates exacerbate demand, prompting public and private payers to expand coverage for insulin delivery devices. Diabetes associations are also running education campaigns that highlight the clinical benefits of pump therapy, such as HbA₁c reductions of 0.5–1.0%, which further encourage uptake. As awareness grows and diagnosis rates improve, the conversion of newly identified patients to pump therapy will sustain double-digit growth in the Mexican insulin pump market over the coming decade.

Mexico Insulin Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Insulin Pumps

- Tethered Pumps

- Disposable/Patch Insulin Pumps

- Insulin Pump Supplies and Accessories

- Infusion Set Insertion Devices

- Insulin Reservoirs/Cartridges

The report has provided a detailed breakup and analysis of the market based on the product type. This includes insulin pumps (tethered pumps and disposable/patch insulin pumps) and insulin pump supplies and accessories (infusion set insertion devices and insulin reservoirs/cartridges).

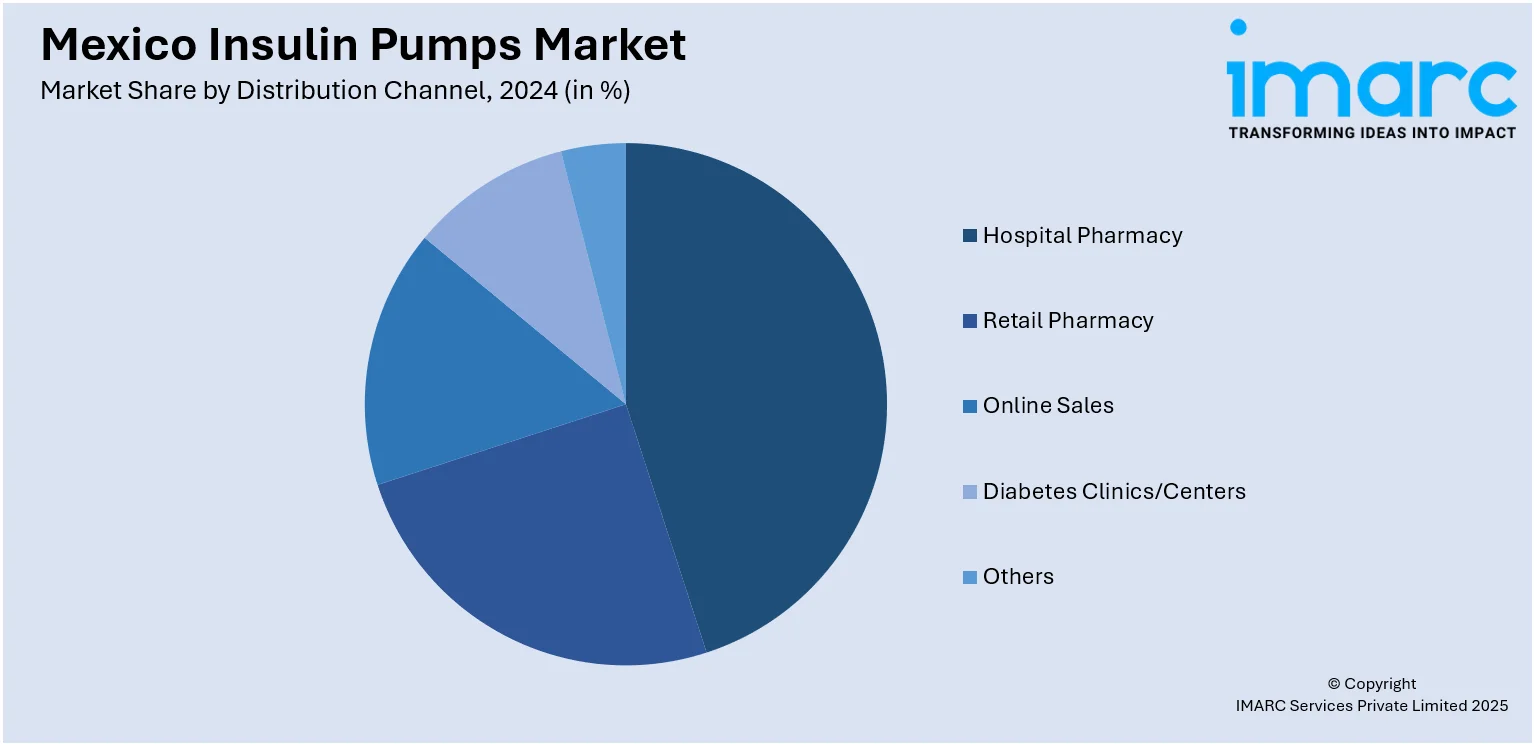

Distribution Channel Insights:

- Hospital Pharmacy

- Retail Pharmacy

- Online Sales

- Diabetes Clinics/Centers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacy, retail pharmacy, online sales, diabetes clinics/centers, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Insulin Pumps Market News:

- August 2024: Modular Medical, an insulin delivery system company, began shifting its MODD1 insulin pump’s pilot manufacturing to Phillips Medisize facilities in Queretaro, Mexico, with PCB assembly in Guadalajara. This strategic move supports their transition to high-volume production while awaiting FDA 510(k) clearance.

- April 2024: Cofepris authorized a new micro-infusion pump for continuous insulin administration in patients with type 1 diabetes. This innovative insulin pump improves glucose monitoring and metabolic control, enhancing treatment and quality of life for users in Mexico.

- May 2023: Convatec partnered with Beta Bionics to support the upcoming launch of the iLet Bionic Pancreas, an automated insulin pump that autonomously calculates 100% of insulin doses using continuous glucose monitoring and weight-based initialization. The infusion sets, essential to this insulin pump, will be manufactured at Convatec’s Mexico production sites.

Mexico Insulin Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Sales, Diabetes Clinics/ Centers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico insulin pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico insulin pumps market on the basis of product type?

- What is the breakup of the Mexico insulin pumps market on the basis of distribution channel?

- What is the breakup of the Mexico insulin pumps market on the basis of region?

- What are the various stages in the value chain of the Mexico insulin pumps market?

- What are the key driving factors and challenges in the Mexico insulin pumps market?

- What is the structure of the Mexico insulin pumps market and who are the key players?

- What is the degree of competition in the Mexico insulin pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico insulin pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico insulin pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico insulin pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)