Mexico Interactive Kiosk Market Size, Share, Trends and Forecast by Component, Type, Mounting Type, Panel Size, Location, Industry Vertical, and Region, 2026-2034

Mexico Interactive Kiosk Market Summary:

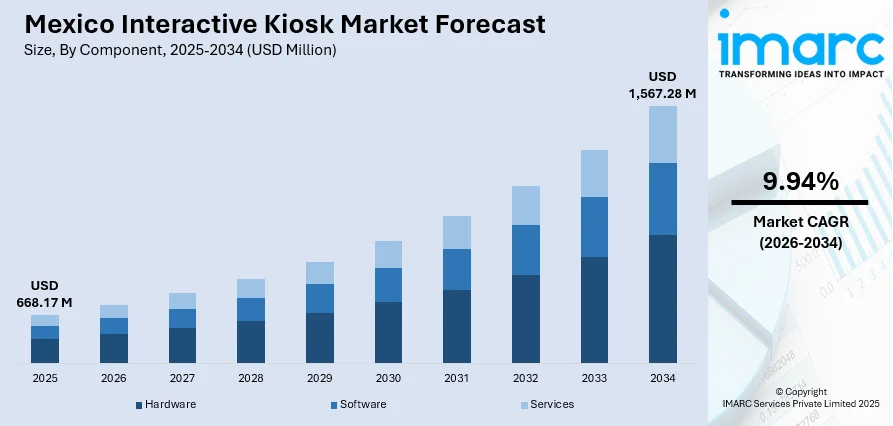

The Mexico interactive kiosk market size was valued at USD 668.17 Million in 2025 and is projected to reach USD 1,567.28 Million by 2034, growing at a compound annual growth rate of 9.94% from 2026-2034.

The Mexican interactive kiosk market is growing rapidly owing to the overall increased digitization in various industries. The adoption of self-service technology is on the rise as organizations realize the importance of customer engagement and labor-saving. The rise of touch-enabled kiosk interfaces in business organizations such as shopping malls, banks, medical facilities, and transport stations is just an indicator of the growing interest in automation and convenient service delivery. The growing focus on digitization and internet connectivity and the growing demands of the population are majorly contributing to the growing interest in the technology.

Key Takeaways and Insights:

-

By Component: Hardware dominates the market with a share of 54% in 2025, driven by the essential role of touchscreens, payment terminals, and physical enclosures in kiosk deployments across retail and banking sectors.

-

By Type: Self-service kiosks lead the market with a share of 44% in 2025, owing to their versatility in handling transactions, check-ins, and information queries without human intervention.

-

By Mounting Type: Floor standing kiosks represent the largest segment with a market share of 71% in 2025, attributed to their visibility, accessibility, and suitability for high-traffic environments.

-

By Panel Size: The 17" - 32" segment dominates with a 57% share in 2025, reflecting optimal screen dimensions for user interaction and space efficiency.

-

By Location: Indoor lead the market with a share of 72% in 2025, supported by controlled environments in shopping malls, hospitals, and airports.

-

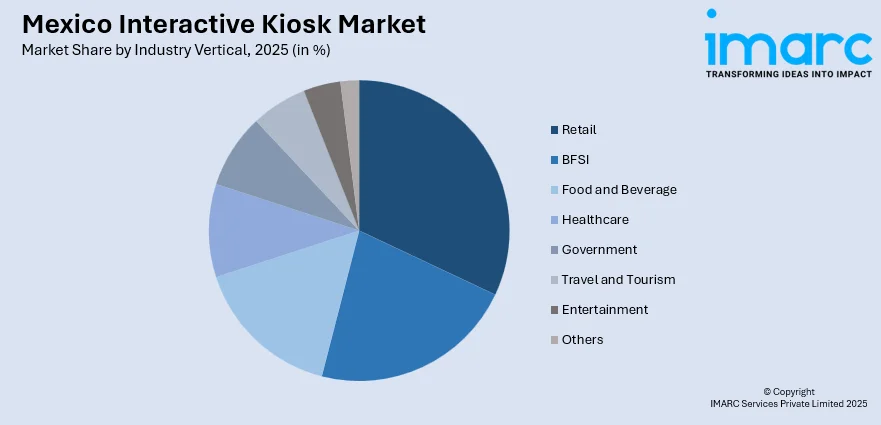

By Industry Vertical: Retail dominated with a 26% market share in 2025, propelled by growing self-checkout adoption and customer engagement initiatives.

-

By Region: Central Mexico leads the market with a share of 44% in 2025, concentrated around Mexico City's metropolitan area where retail, banking, and healthcare infrastructure is most developed.

-

Key Players: The Mexico interactive kiosk market exhibits a competitive landscape with established technology providers and emerging regional players vying for market share through innovation in hardware design, software integration, and customization capabilities.

To get more information on this market Request Sample

The Mexico interactive kiosk market is witnessing transformative growth as businesses across retail, banking, healthcare, and transportation sectors prioritize customer convenience and operational efficiency. In 2025, RCI partnered with Smart Touch at AMDETUR to deploy interactive digital kiosks, replacing paper materials with touchscreens to enhance engagement and streamline visitor information delivery. The rising adoption of contactless payment systems and NFC-enabled technologies has accelerated following heightened awareness around hygiene and safety. Mexican enterprises are increasingly integrating multilingual interfaces and user-friendly designs to ensure inclusivity for diverse consumer demographics. The country's strategic position as a nearshoring destination for global manufacturing has spurred investments in digital infrastructure, creating favorable conditions for kiosk deployments in industrial parks and logistics hubs. Additionally, the expansion of e-commerce and omnichannel retail strategies has prompted businesses to deploy kiosks for order pickups, returns processing, and in-store navigation, bridging the gap between digital and physical shopping experiences.

Mexico Interactive Kiosk Market Trends:

Integration of Artificial Intelligence and Personalization

Interactive kiosks in Mexico are increasingly incorporating artificial intelligence capabilities to deliver personalized user experiences. In January 2025, Walmart México announced plans to roll out smart kiosks with AI and machine learning features to enhance customer interactions and personalize shopping, including kiosks that can complement shoppers’ habits and preferences. Machine learning algorithms analyze consumer behavior patterns to offer tailored product recommendations, promotional content, and service options. This trend is particularly prevalent in retail environments where kiosks now function as intelligent shopping assistants, guiding customers through product catalogs and suggesting complementary items based on purchase history and preferences.

Expansion of Contactless and Biometric Technologies

The adoption of contactless interfaces and biometric authentication systems is reshaping kiosk deployments across Mexico. In April 2025, the Mexican federal government approved a national biometric identity document system linked to CURP, using fingerprints, facial images, and iris scans to reduce fraud and influence kiosk-based user authentication. Facial recognition, fingerprint scanning, and QR code-based interactions are replacing traditional touch-based inputs in banking, healthcare, and government service kiosks. This evolution addresses consumer preferences for hygienic, secure, and expedient transactions while enabling institutions to streamline identity verification processes and reduce fraud risks.

Growth of Self-Service Solutions in Quick-Service Restaurants

Quick-service restaurants throughout Mexico are rapidly deploying self-ordering kiosks to manage peak-hour traffic and enhance customer convenience. For example, McDonald’s México is modernizing many restaurants with digital kiosks under its “experience of the future” initiative, integrating automated ordering and payments to streamline service and reduce queues. These systems integrate seamlessly with loyalty programs and digital payment platforms, enabling patrons to customize orders, redeem rewards, and complete transactions independently. The hospitality sector recognizes these deployments as strategic investments that reduce labor costs while improving order accuracy and throughput efficiency.

Market Outlook 2026-2034:

The Mexico interactive kiosk market outlook remains highly favorable as digitalization initiatives continue reshaping consumer-facing industries. Sustained investments in retail modernization, healthcare infrastructure expansion, and smart city projects are expected to drive consistent demand for self-service solutions. The convergence of advanced technologies including cloud computing, real-time analytics, and Internet of Things connectivity will enable more sophisticated kiosk functionalities, supporting applications ranging from telemedicine consultations to automated government services. The market generated a revenue of USD 668.17 Million in 2025 and is projected to reach a revenue of USD 1,567.28 Million by 2034, growing at a compound annual growth rate of 9.94% from 2026-2034.

Mexico Interactive Kiosk Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Hardware | 54% |

| Type | Self-Service Kiosks | 44% |

| Mounting Type | Floor Standing | 71% |

| Panel Size | 17" - 32" | 57% |

| Location | Indoor | 72% |

| Industry Vertical | Retail | 26% |

| Region | Central Mexico | 44% |

Component Insights:

- Hardware

- Software

- Services

The hardware dominates with a market share of 54% of the total Mexico interactive kiosk market in 2025.

The hardware component encompasses touchscreen displays, payment processing terminals, barcode scanners, printers, and enclosure systems that form the physical foundation of interactive kiosk deployments. Mexican businesses are investing in durable, vandal-resistant hardware designed to withstand high-frequency usage in public environments while maintaining aesthetic appeal and ergonomic accessibility for diverse user populations. At the 10th Congress IA, Tecnología y Negocios América Digital México 2025 in Mexico City, payment‑solution leader Ingenico highlighted the shift toward integrated terminals combining contactless, QR, and biometric capabilities, showing kiosks must evolve for secure, seamless transactions.

Technological advancements in display technologies, including capacitive touchscreens and anti-glare coatings, are enhancing user experiences across indoor and outdoor installations. The integration of multiple payment acceptance modules supporting credit cards, contactless payments, and mobile wallets addresses Mexican consumers' evolving transaction preferences, reduces queue times, improves operational efficiency, enables seamless omnichannel interactions, and supports the country's broader financial inclusion objectives while fostering digital adoption and convenience.

Type Insights:

- Bank Kiosks

- Self-Service Kiosks

- Vending Kiosks

- Others

The self-service kiosks leads with a share of 44% of the total Mexico interactive kiosk market in 2025.

Self-service kiosks are transforming customer interactions across retail, hospitality, and government sectors by enabling autonomous transaction completion, information access, and service requests. Major airlines in Mexico, including Volaris, have introduced self‑service baggage check‑in kiosks at airports, enabling travelers to process luggage quickly and independently, enhancing efficiency and passenger experience. Mexican retailers are deploying these systems to facilitate self-checkout processes, reducing queue times and optimizing staff allocation toward value-added customer service activities.

The versatility of self-service kiosks extends across check-in applications at airports, hotels, and healthcare facilities, allowing passengers and patients to register, update records, print documents, and access wayfinding information independently. By streamlining processes, reducing wait times, and improving accuracy, these kiosks enhance overall user experience. With increasing focus on operational efficiency, convenience, and customer empowerment, self-service kiosks are becoming essential infrastructure, supporting Mexico’s rapidly evolving service economy and the broader adoption of digital solutions.

Mounting Type Insights:

- Floor Standing

- Wall Mount

- Others

The floor standing dominates with a market share of 71% of the total Mexico interactive kiosk market in 2025.

Floor standing kiosks offer maximum visibility and accessibility in high-traffic commercial environments including shopping centers, airport terminals, and hospital lobbies. Their freestanding design allows flexible positioning and repositioning to optimize customer flow patterns and promotional visibility without permanent installation requirements. For example, in February 2025, Thor Urbana improved visitor experiences at major Mexican shopping centers, including Marina Puerto Cancún and Landmark GDL, by implementing digital wayfinding with interactive kiosks to help shoppers navigate and discover stores easily.

The structural stability of floor-standing kiosk units allows the integration of larger display panels and multiple peripherals, supporting complex transaction workflows that involve simultaneous payment processing, document printing, and receipt generation. Mexican businesses increasingly favor these robust configurations for their professional appearance, durability, and comprehensive functionality, as they enhance customer interactions, streamline service delivery, and provide a reliable, high-performance solution for high-traffic, customer-facing environments across retail, hospitality, and financial sectors.

Panel Size Insights:

- 17” - 32”

- Above 32”

The 17" - 32" leads with a share of 57% of the total Mexico interactive kiosk market in 2025.

Medium-sized display panels ranging from seventeen to thirty-two inches provide an ideal balance between user visibility, interaction comfort, and space efficiency. These sizes support comprehensive interface designs, including touchscreen navigation, multimedia content, and integrated peripheral displays, while maintaining compact footprints suitable for retail checkout lanes, bank branches, healthcare reception areas, and other customer-facing environments. Their versatility allows businesses to enhance user engagement and operational efficiency without compromising on ergonomics or spatial constraints.

The preference for medium-sized display panels is driven by key ergonomic considerations, including comfortable viewing angles, appropriately sized touch targets for users of all ages and abilities, and compatibility with standard enclosure designs. Mexican deployments consistently adhere to these specifications, valuing their adaptability across a wide range of application scenarios, from retail and banking to healthcare and hospitality, where user comfort, accessibility, and efficient interaction are essential for a seamless self-service experience.

Location Insights:

- Indoor

- Outdoor

The indoor dominates with a market share of 72% of the total Mexico interactive kiosk market in 2025.

Indoor installations predominate due to controlled environmental conditions that protect sensitive electronic components from temperature extremes, humidity, and precipitation common in Mexico's diverse climate zones. Shopping malls, retail stores, healthcare facilities, and transportation terminals provide sheltered environments where kiosks operate reliably. In June 2025, Guanajuato’s government expanded its digital public service network with over 135 electronic kiosks and 2,700 service points, allowing citizens to complete procedures independently and enhancing efficiency and digital engagement.

The concentration of customer traffic within indoor commercial and institutional spaces helps maximize kiosk utilization rates and enhances return on investment. Indoor deployments are further favored for security reasons, as proximity to staff and comprehensive surveillance coverage reduce the risks of vandalism and theft. Additionally, these settings provide a controlled environment where users can receive assistance when needed, ensuring a safer, more efficient, and user-friendly self-service experience.

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Retail

- Food and Beverage

- Healthcare

- Government

- Travel and Tourism

- Entertainment

- Others

The retail leads with a share of 26% of the total Mexico interactive kiosk market in 2025.

The retail sector’s leadership in kiosk adoption reflects the aggressive modernization initiatives undertaken by major Mexican grocery chains and department stores to improve customer experiences and streamline operations. Self-checkout systems, product information kiosks, and loyalty program terminals are increasingly standard fixtures in modern retail environments, enabling faster transactions, personalized interactions, and enhanced convenience. These deployments help retailers differentiate themselves in competitive markets while driving operational efficiency and customer satisfaction.

Retailers view interactive kiosks as strategic tools for optimizing labor costs during peak shopping periods while ensuring consistent service quality. By integrating inventory visibility, real-time promotional content, and connectivity with mobile applications, these kiosks create seamless omnichannel experiences. Contemporary Mexican consumers increasingly expect such convenience and personalization in their shopping journeys, making kiosks essential for enhancing engagement, driving sales, and supporting operational efficiency in competitive retail environments.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico exhibits a clear dominance with a 44% share of the total Mexico interactive kiosk market in 2025.

Central Mexico leads the kiosk market due to its high concentration of economic activity, dense population, and well-developed commercial infrastructure in the Mexico City metropolitan area and surrounding states. The region is home to headquarters and flagship locations of major retail chains, banks, and healthcare networks, which drive widespread kiosk adoption. These organizations implement self-service solutions across their national operations, setting benchmarks for efficiency, customer experience, and technology integration in Mexico.

The sophisticated consumer base in central Mexico exhibits higher digital literacy and greater acceptance of self-service technologies, motivating businesses to deploy advanced kiosk solutions as key competitive differentiators. Well-developed telecommunications infrastructure and reliable power supply further support uninterrupted kiosk operations, which are critical for customer-facing applications. This combination of tech-savvy consumers and dependable infrastructure enables businesses to implement innovative self-service solutions that enhance convenience, efficiency, and overall customer experience.

Market Dynamics:

Growth Drivers:

Why is the Mexico Interactive Kiosk Market Growing?

Accelerating Digital Transformation Across Industries

Mexico's comprehensive digital transformation agenda is fundamentally reshaping how businesses interact with consumers and deliver services. The government's National Digital Strategy emphasizes expanding internet connectivity, promoting digital government services, and fostering e-commerce development, creating an enabling environment for interactive kiosk deployments. Reflecting this trend in financial services innovation, in 2024, fintech firm Aviva launched AI‑powered physical kiosks in smaller Mexican cities to improve access to digital banking and financial services for underserved populations, demonstrating how companies are integrating kiosk technology to bridge digital divides and enhance service delivery across new regions. Enterprises across retail, banking, healthcare, and transportation sectors are investing in self-service technologies to meet consumer expectations for immediate, convenient, and autonomous service access.

Retail Sector Modernization and Omnichannel Strategies

The Mexican retail landscape is undergoing significant transformation as major chains modernize their store formats and integrate digital technologies to enhance customer experiences. In 2025, the Mexico retail market reached USD 475.2 Billion, and looking forward, IMARC Group expects it to reach USD 698.8 Billion by 2034, exhibiting a CAGR of 4.38% during 2026-2034. Leading grocery retailers are deploying self-checkout systems to manage high transaction volumes efficiently while reducing customer wait times during peak shopping hours. The growth of convenience store networks and expansion of quick-service restaurant chains across urban and suburban markets is driving demand for compact, efficient kiosk solutions that streamline ordering, payment, and service delivery processes. Retailers increasingly view interactive kiosks as essential infrastructure for executing omnichannel strategies that blend physical and digital shopping experiences, enabling capabilities such as buy-online-pickup-in-store and automated returns processing.

Healthcare Infrastructure Expansion and Patient Experience Focus

Mexico's healthcare sector is experiencing substantial infrastructure expansion with numerous hospitals and clinical facilities under construction or renovation across the country. These healthcare investments include modernization of patient-facing services through digital technologies, including self-service kiosks for registration, appointment scheduling, wayfinding, and payment processing. Healthcare institutions recognize that interactive kiosks improve patient flow management, reduce administrative bottlenecks, and free clinical staff to focus on care delivery rather than clerical tasks. The emphasis on enhancing patient experiences and operational efficiency in both public and private healthcare systems positions interactive kiosks as valuable investments supporting quality improvement and capacity optimization objectives.

Market Restraints:

What Challenges the Mexico Interactive Kiosk Market is Facing?

High Initial Investment and Infrastructure Requirements

The substantial capital investment required for kiosk hardware, software licensing, installation, and seamless integration with existing business systems presents significant barriers for small and medium-sized enterprises considering self-service deployments. Furthermore, additional infrastructure requirements, including reliable internet connectivity, consistent electrical supply, and adequate physical security measures, further increase upfront costs and complicate the overall implementation process for these businesses.

Digital Literacy Disparities Across Consumer Segments

Varying levels of technological familiarity across different demographic groups create notable challenges for widespread kiosk adoption. Older consumers, as well as populations in underserved or rural regions, may face difficulties navigating touchscreen interfaces, which can limit the effectiveness of self-service strategies and necessitate continuous staff support, training, and assistance to ensure a satisfactory user experience for all.

Integration Complexity with Legacy Systems

Many Mexican businesses continue to operate legacy information technology infrastructure, which poses significant compatibility challenges when integrating modern interactive kiosk solutions. The complexity and expense of such system integration, especially in highly regulated industries like banking and healthcare, can slow deployment timelines, increase total ownership costs, and require additional technical resources to ensure compliance and seamless operational functionality.

Competitive Landscape:

The Mexico interactive kiosk market features a dynamic competitive environment where international technology providers compete alongside regional manufacturers and system integrators for market share. Established global players leverage their technological expertise, comprehensive product portfolios, and established supply chains to serve enterprise-scale deployments in retail, banking, and hospitality sectors. Regional competitors differentiate through localized customization capabilities, Spanish-language support services, and flexible financing arrangements suited to Mexican business requirements. Strategic partnerships between hardware manufacturers, software developers, and payment processors are enabling comprehensive solution offerings that address evolving market demands for integrated, turnkey kiosk deployments supporting diverse applications.

Recent Developments:

-

In December 2025, NoviSign Digital Signage, in partnership with Spotted, has launched a large network of smart interactive charging kiosks at Mexico City International Airport (AICM). The kiosks combine device charging with interactive digital advertising, QR engagement, and programmatic ads, all managed via a centralized cloud platform to deliver real-time updates, analytics, enhanced passenger experience, and new revenue opportunities.

Mexico Interactive Kiosk Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Types Covered | Bank Kiosks, Self-Service Kiosks, Vending Kiosks, Others |

| Mounting Types Covered | Floor Standing, Wall Mount, Others |

| Panel Sizes Covered | 17” - 32”, Above 32” |

| Locations Covered | Indoor, Outdoor |

| Industry Verticals Covered | BFSI, Retail, Food and Beverage, Healthcare, Government, Travel and Tourism, Entertainment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico interactive kiosk market size was valued at USD 668.17 Million in 2025.

The Mexico interactive kiosk market is expected to grow at a compound annual growth rate of 9.94% from 2026-2034 to reach USD 1,567.28 Million by 2034.

Hardware dominated the market with a 54% share, driven by essential investments in touchscreen displays, payment terminals, and enclosure systems required for kiosk deployments across retail and banking sectors.

Key factors driving the Mexico interactive kiosk market include accelerating digital transformation initiatives, retail sector modernization with self-checkout deployments, expanding healthcare infrastructure, rising consumer demand for contactless transactions, and government support for digitalization.

Major challenges include high initial investment requirements for hardware and software, digital literacy disparities among certain consumer demographics, integration complexity with legacy enterprise systems, and infrastructure limitations in underserved regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)