Mexico Interventional Cardiology Devices Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Mexico Interventional Cardiology Devices Market Overview:

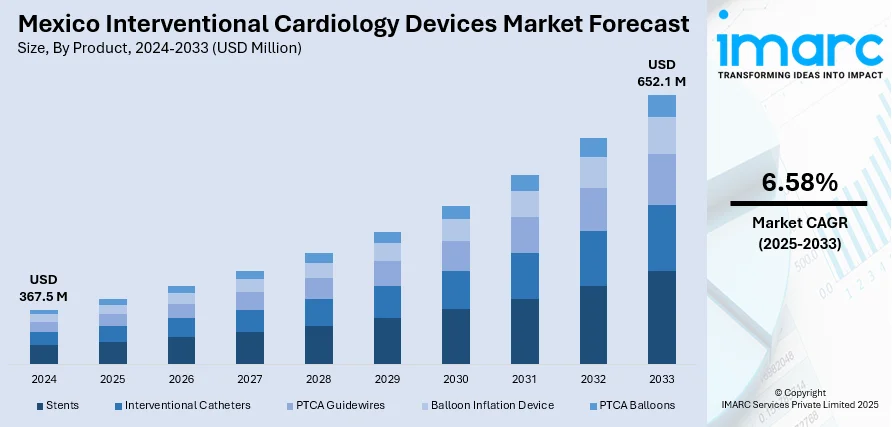

The Mexico interventional cardiology devices market size reached USD 367.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 652.1 Million by 2033, exhibiting a growth rate (CAGR) of 6.58% during 2025-2033. The market is growing steadily, driven by the increasing prevalence of cardiovascular diseases (CVDs) and the rising adoption of minimally invasive procedures. Technological advancements and expanding healthcare infrastructure are further supporting market development. Strong demand for innovative stents, catheters, and guidewires is shaping product trends. Growing awareness and better patient access to specialized treatments are enhancing growth prospects by holding a notable Mexico interventional cardiology devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 367.5 Million |

| Market Forecast in 2033 | USD 652.1 Million |

| Market Growth Rate 2025-2033 | 6.58% |

Mexico Interventional Cardiology Devices Market Trends:

Growing Demand for Accessory Devices

In Mexico, the growing focus on minimally invasive (MI) cardiovascular procedures has significantly boosted demand for accessory devices like guidewires, catheters, and introducer sheaths. These tools play a critical role in enabling the precision and safety of interventional cardiology techniques. Clinicians increasingly prefer procedures that reduce recovery time, complications, and hospital stays, all of which are supported by these advanced accessories. The shift toward high-performance and user-friendly devices has encouraged manufacturers to invest in innovative designs. Hospitals and specialty clinics are also improving their inventory of these tools to match procedural advancements. This trend is expected to deepen as medical professionals seek enhanced procedural control and better patient outcomes using supportive technologies in cardiology.

To get more information of this market, Request Sample

Continued Preference for Coronary Stents

Coronary stents continue to be a mainstay in interventional cardiology procedures in Mexico due to their critical function of fixing blocked or obstructed arteries. They are, for a long time now, extensively employed by cardiologists to open up blood vessels during interventions such as angioplasty. Technological advances regarding stent materials and designs over the years have ensured the devices become safer and more efficient, which has further increased their popularity. Mexican healthcare professionals tend to favor stents that decrease the risk of restenosis and enhance long-term results. Furthermore, the growing population of elderly people and lifestyle-related heart disease continues to drive demand for stent-based therapies. Consequently, coronary stents are anticipated to continue dominating the Mexico interventional cardiology devices market growth.

Strong Regulatory Influence of COFEPRIS

The devices market for interventional cardiology in Mexico is highly influenced by Mexico's regulatory authority, COFEPRIS. This organization regulates that medical devices must be safe, of good quality, and effective before they are allowed onto the market. Manufacturers have to comply with this regulation if they are to obtain approval as well as gain the confidence of healthcare providers. COFEPRIS fosters an environment that promotes compliance and innovation, challenging companies to uphold high standards while introducing new technologies. The rigorous approval process ensures that only trustworthy, patient-safe devices are utilized in procedures. Through this manner, the regulatory environment not only safeguards public health but also facilitates long-term market stability and growth in the interventional cardiology arena.

Mexico Interventional Cardiology Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional for 2025-2033. Our report has categorized the market based on product and end user.

Product Insights:

- Stents

- Drug Eluting Stents

- Bare Metal Stents

- Bio-Absorbable Stents

- Interventional Catheters

- IVUS Catheters

- Guiding Catheters

- Angiography Catheters

- PTCA Guidewires

- Balloon Inflation Device

- PTCA Balloons

- Cutting Balloons

- Scoring Balloons

- Drug Eluting Balloons

- Normal Balloons

The report has provided a detailed breakup and analysis of the market based on the product. This includes stents (drug eluting stents, bare metal stents, and bio-absorbable stents), interventional catheters (IVUS catheters, guiding catheters, and angiography catheters), PTCA guidewires, balloon inflation device, and PTCA balloons (cutting balloons, scoring balloons, drug eluting balloons, and normal balloons).

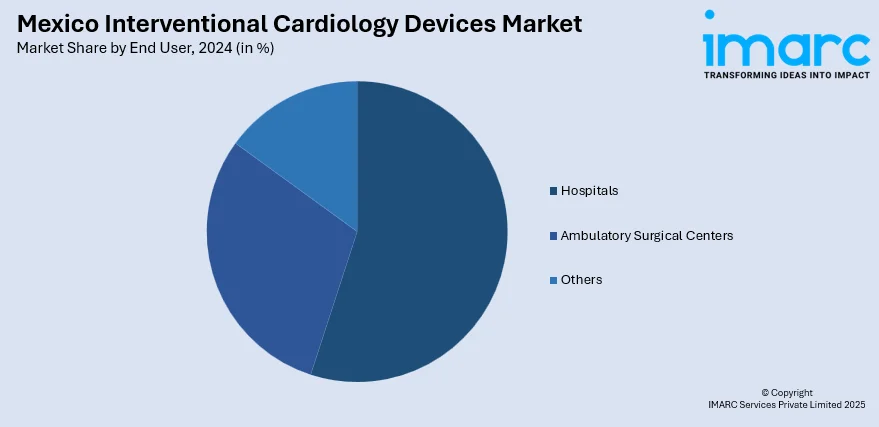

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, ambulatory surgical centers, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Interventional Cardiology Devices Market News:

- In March 2025, Boston Scientific announced an agreement to acquire SoniVie Ltd., a medical device company known for the TIVUS™ Intravascular Ultrasound System. The TIVUS system is designed for renal denervation therapy, offering a minimally invasive treatment for hypertension by targeting nerves around blood vessels. This acquisition expands Boston Scientific’s Interventional Cardiology portfolio and supports ongoing advancements in hypertension treatment, with positive clinical trial results already reported for the TIVUS system.

- In December 2024, SMT (Sahajanand Medical Technologies) launched its Hydra Transcatheter Aortic Valve Replacement (TAVR) system in Mexico, expanding its global reach. The system offers innovative features like frame markers, a supra-annular design, and a flexible frame for precise, safe, and effective aortic valve replacement. Approved by COFEPRIS, Hydra addresses Mexico's growing demand for advanced cardiac care. SMT’s expansion strategy includes over 20 countries, enhancing global access to high-quality cardiovascular solutions.

Mexico Interventional Cardiology Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico interventional cardiology devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico interventional cardiology devices market on the basis of Product?

- What is the breakup of the Mexico interventional cardiology devices market on the basis of end user?

- What is the breakup of the Mexico interventional cardiology devices market on the basis of region?

- What are the various stages in the value chain of the Mexico interventional cardiology devices market?

- What are the key driving factors and challenges in the Mexico interventional cardiology devices?

- What is the structure of the Mexico interventional cardiology devices market and who are the key players?

- What is the degree of competition in the Mexico interventional cardiology devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico interventional cardiology devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico interventional cardiology devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico interventional cardiology devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)