Mexico IoT Sensors Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Mexico IoT Sensors Market Overview:

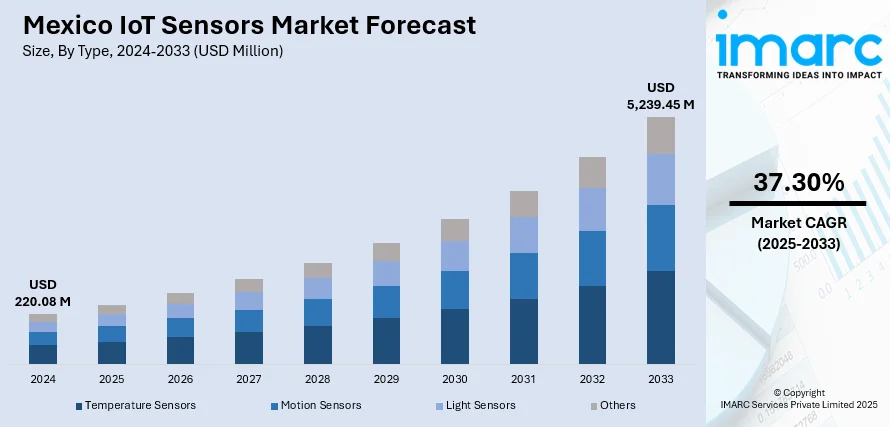

The Mexico IoT sensors market size reached USD 220.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,239.45 Million by 2033, exhibiting a growth rate (CAGR) of 37.30% during 2025-2033. The market is experiencing significant growth, driven by the increasing demand for automation across industries like manufacturing, healthcare, and agriculture. Rising adoption of smart cities and industrial IoT solutions is also boosting the need for advanced sensors. Government initiatives supporting digital transformation and innovations in wireless and energy-efficient sensor technologies are further increasing the Mexico IoT sensors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 220.08 Million |

| Market Forecast in 2033 | USD 5,239.45 Million |

| Market Growth Rate 2025-2033 | 37.30% |

Mexico IoT Sensors Market Trends:

Smart Cities Development

Mexico is witnessing a major change towards the development of smart cities, and IoT sensors are central to the transformation of urban infrastructure. IoT sensors make energy management efficient through monitoring and optimizing the utilization of electricity, water, and waste management systems. In traffic management, IoT sensors assist in the real-time monitoring of traffic flow, helping to decrease congestion and enhance overall transport efficiency. In addition, IoT sensors increase public security through smart surveillance systems and public space real-time monitoring. For instance, In February 2025, Foxconn announced its partnership with Mexico's Sonora state to develop a smart city, signing a memorandum of understanding. Utilizing its Build-Operate-Localize model, Foxconn aims to enhance transportation, public safety, and port management. This project aligns with Sonora's goals in electric mobility and AI, marking Foxconn's first overseas smart city initiative. They facilitate quick intervention in emergencies, enhancing citizens' safety. As cities keep growing, the use of these sensors is becoming a necessity for developing livable, sustainable cities. The emphasis on digitalization by the Mexican government further encourages this, offering the required assistance to smart city projects. This increasing dependency on IoT sensors plays a big role in urban modernization and efficiency, thereby driving Mexico IoT sensors market growth.

To get more information on this market, Request Sample

Agriculture Innovation

In Mexico, IoT sensors are revolutionizing agriculture by facilitating precision farming methods that maximize crop yields and resource allocation. IoT sensors gather real-time information regarding soil moisture levels, temperature, humidity, and nutrient content, allowing farmers to make informed decisions to optimize irrigation and fertilizer application schedules. IoT technology, by tracking climate patterns and weather forecasts, optimizes planting and harvesting schedules, minimizing waste and maximizing productivity. For instance, in January 2024, Mexico's Secretariat of Agriculture expanded a digital system to monitor water and fertilizer usage in agriculture, aiming for sustainable practices. Currently operational on 30,000 hectares, the initiative seeks to reduce water consumption and improve efficiency, particularly in the water-intensive northern state of Sinaloa. This technology-driven mechanism helps to improve sustainability through reduced water consumption and lower pesticide and fertilizer use. Implementation of IoT in Mexican agriculture is taking a huge leap forward as farmers look for more sustainable and efficient farming practices. With the increasing demand for sustainable agriculture practices, market is expected to accelerate, supporting the shift towards smarter, more productive farming systems.

Mexico IoT Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Temperature Sensors

- Motion Sensors

- Light Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes temperature sensors, motion sensors, light sensors, and others.

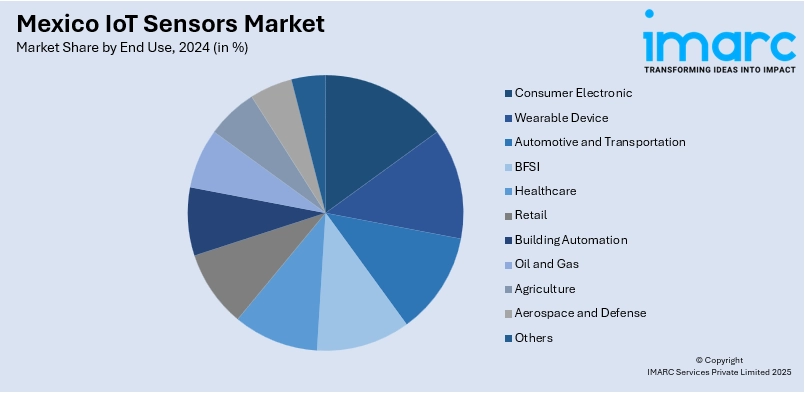

End Use Insights:

- Consumer Electronic

- Wearable Device

- Automotive and Transportation

- BFSI

- Healthcare

- Retail

- Building Automation

- Oil and Gas

- Agriculture

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes consumer electronic, wearable device, automotive and transportation, BFSI, healthcare, retail, building automation, oil and gas, agriculture, aerospace and defense, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico IoT Sensors Market News:

- In April 2024, GigNet and IotaComm announced their collaboration to provide Internet of Things (IoT) solutions for the hospitality sector in the Mexican Caribbean. This partnership aims to improve operational efficiency and enhance the guest experience by utilizing IotaComm's cutting-edge IoT technology coupled with GigNet's comprehensive fiber-optic network, specifically targeting hotels and resorts.

- In September 2023, Liberty Mutual Re, XS Global, and Safehub introduced the world's first sensor-driven parametric reinsurance treaty focused on earthquake risk. This groundbreaking initiative employs real-time, building-specific sensor information to reduce basis risk and accelerate disaster response, particularly in seismically active areas like Mexico, thereby strengthening disaster risk management for policyholders.

Mexico IoT Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Temperature Sensors, Motion Sensors, Light Sensors, Others |

| End Users Covered | Consumer Electronic, Wearable Device, Automotive and Transportation, BFSI, Healthcare, Retail, Building Automation, Oil and Gas, Agriculture, Aerospace and Defense, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico IoT sensors market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico IoT sensors market on the basis of type?

- What is the breakup of the Mexico IoT sensors market on the basis of end use?

- What is the breakup of the Mexico IoT sensors market on the basis of region?

- What are the various stages in the value chain of the Mexico IoT sensors market?

- What are the key driving factors and challenges in the Mexico IoT sensors market?

- What is the structure of the Mexico IoT sensors market and who are the key players?

- What is the degree of competition in the Mexico IoT sensors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico IoT sensors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico IoT sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico IoT sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)