Mexico Lactic Acid Market Size, Share, Trends and Forecast by Raw Material, Form, Application, and Region, 2025-2033

Mexico Lactic Acid Market Overview:

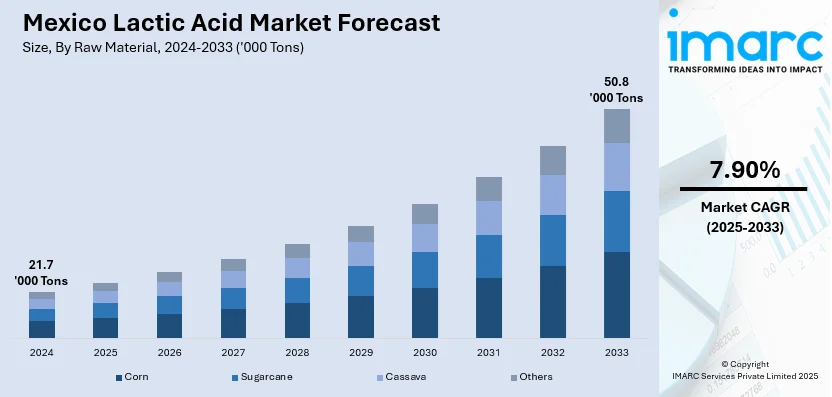

The Mexico lactic acid market size reached 21.7 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 50.8 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. Rising demand for biodegradable plastics, expanding food and beverage applications, growing personal care and pharmaceutical usage, and increased health-conscious consumption are some of the factors propelling the growth of the market. Industrial adoption of green solvents and favorable regulatory support for sustainable materials also contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 21.7 Thousand Tons |

| Market Forecast in 2033 | 50.8 Thousand Tons |

| Market Growth Rate 2025-2033 | 7.90% |

Mexico Lactic Acid Market Trends:

Expansion of Production and Application Capabilities

The Mexico lactic acid market is experiencing increased investment in domestic manufacturing and specialized support infrastructure. Local facilities are being upgraded to expand output and integrate advanced research capabilities focused on food-related applications. This reflects rising demand across bakery, meat preservation, and broader food processing sectors. By enhancing both production lines and application labs, manufacturers can offer tailored solutions to local and regional clients, ensuring faster response times and more reliable supply. These developments also support the growing preference for natural preservatives and sustainable ingredients in food formulations. Strengthening in-region capabilities allows companies to better serve markets across Mexico, Central America, and Latin America, aligning operations more closely with the evolving requirements of downstream industries. For example, in September 2024, Corbion, a global market leader in lactic acid and its derivatives, announced an upgrade to its Querétaro, Mexico facility, aiming to double production capacity and enhance R&D capabilities. The expansion includes a new production line and renovated laboratories for bakery and meat applications, strengthening support for customers across Mexico, Central, and Latin America.

Integration of Energy Storage Systems

Poly-L-lactic acid is gaining wider use across Mexico’s personal care and aesthetics sector. Demand is increasing for injectable formulations that stimulate natural collagen production to improve skin firmness and reduce facial wrinkles. These formulations offer long-lasting effects, aligning with consumer interest in minimally invasive and durable cosmetic treatments. Regulatory clearances in major markets have opened up opportunities for greater availability across North America, including Mexico. The growing focus on non-surgical aesthetic solutions is prompting the wider use of lactic acid-based compounds in dermatology and cosmetic clinics. This expansion into specialized personal care applications highlights the material’s versatility and positions it as a key component in skin rejuvenation and anti-aging solutions. For instance, in April 2023, Galderma received FDA approval for Sculptra, an injectable poly-L-lactic acid (PLLA-SCA) for correcting cheek wrinkles. Sculptra stimulates natural collagen production, offering results lasting up to two years. This approval allows Galderma to expand its aesthetic product offerings in the U.S. and Mexico markets.

Mexico Lactic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on raw material, form, and application.

Raw Material Insights:

- Corn

- Sugarcane

- Cassava

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes corn, sugarcane, cassava, and others.

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

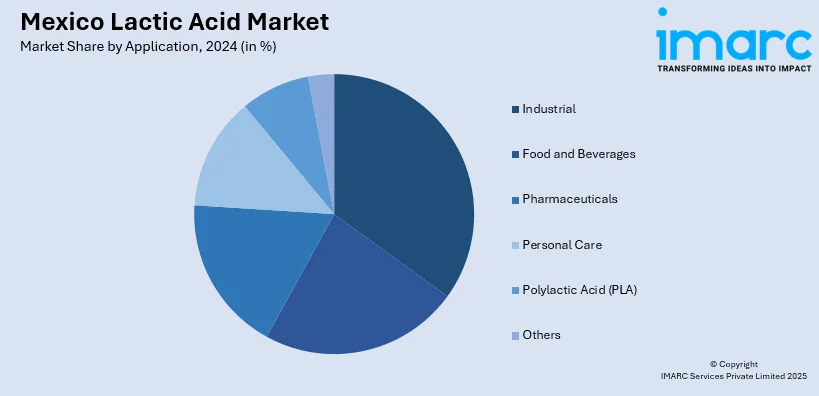

Application Insights:

- Industrial

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid (PLA)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, food and beverages, pharmaceuticals, personal care, polylactic acid (PLA), and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Lactic Acid Market News:

- In October 2024, ProBiotix Health plc announced a commercial partnership with Mexico-based Raff, a specialist in raw materials and ingredients for the dairy and nutraceutical sectors. This collaboration aims to address cardiovascular health issues in Mexico by leveraging Raff's expertise in lactic and probiotic cultures.

Mexico Lactic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Corn, Sugarcane, Cassava, Others |

| Forms Covered | Liquid, Solid |

| Applications Covered | Industrial, Food and Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico lactic acid market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico lactic acid market on the basis of raw material?

- What is the breakup of the Mexico lactic acid market on the basis of form?

- What is the breakup of the Mexico lactic acid market on the basis of application?

- What are the various stages in the value chain of the Mexico lactic acid market?

- What are the key driving factors and challenges in the Mexico lactic acid market?

- What is the structure of the Mexico lactic acid market and who are the key players?

- What is the degree of competition in the Mexico lactic acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico lactic acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico lactic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico lactic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)