Mexico Laminates Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Mexico Laminates Market Overview:

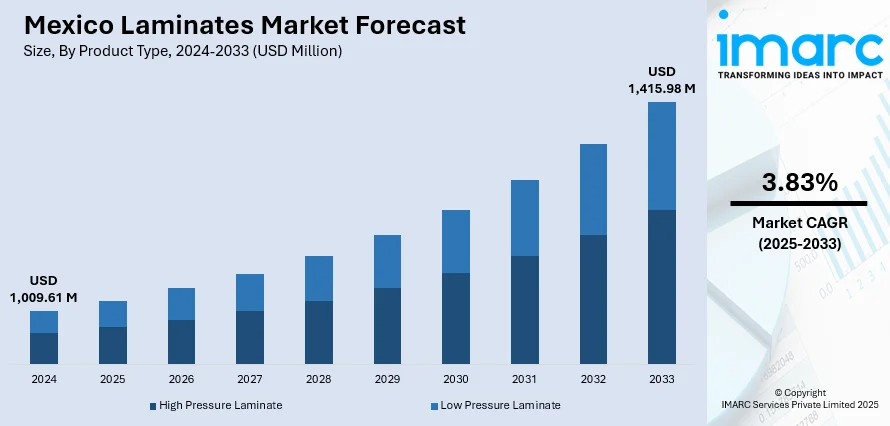

The Mexico Laminates Market size reached USD 1,009.61 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,415.98 Million by 2033, exhibiting a growth rate (CAGR) of 3.83% during 2025-2033. The market is driven by rapid urbanization, growth in residential and commercial construction, and increasing demand for affordable, durable interior materials. Consumers favor laminates for their aesthetic versatility and low maintenance. A shift toward eco-friendly, low-emission, and health-conscious products is shaping market preferences. Technological advancements, including digital printing and improved durability, enable greater customization and performance. These factors together are fueling consistent demand for laminates across sectors like housing, retail, hospitality, and institutional projects throughout the country further impelling the Mexico laminates market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,009.61 Million |

| Market Forecast in 2033 | USD 1,415.98 Million |

| Market Growth Rate 2025-2033 | 3.83% |

Mexico Laminates Market Trends:

Technological Advancements and Customization

Technology is revolutionizing Mexico's laminates market trends by allowing for highly customizable, low-cost designs using digital printing and sophisticated manufacturing. These technologies enable laminates to convincingly replicate natural materials such as wood, stone, and metal, enabling homeowners and designers to create one-of-a-kind environments without the expense of the old standbys. Aesthetics aside, today's laminates offer improved durability, with scratch, heat, and moisture resistance. More customization choices provide customers with more control over color, pattern, and finish, accommodating varied design needs. Such technological advancement is broadening the application of laminates in various industries such as residential, commercial, retail, and hospitality. Consequently, laminates have emerged as a popular material for flexible, stylish, and practical interior surfaces in Mexico, fueled by innovation and changing customer needs.

To get more information on this market, Request Sample

Urbanization and Construction Boom

Mexico’s rapid urban expansion is a key driver of growth in the laminates market, supported by a thriving residential building construction sector, which registered 7,786 economic units in 2024. The highest activity is seen in regions like Jalisco, Ciudad de México, and Nuevo León. Rising residential and commercial construction is boosting demand for durable, stylish, and affordable interior materials. Laminates are favored for kitchen cabinets, flooring, and wall panels due to their versatility, easy maintenance, and diverse textures and finishes. Architects and designers prefer laminates for their modern look and practical benefits. The market is further propelled by the need for long-lasting, aesthetically appealing surfaces in both new and renovated buildings. As infrastructure and urban development continue, laminates are increasingly seen as a cost-effective, reliable solution that meets contemporary design and functional needs, playing a vital role in shaping Mexico’s interior construction and design landscape.

Shift Towards Sustainable and Health-Conscious Materials

Ecological awareness and health consciousness are revolutionizing Mexico's laminates market, from customer purchasing decisions to industry trends. Consumers demand laminates that are eco-friendly, contain recycled content, and release few toxic substances, prioritizing healthier indoor air quality. This trend is pushing producers to invent with antibacterial and water-resistant laminates, satisfying residential, healthcare, and public buildings needs. As the environmental and health consequences of building materials gain better understanding, sustainability has emerged as a major influencing factor in procurement decisions. The need for products that offer performance and environmental-friendly features is compelling the industry towards more sustainable options. Generally, the trend is urging the Mexico laminates market growth to change direction, adopting sustainability and safety as the critical elements of product design and development.

Mexico Laminates Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- High Pressure Laminate

- Low Pressure Laminate

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high pressure laminate and low-pressure laminate.

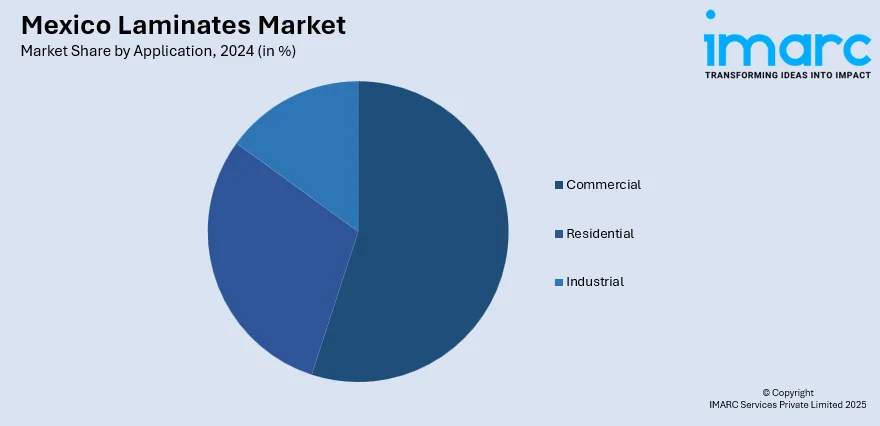

Application Insights:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Laminates Market News:

- In May 2024, Greenlam Industries’ NewMika brand launched its latest 1.25mm laminate collection, featuring 74 new decors with 6 textures, 17 abstracts, 28 solids, and 29 woodgrains. Designed for younger consumers, the collection blends innovation, style, and functionality with features like antibacterial and scratch resistance. It offers easy installation, low maintenance, and sustainability. The collection aims to inspire unique, sophisticated interiors and elevate living spaces with rich textures and contemporary designs.

- In February 2024, Sunon launched its first overseas factory and experience center near Monterrey, Mexico, targeting the North American market. The 202-acre facility features advanced, eco-friendly production lines for panel furniture, seating, and steel products, boosting local manufacturing and employment. Emphasizing sustainability, digital automation, and cultural integration, Sunon aims to improve service quality and strengthen Chinese-Mexican cooperation while advancing its global contract furniture leadership.

Mexico Laminates Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High Pressure Laminate, Low Pressure Laminate |

| Applications Covered | Commercial, Residential, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico laminates market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico laminates market on the basis of product type?

- What is the breakup of the Mexico laminates market on the basis of application?

- What is the breakup of the Mexico laminates market on the basis of region?

- What are the various stages in the value chain of the Mexico laminates market?

- What are the key driving factors and challenges in the Mexico laminates market?

- What is the structure of the Mexico laminates market and who are the key players?

- What is the degree of competition in the Mexico laminates market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico laminates market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico laminates market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico laminates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)