Mexico Leak Detection Market Size, Share, Trends and Forecast by Technology, End User, and Region, 2025-2033

Mexico Leak Detection Market Overview:

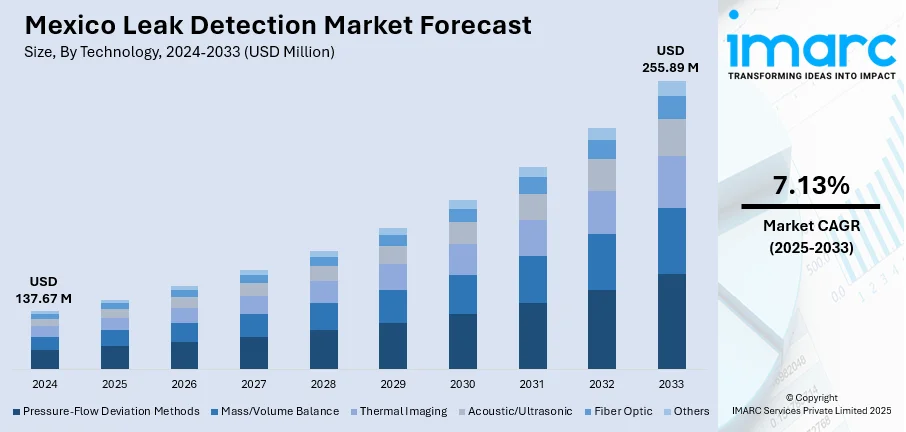

The Mexico leak detection market size reached USD 137.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 255.89 Million by 2033, exhibiting a growth rate (CAGR) of 7.13% during 2025-2033. The market is driven by stringent government regulations promoting sustainable resource management, compelling industries to adopt advanced leak detection technologies. Rising water scarcity and aging infrastructure are accelerating investments in non-revenue water (NRW) reduction, with utilities prioritizing satellite-based monitoring and acoustic detection systems. Additionally, industrial modernization in oil and gas and manufacturing sectors demands efficient leak prevention, further augmenting the Mexico leak detection market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 137.67 Million |

| Market Forecast in 2033 | USD 255.89 Million |

| Market Growth Rate 2025-2033 | 7.13% |

Mexico Leak Detection Market Trends:

Increasing Adoption of Advanced Leak Detection Technologies

The market is experiencing a significant shift toward advanced technologies, driven by the need for improved accuracy and efficiency. Traditional methods, such as manual inspections, are being replaced by smart sensors, acoustic detectors, and IoT-enabled monitoring systems. These technologies provide real-time data, enabling faster leak identification and reducing water and fuel losses, which is critical for industries such as water management, oil and gas, and manufacturing. In Mexico, nearly 43% of the population is not supplied with clean water access. In addition, there is a 40% loss of water due to leakage in the country's infrastructure, which underlines the importance of improved maintenance of pipelines. This situation highlights the increasing need for sophisticated pipeline leak detection systems to minimize waste and enhance water management practices. Government regulations promoting sustainable resource management are further accelerating this trend. Additionally, the integration of AI and machine learning allows predictive maintenance, minimizing downtime and operational costs. As Mexican industries modernize their infrastructure, the demand for automated and non-invasive leak detection solutions is expected to grow, positioning technology providers for expansion in this changing market.

To get more information on this market, Request Sample

Rising Demand for Water Conservation Solutions

Water scarcity and aging infrastructure are key drivers propelling the Mexico leak detection market growth. With increasing urbanization and industrial growth, water loss due to pipeline leaks has become a major concern. Municipalities and private companies are investing in advanced leak detection systems to reduce non-revenue water (NRW) and enhance distribution efficiency. With Non-Revenue Water (NRW) loss rates upwards of 55% in certain areas, Mexico City is facing a significant problem of 40% NRW loss. As a result, this causes 12,000 liters of potable water to be lost every second, which is equal to 345 Olympic-size swimming pools. This can be attributed mainly to leaks, poor maintenance of provisions, and urban sprawl. Such measures, especially the implementation of advanced pipeline leak detection technologies, can prove to be instrumental in resolving the city's perennial water shortage issues. Technologies including satellite-based monitoring and pressure sensors are gaining traction, particularly in regions facing severe water shortages. Furthermore, government initiatives, such as the National Water Commission’s (CONAGUA) infrastructure modernization programs, are encouraging the adoption of these solutions. The growing emphasis on sustainability and cost savings is pushing utilities and industries to prioritize leak detection, creating lucrative opportunities for market players specializing in water management technologies.

Mexico Leak Detection Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology and end user.

Technology Insights:

- Pressure-Flow Deviation Methods

- Mass/Volume Balance

- Thermal Imaging

- Acoustic/Ultrasonic

- Fiber Optic

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes pressure-flow deviation methods, mass/volume balance, thermal imaging, acoustic/ultrasonic, fiber optic, and others.

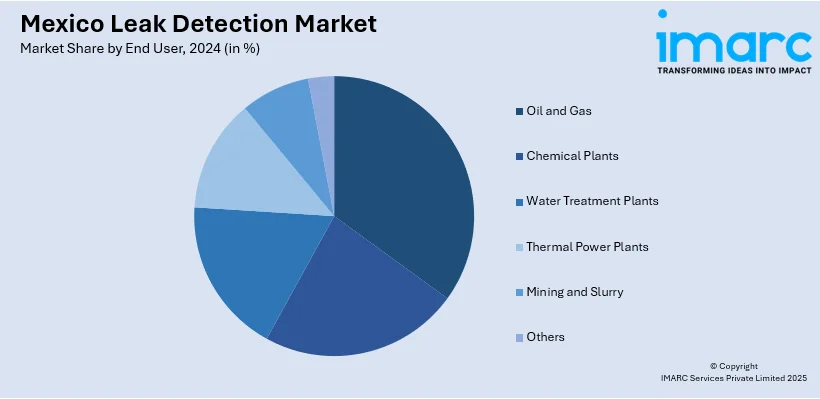

End User Insights:

- Oil and Gas

- Chemical Plants

- Water Treatment Plants

- Thermal Power Plants

- Mining and Slurry

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil and gas, chemical plants, water treatment plants, thermal power plants, mining and slurry, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Leak Detection Market News:

- February 11, 2025: Meta partnered with FIDO Tech, deploying next-generation AI-powered leak detection measures on 300 kilometers of water pipelines in New Mexico's Farmington. This initiative is part of a broader strategy that will tackle water scarcity challenges in the Colorado River Basin. As water loss and redundancy are ultimately a better use of the crucial resources that are essential to sustaining any community, the ten-year project aims to reduce loss and increase the resilience of local water sources. The program reflects a wider need for such leak detection technology in countries such as Mexico, where water shortages and infrastructure problems create major challenges.

Mexico Leak Detection Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Pressure-Flow Deviation Methods, Mass/Volume Balance, Thermal Imaging, Acoustic/Ultrasonic, Fiber Optic, Others |

| End Users Covered | Oil and Gas, Chemical Plants, Water Treatment Plants, Thermal Power Plants, Mining and Slurry, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico leak detection market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico leak detection market on the basis of technology?

- What is the breakup of the Mexico leak detection market on the basis of end user?

- What is the breakup of the Mexico leak detection market on the basis of region?

- What are the various stages in the value chain of the Mexico leak detection market?

- What are the key driving factors and challenges in the Mexico leak detection market?

- What is the structure of the Mexico leak detection market and who are the key players?

- What is the degree of competition in the Mexico leak detection market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico leak detection market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico leak detection market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico leak detection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)