Mexico Lingerie Market Size, Share, Trends and Forecast by Product Type, Material, Price Range, Distribution Channel, and Region, 2025-2033

Mexico Lingerie Market Overview:

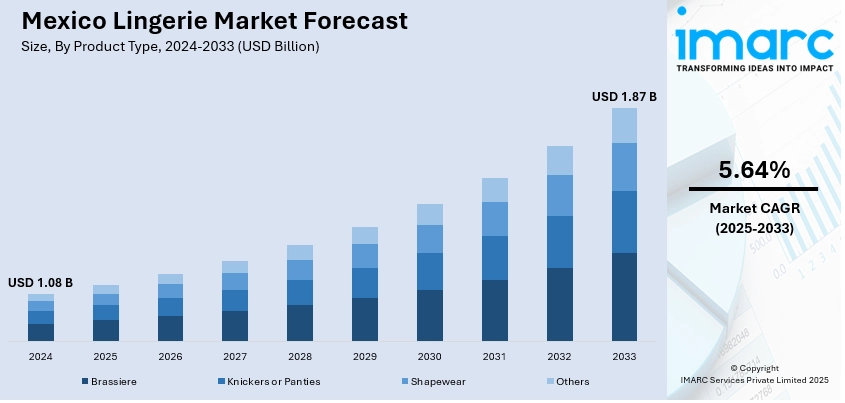

The Mexico lingerie market size reached USD 1.08 Billion in 2024. Looking forward, the market is expected to reach USD 1.87 Billion by 2033, exhibiting a growth rate (CAGR) of 5.64% during 2025-2033. The market is fueled by cultural pride, changing fashion trends, and body positivity. Lingerie that is both comfortable, sensual, and culturally authentic is becoming more appealing to consumers. Digital platforms have made lingerie more readily available, while local brands are picking up speed through inclusive sizing and artisanal-inspired styles. Growing middle class and shifting attitudes toward self-expression have also increased demand for everyday and luxury lingerie, further adding to the growth of Mexico lingerie market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.08 Billion |

| Market Forecast in 2033 | USD 1.87 Billion |

| Market Growth Rate 2025-2033 | 5.64% |

Mexico Lingerie Market Trends:

Cultural Roots and Indigenous Influence

The market for lingerie has strong cultural roots in Mexico's rich heritage and pre-Hispanic textile history. Even before the creation of contemporary lingerie items, indigenous women made undergarments from cotton and agave fiber, which were intricately embroidered and chromatically full of motifs reflecting their identity. This craftsman tradition continues to live on today, and especially in boutique firms that tap into traditional techniques to produce items imbued with Mexican identity. The firms use embroidered accents, bright colors, and regionally produced fabrics—especially in stronger weaving areas such as Oaxaca and Chiapas—where loom tradition is most established. As global design influences mainstream lingerie, there is an increasing value among Mexican consumers for those that express regionalism and cultural authenticity. Women are looking for intimate wear that is both comfortable and fashionable yet also a reflection of their heritage. In response, local fashion designers are doing likewise, creating a niche in the market space where intimate wear converges with cultural heritage and modern design, which further contributes to the Mexico lingerie market growth.

To get more information on this market, Request Sample

Toward Inclusivity and Sensual Self‑Expression

Mexico's lingerie industry has seen a significant movement toward inclusivity and empowerment. As attitudes change in society, Mexican consumers express increasing enthusiasm for varied lingerie varieties with corporations making intimate wear accessible to more than mainstream notions of beauty. Local startups concentrate on size inclusivity and body positivity, serving women who had earlier found it difficult to find proper fitting lingerie. Both niche and mainstream brands now focus on comfort, fit, and self-esteem, and innovative shapewear products boost figures beneath Mexico's fashion trends. Real bodies—various shapes, sizes, and cultural backgrounds are increasingly being used in marketing campaigns reflecting contemporary Mexican attitudes of empowerment. Therefore, Mexican lingerie is no longer merely utilitarian—it is now a self-expression accessory, signifying empowerment, sensuality, and individuality equal to basic fashion.

Digital Acceleration and Omni‑Channel Retail Evolution

The Mexican lingerie market is experiencing significant transformation through e-commerce and omni-channel retail strategies. Mobile and online shopping platforms are rapidly gaining traction, even as physical department stores like Liverpool and Palacio de Hierro continue to be essential for customers seeking in-store fit and service, particularly in major cities like Mexico City. According to the IMARC Group, the Mexico e-commerce market size reached USD 47.5 Billion in 2024, and is further expected to reach USD 176.6 Billion by 2033, exhibiting a growth rate (CAGR) of 14.5% during 2025-2033. E-commerce penetration is on the rise as people are using smartphones, while digital payment systems have improved, and there are more flexible forms of financing, like monthly payments and "buy now, pay later" programs. Consequently, smaller homegrown brands are also using digital-first strategies to compete against incumbent international labels. The blending of physical boutiques with digital experiences—like click‑and‑collect services at local stores—is assisting in preserving a unified customer experience. Hence, the lingerie industry in Mexico is becoming a digitally augmented, consumer-driven environment where omni-channel availability and service excellence are paramount to brand salience.

Mexico Lingerie Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material, price range, and distribution channel.

Product Type Insights:

- Brassiere

- Knickers or Panties

- Shapewear

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes brassiere, knickers or panties, shapewear, and others.

Material Insights:

- Cotton

- Silk

- Satin

- Nylon

- Others

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes cotton, silk, satin, nylon, and others.

Price Range Insights:

- Economy

- Premium

A detailed breakup and analysis of the market based on the price range has also been provided in the report. This includes economy and premium.

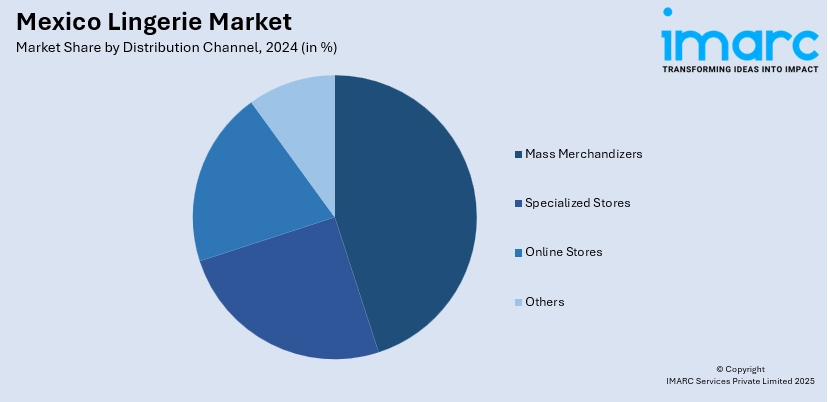

Distribution Channel Insights:

- Mass Merchandizers

- Specialized Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mass merchandizers, specialized stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Lingerie Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Brassiere, Knickers or Panties, Shapewear, Others |

| Materials Covered | Cotton, Silk, Satin, Nylon, Others |

| Price Ranges Covered | Economy, Premium |

| Distribution Channels Covered | Mass Merchandizers, Specialized Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico lingerie market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico lingerie market on the basis of product type?

- What is the breakup of the Mexico lingerie market on the basis of material?

- What is the breakup of the Mexico lingerie market on the basis of price range?

- What is the breakup of the Mexico lingerie market on the basis of distribution channel?

- What is the breakup of the Mexico lingerie market on the basis of region?

- What are the various stages in the value chain of the Mexico lingerie market?

- What are the key driving factors and challenges in the Mexico lingerie market?

- What is the structure of the Mexico lingerie market and who are the key players?

- What is the degree of competition in the Mexico lingerie market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico lingerie market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico lingerie market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico lingerie industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)