Mexico Logistics Automation Market Size, Share, Trends and Forecast by Component, Function, Enterprise Size, Industry Vertical, and Region, 2025-2033

Mexico Logistics Automation Market Overview:

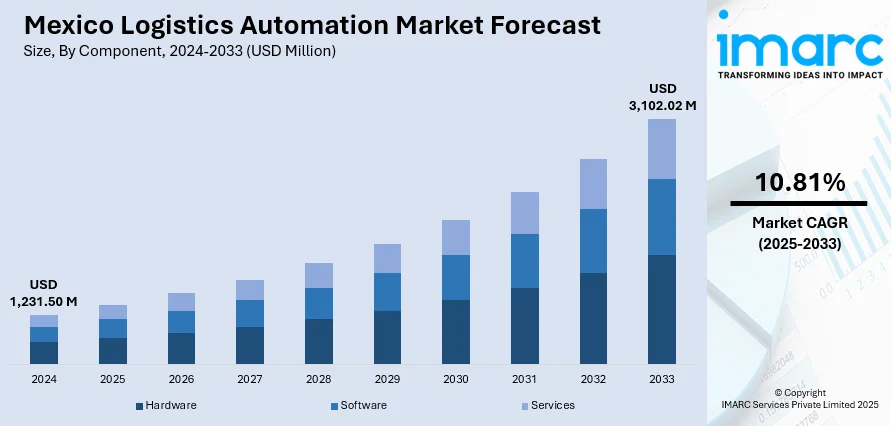

The Mexico logistics automation market size reached USD 1,231.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,102.02 Million by 2033, exhibiting a growth rate (CAGR) of 10.81% during 2025-2033. The growth of the market is driven by increasing e-commerce penetration, rising demand for faster and more accurate order fulfillment, and government initiatives to modernize supply chains, alongside investments in smart warehousing, robotics, and AI to enhance operational efficiency and reduce labor dependency. Mexico logistics automation market share is expected to grow significantly as automation technologies become central to next-generation supply chain strategies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,231.50 Million |

| Market Forecast in 2033 | USD 3,102.02 Million |

| Market Growth Rate 2025-2033 | 10.81% |

Mexico Logistics Automation Market Insights:

- Major Market Drivers: The Mexico logistics automation market is spurred by the swift growth of e-commerce, government backing for Industry 4.0, cross-border trade under USMCA, and investments in AI, robotics, and intelligent warehousing to enhance supply chain efficiency and decrease labor costs.

- Key Market Trends: The adoption of automation is increasing in e-commerce and manufacturing centers, as AMRs, AS/RS, and IoT technologies transform warehouse operations. Collaboration between global technology companies and domestic providers indicates a trend toward digital transformation and real-time inventory optimization throughout logistics networks.

- Competitive Landscape: The market has good multinationals' and regional integrators' participation. Businesses are concentrating on scaleable automation deployments, customized robots, and software platforms to develop operational benefits. Strategic partnerships and acquisitions are becoming typical to increase market reach and technological expertise.

- Challenges and Opportunities: Challenges are high initial costs, constraints of skilled manpower, and complexities in integration with legacy systems. Opportunities exist in public-private collaborations, increasing fulfillment requirements in city centers, and harnessing AI-driven information to drive predictive logistics and last-mile automation improvement.

Mexico Logistics Automation Market Trends:

E-commerce Expansion Accelerating Demand for Automated Warehousing

Mexico's rapidly growing e-commerce sector is driving the need for efficient, automated logistics solutions. With major online retailers and third-party logistics providers like Mercado Libre, Amazon, and Walmart de México leading the charge, investments in automation technologies such as automated storage and retrieval systems (AS/RS), conveyor belts, and autonomous mobile robots (AMRs) are helping handle increasing order volumes and meet consumer demands for faster delivery. Mexico logistics automation market growth is closely tied to these developments. The market is expected to grow from USD 47.5 billion in 2024 to reach USD 176.6 billion by 2033, exhibiting a growth rate (CAGR) of 14.5% during 2025-2033. This surge is creating immense pressure on warehouses to scale operations quickly while minimizing errors and delays. These automated systems also enable real-time inventory tracking and predictive analytics, essential for improving supply chain decision-making and ensuring customer satisfaction, especially in urban hubs like Mexico City, Guadalajara, and Monterrey. These dynamics shape the broader market forecast and reflect emerging Mexico logistics automation market trends in warehousing technology.

To get more information on this market, Request Sample

Government and Manufacturing Sector Push for Industry 4.0 Integration

Mexico's government and industrial sectors are increasingly adopting Industry 4.0 principles to drive advanced logistics automation and enhance supply chain performance, particularly in manufacturing-heavy regions like Baja California, Nuevo León, and Querétaro. The integration of robotics, IoT, and AI in logistics is supported by government-backed incentives. These initiatives aim to boost Mexico's global competitiveness in sectors like automotive, aerospace, and electronics. Additionally, the T-MEC/USMCA trade agreement has encouraged improvements in cross-border logistics with the U.S. and Canada, driving investments in automation to enhance efficiency in customs, warehousing, and last-mile delivery. These transformations provide crucial insights into the Mexico logistics automation market analysis and signal strong market outlook over the coming years.

Mexico Logistics Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, function, enterprise size, and industry vertical.

Component Insights:

- Hardware

- Mobile Robots (AGV, AMR)

- Automated Storage and Retrieval Systems (AS/RS)

- Automated Sorting Systems

- De-palletizing/Palletizing Systems

- Conveyor Systems

- Automatic Identification and Data Collection (AIDC)

- Order Picking

- Software

- Warehouse Management Systems (WMS)

- Warehouse Execution Systems (WES)

- Services

- Value Added Services

- Maintenance

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (mobile robots (AGV, AMR), automated storage and retrieval systems (AS/RS), automated sorting systems, de-palletizing/palletizing systems, conveyor systems, automatic identification and data collection (AIDC), and order picking), software (warehouse management systems (WMS) and warehouse execution systems (WES)), and services (value added services and maintenance).

Function Insights:

- Warehouse and Storage Management

- Transportation Management

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes warehouse and storage management and transportation management.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

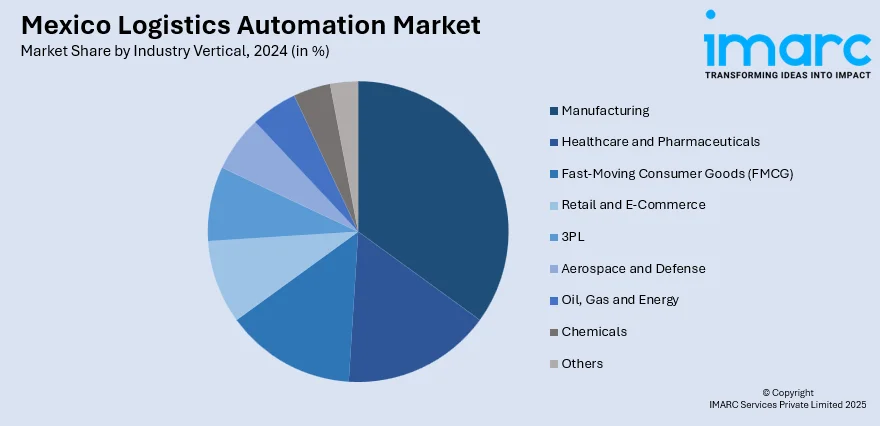

Industry Vertical Insights:

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast-Moving Consumer Goods (FMCG)

- Retail and E-Commerce

- 3PL

- Aerospace and Defense

- Oil, Gas and Energy

- Chemicals

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes manufacturing, healthcare and pharmaceuticals, fast-moving consumer goods (FMCG), retail and e-commerce, 3PL, aerospace and defense, oil, gas and energy, chemicals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- October 2024: Symbotic Inc. officially announced that it had partnered with Walmart de México y Centroamérica (Walmex) to install its sophisticated warehouse automation systems—autonomous mobile robots and robotic arms, at two greenfield distribution facilities outside Mexico City, the company's largest single-phase installation and the launch of Symbotic Mexico.

- July 2024: UPS announced its agreement to acquire Estafeta, a Mexican express delivery company, as part of its 'Better and Bolder' strategy. This acquisition aims to enhance logistics automation by integrating Estafeta's 45-year logistics legacy with UPS's advanced technologies, providing seamless service and greater efficiency for customers in Mexico and beyond

- March 2024: GEODIS and Locus Robotics introduced advanced logistics automation in Mexico, deploying Locus's Origin autonomous mobile robots (AMRs) at a new Cuautitlan Izcalli facility. These robots operate across a three-level mezzanine, managed by the LocusOne platform, enhancing order fulfillment efficiency for a major global apparel brand.

Mexico Logistics Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Functions Covered | Warehouse and Storage Management, Transportation Management |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticles Covered | Manufacturing, Healthcare and Pharmaceuticals, Fast-Moving Consumer Goods (FMCG), Retail and E-Commerce, 3PL, Aerospace and Defense, Oil, Gas and Energy, Chemicals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico logistics automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico logistics automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico logistics automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The logistics automation market in the Mexico was valued at USD 1,231.50 Million in 2024.

The Mexico logistics automation market is projected to exhibit a CAGR of 10.81% during 2025-2033, reaching a value of USD 3,102.02 Million by 2033.

Mexico logistics automation market is fueled by the swift growth of e-commerce, growing need for speed and error-free order fulfillment, government incentives for adopting Industry 4.0, and increased cross-border trade under USMCA. Investments in robotics, AI, and intelligent warehousing also drive operation efficiency and minimize the use of manual labor.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)