Mexico Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2026-2034

Mexico Logistics Market Summary:

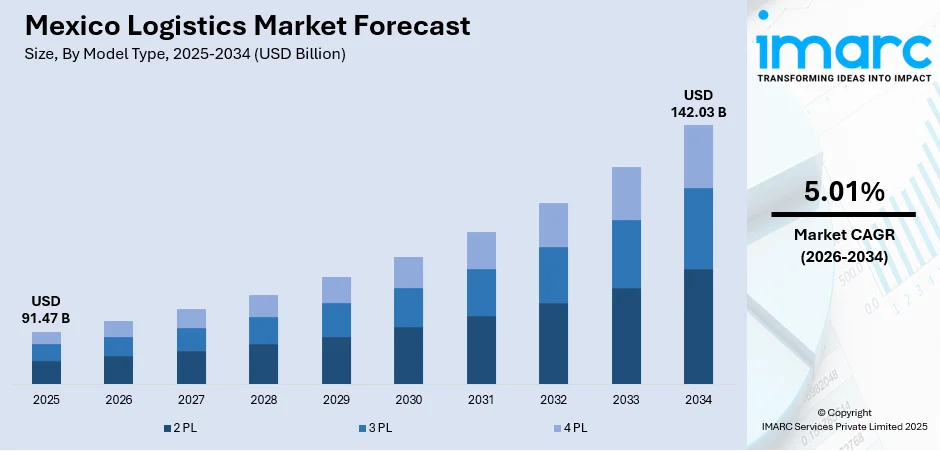

The Mexico logistics market size was valued at USD 91.47 Billion in 2025 and is projected to reach USD 142.03 Billion by 2034, growing at a compound annual growth rate of 5.01% from 2026-2034.

The market is driven by the strategic geographical positioning of Mexico as a gateway for North American trade, accelerating nearshoring activities from multinational corporations, and the rapid expansion of e-commerce platforms demanding efficient last-mile delivery solutions. The increasing adoption of third-party logistics providers and multimodal transportation networks further strengthens operational efficiency across diverse industries, contributing to the expanding Mexico logistics market share.

Key Takeaways and Insights:

- By Model Type: 3 PL dominates the market with a share of 46% in 2025, driven by manufacturers and retailers outsourcing complex supply chains to optimize costs, improve scalability, and enhance service flexibility nationwide operations efficiently.

- By Transportation Mode: Roadways lead the market with a share of 59% in 2025, owing to extensive highway networks, last-mile flexibility, broad geographic reach, and cost efficiency supporting domestic freight movement between major manufacturing and consumption centers.

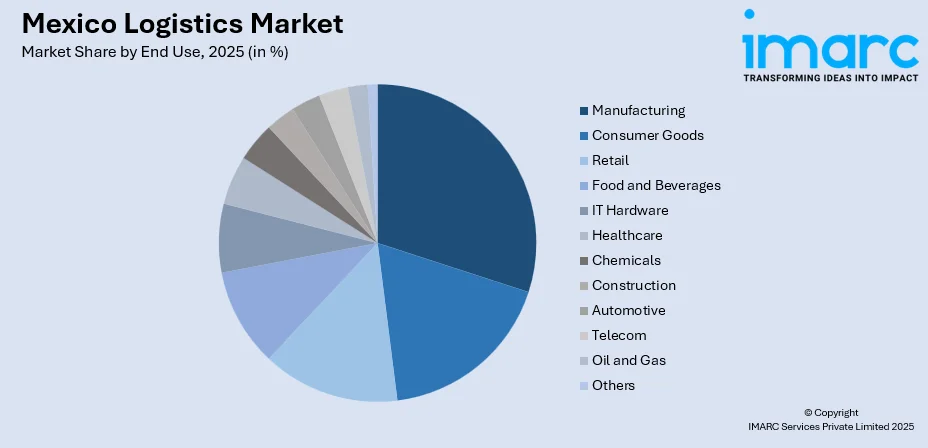

- By End Use: Manufacturing represents the largest segment with a market share of 18% in 2025, driven by Mexico’s strength in automotive, electronics, and consumer goods, demanding integrated logistics, timely deliveries, and resilient supply chain coordination nationwide.

- By Region: Northern Mexico dominates the market with a share of 46% in 2025, owing to proximity to U.S. borders, dense maquiladora clusters, industrial parks, and established trade corridors enabling efficient cross-border freight flows operations.

- Key Players: The Mexico logistics market exhibits a fragmented competitive landscape, with global logistics corporations competing alongside established domestic service providers across various operational segments, leveraging technological innovations and strategic partnerships to enhance service portfolios and geographic reach.

To get more information on this market Request Sample

The Mexico logistics market is experiencing robust growth propelled by several interconnected factors reshaping the supply chain landscape. The strategic geographical positioning of the country serves as a critical enabler for North American trade integration, particularly benefiting from established trade agreements that facilitate seamless cross-border commerce. The accelerating nearshoring trend has generated substantial demand for warehousing facilities, freight services, and customs clearance operations across major industrial corridors. In September 2025, Amazon, Mercado Libre, and GEODIS announced a combined $1.1 Billion investment in the State of Mexico’s logistics sector, expanding distribution centers and logistics infrastructure. Additionally, the rapid digitalization of retail channels and e-commerce expansion necessitates sophisticated last-mile delivery solutions and agile distribution networks. Infrastructure modernization initiatives encompassing highways, ports, and railway systems continue enhancing multimodal transportation capabilities, while the adoption of smart logistics technologies improves operational visibility and efficiency throughout the supply chain ecosystem

Mexico Logistics Market Trends:

Digital Transformation and Smart Logistics Adoption

The integration of advanced technologies is revolutionizing logistics operations across Mexico, with artificial intelligence (AI), Internet of Things (IoT) sensors, and blockchain solutions gaining widespread implementation. Logistics providers are increasingly deploying real-time tracking systems, predictive analytics platforms, and automated warehouse management solutions to enhance operational efficiency and supply chain visibility. The adoption of cloud-based logistics management platforms enables seamless coordination between stakeholders while reducing documentation processing times. In October 2025, Salesforce announced a $1 Billion investment in Mexico to expand AI-driven operations, establish a Global Delivery Center, and accelerate digital transformation across industries. Furthermore, the implementation of autonomous guided vehicles within warehousing facilities and the exploration of drone delivery capabilities for last-mile operations demonstrate the sector's commitment to technological advancement and operational excellence.

Expansion of Multimodal Transportation Networks

The logistics sector is witnessing a significant shift toward integrated multimodal transportation solutions combining road, rail, sea, and air freight capabilities. This approach enables optimal route selection based on cost efficiency, delivery timelines, and cargo specifications while reducing environmental impact. The development of intermodal terminals and logistics parks facilitates seamless cargo transfers between transportation modes, enhancing overall supply chain efficiency. As per sources, in June 2025, the 73-hectare U.A.C Logistics Park, 2 km from Veracruz port, was inaugurated, enhancing Mexico’s global supply chains, supporting multimodal transport, attracting investment, and creating economic and employment opportunities. Moreover, strategic investments in port infrastructure and railway connectivity are strengthening the backbone of multimodal networks, enabling logistics providers to offer comprehensive door-to-door services that meet the diverse requirements of manufacturing, retail, and e-commerce sectors operating within the domestic and international trade ecosystem.

Sustainability and Green Logistics Initiatives

Environmental consciousness is driving transformative changes within the logistics industry as companies prioritize sustainable practices and carbon footprint reduction strategies. The transition toward electric and alternative fuel vehicles for freight transportation is gaining momentum, supported by charging infrastructure development across major logistics corridors. Warehousing facilities are implementing energy-efficient designs, solar power installations, and waste reduction programs to achieve sustainability certifications. As per soures, in May 2025, GEODIS and Prologis launched a 619 kW rooftop solar project at Prologis Park Grande, Tepotzotlán, generating 892 MWh annually to advance sustainable logistics in Mexico. Furthermore, logistics providers are optimizing route planning algorithms to minimize fuel consumption and emissions while packaging innovations reduce material waste throughout the supply chain. These green logistics initiatives align with corporate sustainability commitments and regulatory requirements, positioning environmentally responsible service providers for competitive advantage.

Market Outlook 2026-2034:

The Mexico logistics market is positioned for sustained revenue growth throughout the forecast period, driven by the continued expansion of nearshoring activities, e-commerce proliferation, and infrastructure modernization initiatives. The increasing integration of digital technologies and smart logistics solutions will enhance operational efficiency and service quality across the value chain. Strategic investments in multimodal transportation networks and sustainable logistics practices are expected to reshape competitive dynamics while meeting evolving customer expectations. The market revenue trajectory reflects strong fundamentals supported by favorable trade agreements, manufacturing sector growth, and rising domestic consumption patterns driving demand for comprehensive logistics services. The market generated a revenue of USD 91.47 Billion in 2025 and is projected to reach a revenue of USD 142.03 Billion by 2034, growing at a compound annual growth rate of 5.01% from 2026-2034.

Mexico Logistics Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Model Type | 3 PL | 46% |

| Transportation Mode | Roadways | 59% |

| End Use | Manufacturing | 18% |

| Region | Northern Mexico | 46% |

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

3 PL dominates with a market share of 46% of the total Mexico logistics market in 2025.

3 PL maintains its dominant position within the Mexico logistics market as businesses increasingly recognize the strategic advantages of outsourcing complex supply chain operations to specialized service providers. This model enables companies to focus on core competencies while accessing extensive transportation networks, warehousing infrastructure, and value-added services without substantial capital investments. The flexibility offered by third-party logistics arrangements allows businesses to scale operations according to seasonal demand fluctuations and market expansion requirements.

The growing complexity of supply chain requirements across manufacturing, retail, and e-commerce sectors drives adoption of comprehensive third-party logistics solutions encompassing freight management, inventory optimization, and customs brokerage services. Service providers are differentiating through technology integration, offering real-time visibility platforms, predictive analytics capabilities, and automated order fulfillment systems. The nearshoring trend amplifies demand for third-party logistics expertise in managing cross-border operations, regulatory compliance, and just-in-time delivery requirements for automotive, electronics, and consumer goods industries establishing production facilities across Mexican industrial corridors. In December 2025, DP World opened a 117,000-square-foot multi-customer warehouse in Querétaro, enhancing 3PL capabilities, supporting nearshoring, and strengthening integrated supply chain services for manufacturers across Mexico.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

Roadways lead with a share of 59% of the total Mexico logistics market in 2025.

Roadways maintain its position as the leading logistics mode in Mexico, supported by extensive highway networks connecting industrial centers, distribution hubs, and consumption markets nationwide. The flexibility of trucking services enables door-to-door delivery capabilities essential for serving diverse customer requirements across urban and rural geographies. Road freight offers competitive advantages for time-sensitive shipments, allowing logistics providers to maintain rapid transit times while accommodating various cargo specifications and volume requirements.

The dominance of roadway transportation reflects the ongoing infrastructure development expanding highway capacity and improving connectivity between manufacturing zones and border crossings. According to sources, in June 2025, Mexico’s SICT announced a MX$53.3 Billion investment to modernize and expand the national highway network, enhancing freight connectivity, and supporting logistics efficiency nationwide. Moreover, fleet modernization initiatives incorporating fuel-efficient vehicles, telematics systems, and driver safety technologies enhance operational performance while addressing environmental concerns. The growth of e-commerce necessitates agile road transportation networks capable of supporting last-mile delivery operations in metropolitan areas. Additionally, the integration of trucking services within multimodal logistics chains strengthens the position of road freight as the backbone of domestic distribution and cross-border trade activities throughout the logistics ecosystem.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Manufacturing exhibits a clear dominance with a 18% share of the total Mexico logistics market in 2025.

The manufacturing represents a critical end-use segment driving logistics demand across Mexico, reflecting the country's established position as a production hub for automotive, aerospace, electronics, and consumer goods industries. Manufacturing operations require sophisticated logistics solutions supporting just-in-time delivery of raw materials, component management, and finished goods distribution to domestic and export markets. The complexity of manufacturing supply chains necessitates specialized logistics capabilities including temperature-controlled transportation, hazardous materials handling, and high-value cargo security protocols.

The nearshoring phenomenon continues amplifying logistics demand from manufacturing entities relocating production operations closer to North American markets. According to sources, in April 2025, Volvo announced a $1 Billion investment to expand its heavy-duty truck manufacturing plant in Nuevo León, Mexico, enhancing production capacity and driving logistics demand and supply chain operations. Furthermore, industrial parks and special economic zones across northern and central Mexico attract foreign direct investment requiring comprehensive logistics infrastructure and service capabilities. Manufacturing logistics encompasses inbound supply chain management, production line sequencing, and outbound distribution networks serving regional and global customers. The integration of manufacturing execution systems with logistics platforms enables real-time coordination, inventory optimization, and demand responsiveness essential for maintaining competitive positioning in increasingly dynamic market environments.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico dominates with a market share of 46% of the total Mexico logistics market in 2025.

Northern Mexico dominates the logistics market landscape, benefiting from strategic proximity to United States border crossings and concentration of industrial activities along key trade corridors. The region hosts numerous maquiladoras, automotive manufacturing plants, and electronics assembly facilities generating substantial freight volumes requiring efficient cross-border logistics solutions. Major cities including Monterrey, Tijuana, and Ciudad Juárez serve as logistics hubs offering extensive warehousing capacity, customs brokerage services, and multimodal transportation connectivity.

The northern region's dominance reflects historical patterns of industrial development oriented toward North American trade integration and export manufacturing activities. Infrastructure investments in border crossing facilities, highway networks, and railway connections continue enhancing logistics efficiency and capacity throughout the region. The nearshoring trend reinforces northern Mexico's competitive positioning as companies prioritize locations offering rapid access to United States markets and established logistics ecosystems. Regional logistics providers specialize in cross-border operations, customs compliance, and integrated supply chain solutions serving the automotive, aerospace, medical devices, and electronics industries concentrated across northern industrial corridors.

Market Dynamics:

Growth Drivers:

Why is the Mexico Logistics Market Growing?

Accelerating Nearshoring and Manufacturing Relocation Activities

The strategic repositioning of global supply chains is generating unprecedented logistics demand as multinational corporations relocate manufacturing operations to Mexico, seeking proximity to North American consumer markets and reduced supply chain vulnerabilities. This nearshoring phenomenon drives substantial investment in warehousing facilities, freight transportation capacity, and specialized logistics services across industrial corridors stretching from border cities through central manufacturing zones. As per sources, in November 2025, Canadian company MARKDOM inaugurated a $25 Million manufacturing plant in Irapuato, Guanajuato, expanding production capacity, reinforcing nearshoring trends, and enhancing Mexico’s industrial supply chains and logistics integration for North American markets. Moreover, the establishment of new production facilities creates immediate requirements for inbound logistics supporting raw material and component flows while simultaneously expanding outbound distribution networks serving domestic and export markets. The favorable trade environment facilitates customs integration and cross-border freight movement, encouraging further manufacturing investment and associated logistics infrastructure development throughout the country.

Rapid E-Commerce Expansion and Digital Retail Transformation

The accelerating shift toward digital commerce channels is fundamentally reshaping logistics requirements as consumers increasingly expect rapid delivery, flexible fulfillment options, and seamless return processes. E-commerce growth necessitates sophisticated last-mile delivery networks capable of reaching urban and suburban customers within compressed timeframes while managing diverse product categories and handling requirements. According to sources, in 2025, DHL invested US$60 Million in Mexico to expand its ground delivery fleet by 300 vehicles, preparing for El Buen Fin and ensuring timely e‑commerce deliveries nationwide. Further, the expansion of online retail drives investment in fulfillment center infrastructure, automated sorting systems, and technology platforms enabling real-time order tracking and delivery coordination. Omnichannel retail strategies require integrated logistics solutions connecting physical store networks with digital fulfillment capabilities, creating demand for versatile distribution approaches and inventory positioning strategies that maximize customer service while optimizing operational costs throughout the retail supply chain ecosystem.

Infrastructure Modernization and Connectivity Enhancement

Sustained investment in transportation infrastructure is enhancing logistics capabilities through highway expansion, port modernization, and railway network development connecting major production centers with domestic markets and international trade gateways. Infrastructure improvements reduce transit times, increase freight capacity, and enable more efficient multimodal transportation solutions optimizing cost and service performance across supply chains. The development of logistics parks and intermodal terminals facilitates seamless cargo transfers between transportation modes while providing value-added services including warehousing, consolidation, and customs processing. Government initiatives supporting infrastructure development recognize the critical role of logistics efficiency in attracting manufacturing investment and enabling export competitiveness, allocating resources toward strategic corridor upgrades and border crossing improvements that benefit the broader logistics ecosystem.

Market Restraints:

What Challenges the Mexico Logistics Market is Facing?

Infrastructure Bottlenecks and Capacity Constraints

Despite ongoing infrastructure investments, logistics operations face challenges from congested transportation corridors, limited port capacity, and inadequate railway connectivity in certain regions. Border crossing delays and customs processing inefficiencies impact cross-border freight movement, affecting delivery reliability and supply chain predictability. These infrastructure limitations constrain logistics efficiency and increase operational costs, particularly during peak demand periods when capacity constraints become most pronounced.

Security Concerns and Cargo Protection Challenges

Cargo theft and security incidents along transportation routes present ongoing challenges for logistics operations, requiring substantial investment in protective measures, tracking technologies, and risk mitigation strategies. Security concerns influence route planning decisions, transportation mode selection, and insurance costs across the logistics industry. Logistics providers must balance security requirements with operational efficiency while maintaining cost competitiveness in serving customer supply chain needs.

Skilled Workforce Shortages and Talent Development Gaps

The logistics industry faces challenges in attracting and retaining qualified professionals, particularly experienced truck drivers and supply chain management specialists essential for operational excellence. Workforce shortages impact service capacity and operational reliability while driving labor cost increases across the industry. The evolving technological landscape requires continuous training and skill development programs to equip logistics professionals with capabilities necessary for managing sophisticated supply chain systems.

Competitive Landscape:

The Mexico logistics market demonstrates a fragmented competitive landscape marked by the coexistence of global logistics enterprises, regional operators, and niche service providers catering to varied industry requirements. Companies compete by differentiating their service portfolios, geographic reach, technological integration, and sector-specific expertise to meet complex supply chain demands. Strategic alliances, mergers, and acquisitions continue to influence market dynamics as players aim to strengthen capabilities, scale operations, and broaden customer bases. Competitive intensity remains high, with operational efficiency, service reliability, and customer responsiveness shaping market positioning. Increasing investments in digital platforms, automation solutions, data analytics, and sustainability initiatives highlight shifting competitive priorities and long-term value creation strategies across the logistics ecosystem.

Recent Developments:

- In June 2025, Amazon Mexico partnered with Rappi to launch Amazon Now, delivering over 5,000 essential products in under 15 minutes across Mexico’s 10 largest cities, including Mexico City, Guadalajara, and Monterrey, offering ultrafast e‑commerce fulfillment and integrating restaurant orders to enhance digital retail and customer convenience.

Mexico Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico logistics market size was valued at USD 91.47 Billion in 2025.

The Mexico logistics market is expected to grow at a compound annual growth rate of 5.01% from 2026-2034 to reach USD 142.03 Billion by 2034.

3 PL held the largest share of the Mexico logistics market, driven by rising outsourcing of supply chain operations by manufacturing and retail enterprises seeking improved operational flexibility, scalable capacity, service integration, and sustained cost optimization across distribution networks.

Key factors driving the Mexico logistics market include accelerating nearshoring activities from multinational corporations, rapid e-commerce expansion demanding efficient last-mile delivery, infrastructure modernization enhancing multimodal connectivity, and favorable trade agreements facilitating cross-border commerce.

Major challenges include infrastructure bottlenecks at border crossings and ports, cargo security concerns along transportation corridors, skilled workforce shortages particularly for truck drivers, regulatory complexity affecting customs operations, and the need for substantial investment in sustainable logistics technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)