Mexico Low Calorie Sweeteners Market Size, Share, Trends and Forecast by Source, Type, Application, and Region, 2025-2033

Mexico Low Calorie Sweeteners Market Overview:

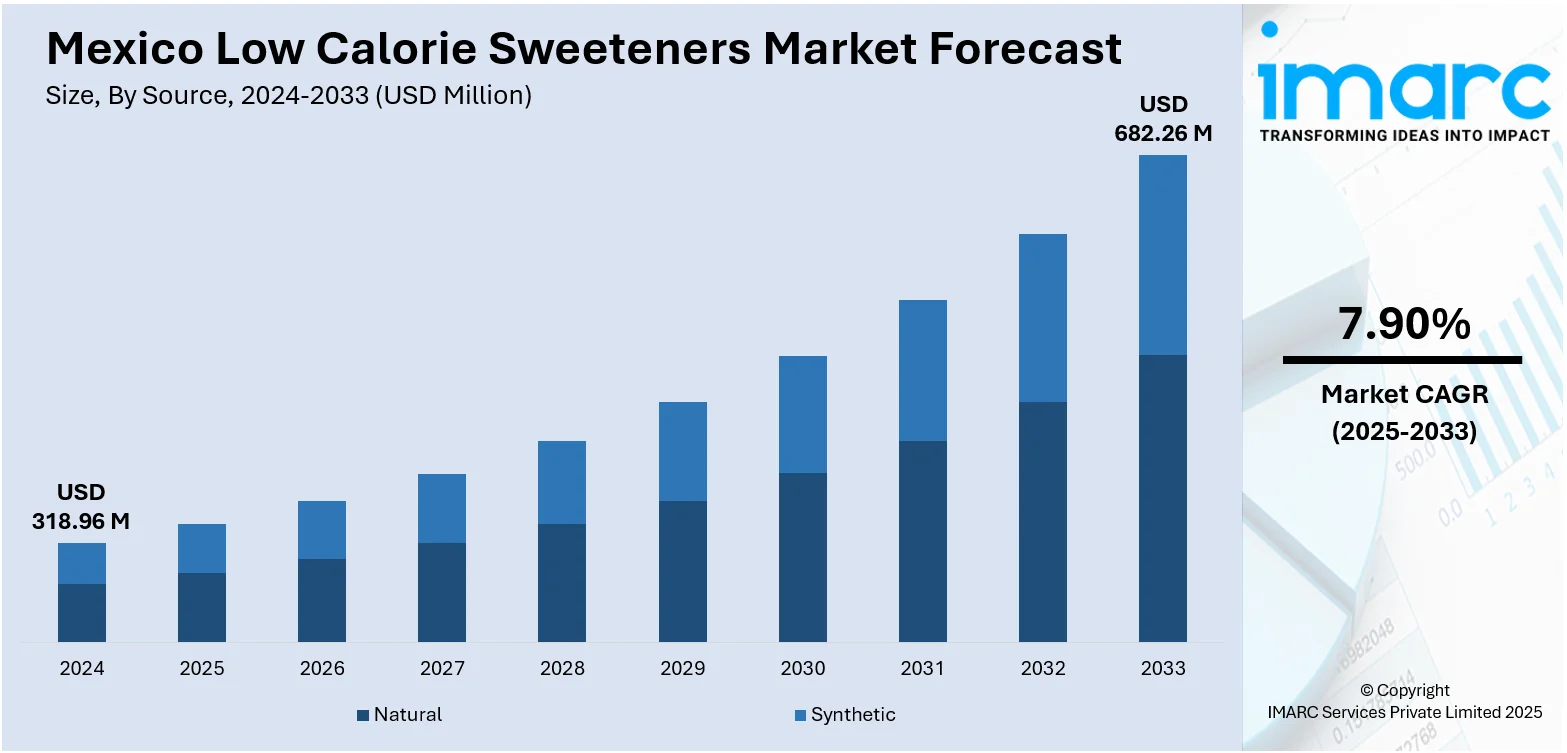

The Mexico low calorie sweeteners market size reached USD 318.96 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 682.26 Million by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. Increasing health awareness, rising obesity and diabetes rates, and government initiatives like sugar taxes and labeling regulations are some of the factors contributing to Mexico low calorie sweeteners market share. Consumers prefer natural, clean-label ingredients such as stevia and monk fruit, fueling demand in beverages, dairy, and snacks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 318.96 Million |

| Market Forecast in 2033 | USD 682.26 Million |

| Market Growth Rate 2025-2033 | 7.90% |

Mexico Low Calorie Sweeteners Market Trends:

Rising Interest in Fermented Sweet Proteins

Mexico’s low calorie sweeteners market is shifting toward innovative, health-focused alternatives, with sweet proteins gaining increasing attention. These plant-based proteins are produced through precision fermentation and offer intense sweetness, enabling significant sugar reduction in food products without sacrificing taste. They provide benefits for digestive and blood sugar health, functioning similarly to dietary proteins. Growing consumer demand for clean-label and sustainable ingredients drives interest in these sweeteners, especially in baked goods where sugar contributes to texture and structure. Their environmentally efficient production reduces reliance on traditional agriculture, supporting sustainability goals. This development highlights a move toward next-generation sweetening solutions that balance health, taste, and ecological impact in Mexico’s evolving food and beverage landscape. These factors are intensifying the Mexico low calorie sweeteners market growth. For example, in May 2024, Grupo Bimbo, the Mexico-based global bakery giant, partnered with Oobli to integrate sweet proteins as a novel, low calorie sugar alternative in baked goods. Sweet proteins, derived via precision fermentation, are up to 5,000 times sweeter than sugar and support gut and blood sugar health. This marks Bimbo’s first use of sweet proteins, aligning with Mexico’s rising demand for sustainable, healthier sweetener solutions in the food and beverage sector.

To get more information on this market, Request Sample

Emerging Focus on Prebiotic Low Calorie Sweeteners

In Mexico’s expanding low calorie sweeteners market, ingredients that combine calorie reduction with digestive health benefits are gaining prominence. One such sweetener recently achieved a pioneering prebiotic certification, highlighting its role in supporting gut health without sacrificing taste or texture. This recognition strengthens its position among functional sweeteners sought by health-conscious consumers. Distribution is supported by a leading sugar refining company with significant operations in Mexico, ensuring local availability and supply. The growing preference for gut-friendly, reduced-calorie sweeteners reflects wider consumer interest in products that promote wellness while meeting taste expectations. This development signals increased adoption of innovative, multifunctional sweeteners in Mexico’s food and beverage sector. For instance, in March 2024, Tagatose, a low calorie sweetener distributed by ASR Group in Mexico, became the first to receive the NutraStrong Prebiotic Verified certification. Developed by Bonumose, Inc., tagatose supports digestive health while maintaining taste and texture. This milestone enhances its appeal in Mexico's growing market for functional, reduced-calorie products, aligning with rising consumer demand for gut-friendly sweeteners. ASR Group operates a major sugar refinery in Mexico, supporting local distribution.

Mexico Low Calorie Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, type, and application.

Source Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the source. This includes natural and synthetic.

Type Insights:

- Sucralose

- Saccharin

- Aspartame

- Neotame

- Advantame

- Acesulfame Potassium

- Stevia

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes sucralose, saccharin, aspartame, neotame, advantame, acesulfame potassium, stevia, and others.

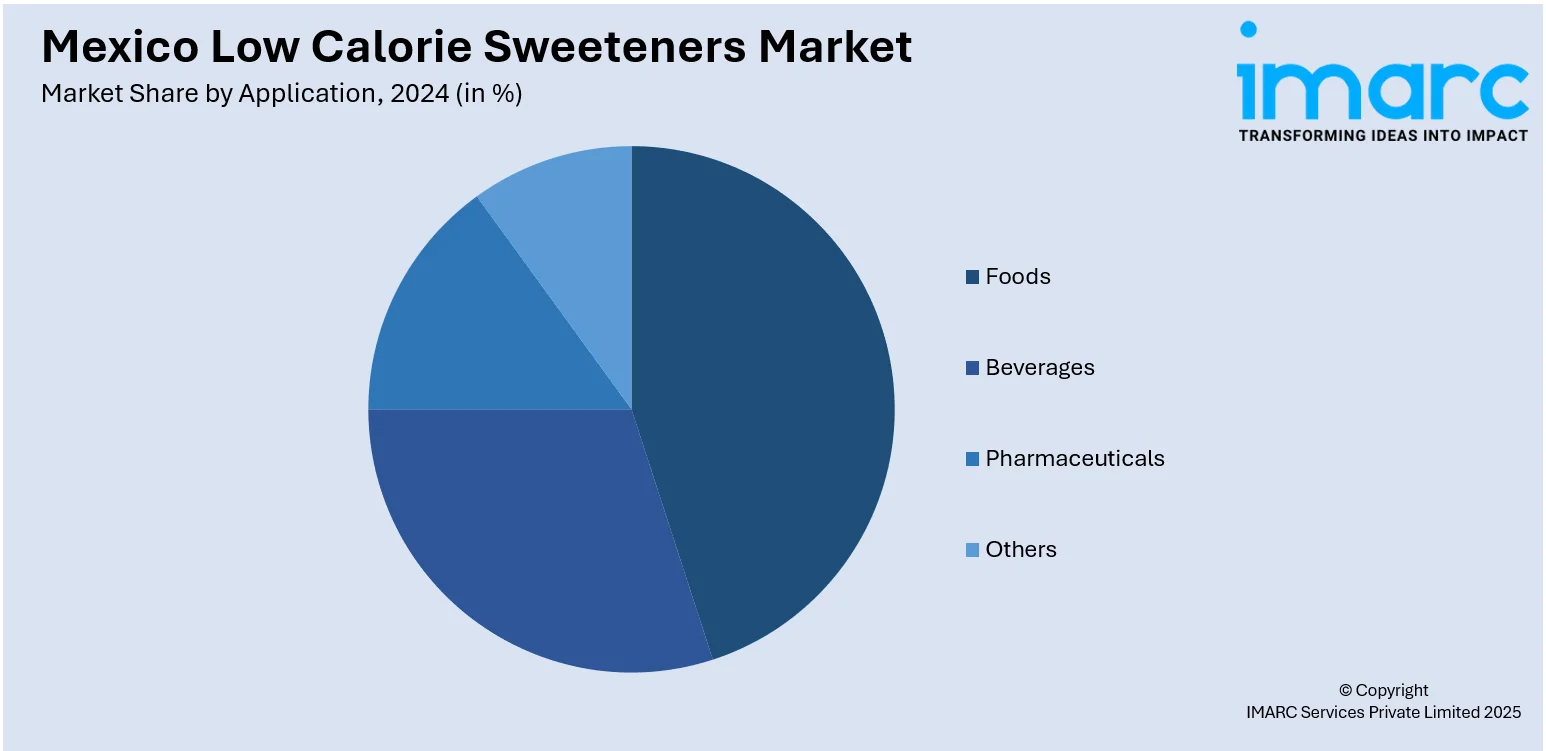

Application Insights:

- Foods

- Bakery

- Frozen Food and Dairy

- Confectionery

- Others

- Beverages

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes foods (bakery, frozen food and dairy, confectionery, and others), beverages, pharmaceuticals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Low Calorie Sweeteners Market News:

- In January 2024, Ingredion introduced PureCircle Clean Taste Solubility Solution, a clean-label, plant-based stevia solution for food manufacturers. This groundbreaking solution replicates sugar's sensory character without additives and has better solubility than artificial sweeteners, perfect for beverages, syrups, sauces, and more.

Mexico Low Calorie Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Natural, Synthetic |

| Types Covered | Sucralose, Saccharin, Aspartame, Neotame, Advantame, Acesulfame Potassium, Stevia, Others |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico low calorie sweeteners market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico low calorie sweeteners market on the basis of source?

- What is the breakup of the Mexico low calorie sweeteners market on the basis of type?

- What is the breakup of the Mexico low calorie sweeteners market on the basis of application?

- What is the breakup of the Mexico low calorie sweeteners market on the basis of region?

- What are the various stages in the value chain of the Mexico low calorie sweeteners market?

- What are the key driving factors and challenges in the Mexico low calorie sweeteners market?

- What is the structure of the Mexico low calorie sweeteners market and who are the key players?

- What is the degree of competition in the Mexico low calorie sweeteners market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico low calorie sweeteners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico low calorie sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico low calorie sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)