Mexico Luxury Apparel Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Mexico Luxury Apparel Market Overview:

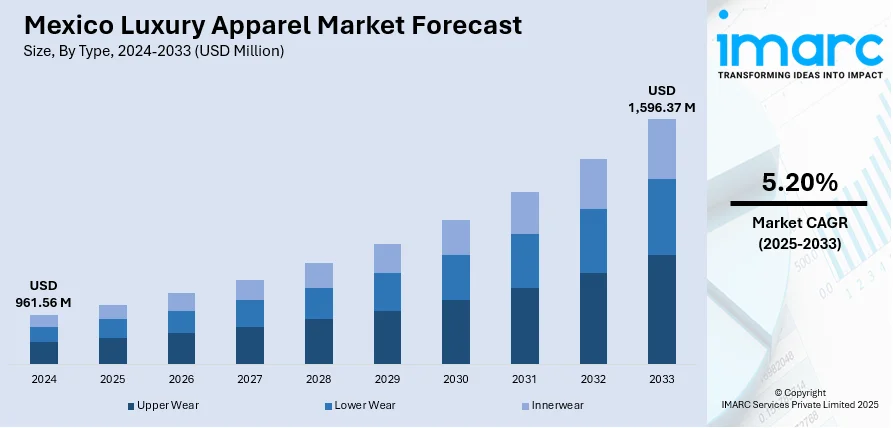

The Mexico luxury apparel market size reached USD 961.56 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,596.37 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is experiencing steady growth, fueled by rising disposable incomes, growing affluent population, and increasing demand for high-end fashion brands. With a focus on premium quality, design, and exclusivity, luxury apparel is also gaining traction among Mexican consumers. The increasing number of international luxury brands entering the region is further driving Mexico luxury apparel market share to grow in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 961.56 Million |

| Market Forecast in 2033 | USD 1,596.37 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Luxury Apparel Market Trends:

Online Shopping Growth

The expansion of e-commerce platforms is greatly revolutionizing Mexico's high-fashion apparel market offering consumers easy access to premium fashion. With the growing popularity of online shopping luxury brands are extending their online presence by offering exclusive fashion collections on official websites and third-party sites. This trend has democratized high-end apparel making it more accessible to many especially in urban areas where traditional luxury stores might be scarce. With secure payment, quick delivery, and convenient returns, online shopping is revolutionizing the way consumers buy luxury fashion. Mexican consumers especially young, technology-literate buyers are more likely to shop online for designer wear frequently guided by international fashion trends. Online also provides access to wider ranges of premium and niche luxury brands, satisfying the increasing desire for variety and exclusivity. For instance, in June 2025, Julian Fashion, the Italian luxury retailer, partnered with ESW to expand into seven new markets, including Mexico. This collaboration aims to enhance and localize the checkout experience, streamline logistics, and optimize global operations. The partnership will facilitate Julian Fashion's growth while improving customer satisfaction across multiple regions. As e-commerce continues to thrive, the online shopping experience is expected to be a key driver of growth in the Mexico luxury apparel market.

To get more information on this market, Request Sample

Growing Demand for Premium and Designer Brands

Mexico luxury apparel market growth is being significantly driven by the rising demand for international and high-end designer labels. As the country's wealthy population increases, so does demand for luxury fashion. Mexican consumers are increasingly looking for high-end brands like Gucci, Prada, Louis Vuitton, and other iconic labels, that deliver exclusivity, better craftsmanship, and classic style. The trend is especially prevalent among millennials and Generation Z, who are attracted to the status and quality of high-end labels. The increasing number of high-end retail outlets and online platforms further spurs demand for these designer goods. Additionally, international fashion trends are more accessible than ever with international brands now presenting collections best suited for local tastes. For instance, in April 2024, Dior opened a men’s shop-in-shop at El Palacio de Hierro Polanco in Mexico City, complementing its existing women’s store. Designed by Kim Jones, the boutique showcases the summer 2024 men’s collection, blending modern aesthetics with Dior’s rich history in Mexico, dating back to 1947. Consequently, Mexico is experiencing a constant increase in demand for designer and premium clothing, which is leading to consistent growth in the luxury apparel market.

Mexico Luxury Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Upper Wear

- Lower Wear

- Innerwear

The report has provided a detailed breakup and analysis of the market based on the type. This includes upper wear, lower wear, and innerwear.

Distribution Channel Insights:

.webp)

- Offline Channel

- Online Channel

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline channel and online channel.

.End User Insights:

- Men

- Women

- Children

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and children.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Luxury Apparel Market News:

- In July 2024, Retail Fashion Group, a subsidiary of Grupo Sordo Madaleno, expanded in Guadalajara with five new luxury brands: Maje, Sandro, Alo Yoga, AllSaints, and Zadig & Voltaire. Standalone stores will open at the Andares shopping center, enhancing the luxury retail landscape in the region.

- In June 2024, Balenciaga opened its first store in Cancún, Mexico, at La Isla Shopping Village. The 580 square meters venue features the latest ready-to-wear collections for men and women, along with shoes, bags, and accessories.

- In June 2024, Bottega Veneta launched its first store in Cancun, designed by Matthieu Blazy and inspired by Mediterranean coastal architecture. The 349-square-meter space features Venetian marmorino plaster and Palladiano terrazzo. It showcases the Summer 2024 collection, including exclusive ready-to-wear items and a handcrafted Sardine bag.

Mexico Luxury Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upper Wear, Lower Wear, Innerwear |

| Distributions Channels Covered | Offline Channel, Online Channel |

| End Users Covered | Men, Women, Children |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico luxury apparel market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico luxury apparel market on the basis of type?

- What is the breakup of the Mexico luxury apparel market on the basis of distribution channel?

- What is the breakup of the Mexico luxury apparel market on the basis of end user?

- What is the breakup of the Mexico luxury apparel market on the basis of region?

- What are the various stages in the value chain of the Mexico luxury apparel market?

- What are the key driving factors and challenges in the Mexico luxury apparel market?

- What is the structure of the Mexico luxury apparel market and who are the key players?

- What is the degree of competition in the Mexico luxury apparel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico luxury apparel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico luxury apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico luxury apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)