Mexico Luxury Cosmetics Market Size, Share, Trends and Forecast by Product Type, Type, Distribution Channel, End User, and Region, 2026-2034

Mexico Luxury Cosmetics Market Summary:

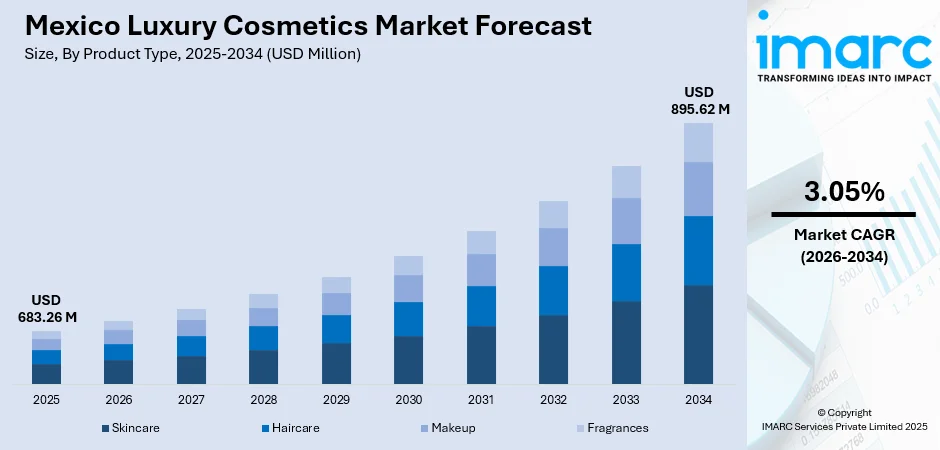

The Mexico luxury cosmetics market size was valued at USD 683.26 Million in 2025 and is projected to reach USD 895.62 Million by 2034, growing at a compound annual growth rate of 3.05% from 2026-2034.

The market is driven by rising disposable incomes among affluent Mexican consumers, increasing demand for premium skincare formulations, and growing preference for sustainable and clean beauty products. Digital transformation through e-commerce platforms and influencer marketing continues to accelerate sales, while consumers seek personalized, high-quality formulations and exclusive brand experiences offered through specialty retail channels, collectively expanding the Mexico luxury cosmetics market share.

Key Takeaways and Insights:

- By Product Type: Skincare dominates the market with a share of 37.82% in 2025, driven by growing skin health awareness, anti-aging concerns, demand for dermatology-backed products, and social media–influenced multi-step routines.

- By Type: Conventional leads the market with a share of 70.65% in 2025, owing to established brand trust, wide availability, proven efficacy, and competitive pricing appealing to a broad consumer base seeking premium beauty solutions.

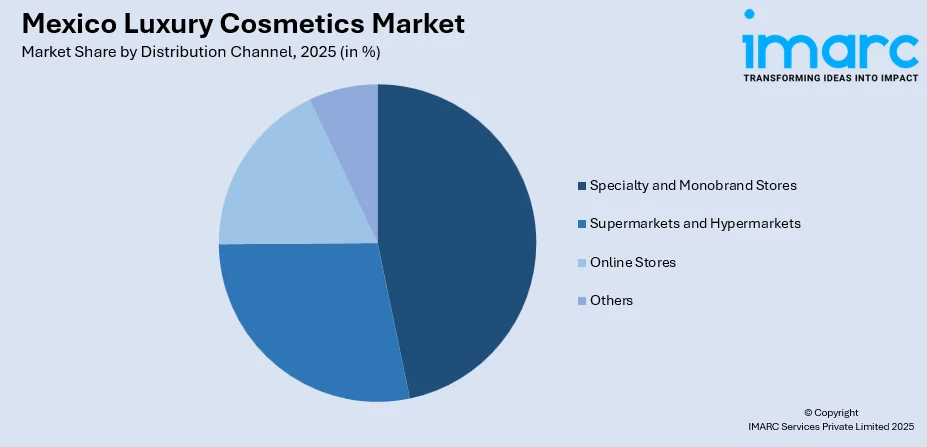

- By Distribution Channel: Specialty and monobrand stores represent the largest segment with a market share of 46.51% in 2025, driven by curated assortments, personalized service, expert consultations, exclusive experiences, and the premium shopping environment preferred by luxury cosmetics consumers.

- By End User: Female dominates the market with a share of 88.9% in 2025, owing to higher beauty consciousness, extensive skincare and makeup routines, social media trends, and cultural emphasis on personal grooming in Mexico.

- Key Players: The Mexico luxury cosmetics market exhibits a moderately consolidated competitive landscape, with multinational beauty corporations competing alongside premium regional brands across diverse price segments. Leading players leverage extensive distribution networks, innovative product development, strategic marketing investments, and exclusive retail partnerships to maintain market positioning and capture evolving consumer preferences.

To get more information on this market Request Sample

The Mexico luxury cosmetics market is experiencing robust growth fueled by several interconnected factors shaping consumer behavior and industry dynamics. Rising disposable incomes among Mexico's expanding affluent and upper-middle-class population have significantly enhanced purchasing power for premium beauty products. The increasing urbanization, particularly in metropolitan areas, has exposed consumers to global beauty trends and elevated aspirations for high-end skincare and cosmetics. Growing beauty consciousness, influenced by social media platforms and digital content creators, has driven demand for scientifically advanced formulations and exclusive brand offerings. Additionally, the cultural emphasis on personal appearance and grooming continues to motivate investment in luxury beauty products. The proliferation of specialty retail channels, including flagship stores and premium department store beauty counters, has enhanced accessibility to international luxury brands while providing immersive shopping experiences that justify premium pricing. In August 2025, Ulta Beauty opened its first stores in Mexico at Antara Fashion Hall and Galerías Metepec, which offers 35 global and local brands, with expansion planned throughout 2025, globally.

Mexico Luxury Cosmetics Market Trends:

Rising Demand for Sustainable and Clean Beauty Formulations

Mexican luxury cosmetics consumers are increasingly prioritizing sustainable and clean beauty products that align with their environmental and ethical values. High-end buyers are actively seeking brands offering eco-friendly packaging solutions, cruelty-free formulations, and naturally derived ingredients. This shift is particularly pronounced among millennial and Generation Z consumers who demonstrate willingness to invest in premium products reflecting their sustainability beliefs. Luxury brands international and domestic are responding by launching refillable compacts, biodegradable packaging innovations, and vegan skincare collections. In February 2025, Aora MÉXICO partnered with rePurpose Global to become the first luxury beauty brand in Mexico certified Plastic Negative, removing nine times more plastic waste than used. Moreover, traditional ingredients such as nopal, avocado oil, and vanilla are being incorporated into luxury formulations, combining heritage with sustainability appeal.

Digital Transformation and Omnichannel Shopping Experiences

The luxury cosmetics landscape in Mexico is being transformed by digital innovation and seamless omnichannel retail experiences. E-commerce platforms equipped with augmented reality (AR) try-on tools and artificial intelligence (AI) powered skincare consultations are revolutionizing how affluent consumers discover and purchase high-end beauty products. In October 2025, Estée Lauder launched its products on Amazon Premium Beauty in Mexico, expanding nationwide access to prestige skincare, makeup, and fragrance for consumers in urban and remote regions. Moreover, social commerce through platforms is gaining significant traction as key sales channels for luxury brands. Mexican luxury consumers increasingly expect fast delivery services, exclusive online product launches, and VIP digital experiences. Premium retailers are integrating click-and-collect services, virtual beauty advisors, and personalized recommendation engines to enhance customer engagement and satisfaction.

Premiumization of Skincare Through Science-Backed Innovations

The luxury skincare segment is experiencing significant premiumization as Mexican consumers increasingly seek dermatology-backed and clinically proven formulations. Demand for advanced anti-aging treatments, brightening serums, and targeted repair mechanisms continues to accelerate among affluent consumers prioritizing long-term skin health. Dermocosmetic brands combining pharmaceutical-grade active ingredients with luxury positioning are gaining substantial market traction. According to sources, in 2025, Global Skin Mexico showcased Seduskin and Promedics innovations at Dermacosmética 2025 in Mexico City, highlighting clinically validated, science-backed skincare treatments for dermatology and aesthetic medicine. Furthermore, personalized skincare solutions leveraging skin analysis technologies and customized formulation approaches are emerging as significant differentiators. This trend reflects sophisticated consumer expectations for efficacy-driven luxury products delivering measurable results.

Market Outlook 2026-2034:

The Mexico luxury cosmetics market is positioned for sustained revenue growth throughout the forecast period, driven by expanding affluent consumer demographics, digital retail evolution, and premiumization trends across product categories. Market revenue is expected to benefit from increasing penetration of international luxury brands, rising domestic brand sophistication, and enhanced distribution infrastructure. Strategic investments in e-commerce capabilities, sustainable product development, and personalized customer experiences will support revenue expansion as luxury beauty consumption continues gaining cultural significance among Mexican consumers. The market generated a revenue of USD 683.26 Million in 2025 and is projected to reach a revenue of USD 895.62 Million by 2034, growing at a compound annual growth rate of 3.05% from 2026-2034.

Mexico Luxury Cosmetics Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Skincare | 37.82% |

| Type | Conventional | 70.65% |

| Distribution Channel | Specialty and Monobrand Stores | 46.51% |

| End User | Female | 88.9% |

Product Type Insights:

- Skincare

- Haircare

- Makeup

- Fragrances

Skincare dominates with a market share of 37.82% of the total Mexico luxury cosmetics market in 2025.

The skincare dominates the Mexico luxury cosmetics market, commanding the largest revenue share among all product categories. This leadership position reflects heightened consumer awareness regarding skin health maintenance, prevention-focused beauty routines, and the cultural prioritization of radiant, youthful complexions. In December 2025, Clinique launched its products in the Amazon.com.mx Premium Beauty store, expanding nationwide access to dermatologist-guided, allergy-tested, and fragrance-free skincare and makeup solutions. Further, luxury consumers are embracing multi-step skincare regimens incorporating cleansers, serums, moisturizers, and treatment products targeting specific concerns including anti-aging, hyperpigmentation, and environmental protection.

The segment's growth is further accelerated by social media influence promoting elaborate skincare routines and the increasing availability of dermocosmetic brands through specialty retail channels. Premium skincare products featuring advanced active ingredients, innovative delivery systems, and clinically proven efficacy continue attracting discerning consumers willing to invest in quality formulations. Rising demand for sun protection products addressing Mexico's high UV exposure and anti-pollution skincare solutions supporting urban consumers further strengthens segment performance.

Type Insights:

- Organic

- Conventional

Conventional leads with a share of 70.65% of the total Mexico luxury cosmetics market in 2025.

Conventional maintains its dominant position within the Mexico luxury cosmetics market, capturing the majority revenue share. This leadership stems from established brand heritage, proven product efficacy, extensive distribution networks, and strong consumer trust developed through decades of market presence. As per sources, in November 2025, The Estée Lauder Companies made a strategic minority investment in Mexican luxury fragrance brand XINÚ, marking its first investment in Latin America to support local entrepreneurship and innovation. Furthermore, conventional luxury formulations benefit from sophisticated research and development capabilities, consistent quality standards, and comprehensive product portfolios addressing diverse beauty needs.

Conventional continues demonstrating resilience through continuous innovation in formulation technologies and packaging designs while maintaining competitive positioning against emerging organic alternatives. The segment appeals to consumers prioritizing performance and brand prestige, particularly those seeking advanced anti-aging treatments and color cosmetics with superior wear characteristics. Strategic marketing investments and celebrity endorsements further reinforce conventional luxury brands' market leadership.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty and Monobrand Stores

- Online Stores

- Others

Specialty and monobrand stores exhibit a clear dominance with a 46.51% share of the total Mexico luxury cosmetics market in 2025.

Specialty and monobrand stores command the leading position in the Mexico luxury cosmetics distribution landscape, reflecting consumer preferences for premium shopping experiences. As per sources, in 2025, Patrick Ta Beauty, valued at over $70 Million, expanded globally into Latin America via Sephora Mexico, marking the brand’s first major international retail launch. Moreover, these retail formats offer personalized beauty consultations, expert product recommendations, and curated assortments that justify luxury price positioning. The immersive store environments featuring trained beauty advisors and exclusive product launches create differentiated experiences that affluent consumers value.

Premium department store beauty counters and dedicated brand boutiques continue expanding across major Mexican metropolitan areas, enhancing accessibility for luxury cosmetics consumers. The channel's success reflects the importance of tactile product experiences and professional skincare analysis in luxury beauty purchasing decisions. Retailers are investing in store renovations, technology integration, and enhanced service offerings to maintain competitive advantages against digital alternatives.

End User Insights:

- Male

- Female

Female dominates with a market share of 88.9% of the total Mexico luxury cosmetics market in 2025.

Female dominates the Mexico luxury cosmetics market with an overwhelming revenue share, reflecting longstanding cultural emphasis on feminine beauty and personal grooming. In November 2025, Chica Beauty expanded to Mexico via Amazon, following double-digit annual growth since 2021, reflecting rising demand among Latin women for confidence-boosting beauty products. Mexican women demonstrate high engagement with comprehensive beauty routines encompassing skincare, makeup, haircare, and fragrance products. The segment's leadership is reinforced by strong social media influence, beauty content consumption, and aspirational purchasing behavior.

Female age demographics drive demand for premium skincare solutions, prestige color cosmetics, and luxury fragrances. The increasing participation of women in the workforce has elevated spending capacity while maintaining beauty as a cultural priority. Brands continue developing female-targeted product innovations and marketing strategies recognizing this segment's decisive market influence and evolving preferences.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for luxury cosmetics, characterized by higher income levels and strong urbanization in cities like Monterrey and Tijuana. The region demonstrates robust demand for premium and international beauty products, driven by cross-border shopping influences and exposure to United States beauty trends. Affluent consumers in this region favor advanced skincare formulations and prestige brands, supported by well-developed retail infrastructure and growing e-commerce adoption.

Central Mexico, anchored by Mexico City, dominates the national luxury cosmetics market with the largest consumer base and highest purchasing power concentration. The region serves as the cultural and economic hub where beauty trends originate and proliferate nationwide. Premium retail infrastructure including flagship stores, luxury department counters, and specialty boutiques provides extensive access to international and domestic luxury brands. The sophisticated consumer base demonstrates strong brand awareness and preference for exclusive beauty experiences.

Southern Mexico presents emerging growth opportunities within the luxury cosmetics market as regional awareness and purchasing power gradually increase. While currently demonstrating preference for more accessible premium products, the region shows growing sophistication in beauty consumption patterns. Traditional and locally inspired beauty preferences influence product demand, with increasing exposure to national trends through digital channels driving luxury cosmetics adoption among aspirational consumers in developing urban centers.

Other regions including Pacific Coast, Bajío, and Yucatan Peninsula collectively contribute to market growth through accelerating urbanization and rising beauty consciousness. Secondary cities like Querétaro, Guadalajara, and Mérida are experiencing increasing luxury cosmetics penetration as retail expansion and digital commerce enhance product accessibility. Tourism-driven coastal areas demonstrate demand for sun protection and skincare products while regional economic development supports premiumization trends.

Market Dynamics:

Growth Drivers:

Why is the Mexico Luxury Cosmetics Market Growing?

Rising Affluence and Premium Consumption Patterns

The expansion of Mexico's affluent and upper-middle-class population represents a fundamental driver of luxury cosmetics market growth. Increasing household incomes, particularly in major metropolitan areas, have significantly enhanced consumer purchasing power for premium beauty products. This growing affluence is accompanied by evolving consumption patterns favoring quality over quantity, with consumers demonstrating willingness to invest in high-end skincare and cosmetics offering superior formulations and brand prestige. According to sources, in 2025, Maribel Yébenes launched in Mexico at El Palacio de Hierro during the 2025 Beauty Festival, hosting a sold-out event introducing its advanced aesthetic and luxury beauty protocols. Furthermore, the aspirational purchasing behavior among emerging affluent segments further expands the addressable market for luxury beauty brands. Economic development and employment growth continue supporting disposable income increases that translate into elevated beauty spending across demographic segments.

Digital Influence and Social Media Beauty Culture

The pervasive influence of digital platforms and social media has fundamentally transformed Mexican beauty consumption patterns, driving significant growth in luxury cosmetics demand. Beauty content creators and influencers have established powerful channels for product discovery, education, and recommendation that directly impact purchasing decisions. Mexican consumers actively engage with beauty tutorials, skincare routines, and product reviews that elevate awareness of premium formulations and justify luxury investments. Social commerce integration enables seamless transitions from content consumption to purchase, accelerating conversion rates for luxury brands. The democratization of beauty knowledge through digital channels has expanded luxury cosmetics consideration beyond traditional affluent segments to aspirational consumers seeking premium experiences.

Expanding Premium Retail Infrastructure

The continuous expansion of premium retail infrastructure across Mexican cities significantly supports luxury cosmetics market growth by enhancing product accessibility and shopping experiences. International luxury brands are establishing flagship stores, dedicated boutiques, and premium department store counters in major metropolitan areas and emerging secondary cities. As per sources, Sephora Mexico reached multiple stores nationwide, continuing its expansion strategy to open 60 physical stores within five years, enhancing accessibility to luxury cosmetics across major cities. Moreover, this retail development brings exclusive product assortments, professional beauty services, and immersive brand experiences closer to target consumers. The growth of modern shopping destinations and premium retail complexes creates environments conducive to luxury beauty purchasing. Additionally, omnichannel retail strategies integrating physical stores with digital platforms provide comprehensive coverage that captures diverse consumer shopping preferences.

Market Restraints:

What Challenges the Mexico Luxury Cosmetics Market is Facing?

Premium Price Sensitivity and Economic Uncertainty

Despite growing affluence, significant portions of the Mexican consumer base remain sensitive to premium price positioning, limiting luxury cosmetics market expansion. Economic uncertainties, currency fluctuations, and inflationary pressures can reduce discretionary spending on high-end beauty products. Consumers may downgrade to mass-premium alternatives during economic downturns, challenging luxury brand volume growth.

Counterfeit Products and Gray Market Competition

The prevalence of counterfeit luxury cosmetics and gray market products poses substantial challenges to legitimate brand operators and market integrity. Fraudulent products compromise consumer safety through unregulated formulations while eroding brand equity and consumer trust. Cross-border shopping and unauthorized distribution channels undercut official retail pricing and complicate market control efforts.

Regulatory Compliance and Market Entry Barriers

Complex regulatory requirements governing cosmetics registration, labeling, and safety standards create barriers for market participants, particularly newer or smaller brands. Compliance with federal health authority regulations requires significant investment in documentation, testing, and approval processes. These requirements can delay product launches and increase operational costs, limiting market dynamism.

Competitive Landscape:

The Mexico luxury cosmetics market exhibits a moderately consolidated competitive structure characterized by the presence of established multinational beauty corporations alongside premium regional players and emerging domestic brands. Market leaders maintain competitive positioning through extensive distribution networks, substantial marketing investments, continuous product innovation, and strong brand heritage. International luxury conglomerates leverage global research capabilities and portfolio diversification to capture diverse consumer segments across skincare, makeup, and fragrance categories. Premium players compete through differentiated positioning emphasizing sustainability, natural ingredients, or dermatological expertise. The competitive intensity continues increasing as brands invest in digital transformation, influencer partnerships, and experiential retail to capture evolving consumer preferences and loyalty.

Recent Developments:

- In May 2025, Charlotte Tilbury entered the Mexico luxury cosmetics market, launching its complete makeup, skincare, and fragrance range in Sephora Mexico. The brand also planned counters at two El Palacio de Hierro stores and a travel retail concession at Mexico City Airport, marking its first Latin American expansion.

Mexico Luxury Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skincare, Haircare, Makeup, Fragrances |

| Types Covered | Organic, Conventional |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty and Monobrand Stores, Online Stores, Others |

| End Users Covered | Male, Female |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico luxury cosmetics market size was valued at USD 683.26 Million in 2025.

The Mexico luxury cosmetics market is expected to grow at a compound annual growth rate of 3.05% from 2026-2034 to reach USD 895.62 Million by 2034.

Skincare dominated the market, driven by rising consumer focus on skin health, anti-aging solutions, dermatology-backed formulations, and multi-step skincare routines shaped by social media trends and beauty-conscious culture.

Key factors driving the Mexico luxury cosmetics market include rising disposable incomes, increasing demand for premium skincare products, growing sustainability preferences, digital transformation in retail, influencer marketing impact, expanding premium retail infrastructure, and evolving consumer beauty consciousness.

Major challenges include premium price sensitivity among broader consumer segments, prevalence of counterfeit products undermining brand integrity, complex regulatory compliance requirements, gray market competition affecting pricing structures, economic uncertainties impacting discretionary spending, and limited penetration in rural and emerging regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)