Mexico Luxury Furniture Market Size, Share, Trends and Forecast by Raw Material, Application, Distribution Channel, Design, and Region, 2025-2033

Mexico Luxury Furniture Market Overview:

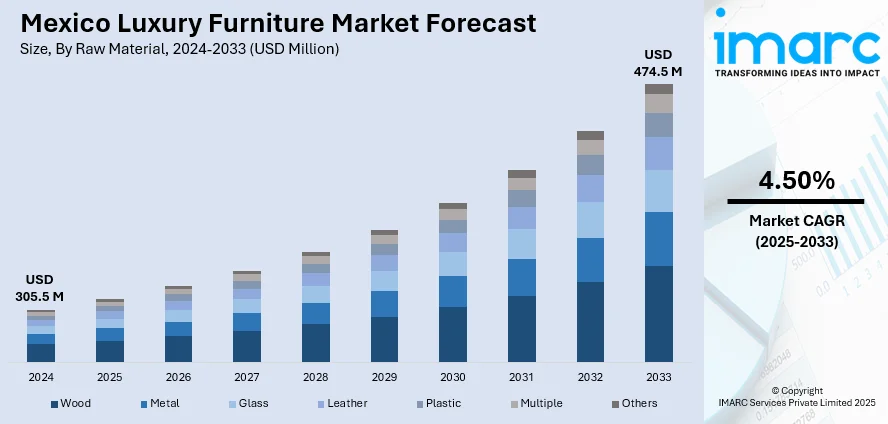

The Mexico luxury furniture market size reached USD 305.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 474.5 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The growing demand for high-end interior aesthetics, premium materials, and custom-designed furniture among affluent consumers, along with increasing investments in hospitality and residential sectors, are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 305.5 Million |

| Market Forecast in 2033 | USD 474.5 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Mexico Luxury Furniture Market Trends:

Expanding Global Visibility of Latin American Design

Luxury furniture from Mexico is receiving worldwide recognition as curated platforms highlight regional expertise. A new project brings together high-end furniture and décor from Mexican and Latin American designers, with an emphasis on modern aesthetics rather than folklore tropes. This approach is influencing perceptions of Mexican design while simultaneously making it more accessible to global purchasers. The decision to have a physical presence in the United States shows a rising belief in the worldwide appeal of modern Latin American luxury. By linking markets, such platforms provide new potential for regional producers to reach affluent purchasers overseas, establishing Mexico as a prominent participant in the upmarket design environment. This trend is consistent with growing consumer demand for authentic, culturally based workmanship with contemporary appeal. For example, in December 2023, a Mexican architect launched OMET, a platform showcasing and selling luxury furniture and home décor by designers across Mexico and Latin America. In October 2023, she expanded OMET by opening a showroom in Austin, Texas, aiming to present modern Mexican design beyond traditional clichés.

Emphasis on Craftsmanship and Transparency in Production

There is growing interest among luxury furniture buyers in understanding the artistry behind each piece. Brands are responding by offering behind-the-scenes access to their manufacturing processes, highlighting the meticulous techniques and skilled artisans responsible for high-end furniture. In Mexico, where craftsmanship plays a central role in luxury design, such initiatives resonate strongly with consumers who value authenticity and quality. Virtual factory tours are emerging as a way to build trust and emotional connection, offering an immersive experience that blends storytelling with transparency. This approach not only elevates the perceived value of the product but also reinforces the cultural and artisanal heritage embedded in Mexican luxury furniture, making it more appealing to both domestic and international buyers. For instance, in July 2024, Marge Carson, a luxury furniture manufacturer, released a virtual tour of its factory, showcasing the craftsmanship involved in producing its high-end furniture. The video series provides insights into the detailed processes and skilled artisanship that define Marge Carson's products.

Mexico Luxury Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on raw material, application, distribution channel, and design.

Raw Material Insights:

- Wood

- Metal

- Glass

- Leather

- Plastic

- Multiple

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes wood, metal, glass, leather, plastic, multiple, and others.

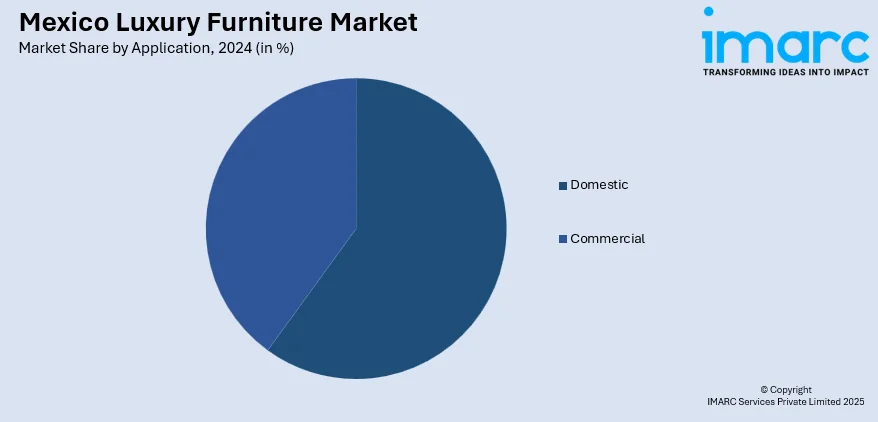

Application Insights:

- Domestic

- Living Room and Bedroom

- Kitchen

- Bathroom

- Outdoor

- Lighting

- Commercial

- Office

- Hospitality

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes domestic (living room and bedroom, kitchen, bathroom, outdoor, and lighting) and commercial (office, hospitality, and others).

Distribution Channel Insights:

- Conventional Furniture Stores

- Specialty Stores

- Online Retailers

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes conventional furniture stores, specialty stores, online retailers, and others.

Design Insights:

- Modern

- Contemporary

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes modern and contemporary.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Luxury Furniture Market News:

- In November 2024, Tribesigns strengthened its partnership with Wayfair during High Point Market 2024, one of America's premier furniture trade shows. The brand showcased its signature design-led furniture, reinforcing its global positioning. This collaboration hints at expanded market reach, potentially impacting luxury furniture trends in Mexico.

Mexico Luxury Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Wood, Metal, Glass, Leather, Plastic, Multiple, Others |

| Applications Covered |

|

| Distribution Channels Covered | Conventional Furniture Stores, Specialty Stores, Online Retailers, Others |

| Designs Covered | Modern, Contemporary |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico luxury furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico luxury furniture market on the basis of raw material?

- What is the breakup of the Mexico luxury furniture market on the basis of application?

- What is the breakup of the Mexico luxury furniture market on the basis of distribution channel?

- What is the breakup of the Mexico luxury furniture market on the basis of design?

- What are the various stages in the value chain of the Mexico luxury furniture market?

- What are the key driving factors and challenges in the Mexico luxury furniture market?

- What is the structure of the Mexico luxury furniture market and who are the key players?

- What is the degree of competition in the Mexico luxury furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico luxury furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico luxury furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico luxury furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)